At the end of summer, we compiled a comprehensive report on the gaming stock market situation. To update the data and capture trends, we again analyzed the status of over 60 public companies and examined how their positions have changed since the beginning of 2025. Inside, you'll find our traditional abundance of graphs, numbers, and information across various markets.

Note:

- All data concerning market capitalization and stock values are accurate as of November 26, 2025 — some metrics may have slightly changed by the article's publication, but not significantly;

- The phrase "since the beginning of the year" describes the percentage change from the close of trading at the end of 2024 (the last days of December) to the present date (November 26, 2025);

- Metrics such as market capitalization and stock value are presented in US dollars for uniformity, though we also provide data in the "original" currencies (yen, yuan, zloty, etc.) in specific cases;

- For convenience, abbreviations are used for some terms — for example, YoY (year-over-year), YTD (year-to-date), and so on.

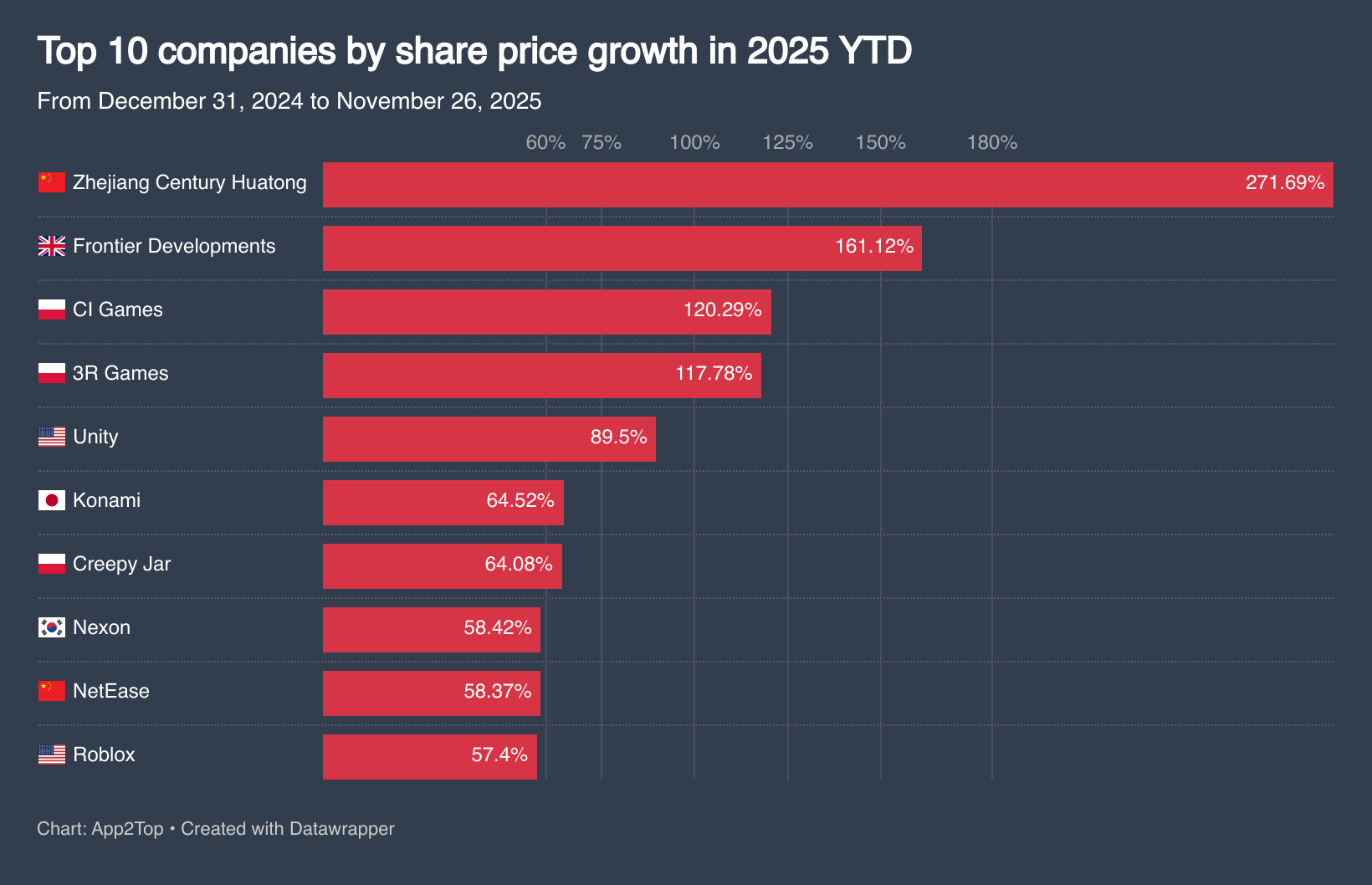

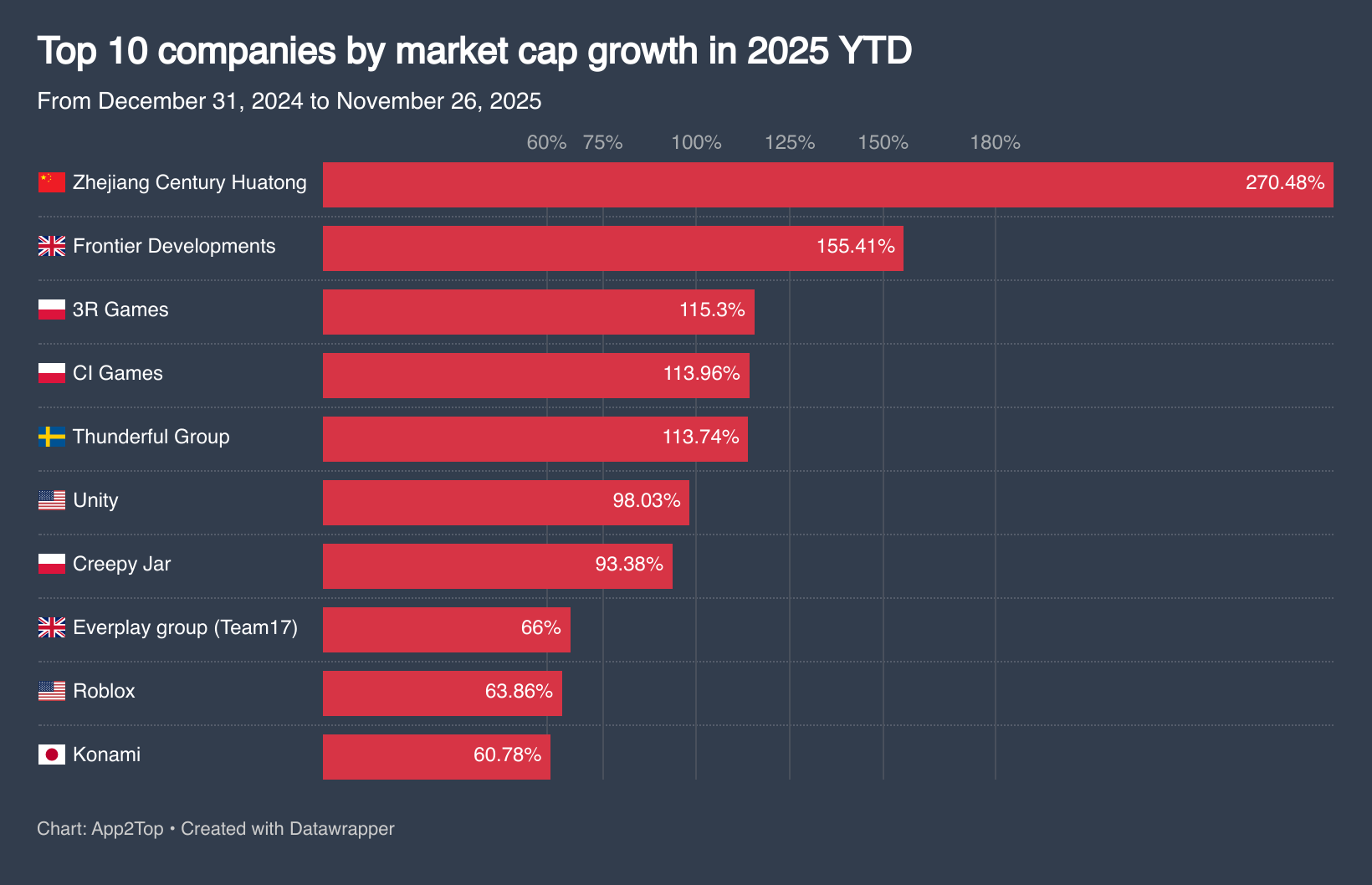

As it was three months ago, the global leader in terms of market capitalization and stock value growth remains the Chinese holding Zhejiang Century Huatong. In terms of percentage change, it far outpaces all other companies on the list.

Among other interesting observations:

- key Chinese companies are on the rise, whereas Japan has experienced an expected correction following a rapid growth in the first half of the year;

- investors still place strong belief in small Polish studios;

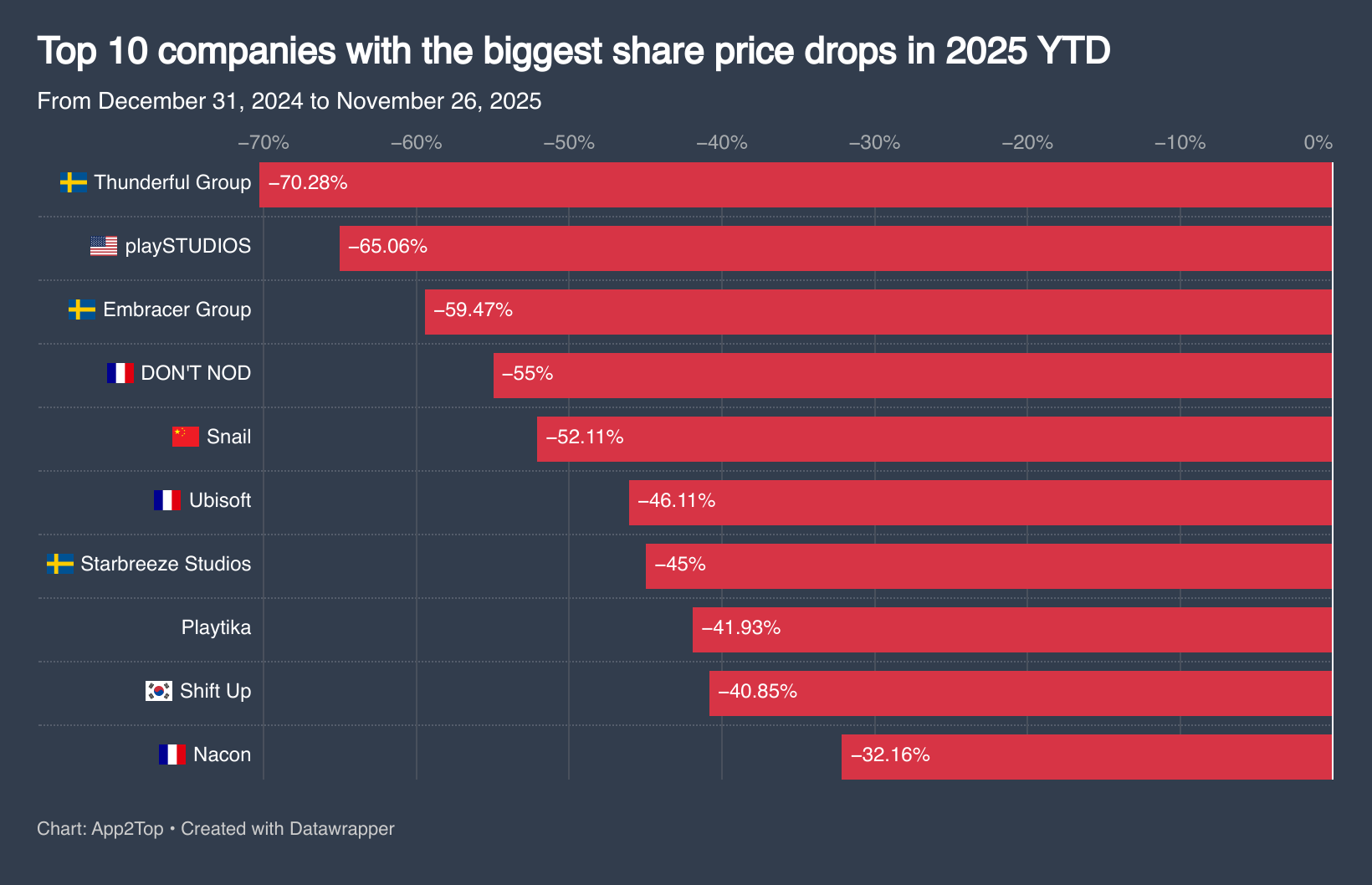

- the dire situation of Swedish companies has not only failed to improve but has worsened;

- Unity exceeds all expectations due to strong belief in its new AI advertising platform strategy.

But let's take it step by step.

Chinese Companies Exhibit Steady Growth

Zhejiang Century Huatong, a company rarely covered by gaming media, continues to show impressive growth rates. We wrote about this in our August article, and since then, the holding's positions have only strengthened.

Century Huatong’s market capitalization has surpassed $19 billion, soaring by over 270% since the start of the year. The stock price, though seemingly modest at 18.25 yuan ($2.58 per share), reflects a growth of 271.7%. Additionally, a historical peak of $3.1 per share was recorded in September.

The reasons are simply rooted in the company's financial successes:

- Revenue for the first three quarters exceeded 27.2 billion yuan ($3.8 billion), +75.3% YoY;

- Net profit increased by 141.6% to 4.35 billion yuan ($614 million);

- Downloads of Whiteout Survival surpassed 200 million;

- The company has increased its hiring in AI, actively working on integrating various models into its business pipeline.

Recall that besides their main hit Whiteout Survival, their gaming division called Diandian Interactive (Century Games) operates numerous other projects. Among them is the mobile strategy game Kingshot. Another subsidiary, Shengqu Games, publishes popular foreign titles in China, including Final Fantasy XIV and MapleStory.

As was the case three months ago, Chinese companies remain the most stable in terms of growth. For example:

- Shares in Tencent have grown more than 50% since the start of the year, reaching $80.37 per share, with its market capitalization exceeding $720 billion;

- Shares in NetEase are at $27.98 per share (+58.37% YTD), with a market cap reaching $90 billion;

- Perfect World shares are at $2.2 per share (+56.51% YTD), market capitalization reaching $4.3 billion;

- 37Games shares are at $3.05 per share (+43.4% YTD), market capitalization reaching $6.7 billion.

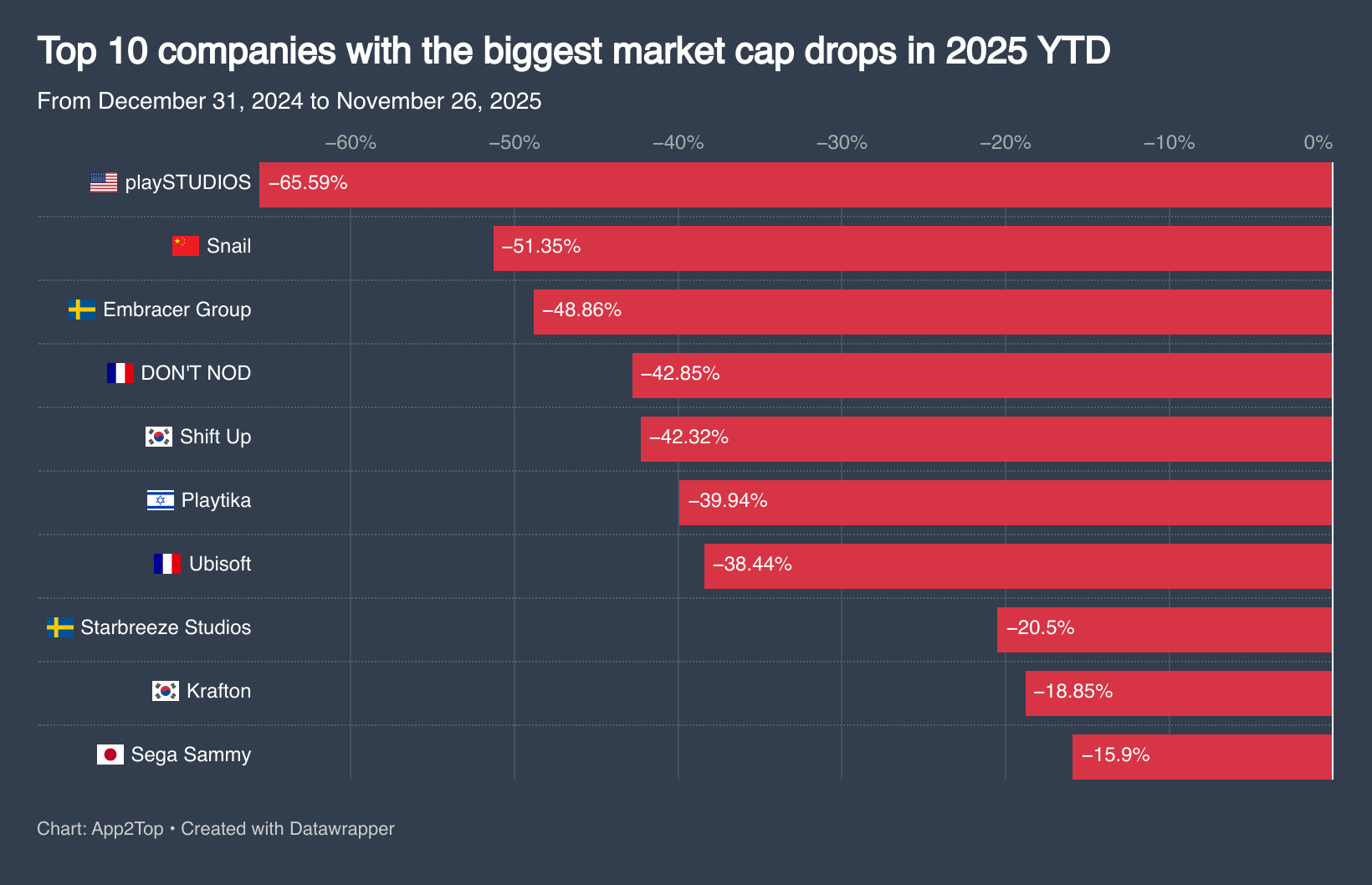

Of course, there are less fortunate examples. Shares in Snail , known for the ARK franchise, have decreased by 52.11% to $0.89 per share since the start of the year (note: although the company is Chinese, it is traded in the US). This is particularly due to poor financial results. In the third quarter, the company's revenue was $13.8 million (-38.7% YoY), and instead of profit, it recorded a net loss of $7.9 million.

Important: Analysts note a stable growth in the Chinese gaming market. For the first half of the year, domestic revenue reached $23.4 billion (+14.08% YoY). The segment showing the most growth was WeChat mini-games, generating $3.2 billion (+40.2% YoY). Additionally, Niko Partners predicts that by the end of 2025, Chinese gamers' consumer spending will exceed $50 billion.

Japan Grows Amid Weak Yen, and Nexon Leads in South Korea

Up until late summer, Japanese gaming companies showed unprecedented growth and broke records. In the first half of the year, some major players — Sony, Nintendo, Bandai Namco, Konami, and Capcom — hit historical highs in stock value.

By the end of November, the market corrected itself after a brief overvaluation by investors. However, the largest public companies either continue to show impressive growth or remain extremely stable:

- Konami shares rose 64.52% YTD to ¥23,760 ($152.6), due in part to the growth of mobile gaming, a successful return to the AAA video game segment, and strong financial results exceeding market forecasts;

- Square Enix shares are at $19.71 each (+49.3% YTD), despite weak financial results — revenue and profits continue to fall, but the company has focused on dividends and presented a new medium-term growth strategy with a portfolio revision and increased efficiency in the video game business;

- Nintendo — $84.02 per share (+44.65% YTD), thanks, in part, to the successful launch of the Switch 2, stable results, and a new annual revenue forecast (expected to be record-breaking);

- Sony — $28.1 per share (+37.62% YTD), with the gaming division continuing to show good results.

As for general trends for Japanese gaming companies, the weak yen should not be overlooked, especially given that many publishers focus on export revenue. Another factor is shareholder incentives, including increased buybacks and dividends.

However, by late autumn, a laggard has emerged among Japanese companies. Sega Sammy shares have declined, falling 14.1% YTD to $16.94 per share. Its market capitalization has decreased by almost 16% to $3.6 billion. This is due to declining game sales in the last quarter, poor Rovio results, and a sharp drop in the arcade Pachinko segment.

In South Korea, the situation is noticeably different, as among local companies, there is only one clear leader — Nexon. Traded in Japan, the company recorded a 58.42% YTD increase in stock value to ¥3,690 ($23.57 per share), with its market capitalization approaching $19 billion.

To summarize Nexon's results briefly — the company is doing great. Operating income is growing by double digits, franchises like Dungeon & Fighter and MapleStory continue to generate steady revenue, and the success of ARC Raiders has strengthened investors' confidence in the portfolio of new projects. The company also promises to return more than 33% of its annual operating income to shareholders.

The situation is reversed for Krafton. Investors are very dissatisfied with the lack of dividends and new successful releases. Recent months have renewed concerns about the company's heavy reliance on a single game's performance (PUBG) and the possibility that its initial post-IPO valuation in 2021 may have been too high. As a result, shares have fallen 19.43% YTD to $173.94 per share.

Problems are also observed with Shift Up, which continues to fall after going public last year. Despite another record quarter, investors are dissatisfied with the postponement of future releases to 2027–2028, and the downgrade from JPMorgan and other experts only heightens shareholder concerns. Since the beginning of the year, Shift Up's stock has fallen by 40.85% to $24.69 per share, and since going public, they have lost almost 50% in value.

Swedish Crisis Continues — and Other European Data

Traditionally, the most "unfortunate" country is Sweden. Local gaming companies continue to fall amid financial difficulties, unsuccessful releases, and shortsighted M&A decisions. There are no signs of stabilization.

The most illustrative examples:

- Embracer Group — once the largest Swedish holding, is still reaping the painful restructuring results (the sale of "surplus" assets is ongoing, the parent company is preparing for a rebrand, and Coffee Stain is planning an IPO), and amid weak results, shares have fallen almost 60% YTD to SEK 81.14 ($8.51);

- Thunderful Group — $0.02 per share (-70.28% YTD) in the wake of prolonged revenue decline, significant write-offs, poor game performance like SteamWorld Build (the company also sold a controlling stake to Atari and narrowly avoided bankruptcy);

- Starbreeze — $0.01 per share (-45% YTD), continues to face financial problems, and recently wrote off $27 million on a canceled D&D game.

Other Swedish companies are also in the red zone. Among them are G5 Entertainment (-25.17% YTD), Paradox Interactive (-25% YTD), and Enad Global 7 (-25% YTD).

A completely different picture emerges in Poland, a country with numerous public gaming companies. Particularly successful are relatively small or medium-sized studios.

The biggest gainers since the start of the year are CI Games (+120.29%) and 3R Games (+117.78%). The former exhibits growth largely due to the success of Lords of the Fallen and investor optimism about its future release pipeline. 3R Games stays on top thanks to the growth of its VR business and the investments received for it.

Creepy Jar (+64% YTD) and Ultimate Games (+50.35% YTD) are also doing well. But the situation is less clear for other established players:

- Bloober Team — $6.49 per share (-5.2% YTD);

- PlayWay — $71.75 per share (-7.75% YTD);

- 11 bit studios — $42.72 per share (-11.96% YTD).

Finally, CD Projekt, Poland's largest gaming company, remains in the green. Its shares have risen nearly 24% since the start of the year to PLN 240 ($25.18) per share, with a market cap exceeding $6.5 billion. Despite no new releases, investors remain optimistic due to strong financial results and faith in its future release pipeline (including "The Witcher 4," a Cyberpunk sequel).

Interestingly, just a few years ago, media headlines occasionally noted how CD Projekt had once again surpassed Ubisoft in market capitalization. But now, there is a substantial gap between the two companies.

Speaking of Ubisoft, its market capitalization has plummeted to nearly $1 billion, with shares down almost 50% YTD to €6.93 each. The French company is in a prolonged crisis. Neither the release of Assassin’s Creed Shadows nor the deal with Tencent has alleviated the situation. The latter is expected to help Ubisoft reduce its €1.15 billion net debt, but there's a long way to returning to its former standing.

Other French companies are also in the red:

- PullUp Entertainment — $19.9 per share (-26.81% YTD);

- Nacon — $0.58 per share (-32.16% YTD);

- Don’t Nod — $0.77 per share (-55% YTD).

When it comes to Europe, it's worth mentioning the success of Frontier Developments. The company has made a real comeback, and in growth rate on the stock market, it is behind only Zhejiang Century Huatong among all gaming companies worldwide. Since the start of the year, its shares have grown by 161.12% to $6.8 apiece, with a market cap reaching $240 million. This is due, among other factors, to the success of its recent releases (Planet Coaster 2 and Jurassic World Evolution 3).

More data on the state of the European gaming market (including in individual countries) can be found in our major analytical report.

US Situation: EA Grows Amid a Pending LBO, and Unity Gains from AI

By the end of summer, the leader in growth among American companies was Roblox. Since then, it has yielded some ground but remains significantly up. Since the start of the year, its shares have grown by 57.4% to $91.07 each, with a market cap of $63.9 billion. This is supported by the steady growth of the platform's active audience and positive short-term projections from market analysts.

Most surprising are the figures from Unity. Although revenue exceeds company expectations, its net losses persist — reaching $127 million last quarter. Nonetheless, the company's shares have risen 89.5% YTD to $42.58 each, with a market valuation exceeding $18 billion. This is still far from the all-time high of nearly $200 per share, but investors remain highly optimistic.

The main reason is the company's significant pivot toward AI. This year, Unity launched the machine-learning-based advertising platform Vector, and any applications of LLM and similar technologies today are well-known magnets for investors.

Strong results are also shown by Electronic Arts. Amid preparations for a buyout by an investor consortium (a detailed LBO deal analysis is available here), its shares have risen nearly 38% YTD to $201.66 each. Meanwhile, the financial results leave much to be desired — last quarter's revenue fell by 9.2% YoY, and net profit plummeted 53.4% to $137 million.