What are the ways to calculate LTV, what can and should this metric be used for, as well as the pitfalls of working with it? Vera Karpova, devtodev analyst.

Vera Karpova

In this article, we will talk about one of the most important financial metrics that allows you to optimize the cost of attracting users, plan income for a long time ahead, evaluate the effectiveness of attraction channels, identify the most financially attractive user segments, and much more.

This Lifetime value (or Customer lifetime value, CLV) is the average amount of money from one user for his entire “life” in the project.

Perhaps no other indicator can compare with Lifetime value in terms of the number of calculation options, various nuances and importance in assessing the financial effectiveness of the product.

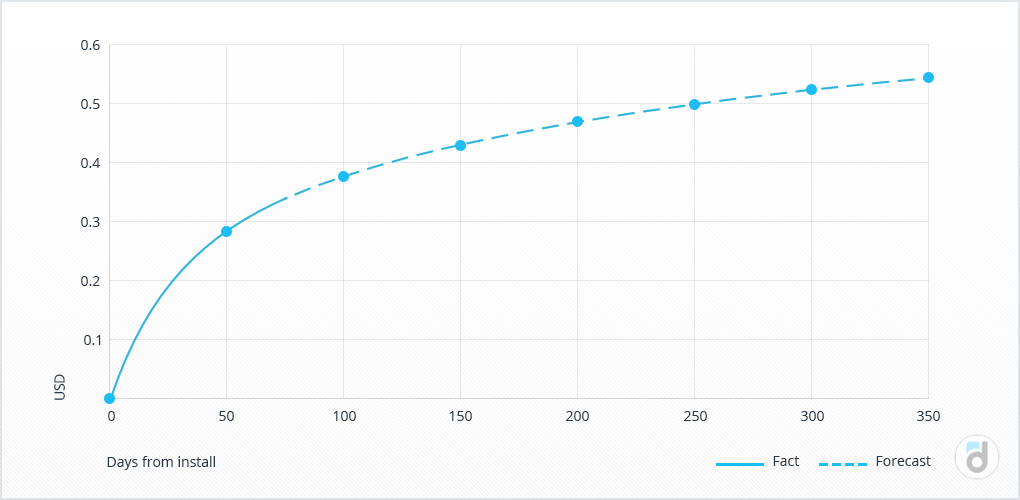

In fact, LTV is a cumulative ARPU, which we have already talked about earlier, which has reached a certain constant value. That is, the average income that one user gradually brings to the product.

The LTV graph looks the same as the cumulative ARPU graph and similar statements are true for this indicator – it is calculated for cohorts, and its graph and value only grow over time.

Moreover, at first the graph grows quite quickly, and then the growth slows down and eventually stops altogether.

This trend is associated with the outflow of users from the application – at first there are a lot of people in the cohort and they actively make payments, and then most of the users leave the project and along with their departure, income growth decreases.

LTV has a direct proportional effect on income, which is obvious, since the more one user brings money to the project, the higher the total income.

Revenue = Lifetime value * Active users

When working with LTV, it makes sense to analyze this indicator in the context of different segments, because users behave and pay differently. For example, you can select segments by country, traffic sources, or depending on the performance of certain actions, such as completing a tutorial. Probably, the LTV of all these segments will be different.

Why do I need LTV?

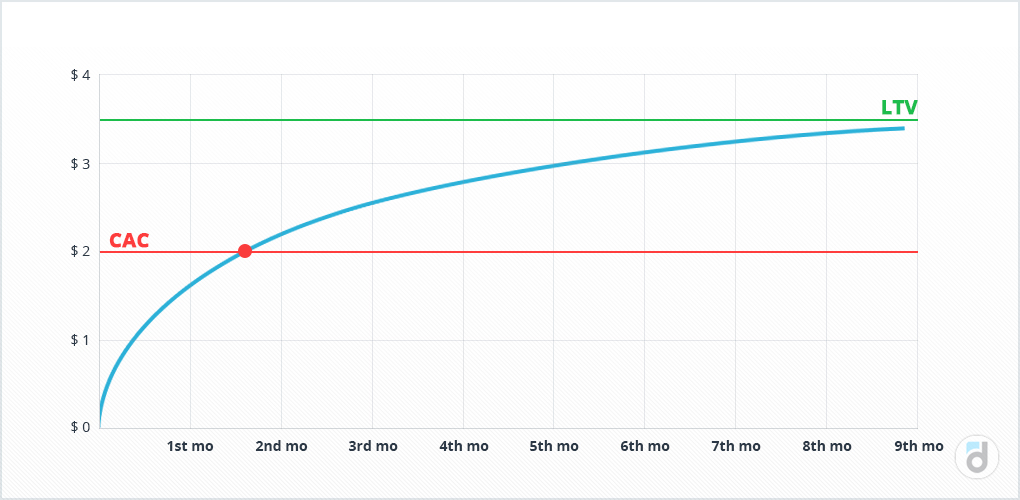

One of the most frequent uses of this metric is to evaluate purchased traffic. LTV gives an understanding of how much one user will pay for his entire life in the project. Therefore, when purchasing traffic, it is worth paying attention to the fact that the cost of attracting a user (customer acquisition cost, or CAC) should be less than his LTV, otherwise the purchase of such traffic will only bring losses.

Moreover, using Lifetime value, you can find out exactly when the user will recoup the costs of their attraction.

This will happen at the moment when LTV becomes equal to CAC.

If the intersection of the lines occurs after, for example, 2 years of the user’s stay in the project, then it is also worth considering the expediency of buying such traffic.

LTV can be considered the upper limit of the cost of purchased traffic, but it is still quite risky to buy it at a price equal to Lifetime value.

Therefore, it is often possible to find a recommendation to adhere to this ratio:

LTV > 3*CAC

Its implementation indicates the viability and success of the product.

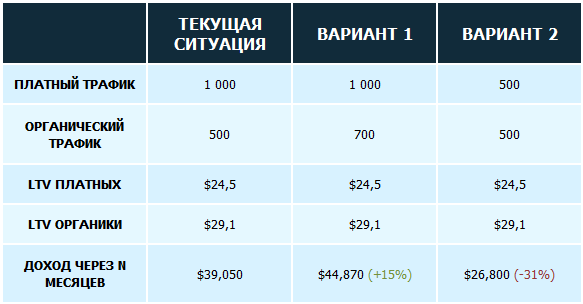

Another option for using LTV is revenue forecasting, especially if you pre–calculate this indicator for different segments. Then, if you know the structure of the audience and the Lifetime value of each segment, you can calculate the revenue that each of them will bring after a certain time.

Let’s say we know the LTV of users attracted for money and who came organically, then we can consider how experiments with traffic will affect revenue: what will happen if we increase the number of organic installations by opening the application for a new country, or how the reduction of paid traffic will affect total revenue.

How to increase LTV?

Since Lifetime value is a complex indicator, it is unlikely to directly affect it. Therefore, in order to maximize this metric, it is worth paying attention to the indicators that most strongly affect it – how long the user “lives” in the project (Lifetime) and how much he pays (ARPU).

Retention, in turn, affects the user’s lifetime in the project, and ARPU consists of the share of payers and their average check.

Lifetime value = Lifetime * ARPU

Lifetime can be calculated as an integral of Retention, and ARPU as a product of Paying share and ARPPU.

Thus, we can identify the 5 most closely related to LTV metrics:

- Lifetime;

- ARPU;

- Retention;

- Paying share;

- ARPPU.

They will be the levers of influence on Lifetime value. By increasing the values of these metrics, LTV can be increased.

How to calculate Lifetime value?

There are a lot of ways to calculate LTV and this is due to many factors, which will be discussed below.

Ideally, to calculate the LTV, you need to take a cohort of users who installed the application during a certain period and track how they will pay from month to month, and then, when there are no users left in the cohort due to the inevitable outflow, divide all the income they brought by the number of users in the cohort.

The problem with this method is that such a calculation can take a large amount of time, since users can “live” in the application for six months, a year, and even more. Usually no one has that much time to calculate LTV.

Moreover, during this time, many changes will probably occur in the application, and new users will behave quite differently from the users of the cohort we are watching. Accordingly, their Lifetime value has every chance to change.

And the whole complexity of the calculation just lies in the fact that it needs to be done based on the available small amount of data for a short period that the user spent in the application.

Therefore, all calculation methods used in practice are not entirely accurate and have their positive and negative sides.

However, let’s consider several approaches. And to begin with, let’s analyze the formula specified above:

Lifetime value = Lifetime * ARPU

Its disadvantages are that, firstly, Lifetime itself does not have an unambiguous exact calculation method and, like Lifetime value, is calculated in advance from a small amount of data. Secondly, ARPU is also constantly changing, and only one constant value is used in the formula.

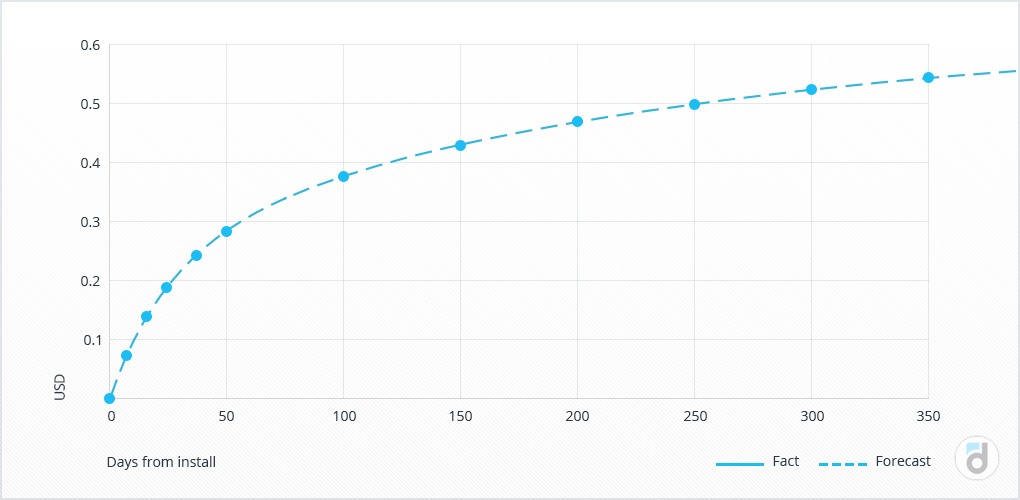

Another way to calculate LTV is through a cumulative ARPU.

If the values of the cumulative ARPU are known for a certain period of time, for example, for the 1st, 7th, 14th, 30th days, then using mathematical approximation, it is possible to complete the curve for a longer period, the limit of which will be LTV.

These are not all methods of calculating Lifetime value and, perhaps, not the simplest, but this is an indicator that is still worth considering, because it combines the most important metrics, takes into account both paying and non-paying users, and is one of the most important financial indicators.

Knowing LTV, you can understand which type of customers is of the greatest value, how soon the costs of attracting them will be recouped, what income we will receive in six months or a year from new users, how income will change if retention is increased, and much more. Thus, Lifetime value encourages you to work on the most important financial and user metrics and plan your business for a longer time.

See also: