On March 12, the Sensor Tower analytical company published a large-scale study on the situation in mobile gaming by the end of 2022. We have already written about him briefly. Time for detailed material with key calculations from the study.

Basic figures

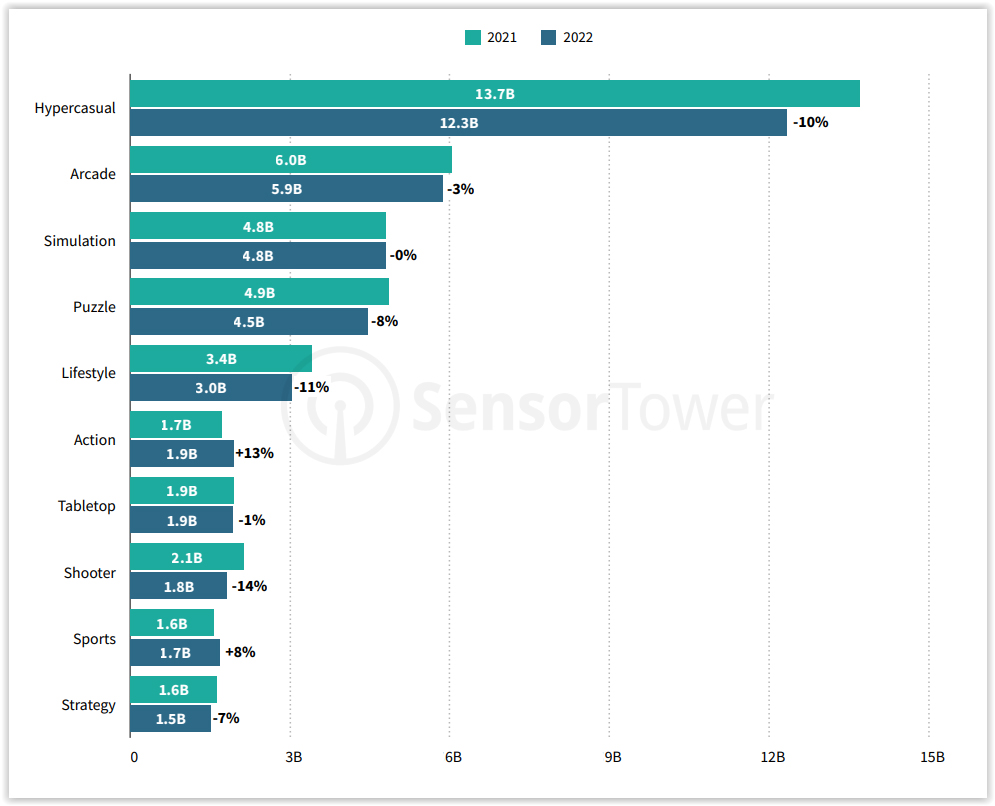

The top mobile game genres experienced a decline in downloads in 2022.

Comparison of game genre downloads in 2021 and 2022 (mobile, top 10 genres by downloads)

Analysts explain this:

- by introducing a new privacy policy, increased the purchase price of the download (CPI);

- the recession that followed the growth of user purchase budgets;

- restoration of doc-like habits in users.

The most significant drop is in the genre of hyper—casual games. In the fourth quarter of 2022, their downloads decreased by 24% relative to the same quarter of 2021.

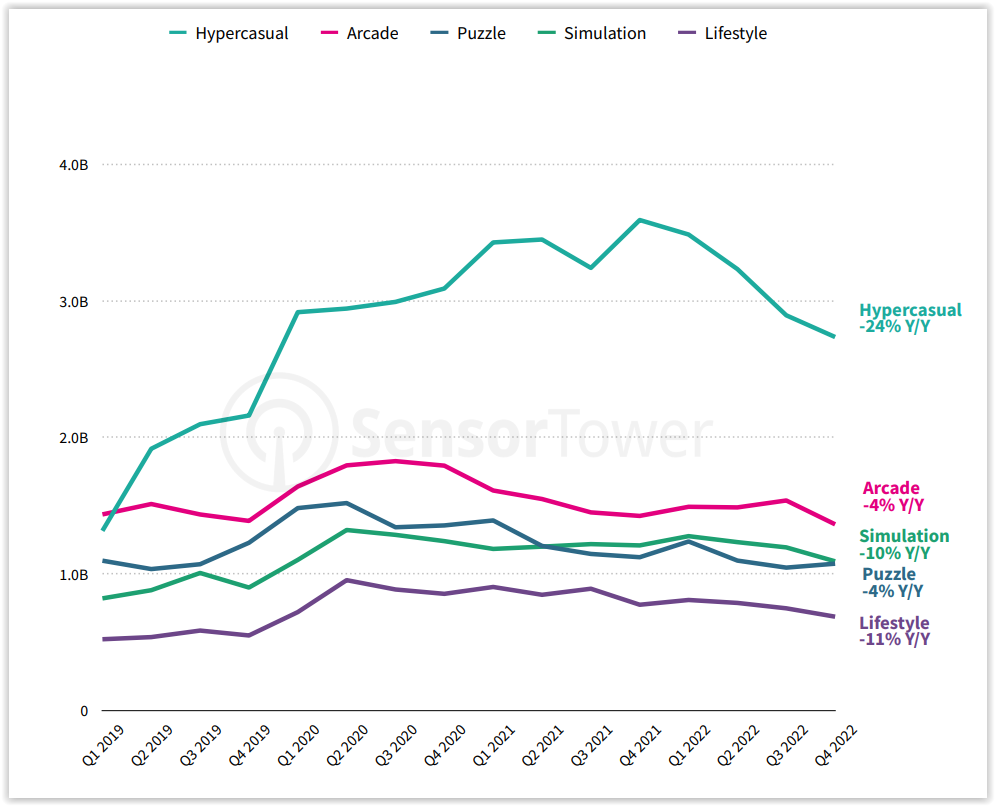

Dynamics of game genre downloads in 2019-2022 (mobile, top 5 genres by downloads)

Why?

The profitability of hyper-casual products is directly related to the cost of users and monetization based on the display of promotional videos. One of the reasons: the cost of users has increased, but eCPM, as we recently wrote, has not.

While previously popular genres had a drop in downloads, other downloads were growing:

- downloads of hybrid-casual games increased by 13 in annual terms% ;

- subscription games (which are distributed through services a la Netflix and Apple Arcade) have increased downloads by 24%.

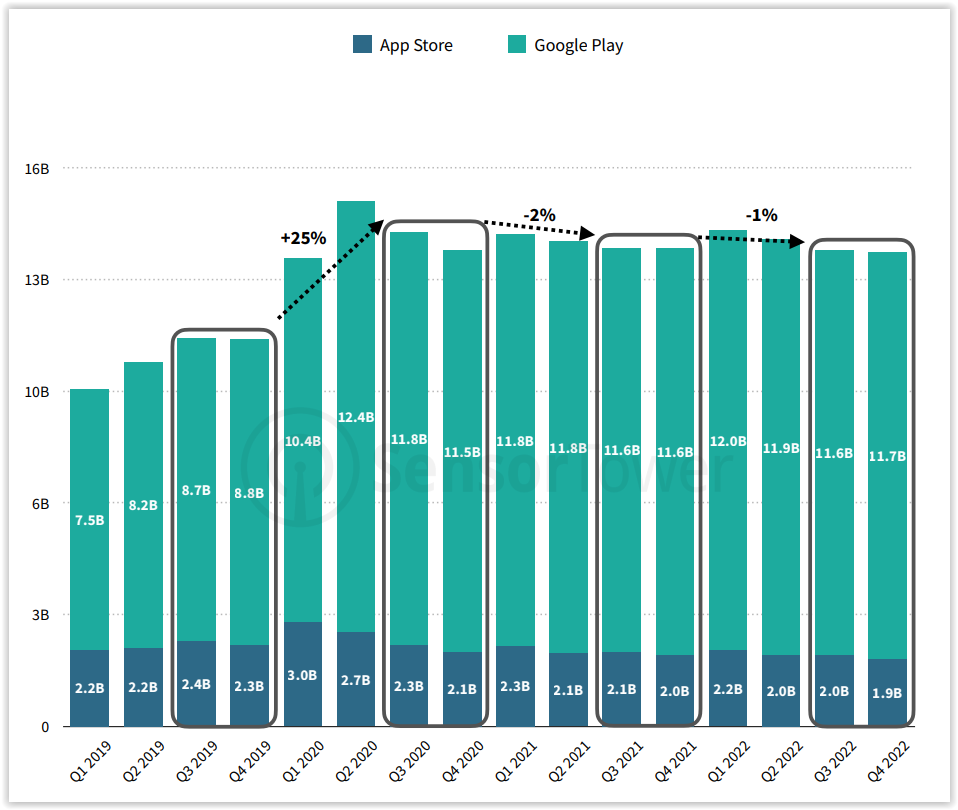

Despite the drop in downloads for many genres, the total game downloads have been stable at the level of 13.8 billion since 2020.

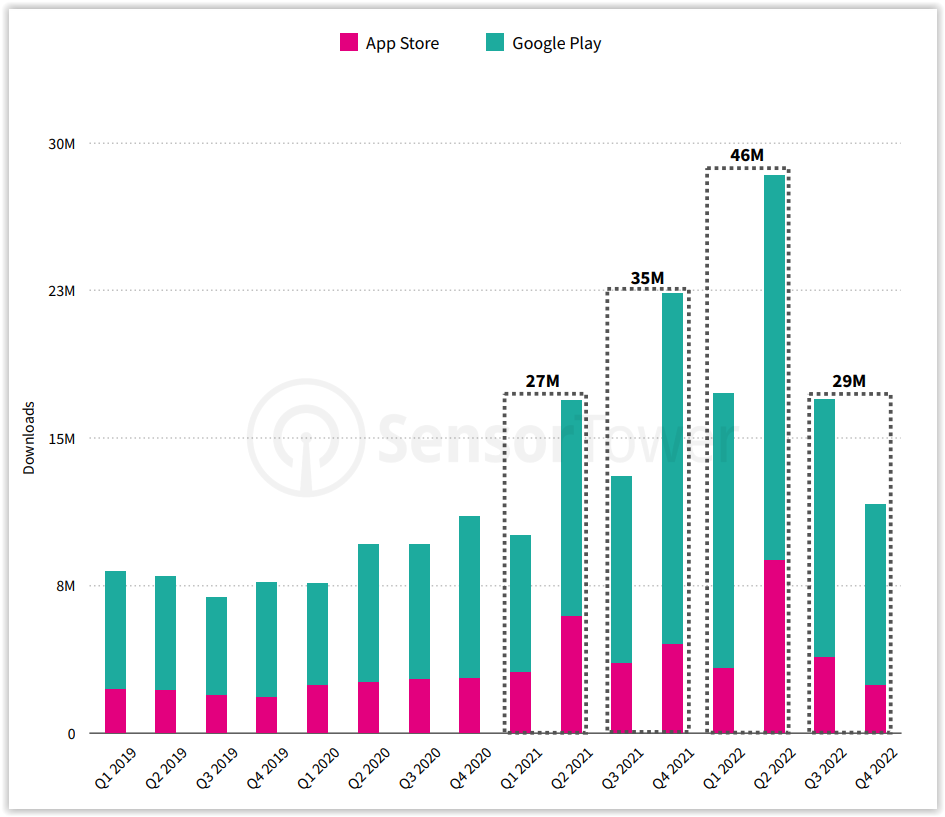

Dynamics of mobile game downloads (App Store and Google Play)

India is the leader in mobile game downloads, accounting for 17% of all installations.

Dynamics of mobile game downloads in 2019-2022 (mobile, top 5 markets by downloads)

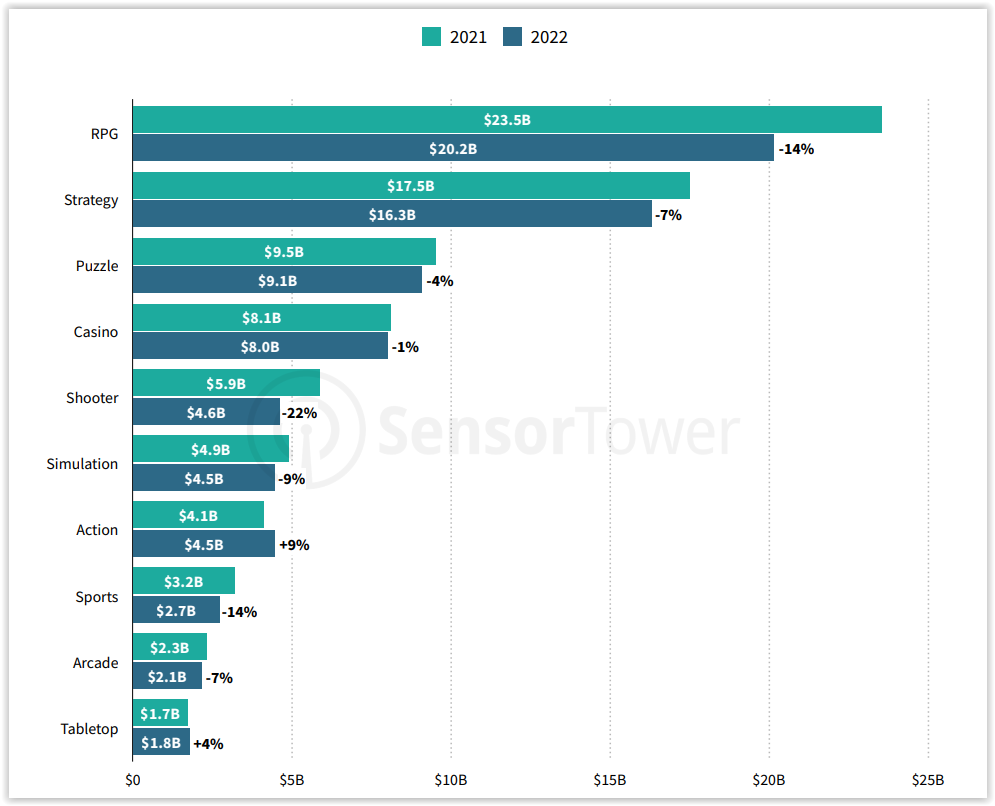

Revenue from most genres in the top 10 at the box office also fell significantly.

Comparison of revenue of game genres in 2021 and 2022 (mobile, top 10 genres at the box office)

One of the exceptions was the Action genre, which in 2022 increased its annual box office by 9% relative to 2021.

All thanks to the success of such midcorn titles as Genshin Impact, Dragon Ball Legends and Marvel Contest of Champions, as well as hybrid-based Survivor.io .

The biggest drop in the box office in the fourth quarter in annual terms in two genres:

- RPG genre sales fell by 20% (from $5.6 billion to $4.5 billion);

- sales of the Shooter genre fell by 25% (from $1.4 billion to $1 billion).

Revenue dynamics of game genres in 2019-2022 (mobile, top 5 genres at the box office)

The drop in the box office of shooters is explained by a decrease in interest in such titles as PUBG Mobile, Garena Free Fire and Call of Duty Mobile. Plus, EA failed to successfully bring Apex Legends Mobile and Battlefield Mobile to the market.

The general cash situation in the market is also unfavorable. Total gaming revenue fell by 16% year-on-year in the fourth quarter of 2022.

Revenue dynamics of mobile games (App Store, Google Play)

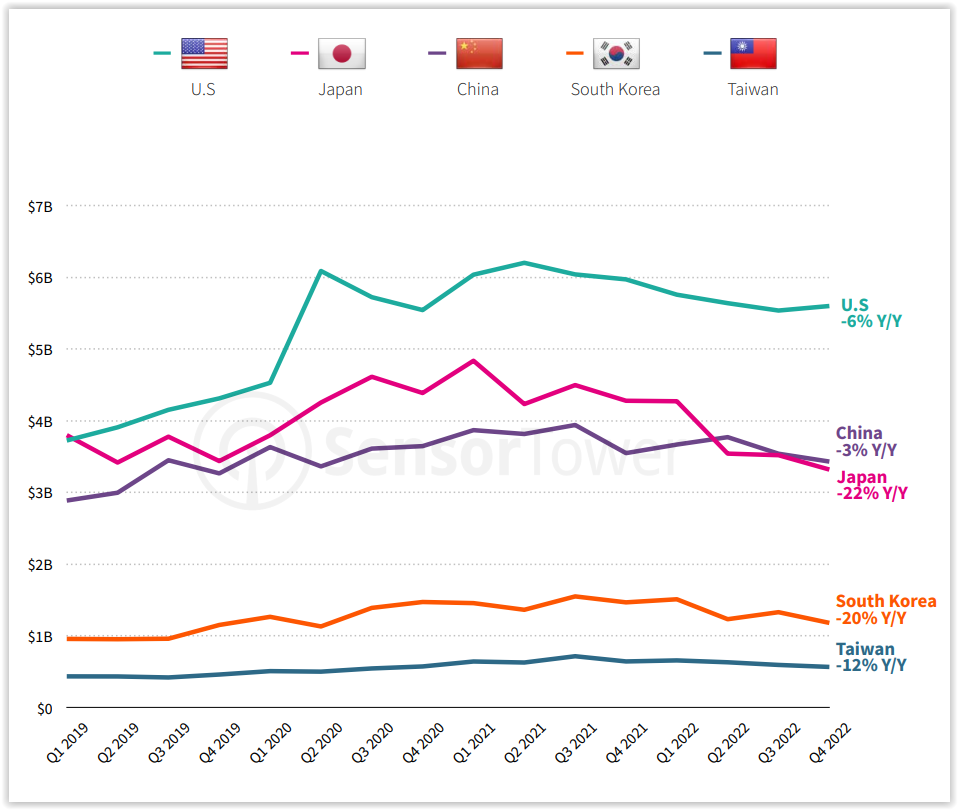

The main recession was observed in Japan and South Korea, which in the fourth quarter of 2022 lost more than 20% of the cash register in annual terms.

Revenue dynamics of mobile gaming games in 2019-2022 (mobile, top 5 markets by cash register)

Sensor Tower does not disclose the reasons. However, it is possible that this is due to macroeconomic factors.

For example, in October alone in the capital of Japan, basic consumer prices increased by 3.4% year-on-year. According to the publication “Kursiv”, “Consumer inflation in the capital of Japan has reached a 33-year high, showing the fastest annual pace since 1989.”

Hybrid Casual Games

Special attention in the report is paid to the direction (or, as specified in the report, the product model) of hybrid casual games (Hybridcasual).

By them, Sensor Tower understands products whose gameplay resembles hyper-casual titles, and monetization and retention mechanics are taken from midcore and casual games.

Hybrid – casual games are characterized by:

- easy-to-understand game mechanics that do not require mental effort to assimilate and play;

- simplified meta in the spirit of midcore titles (collections, any progression, and so on);

- hybrid monetization, which implies both the possibility of buying in-game currency or bonuses, and the presence of rewarding and full-screen advertising;

- a more modest production budget compared to casual games (reuse of code, libraries, and even visual content from game to game);

- more attractive to a wide audience.

Classic representatives of the hybrid—casual direction – Archero and My Little Universe

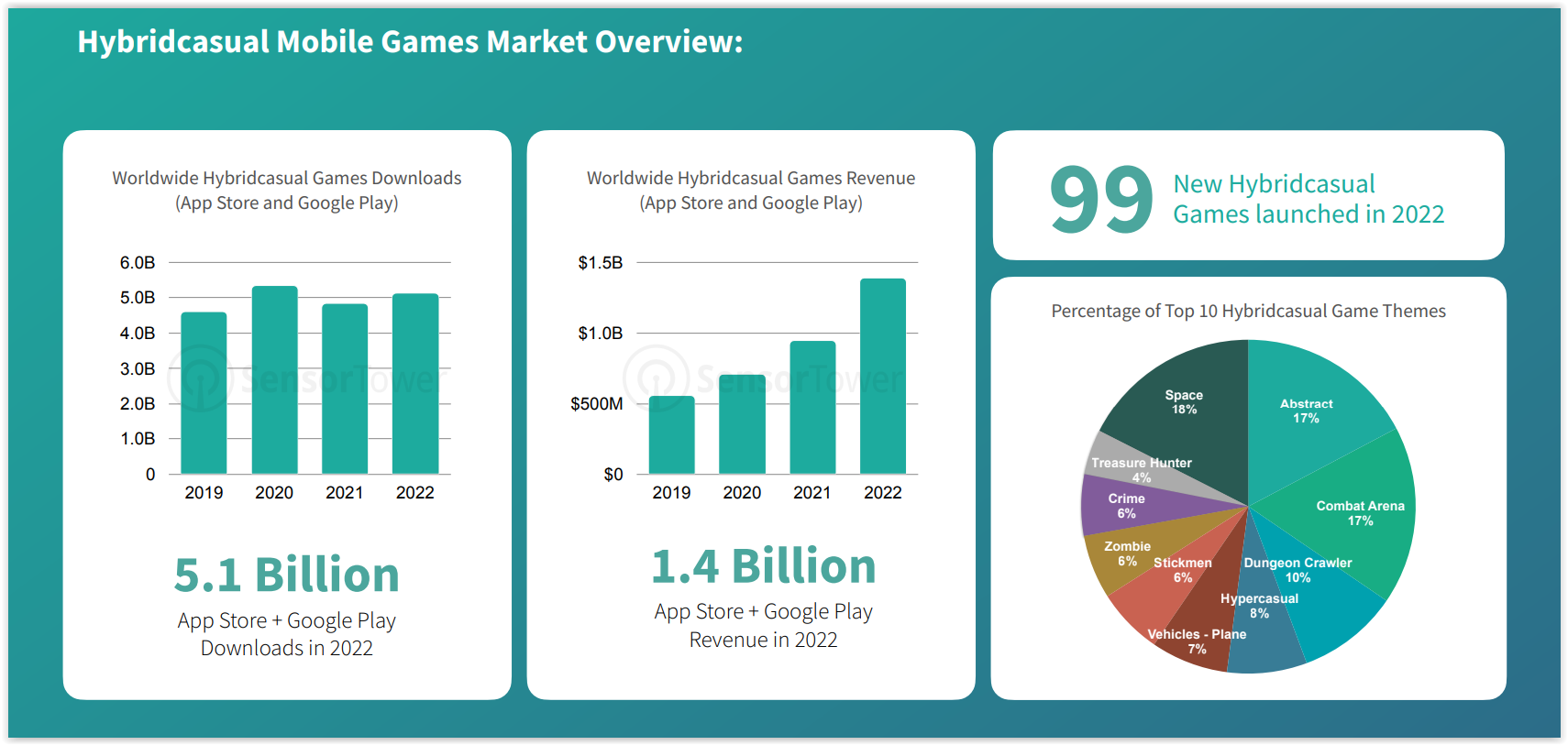

It is still difficult to talk about the explosive growth of the popularity of the direction. Its downloads will remain at the level of 4-5 billion from 2019. However, the revenue of hybrid casual games is steadily growing.

The situation in the segment of hybrid casual games by the end of 2022

At the same time, it is also important to understand: what growth / decline rates the direction of hybrid casual games shows directly depends on the success of a particular game in a particular period of time. There are so few hits in the niche that any success greatly changes the disposition.

For example, the growth of downloads of the hybrid-casual direction in June-August was due to the success of Stumble Guys, and the direction achieved peak values in the fourth quarter due to its huge popularity Survivor.io .

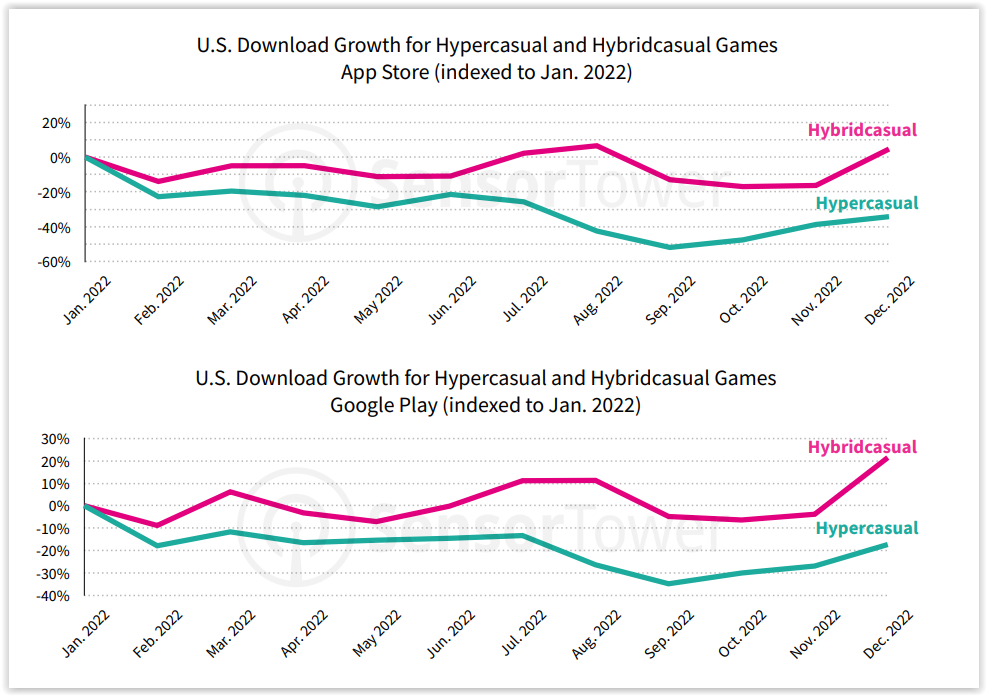

Dynamics of downloads of hybrid-casual and hyper-casual games in the USA by store

Also, Sensor Tower does not agree that some interpret hybrid-casual games as the development of a hyper-casual genre. The main argument is that not only those who previously created hyper-casual projects, but also those who specialized in casual and midcore games, have moved to the development of hybrid-casual games.

By the way, over 700 hybrid-casual products were released last year.

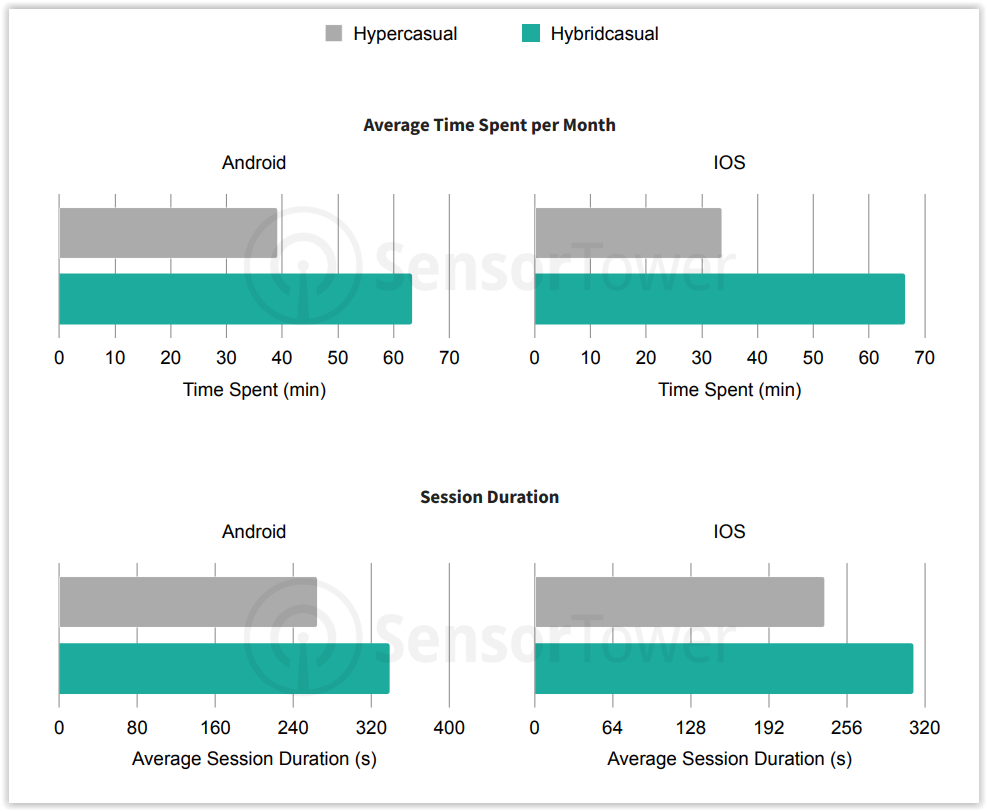

From the strange: Sensor Tower also attributed the midcore Rush Royale: Tower Defense TD to hybrid-casual games for some reason. Against this background, it is not surprising that service analysts believe that gaming sessions in hybrid-casual games are much longer than in hyper-casual ones.

Comparison of the amount of time spent in projects and the duration of the session in hybrid-casual and hyper-casual games by stora

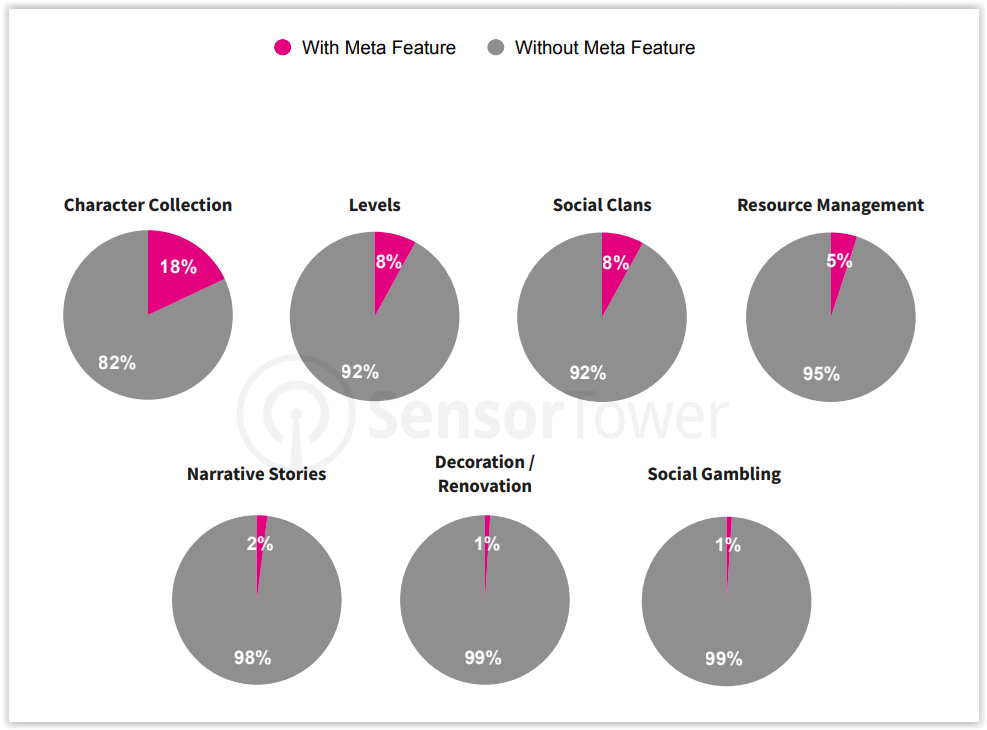

The most used meta in hybrid-casual games is the Character Collection mechanics. It is present in 18% of hybrid casual games. The second place with 8% each is shared by the mechanics of Levels and Social Clans (levels and clans).

Metas used in hybrid-casual games and their prevalence

Subscription games

Sensor Tower has few subscription game analysts, but there were some interesting moments.

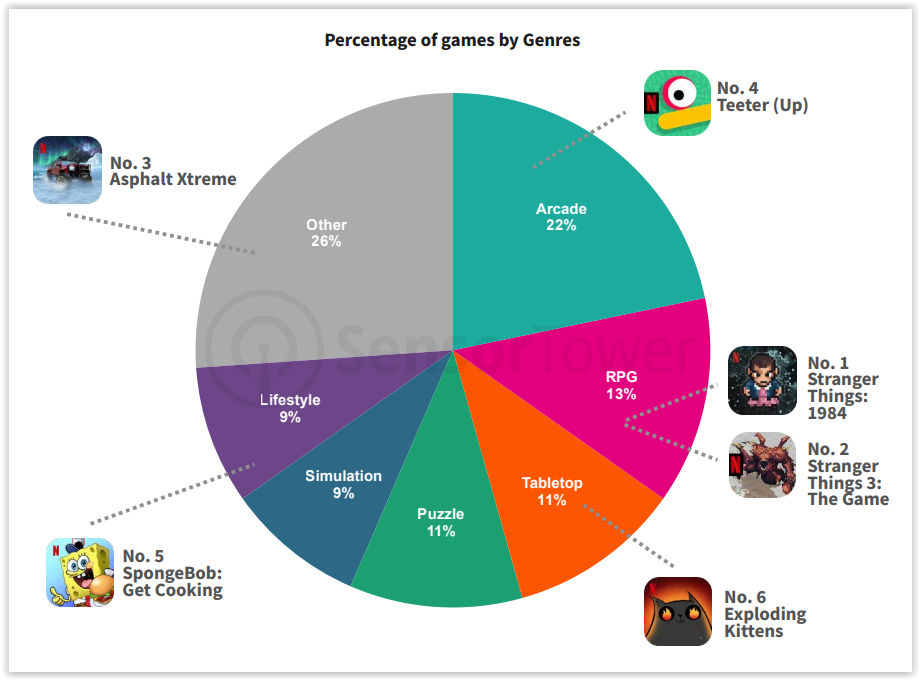

In 2022, total downloads of games from the Netflix catalog reached 24.6 million. Most of them came from games in the Arcade genre.

Segmentation of the Netflix game library by genre

This is modest, considering the library of 50 titles.

Moreover, the top platform games also have a relatively low level of downloads.

Top 5 Most Popular Games in the Netflix Game Library

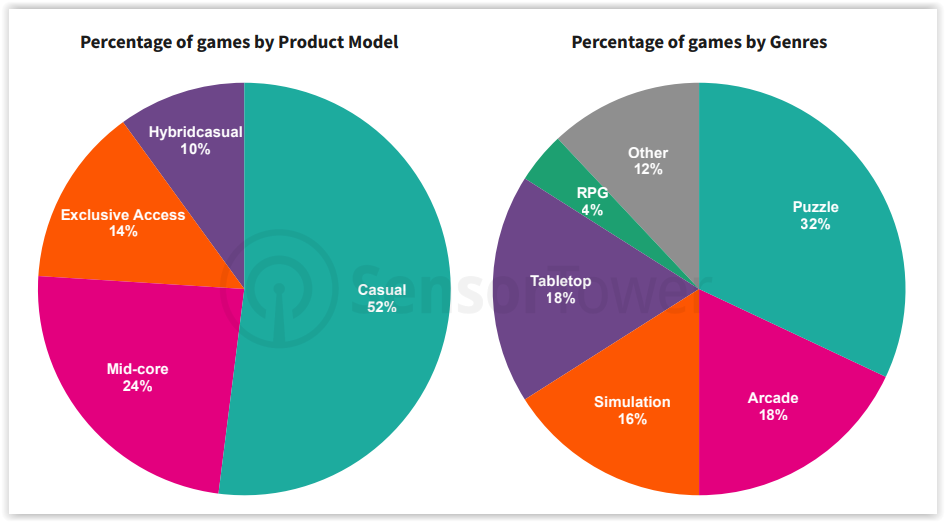

Unfortunately, Sensor Tower does not have data on downloads made over the past year from Apple Arcade. The service managed to collect only information about what kinds of games and genres there are on the platform.

Segmentation of the Apple Arcade game library by product model and genres

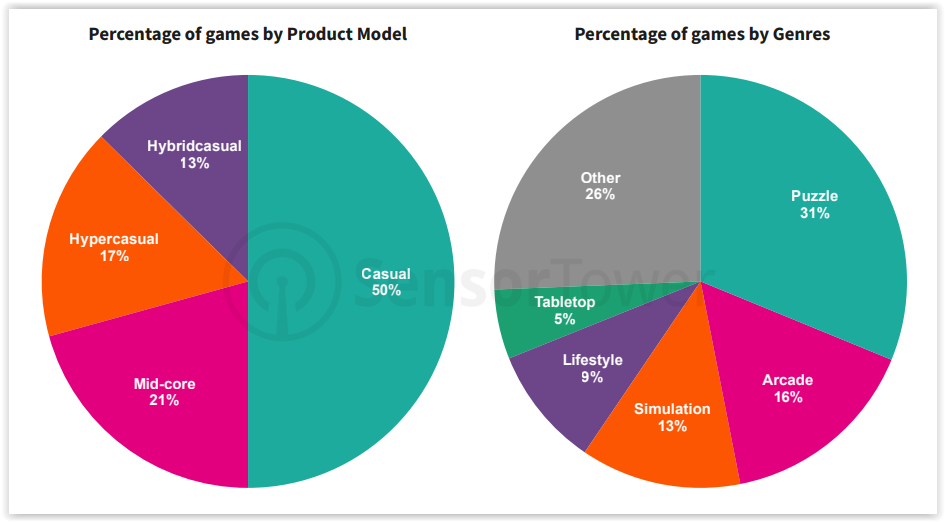

A similar situation (lack of information on downloads) is observed in the case of Google Play Pass, the Android equivalent of Apple Arcade. There is data only on which games are presented on the site.

Segmentation of the Google Play Pass game library by product model and genres

Games with Crypt and NFT

In the second quarter of 2022, games that supported crypta and NFT reached peak downloads. But then the collapse began. In the second half of the year, the cumulative downloads of such projects did not reach even 30 million installations.

Dynamics of downloads of games with crypta and NFT (App Store, Google Play)

Players’ spending on purchases in these games has also decreased. They fell by 35% compared to the previous year: from $516 million in 2021 to $336 million in 2022.

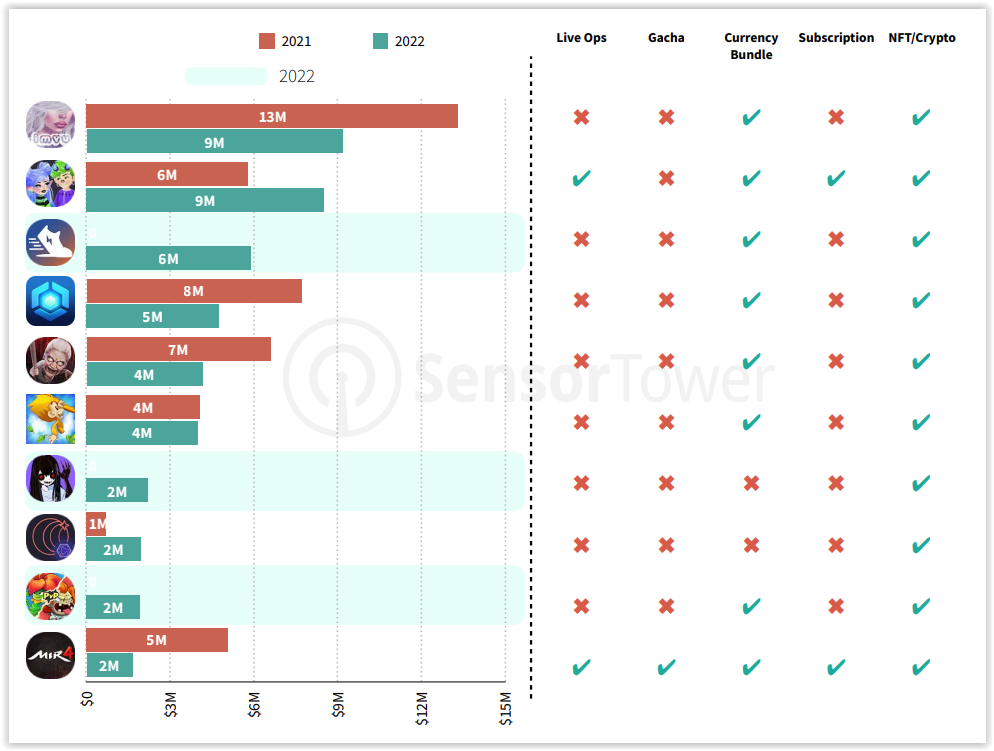

Top 10 most downloaded mobile games supporting Crypt and NFT (App Store and Google Play)

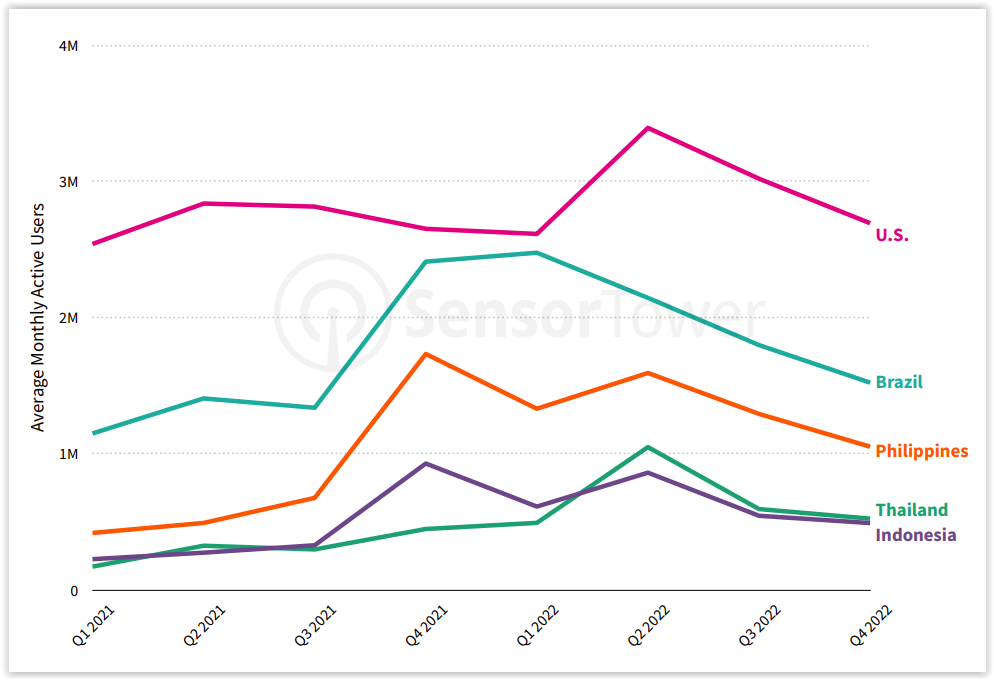

The fall affected all the major markets for the segment, not only in terms of downloads and cash registers, but also MAU. For example, the cumulative monthly audience of such titles in Brazil in the fourth quarter of 2022 fell by 39% compared to the results of the first quarter.

Dynamics of MAU of mobile games supporting crypt and NFT by country (App Store and Android)

Among the top 10 markets for downloads of mobile games supporting crypta and NFT, only one country has seen an increase in MAU — India. In it, the cumulative monthly audience of such games increased in the fourth quarter of 2022 relative to the first quarter by 130% (up to 880 thousand).

Monetization tools

A separate chapter in the report is devoted to mobile game monetization tools.

LiveOps

Sensor Tower itself does not give a specific concept of what LiveOps is, saying that it is “a key tool for monetization and retention in the highest-grossing games, aimed at maintaining a high level of retention and spending.”

We, in turn, urge you to keep in mind the three definitions of LiveOps:

- from Tommy Leung, founder of Captivate Games: “Any changes in the project that are made without a separate release of a new version or update“;

- from Alexander Shtachenko, founder of the ProGameDev blog: “operational activities aimed at improving the performance of the product, based on data analysis, through changes and improvements to the basic functionality“;

- from Anton Finyukov, the leading game designer of Pixel Gun 3D: “a set of in-game events, content, narrative and promotions. This is necessary to maintain the life of the project when the players have already mastered the core and meta — then they need events to refresh the experience, get new emotions and not turn the game into a routine.”

According to Sensor Tower, all the top 10 highest-grossing mobile games of 2022 use LiveOps.

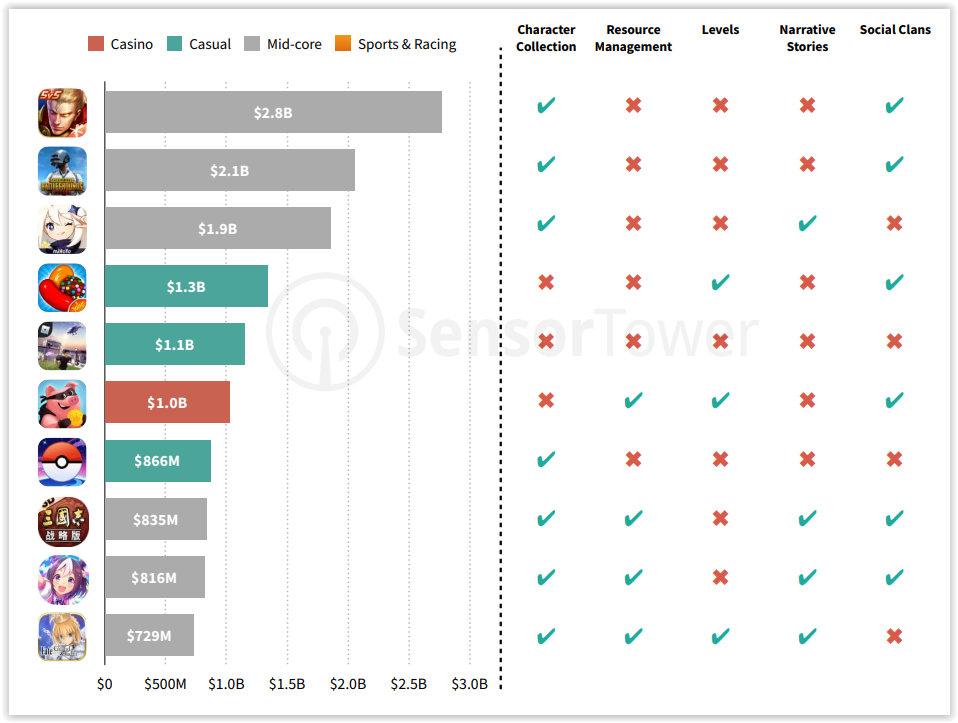

Top 10 highest-grossing mobile games by the end of 2022 and the monetization tools used in them

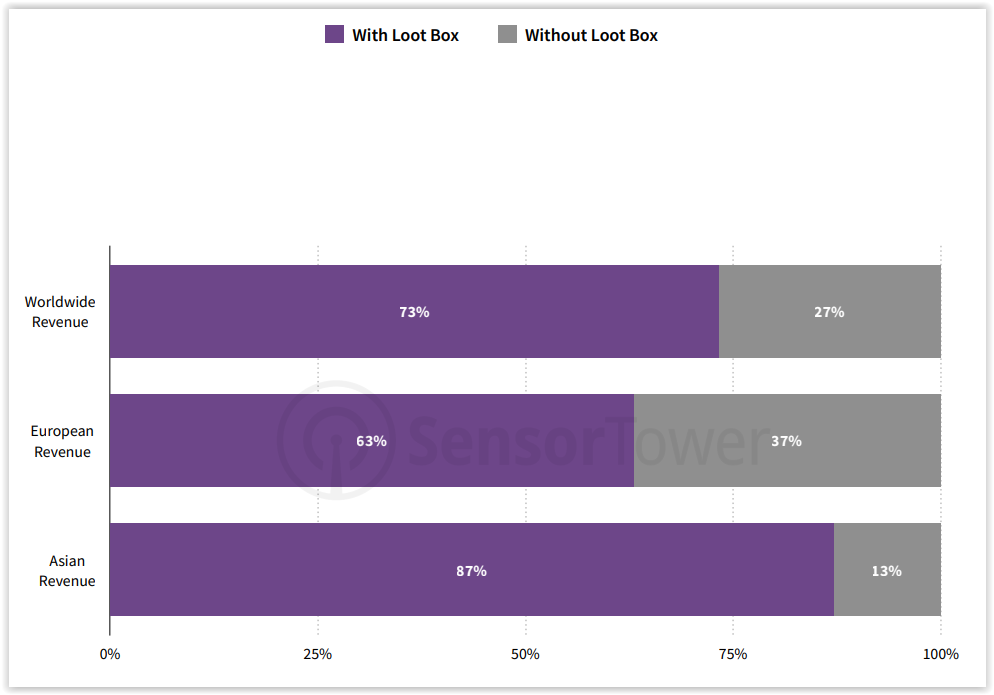

Loot boxes

Over the past year, regulators in various countries have increasingly opposed loot boxes. And if it comes to real bans, it can seriously hit the mobile games market, because 73% of global revenue is responsible for projects that support this mechanics.

The share of revenue that came from mobile games with loot boxes in 2022

At the same time, only 15% of mobile games have this mechanic.

Collecting characters

One of the most popular meta mechanics present in 70% of the top earning games is character collecting.

Top 10 highest-grossing mobile games by the end of 2022 and meta mechanics used in them

***

The full version of the study can be found at this link.