Analysts of “red Ani” continue a series of publications about mobile gaming markets in different countries. Korea is next in line.

Top companiesTo begin with, South Korea is the third largest mobile gaming market in the world.

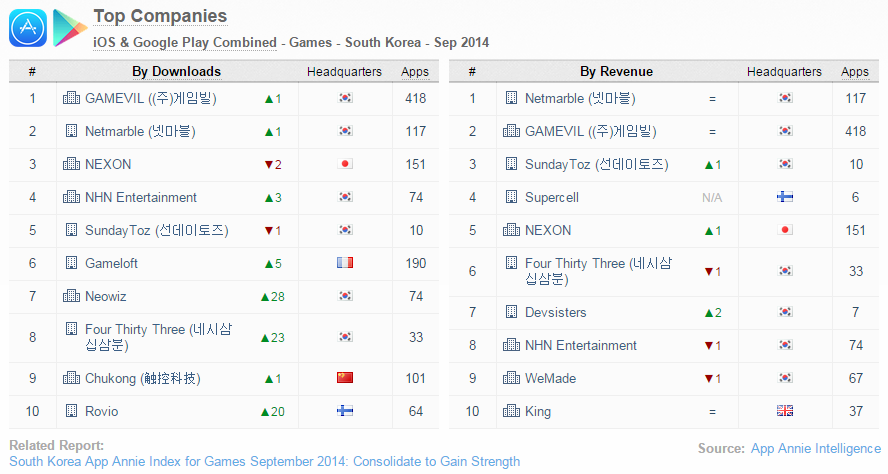

It can be safely called closed. It is difficult for foreign companies on it. The main players have a “residence permit” in Hanguk. Of the top ten download companies, six are local. Two more are Asian (Japanese Nexon and Chinese Chukong). There are even fewer “newcomers” in the box office top – only three firms: Supercell, Nexon and King.

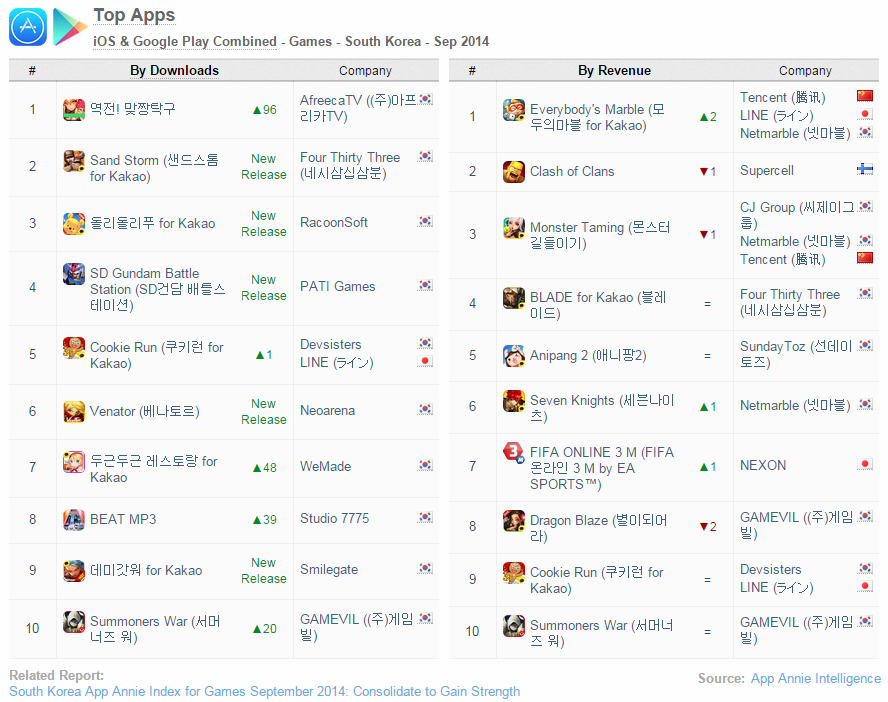

Top GamesThe situation is similar with games.

Moreover, I would say, it even more vividly reflects the closeness of the market. Of the top ten download projects, only one was published by a non-Korean publisher, namely the Japanese Cookie Run. The cash Korean gaming top clearly displays a far from unique, but, as it seems, a trending situation when projects have not one / two publishers, but their whole complex. For example, Everybody’s Marble is published by LINE in Japan, Tencent in China, and Netmarble and Kakao in Korea.

SpecificityAs App Annie notes, traditionally in the Korean market, games are promoted through pre-registration, advertising on Facebook and Naver, as well as in the subway and on television.

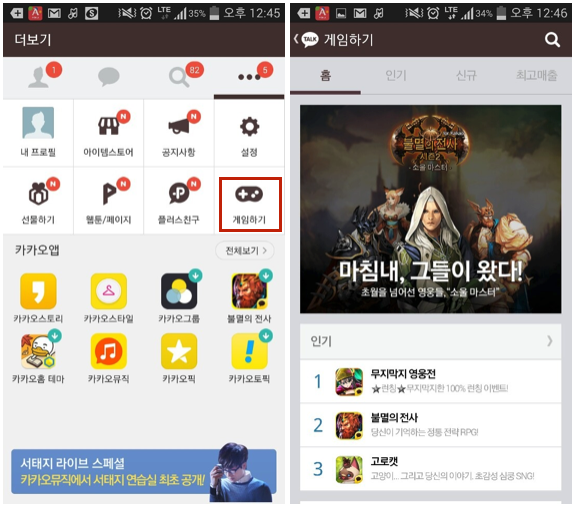

The situation has changed somewhat in recent years. The reason for this, as we have repeatedly written, is the high popularity of messengers, which have become an important source of acquisition and retention of mobile users. Therefore, for a couple of years now, all Korean (and not only) developers have been dreaming of getting into the games section in the Kakao messenger.

WeChat Facebook’s main difference from other Asian messengers, like WeChat and LINE, is that it does not publish games, but only, in fact, provides its inventory to increase visibility, plus, of course, obliges to implement its SDK in the local version, which is an analogue of such, for example, Facebook. The publisher himself is responsible for publishing and operating the project, respectively.

Again, we are not talking about exclusivity. The publisher is free to release two versions of the same game on the Korean market at once. One with the Kakao SDK, the other in any other form. However, there is not much sense in this. Despite the fact that the messenger takes 30% of revenue for its inventory, it also has an extensive user base. MAU KakaoGame for July was more than 20 million people. The total revenue of all projects since the beginning of 2014 for the first half of 2014 is $560 million.

Leaders The central players in the Korean mobile games market until recently were CJ Netmarble and CJ Games (both are daughters of CJ Group, a solid part of the shares of CJ Games are in the hands of the ubiquitous Tencent).

Since October, they have been merged into Netmarble Games Corporation, which today has become the first number among publishers in terms of downloads and revenue in South Korea. The main hits of the company at the moment are: Everybody’s Marble, Monster Taming and Seven Knights.

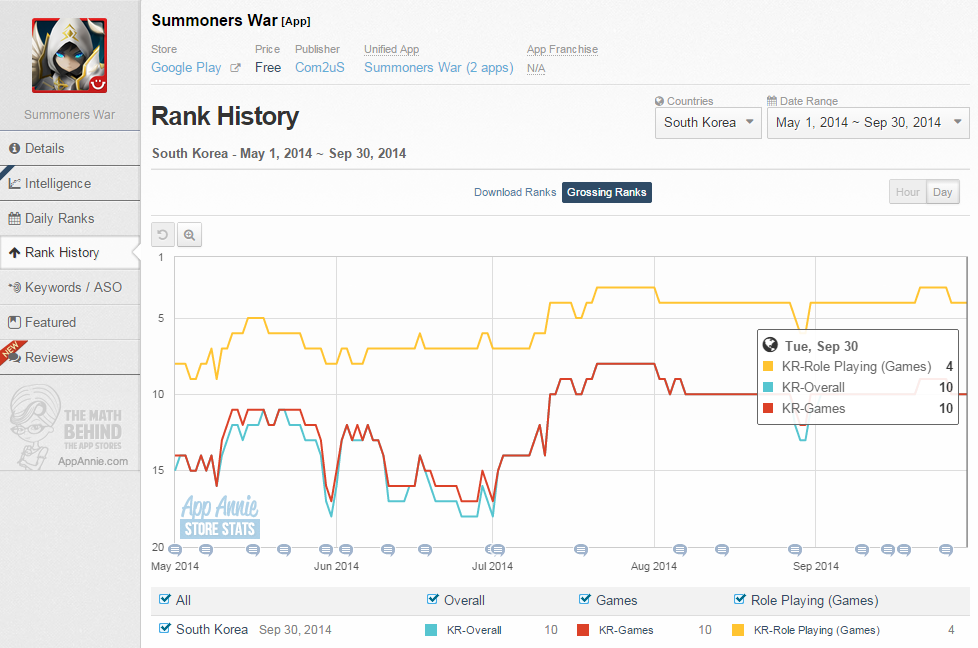

The second major player in the Korean market is Gamevil, which acquired its direct competitor Com2uS almost exactly a year ago. According to App Annie, the situation was advantageous for both sides: Com2uS is strong in “creativity” and “code”, and Gamevil is strong in analytics and business. Today, the union of companies has its own social gaming platform Hive, the main blockbuster of which is the game Summoners War.