In January, KamaGames announced a partnership with Yoozoo Games. The companies jointly launched Poker Champions in India, a version of Pokerist adapted to the local market. In an interview with KamaGames CEO Andrey Kuznetsov, we talked about the Indian mobile games market.

Alexander Semenov, Senior Editor App2Top.ru Q: How many mobile gamers are there in India right now?

Andrey Kuznetsov

Andrey Kuznetsov, CEO of KamaGames: According to Statista, by the end of 2018, India’s mobile gaming audience will reach an impressive 300 million people. This is definitely a growing, developing market in which we are very interested in terms of the growth of our own company.

Previously, it was widely believed that the level of penetration of smartphones and tablets in the country is quite low. What now?

Kuznetsov: The penetration of mobile devices is currently higher than ever due to the evolution of 4G networks and the availability of relatively inexpensive devices on the market. According to last year’s Omidyar Network estimate, the availability of mobile phones among the population will grow from the current 65-75% to 85-90% by 2020.

This means that we should also expect an increase in the number of mobile gamers. At the moment, the market penetration is 19.9%, but most likely it will quietly reach 26% by 2022.

Which platforms are the most popular among mobile players in India?

Kuznetsov: Android is by far the dominant OS in the region, according to Statista.

How active are Indian gamers in terms of spending?

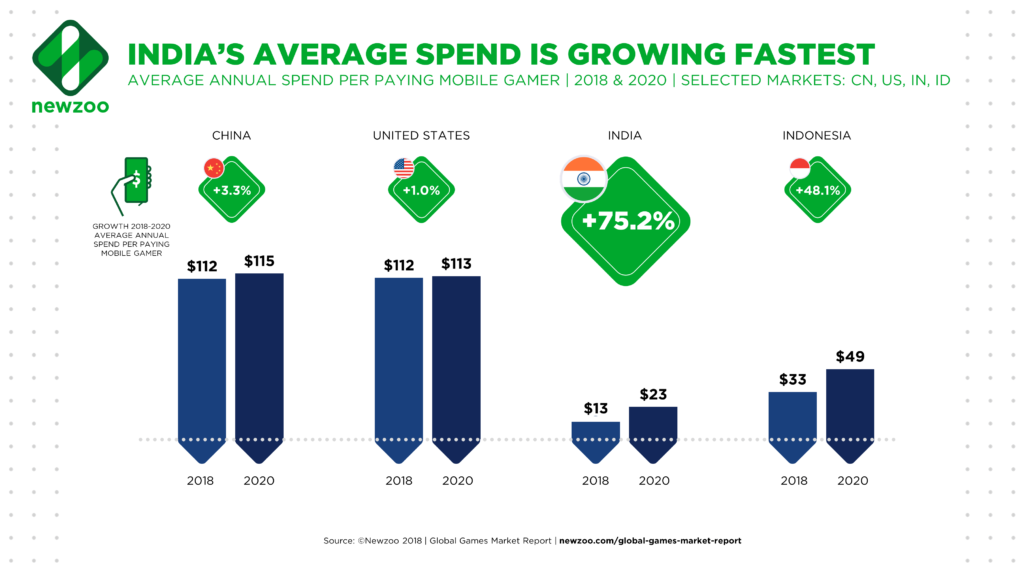

Kuznetsov: Now Indian players are just getting used to paying in games, but everything indicates a shift in their behavior. According to the latest Newzoo material, the projected revenue from mobile games will grow from $1.1 billion in 2018 to $2.4 billion in 2020 at a cumulative annual growth rate of 49%. Now ARPPU in India is about $13, but this figure will increase by at least 75% and reach $23 by 2020.

Growth dynamics of average User spending on games in India (forecast)

What do Indian developers mainly earn from, which monetization model do they mostly resort to?

Kuznetsov: It strongly depends on the chosen monetization strategy for a particular game, genre, and all that other stuff.

For example, within our portfolio of social casinos, the main source of money is IAP. But we also provide the opportunity to earn free chips by watching video ads and completing tasks. But these sources are insignificant compared to the income coming from micropayments.

Are there influential social platforms like WeChat in the local market, where presence is necessary for success?

Kuznetsov: Facebook is the number one social platform in India. 250 million people are registered in the region on it. For comparison, Facebook has only 230 million users in the USA. If developers are interested in a gaming audience, they should seriously consider having their game on Facebook.

For example, we became the first company to launch an HTML5 version of poker for Instant Games.

Poker Champions

What is a popular title in India in terms of downloads?

Kuznetsov: According to SensorTower, the top 30 titles receive from 1.5 to 4 million installs per month (this is the total downloads from iOS and Android). You can focus on these numbers. For social casinos, the numbers are smaller. Top projects in the genre receive 50-300 thousand downloads per month (in total on both platforms).

Can you share the average gaming metrics (ARPU, retention) for the Indian market?

Kuznetsov: Despite the fact that we have just entered the market, our metrics on iOS are better than on Android. ARPU is relatively small, but retention is good if the traffic sources are decent.

In India, you should be especially careful when investing in traffic, because there is a risk of buying users with cheap devices and getting poor performance.

What types of games are most popular in India?

Kuznetsov: If you take a look at the top 5 games with the highest number of downloads for the first quarter of 2018, these will be: board games, arcade games, as well as casual games in the spirit of match-3.

Ludo King is the most downloaded app in India according to the results of last February. Candy Crush and Subway Surfers are also in demand.

Yoozoo Games and KamaGames have entered the Indian market with a social casino. To what extent is this type of project in demand in the region? And what about slots?

Kuznetsov: Despite the fact that the Indian audience currently pays less than the audience of some other markets, we are confident in the great potential of the social casino both in terms of audience growth and monetization.

I would call Teen Patti the most popular game in the social casino genre in India, but slots have yet to reach their potential.

Important: The Indian market requires scrupulous adaptation and localization of graphics and content to the peculiarities of the local culture so that the project can claim success.

How popular are Western games?

Kuznetsov: At the moment — not really. Poker continues to be inferior to Teen Patti, but if you believe the figures I gave a little earlier, there is potential for development and growth in the not so distant future.

There are plenty of Teen Patti in the Indian market. The two largest are from Moonfrog (pictured) and from Octro.

Is it even possible to launch a Western game without an Indian publisher?

Kuznetsov: Such a strategy is unreasonable and contains significant risks, since a foreign publisher may miss important features for the local market. The Indian audience is used to a certain interface, certain colors and certain content (sales, promotion), which differ from those that are common in Western projects. If we take all these things into account, the Western project will have a better chance of success.

What are the main changes that a Western razarbotchik should make to the game before launching in India?

Kuznetsov: Again, it is important to offer the local audience the game they want to play. The most important change is the color scheme of the application. Then — localization and a clear promotion plan, which, for example, will take into account local holidays.

Today, many Western publishers look at India as skeptically as they looked at the Chinese mobile market five or seven years ago. They do not believe that it is possible to make money on it. Are they risking losing the market again?

Kuznetsov: India has a long way to go until there is a good ROI here, but it will definitely happen. Its growth dynamics have already proved this. Of course, any emerging market is a risky market, but the size of the user audience in India is too large to underestimate. Plus, compared to China, this market is much more open and favorable for investors.

Also on the topic: