The Chinese analytical service SocialPeta shared the results of last year in the mobile games market, and also told what to expect from this year. There are a couple of interesting figures in the study.

Fiona Long — SocialPetaResults of 2020

Fiona Long — SocialPetaResults of 2020

General market figures

- In financial terms, the mobile games industry has shown excellent results. Its turnover by the end of 2020 reached $77.2 billion. SocialPeta expects its further growth in 2021.

- The number of mobile players increased by 12% last year to a threshold of 2.5 billion people. Most likely, this year there will be even more of them, because in many countries movement is still limited.

- Mobile games accounted for 21% of all Android downloads and 25% of all iOS downloads. In 2021, the share of games will increase, given the growing interest in it from non-core investors.

Traffic situation

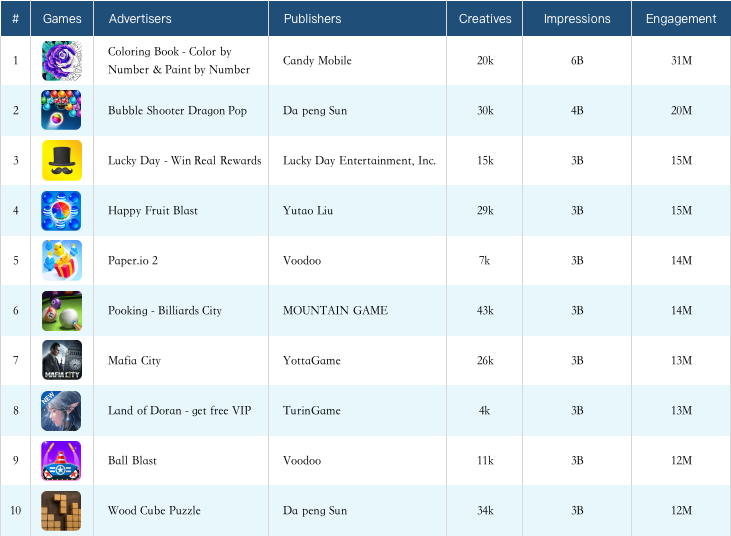

Advertisers

The number of advertisers among mobile games increased by 9% in 2020. At the end of the year, it reached a value of 60 thousand unique applications (on average, 20 thousand games are ordered per month).

By the way, games are responsible for a share of 24% of all mobile advertisers.

Creatives

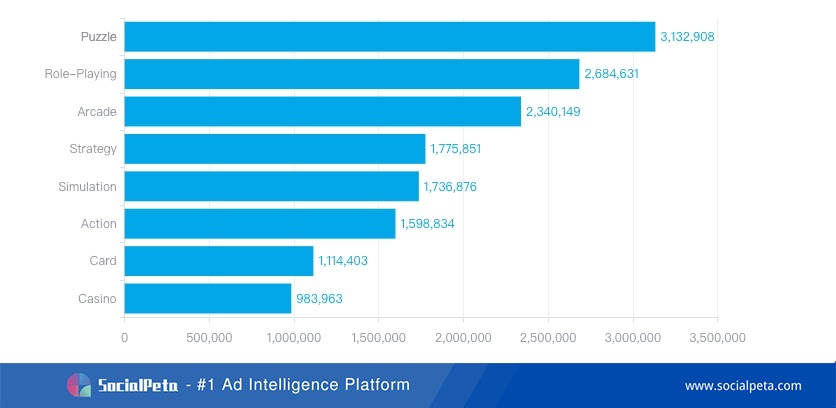

In 2020, SocialPeta recorded the launch of 12 million mobile game creatives. A quarter of them came from puzzle creatives. Creatives in role-playing games are in second place by a small margin.

At the same time, strategic games are the most active in terms of campaigns. On average, there are 359 creatives per strategic game per year.

Purchase price

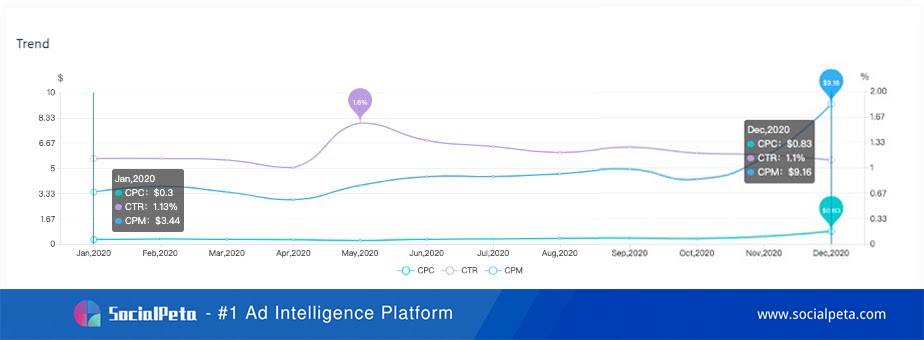

The cost per thousand impressions of advertising (CPM) for the period from January to December 2020 increased by an average of 166.27% across the market.

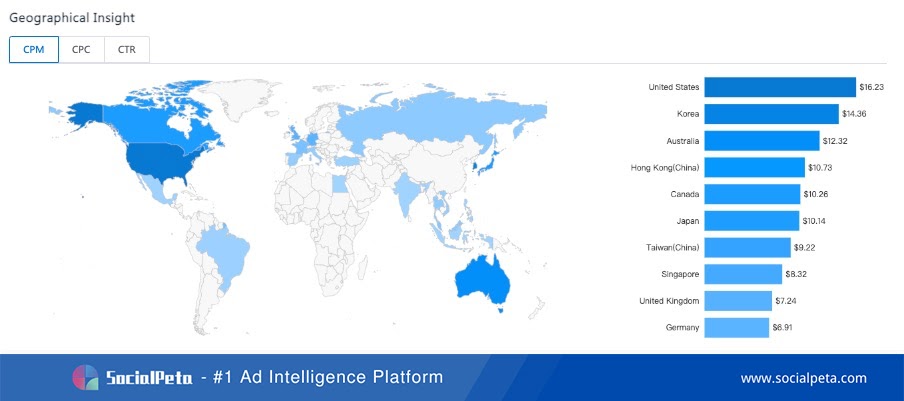

Still, the highest rates for advertising in the United States. Here CPM reaches $40.09. Traffic in South Korea and Australia is also very expensive.

Trends of 2021

Among the central events of 2020 is an increase in UA spending by gaming brands against the backdrop of a global lockdown. The problem is that today it is impossible to rule out a scenario where the operating expenses of a number of major players will exceed their revenue. This can provoke a crisis in the market.

Companies specializing in mobile games are trying to prevent such a development of the event. To avoid this, many of them are trying to work in three directions today.

1. Simplification of the operating model and reduction of unnecessary costs

An important trend in 2021 is operational changes. Companies are trying to simplify ongoing processes, development, and generally improve the efficiency of departments in order to get rid of unnecessary expenses and risks.

The focus on conducting CTR tests at the first stages of development is one of the consequences of the trend. Immediately before the start of development (or at its early stages) they help to understand the potential relevance of the project in the market.

2. Evaluation of in-game advertising as a key monetization tool

The role of advertising monetization continues to increase. Including motivated. This is also evidenced by the figures: 74% of American gamers will watch a commercial if they are offered something in return.

Therefore, it is becoming standard for an increasing number of companies not to limit themselves exclusively to IAP monetization (obviously, we do not take into account the hyper-casual direction, and so built on advertising).

3. The growth of spending on mobile analytics tools

Development teams are investing more and more in mobile analytics. The goal is obvious: to be able to build predictive models and secure long-term investments.

Companies want to avoid a situation in which their revenue will be less than the cost of promotion. Or, at least, they tend to find out about it in advance, and not after the fact.

***

Other data on the mobile games market can be found in the original 2020 White Paper report on Media Buying in the Global Mobile Market.