AppQuantum advertising monetization managers have prepared a continuation of the analysis of how mobile advertising works today. In the second material, they covered in detail the issues of setting up advertising mediation.

In the first part of the article “How advertising monetization works in games“, we talked about the process of monetization of advertising in mobile applications: what is bidding, waterfalls and calls, how advertising networks work and bidding with them.

In the second part, we will talk about setting up advertising mediation. After reading this material, you will be able to understand the principles by which waterfalls are collected and optimized.

1. Who should read this article and why?

Our text is aimed at beginners in advertising monetization. We will try to give the simplest and most practical advice that will guide you step by step on the main issues, starting with the choice of a mediator, ending with what parameters to monitor the effectiveness of your waterfalls.

2. How to choose a mediator?

There are several ready-made solutions for advertising mediation. Among them: ironSource, AppLovin MAX, MoPub and AdMob. They have approximately the same functionality, and the existing differences mostly relate to the internal device, UI and other things. If you have never used any of these services, then you will have to make a decision virtually blindly. In this case, we recommend starting with AppLovin MAX. In our opinion, it has the most intuitive interface, a good set of tools for large advertising campaigns and high-quality analytics showing results both by country and by individual positions.

If you have several applications, and you can afford to allocate time and effort for experiments, we recommend connecting different mediators, comparing them with each other in terms of functionality and convenience, and choosing the most suitable one for you personally.

3. Which networks should I connect?

By choosing a mediator, you are faced with the following questions — which and how many advertising networks to connect.

Let’s deal with the second one first. There are no restrictions on the number of networks in one application, but there may be a limited number of the mediator you choose. It must be remembered: with a one-time connection of a large number of advertising networks to the waterfall, you increase the time it will take to select the optimal configuration. And since it is better to optimize the network so that it occupies several positions in the waterfall (we will get to that later), then adding each new grid significantly lengthens the waterfall.

We suggest proceeding not from the number of networks, but from the number of calls. And here, in our opinion, the optimal number is 25. There is enough space for optimization, and the user does not have time to leave without waiting for an advertisement.

Now about which networks to choose. We recommend that you first add to the application a set of the most popular advertising networks that work well on almost any GEO: Facebook Audience Network, AdMob, Unity Ads, IronSource, Fyber.

The list of advertising networks will also include a mediator grid. For example, MAX has AppLovin, ironSource has the same name ironSource.

In addition to the networks that are popular all over the world, there are also local ones that work on their GEO no worse than large ones. Let’s say a Chinese advertising network in China will work better than ironSource. And Facebook Audience Network doesn’t work there in principle, because access to Facebook is closed in China.

In general, each network has its pros and cons, they will work differently on different applications, so we recommend not stopping at one thing, but trying and experimenting.

It is more efficient to start with 3-4 large networks in the waterfall, understand how they redeem, and then dilute the waterfall with local or smaller grids.

An example of such a setup:

- Facebook Audience Network + the network that owns the mediator;

- next — non-bidding networks: Unity Ads, AdMob and Fyber.

4. Setting up mediation?

Having selected the mediator and the initial set of advertising networks, we proceed to the direct setting of prices and positions.

As we mentioned in the first part of the article, you need to set the price for the display yourself. More precisely, for 1000 impressions (cost per mile or CPM).

To do this, you need to create a call position in the mediator (they are called differently in different mediators, at the end of the article we will give several comparisons of terms), choose which network will occupy it and how much it will cost to show 1000 commercials of this network in this position.

How to understand what price will be optimal? To do this, you need to analyze your incoming traffic and understand which users come to your application — the price will depend on their quality.

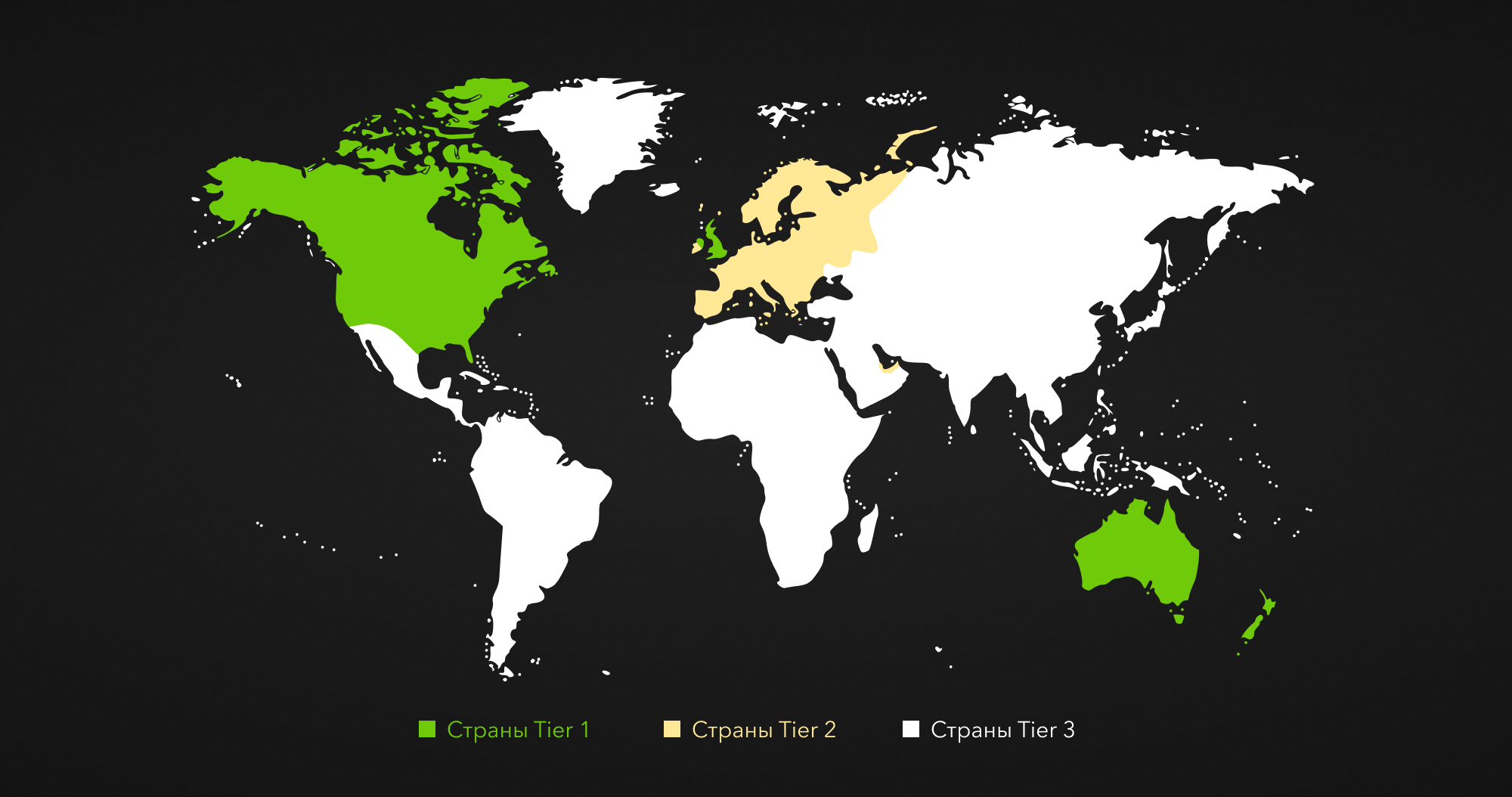

The higher the solvency of your users, the higher the upper limit of CPM can be set. The solvency of users from different countries is different, and they are usually divided into shooting ranges (ranks) by geographical location. So, there are countries of the first shooting range (USA, UK, Canada, New Zealand, Australia), the second shooting range (mainly European countries there) and the countries of the third shooting range (roughly we can say that all other countries are included here, but sometimes the 4th shooting range is also singled out).

For the countries of the first shooting range, we recommend setting the lower limit at least $3, and the upper limit around $100. For the second — from $1 to $60. The upper value for the third dash will be $20-30.

If you buy with a wide target around the world, then focus on your CPI. If this is an inexpensive game, where the installation price is about 5 cents, then the CPM there will be low. Therefore, advertising will not be redeemed at a high price.

Biddings can help you understand the boundaries of your waterfall, if they worked on the project before the optimization began. Based on their eCPM, you can roughly estimate the quality of your users. Let’s make a reservation right away that bidding is not available to any application. For most grids, this option is in the alpha/beta state. However, mediators with the support of bidding networks are becoming more and more available.

Let’s say you got an average eCPM on rewarded equal to $25. To facilitate the process of selecting the upper limit, you can multiply the average eCPM of bids by 3. The upper position in this case can reach ~ $80. The lower one will be around $1, but it is irrelevant to put it below $3 in the countries of the first shooting range, because there is very little potentially interesting traffic that biddings are likely to take away.

After you have decided on the upper and lower limits of the CPM, proceed to filling the waterfall. Here we also recommend paying attention to GEO and traffic quality. If you work with expensive traffic and high CPI, then the CPM will be high, which means you can make the waterfall denser at high positions, and less dense closer to the bottom. At the same time, there should be no more than 3 calls to AdMob in the waterfall.

5. Waterfall optimization?

Waterfall optimization consists in selecting such positions for the networks on which they buy advertising most effectively. So before moving on to rearranging positions in the waterfall, drive it for a week or two to collect data.

Whichever mediator you choose to work with, it will always have a report on how many impressions which sets were bought and what you will get from it. This is the report you will need to work with. First of all, we recommend looking at the fill rate indicator by country.

Fill rate is the percentage of impressions that was filled by the advertising network. It is calculated as the number of ad impressions divided by the number of ad requests from the application.

Thus, the higher the fill rate, the better, because the more times the user was shown an ad, the higher your profit.

How can we use this metric to understand what can be improved?

Example: AdMob is set for $100. We see that its fill rate is 20% at the same time. If you place a higher bid, AdMob will most likely buy it out as well. Because of this, the fill rate will inevitably sink, but the income from a higher position may be more significant than the effect of the drawdown.

Also a reliable indicator is your profit. Look at the set prices, at how much money you have received. If you have a low profit for your position for $ 100, then you can lower the price, your ads will be bought more often and the final profit will rise.

In addition, pay attention to the number of impressions — direct ad impressions. Ideally, they should be evenly distributed across all calls. If you see a spike somewhere, it means that you can definitely split the position into several and experiment with prices.

6. Split tests

As you have already understood, in mediation everything is solved through experiments and data collection. To check how well the new network will work in certain positions, you need to test it in these positions for some time.

We usually don’t know how the new grid will affect the fill rate or CPM. Let’s give an extremely general example: after analyzing the added positions, it turned out that the new network spends 6 seconds on polling each placement — it’s a long time. It’s a long time, because by taking 3 positions, she adds as much as 18 seconds to the waterfall. Losing users, we lose ad views, requests — accordingly, we lose money.

However, waterfalls cannot be increased indefinitely. We cannot assess the impact of a new network or new positions on the waterfall and find out about the 18 seconds we wrote about above if the mediator does not show latency (most do not show). And then split tests come to our aid. What is the point: you create 2 waterfalls, one is current, the second is modified, and show them to two groups of users. Some mediators have built-in tools for this.

When analyzing the results, pay great attention to various abnormal bursts. If you see that impressions have dropped by 20% in the test group, this may mean that there is a problem with the adapter or the advertising network. However, for a small audience, there may be a qualitative difference between users in groups. In such cases, a repeat test is done. If the results are the same, it’s time to look for problems in integration.

7. Dealing with advertising network errors

The actual problem of advertising networks is the issuance of inappropriate content to the user. For example, in Idle Light City, a 3+ rated game, a child watches a casino advertisement. After complaints and moderation of such ads, it usually turns out that this is an error on the part of the advertiser who specified incorrect values.

We mostly learn about such content through user complaints.

Users do not write the name of the advertising network, but often send screenshots that can be used to restore the source. If there is no screenshot, MAX has an Ad Review function. It shows which ads are running in our application — so it’s much easier to determine the grid.

8. Afterword

Working with mediation is a constant search for the best solution, which can change along with the game, the audience, the market, the release of new services, and so on. In this article, we tried to give the most useful tips, but our recommendations are not a solution that works once and for all — the market is developing rapidly.

In addition, we did not touch on another important aspect of working with mediation — negotiations with network managers, as a result of which you can get an increased number of placements, an increased fill rate, a beta test of bidding, etc. These tools become available only with a set of volume — the more volume you have, the more interesting you are as an advertiser.

And the last: we only talked about manual optimization and traditional waterfalls. Recently, there are more and more bidding networks, they are becoming available to an increasingly wide range of developers. In this race, not the most “handy” will win, but the one who has the opportunity to collect and process a large amount of data on their users to make the most effective requests to networks.

9. Terms

Now let’s go through all the terms that we mentioned in this article.

Remark: in different networks, the same phenomena can be denoted in different ways.

For example, a “call” (a survey of the grid for the presence of advertising at a set price until someone gives it away) is indicated in various grids as follows:

Instants at ironSource;

Ad Unit at MAX;

Placement in Unity Ads, Mintegral, Fyber and InMobi;

Slot at myTarget;

Ad Space at Smaato;

Placement Reference ID at Vungle;

Ad Unit Id at Ogury;

Ad Location at Chartboost.

We advise you to look into the special sections of the grids if you have a dissonance about the terms. In ironSource, for example, there are question tips for this.

Impression — viewing the ad by the user.

Ad Network — advertising network.

Placement — id inside the grid, by which we make the request.

Attempts — the number of requests from the mediator to a certain position.

Response — grid responses for requests.

Fill rate — the ratio of responses to requests. The lower it is, the less the grid responds at this position. If you see high fill rate indicators (for example 99), it means that you have a bidding network in front of you. They, as a rule, always “filly” well.

Win rate is the percentage of “wins” of a particular bidding network in the auction. Only biddings have this indicator.

Waterfall (or waterfall) is a list of grids that are gradually interrogated by the mediator for the presence of advertising at the requested price.

CPI (cost per install) — the price of one download of the application.

CPM (cost per mile) is the revenue received from the network for 1000 ad impressions in its application.

Bidding network — a network to which the mediator sends a request with data on the price of the impression for the user. That is, she sets the price for the display herself.

A non—bidding network is a network that adapts to the price set by the application developer.

Tier 1 — countries with high purchasing power. Tier 1 has the biggest payouts, high competition and the most expensive traffic.

Tier 2 — countries with moderate average income per capita. The competition is lower here.

Tier 3 — developing countries with low purchasing power.