Analysts from Sensor Tower have published a large study of the US mobile advertising market. The report lists the key sites and advertisers focused on the gaming market. We have prepared a squeeze in Russian.Call of Duty: Mobile

Note:

In its research, Sensor Tower is based on the “voice share” (SOV) metric. This is an indicator of advertising activity, expressed by the ratio of advertising expenses of an individual company/product to total advertising expenses in the entire market in the same category. In this case, we are talking about comparing advertising networks not in terms of advertising volume or their immediate popularity, but about the share of game advertising on a particular site.

Key data

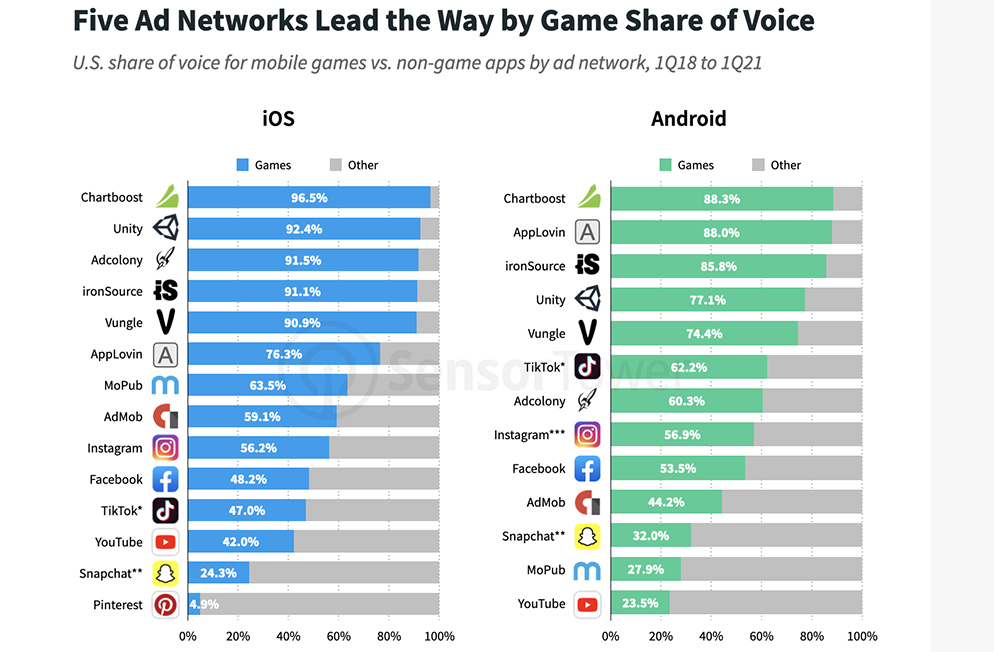

- In the period from the 1st quarter of 2018 to the first quarter of 2021, the networks with the largest presence of game advertising in the United States were Chartboost, Unity, AdColony, ironSource and Vungle. All of them have a voice share of game advertising in the American App Store above 90%. If we take the data from the beginning of 2019, then AppLovin will be added to them, which switched to games around the same time and began actively investing in developers.Instagram Facebook, AdMob, TikTok and YouTube have become other networks for which gaming traffic is important.

- Although they are not primarily focused on games, they still have a voice share in this segment in the region of 40-60%.Voice share of gaming and non-gaming advertising in various networks on iOS and Android

The most popular type of advertising for mobile games is video.

- At all key venues, this format had a voice share of over 50% in the first quarter of 2021. The exception is AppLovin, which has become more focused on playable advertising due to its popularity among developers of hyper-casual titles.Puzzles have the highest SOV on the six sites with the largest share of game advertising voice.

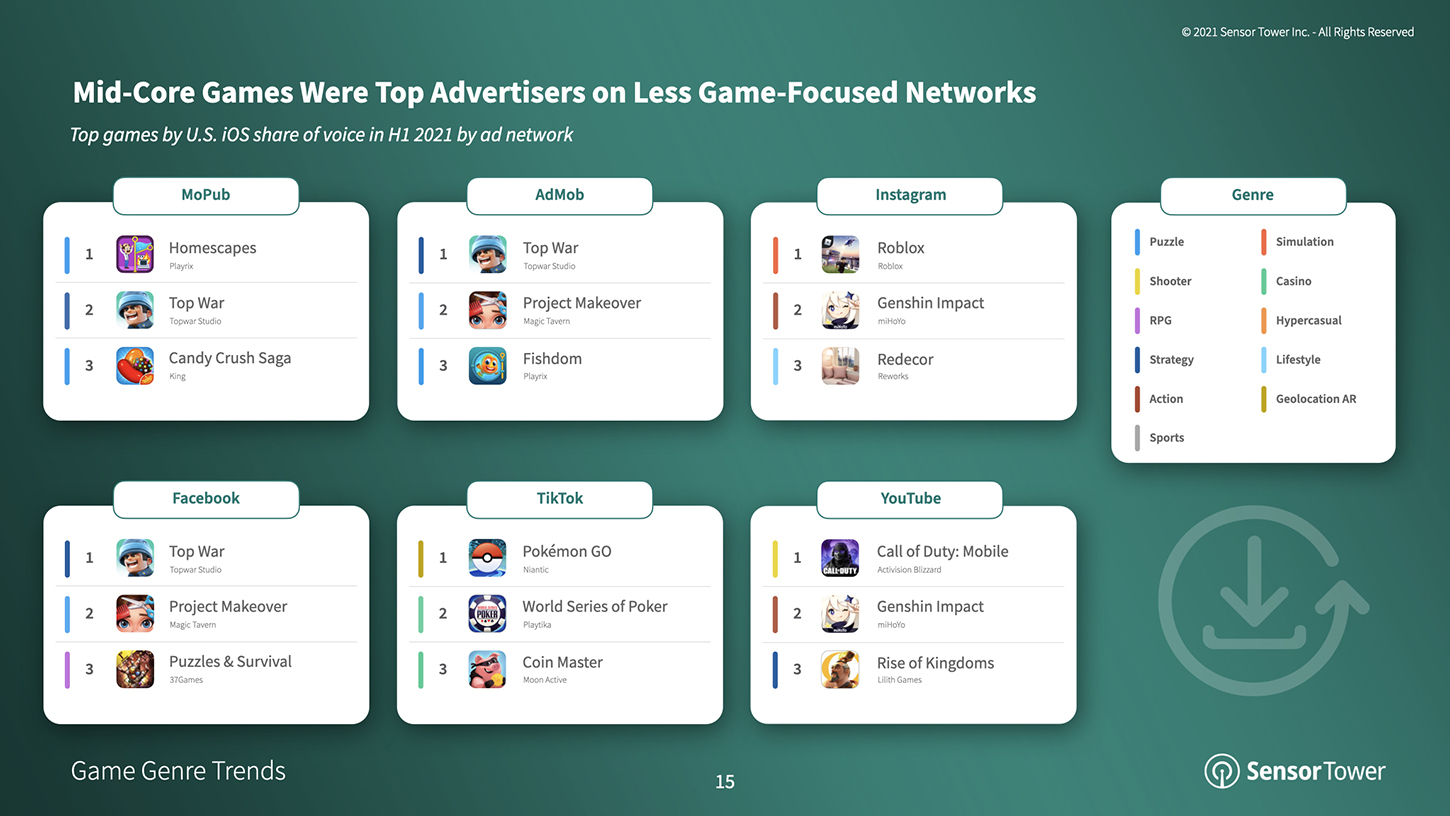

- However, midcore genres (RPG, shooters and simulators) also entered the top 5 for this indicator in some networks.Advertising networks focused not only on game advertising are more often used by developers of midcore titles.

- The strategies were ranked in the top 3 by voice share on Facebook, Admob and MoPub. And shooters take the first place on YouTube.The main advertisers by voice share in gaming advertising networks for the first quarter of 2021 on iOS were Angry Birds Dream Blast, Candy Crush Saga, Homescapes, Call of Duty: Mobile and Project Makeover.

- Games with the largest share of voice in gaming advertising networks in the American App Store (for the first quarter of 2021)

The leadership in non-gaming advertising networks in terms of voice share for the same period on iOS went to other titles.

- Among them are Homescapes, Top War, Roblox and Pokémon GO.Games with the largest share of voice in non-gaming advertising networks in the American App Store (for the first quarter of 2021)

The choice of an advertising network is often determined by the target audience.

- Social casinos have the highest share of votes on AdColony, since this platform is chosen by game developers for a female and older audience. YouTube, on the contrary, is chosen by developers of titles for younger male gamers.Highest average RPD (revenue per download)

- YouTube has $50. Adcolony ($22), Facebook ($22), Chartboost ($9) and AppLovin ($3) follow.