On March 20, the French publisher Ubisoft announced the signing of an agreement with Vivendi. According to the agreement, Vivendi sells its entire stake in Ubisoft. The deal is estimated at €2 billion.

What happened?

French media mogul Vivendi has given up a 27.3% stake in Ubisoft. This is 30 million shares. As part of the agreement, the value of one share was estimated at €66. In other words, the transaction amount is €2 billion. A whole group of companies acted as buyers.

Who bought the shares?

There are four major buyers:

Ubisoft. She bought 7.5 million shares or 6.8% of the company. It is not reported how many of the company’s own shares are in its hands. However, in December last year, she bought 10%.

Tencent. The Chinese giant acquired 5.5 million shares (5% of the company). But he did not get the votes in the company’s board of directors at his disposal for this. Moreover, the company has committed not to transfer the received shares or increase its share. However, Tencent has agreed with Ubisoft to publish its games in China.

Ontario Teachers. The Canadian Pension Fund took 3.7 million shares (3.4% of the company). The purchase was made on the same terms as with Tencent.

Guillemot Brothers. Representing the interests of the founders and current leaders of Ubisoft, the institute acquired 3 million shares. Thanks to this, the Guillemot family brought its share in the shareholders’ votes to 24.6%, and its share in the company’s capital to 18.5%.

The remaining shares will be sold to institutional investors at a fixed, not market price. Initially, it was planned that 8.9 million shares would be sold this way, but due to the big hype, their number was increased by 1.5 million.

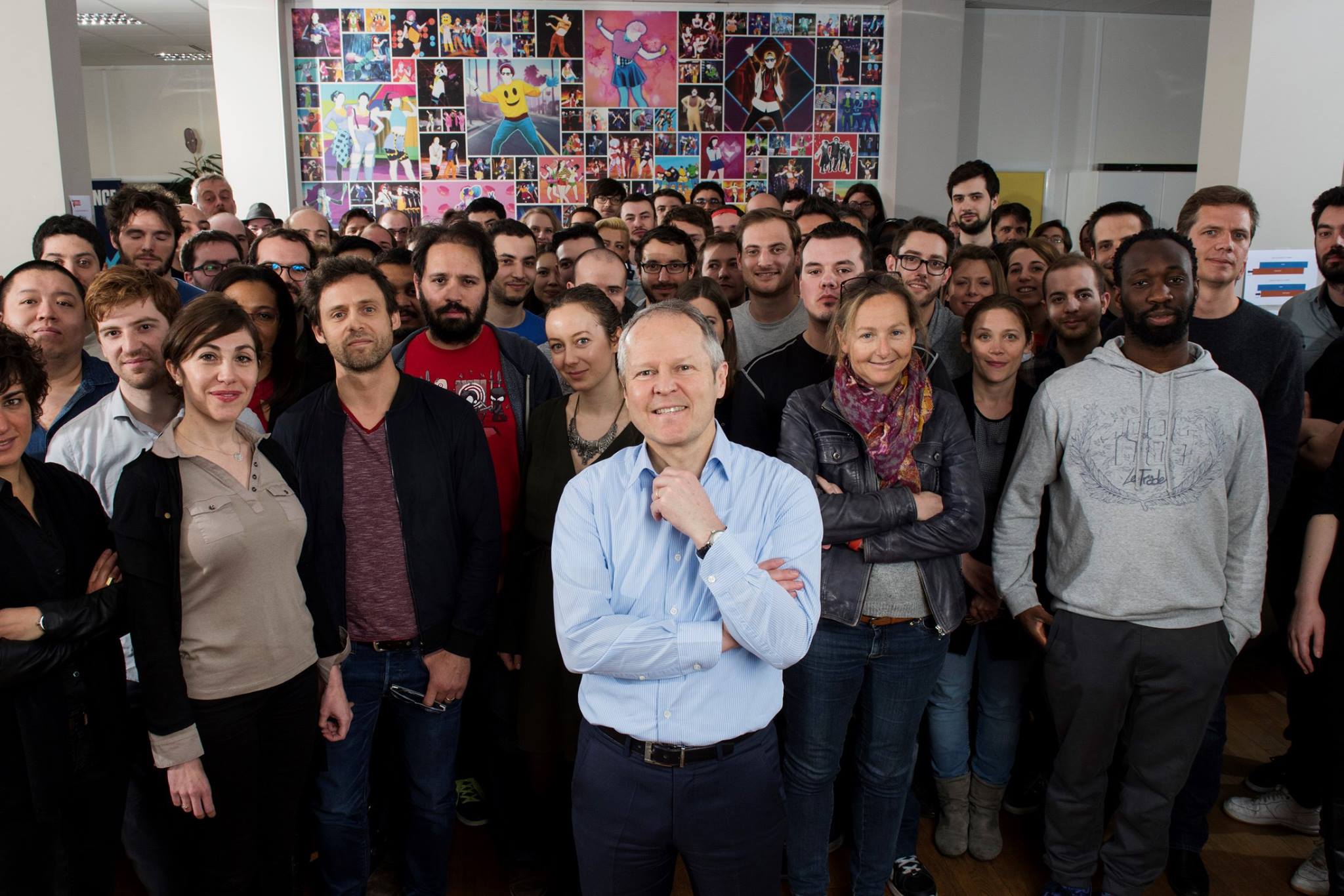

In the center of the photo is Yves Guillemot, the founder and head of Ubisoft. He posted this photo, announcing the conclusion of an agreement with Vivendi Why was the deal unexpected for the industry?

Vivendi has been buying Ubisoft shares since 2015. After the hostile takeover of Gameloft in 2016, another company founded by the Guillemot family, Vivendi systematically brought its stake in Ubisoft to a threshold of 30%.

After that, the media empire, according to French law, was given the opportunity to begin the hostile takeover stage at a price set by the market regulator.

However, something forced Vivendi to abandon these plans, which were relevant for the company back in November 2017.

Why did Vivendi make a deal and refuse to take over?

One of the possible reasons was a 42% drop in Gameloft’s profit in 2017.

By the way, in fact, the drop was much larger. The fact is that Gameloft’s profit in 2017 amounted to € 4 million, and in 2016 — €7 million. However, the latter amount includes only the money that the publisher earned while already being part of Vivendi, that is, earnings for the last two quarters of 2017.

The gaming asset after the resignation of CEO Michel Guillemot, caused by a hostile takeover, so disappointed Vivendi that a month ago she announced that Gameloft would now specialize in mobile advertising and casual games.

This is a very radical decision, because Gameloft has always specialized in three-dimensional midcore and hardcore titles for smartphones and tablets.

Summing up, Vivendi’s management could come to the conclusion that in the event of a purchase by Ubisoft, the scenario could repeat itself: Guillemot will leave and the gaming company will start losing money and will require restructuring.

The second possible reason is the rapid rise in the price of Ubisoft shares. In October 2015, when the story was just beginning, the value of one Ubisoft share was less than €20. But since that time they have been constantly growing. In 2016 it reached €30, in mid-2017 it was already worth €50. In January 2018, the price of one Ubisoft share peaked at €70.

Simply put, there could be a situation in which Vivendi could no longer afford to take over the company.

Did Vivendi gain anything from the deal?

From the point of view of money, definitely yes. The current 27.3% stake cost Vivendi €794 million. Now she has earned €2 billion for them. Ubisoft turned out to be a very profitable investment for the media company.

The company’s new blockbuster is on the way — Far Cry 5 Conclusion

The last three years have been a very difficult period for Ubisoft. She did her best to avoid being absorbed. And first of all, for this, she actively fought for users.

She revised her policy regarding the release of games for her largest franchises (for example, she abandoned the policy of annual releases of games for Assassin’s Creed and Far Cry, which affected the quality of projects and the lack of significant innovations in them), took up the release of bold experimental projects (Mario + Rabbids Kingdom Battle, For Honor), I learned how to work with the audience and premium service projects (at least the success of Rainbow Six: Siege and Tom Clancy’s Ghost Recon Wildlands and the willingness to make concessions to the community speaks about this).

In a sense, the Guillemot company can thank Vivendi for this. It is unknown whether this push would have happened, as, indeed, the announcement of Beyond Good & Evil 2, if there had not been a driving takeover threat.

Source: Ubisoft