How the mobile advertising market has changed in the gaming segment, — SocialPeta and Nativex told in a large-scale report. We briefly share the key points of the study.

Let’s start with the curious. Analysts for the year counted a total of 250 thousand advertisers. Most of them are non—gaming applications (games account for only 19% of all creatives). And if their number is growing rapidly, then the number of game advertisers is growing relatively slightly.

Now to the charts.

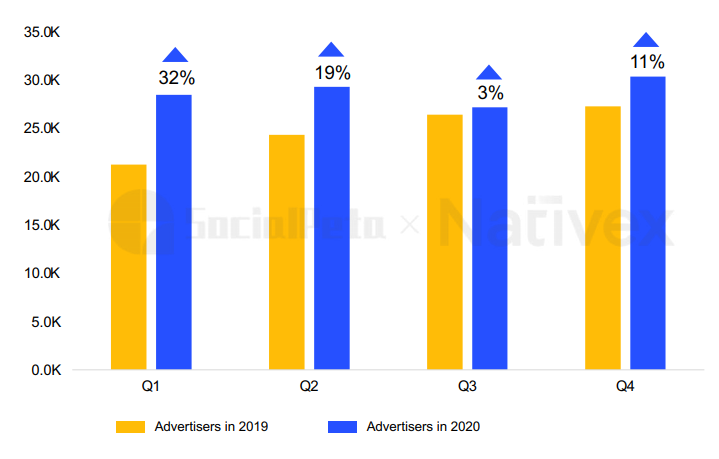

The number of game advertisers (advertisers — here are the games ordering ads) in 2020, it increased by 7.8%. The main growth occurred in the 1st quarter: it was 32%.

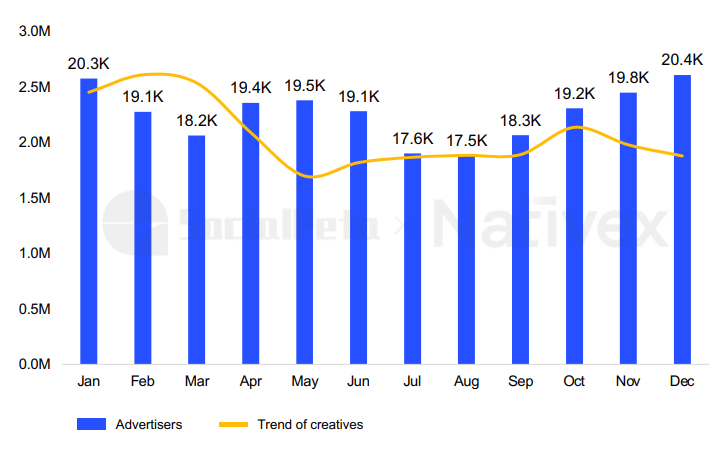

The peak growth of advertisers was observed in January 2020. In total, more than 20 thousand gaming applications were ordered for advertising during the month (most of the advertisers were on Android, their ratio to iOS advertisers is 6 to 4).

On the chart just above, the yellow bar is the number of creatives themselves. Their growth was observed in the 1st and 4th quarters.

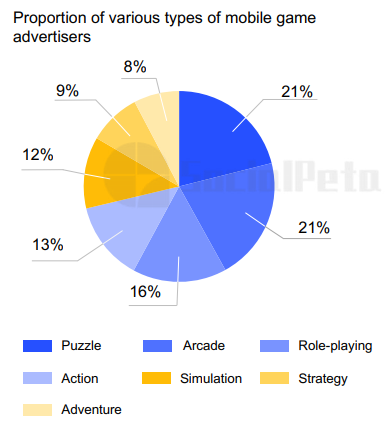

The largest number of advertisers in the gaming segment was among puzzle games (puzzles, which also include match-3 in mobile stores). We ordered advertising of 11 thousand similar games.

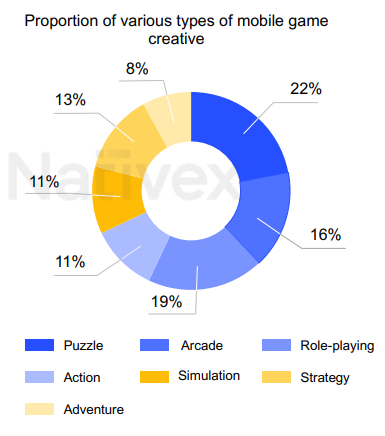

In addition, most of the creatives themselves were also devoted to puzzles. We are talking about 2.8 million published creatives.

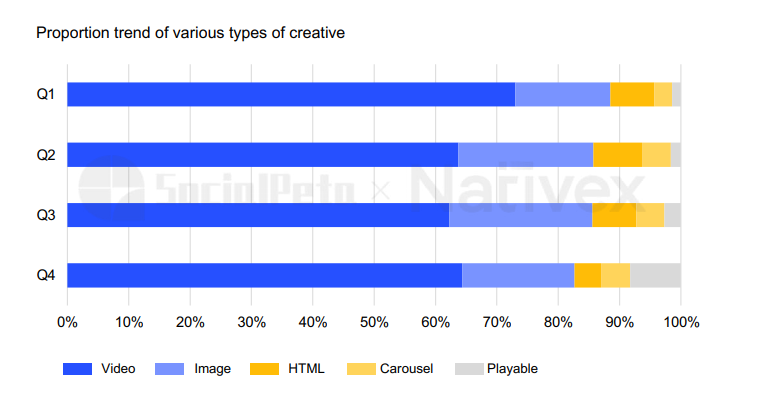

The most common type of creatives were video clips. They accounted for more than 60% of all advertising.

Playable advertising has significantly strengthened its position. If in the 1st quarter it accounted for less than 2% of all creatives in games, then in the 4th quarter its share almost reached 8%.

The most popular were videos with screen recordings, staged scenes (sitcoms), videos with real people and MG animation. As a rule, the gameplay was demonstrated during the promotion of casual games, and advertising with real people was more often found in commercials of midcore and hardcore games.

Facebook Instagram (FB News Feed, Audience Network, Instagram, Messenger) and Google (Google Ads, YouTube) remained the most popular international advertising channels for promoting games in 2020. In China, among the leaders, SocialPeta notes providers such as Toutiao, DouYin, Tencent Social Ads and Pangle.

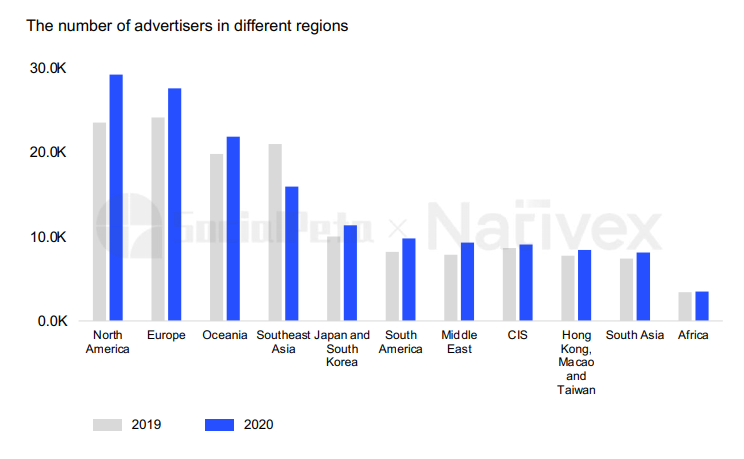

In terms of the number of advertisers, North America was the leader. There was also the largest increase in their number relative to 2019. In Japan and South Korea, for example, there was also growth, but it was not so significant — by 15.4% and 3.5%, respectively.

***

The report also includes an analysis of the most popular advertisers in various networks (including Chinese ones) and a detailed overview of the non-gaming mobile market over the past year. They can be found in the full version of the study (caution: 80 slides!) follow this link.