Versus.legal continues the cycle of analysis of foreign jurisdictions and special economic zones (SEZ) in Russia for doing business. Articles about Cyprus, Ireland, Delaware and the Kaliningrad Region SEZ have already been published. This time she decided to stay in Russia and turn to another interesting option for moving IT companies to the Murmansk region.

The material was prepared by Marina Pozhidaeva, a lawyer for Versus. Legal.

How can the Murmansk region be interesting?

The year 2020 has become fateful for the Murmansk Region and has incorporated a number of decisions aimed at the long-term development of the northern regions of Russia.

In July 2020, with the adoption of the Federal Law “On State Support for Entrepreneurship in the Arctic Zone of the Russian Federation”, the Arctic zone of the Russian Federation acquired the status of a special economic zone of the Russian Federation with a special legal regime and measures of state support for business.

But the Arctic zone includes 9 regions of Russia – why does the Murmansk Region stand out from all of them?

First of all, because in December 2020, tax benefits were established in the region for residents of the Arctic zone of the Russian Federation, which became available to business, including from the IT sector, from 2021.

What should I pay attention to?

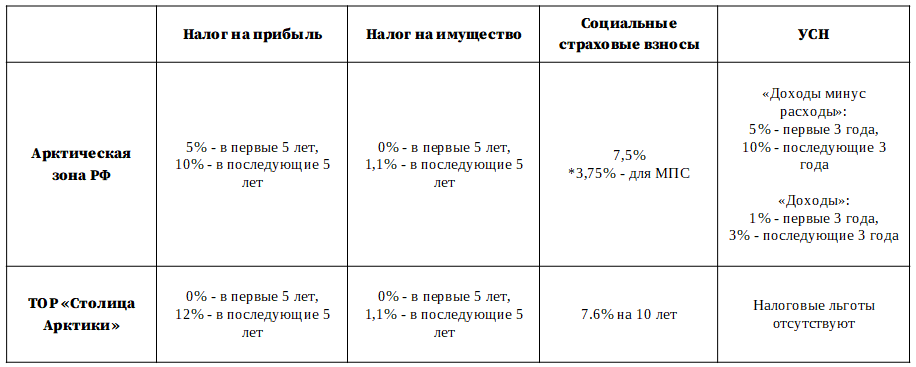

1. Preferential income tax rate: 5% is credited to the regional budget in the first five years, 10% – in the next five years.

The established preferential income tax rate to the regional budget gives the right to apply the income tax rate credited to the federal budget in the amount of 0% for ten years.

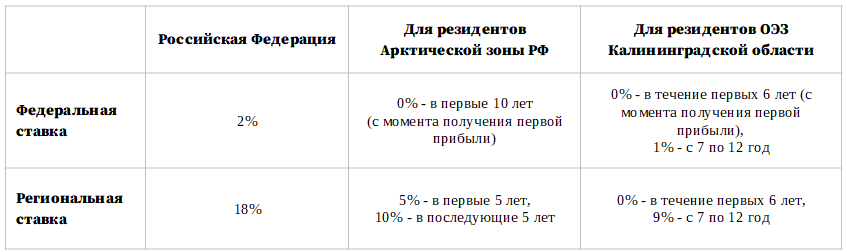

Let’s compare it with the federal rules and conditions of the Kaliningrad region:

Special conditions:

As explained by the Ministry of Finance of the Russian Federation, reduced income tax rates are applied either to the entire tax base, or only to profits received from activities carried out in the execution of the agreement on the implementation of investment activities in the Arctic zone of the Russian Federation.

At the same time, a resident of the Arctic zone cannot have separate divisions (branches or representative offices) located outside the Arctic zone (for example, in Moscow or St. Petersburg). It should be borne in mind that a separate division can be recognized as such on the grounds of affiliation – regardless of whether its creation is reflected or not reflected in the constituent documents of the organization.

However, nothing prohibits the creation of a subsidiary within the Arctic zone as an independent legal entity to carry out activities on an investment project.

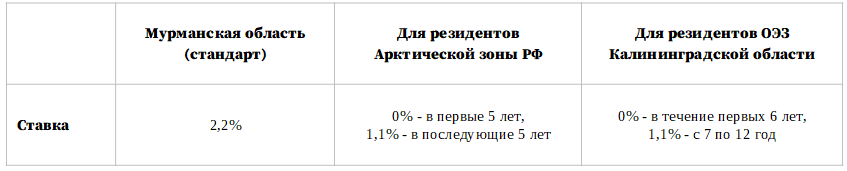

2. Preferential property tax rates: in the first five years the rate is 0%, in the next five years — 1.1%.

Clearly:

Special conditions:

The company’s property must be registered as fixed assets after the date of inclusion of the company in the register of residents of the Arctic zone of the Russian Federation, and it should not have been previously accounted for in the accounting of other taxpayers who are tax-registered in the Murmansk region.

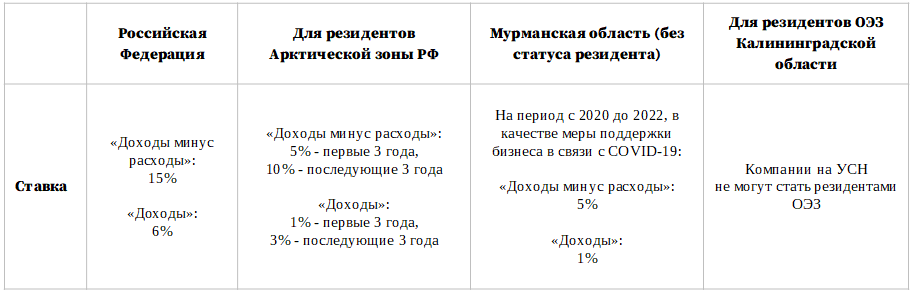

3. Preferential conditions for taxpayers – residents of the Arctic zone applying the taxation system (USN): in the “income minus expenses” mode, the rate will be 5% in the first three years and 10% in the next three years; when using the “income” mode, the rate will be 1% in the first three years and 3% in the following three years.

Clearly:

Taking into account the fact that for legal entities the USN replaces income tax, property tax on business objects (except for commercial and office real estate) and VAT, SME companies may not take into account certain advantages of the SEZ of the Kaliningrad zone for income tax and property tax and from the moment of creation and registration as a resident of the Arctic zones of the Russian Federation to work on the USN.

It is important that the use of the STS is beneficial from the point of view of long-term tax planning: the benefits of the SEZ of the Kaliningrad region and the Arctic zone are temporary, and from the moment they expire, the company will have to switch to a general taxation regime.

For residents of the Arctic zone registered in the Murmansk region, this transition will be quite smooth: if the SME company continues to use the “income” mode, then after the end of the preferential tax period it will pay only 6% of the USN.

It is not worth counting too much on the regional USN rate in the Murmansk region – the rates of 1% and 5% are set to support business during the pandemic and it is not known what rates to expect after 2022. Before the pandemic in the Murmansk region, the USN rates for IT companies (activities under the code 62.0 OKVED) were 6% in the “income” mode and 10% in the “income minus expenses” mode. Accordingly, these rates cannot be called attractive for IT companies that could count on more favorable conditions in other regions.

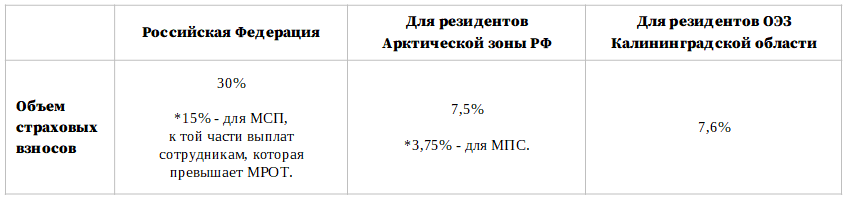

4. In September 2020, a Decree of the Government of the Russian Federation was adopted on partial compensation of insurance premiums for entrepreneurs-residents of the Arctic zone: The Government compensates a resident of the Arctic zone 75% of the amount of insurance premiums. This means that its actual deductions will amount to 7.5%, or 3.75% for small and medium-sized businesses (SMEs).

Clearly:

5. At the end of October 2020, the Strategy for the Development of the Arctic Zone of the Russian Federation for the period up to 2035 was approved by the Decree of the President of the Russian Federation. For the IT business, this document is interesting because the Strategy includes one of the priority areas – the formation of a network of data processing centers based on Russian software and equipment (but so far only in the Republic of Karelia). This direction should contribute to the influx of highly qualified IT specialists to the Arctic zone, which is important for the formation of the staff of a new company resident in the Arctic zone of the Russian Federation.

In this case, we can expect that the relocation program of highly qualified workers will work in the Arctic zone of the Russian Federation and additional support measures will appear when moving. To date, unlike the Kaliningrad SEZ, there is no relocation program in the Arctic zone.

How to become a resident of the Arctic zone of the Russian Federation?

In order to apply the benefits of the Arctic zone of the Russian Federation, it is necessary to obtain the status of a resident of the Arctic zone.

A legal entity or an individual entrepreneur who plans to implement commercial projects in the Arctic and meets a number of criteria can become a resident of the Arctic zone. The criteria are the same for both companies and sole proprietors.

- The company must be registered in the territory of the region included in the Arctic zone of the Russian Federation. The Murmansk Region belongs to such regions.

- The company must make a minimum amount of capital investments in the investment project. Similarly to the SEZ of the Kaliningrad region, the “entrance ticket” to the Arctic zone will cost the company at least 1 million rubles, excluding VAT.

- The investment project or line of activity must be new to the applicant at the time of applying for resident status. A new project is considered a project in which, at the time of filing the application, the volume of capital investments is less than 25% of the total investment planned in the business plan.

- The applicant should not be in the process of reorganization, liquidation, bankruptcy.

- The applicant should not have arrears on taxes and fees, insurance premiums, as well as arrears on other mandatory payments to the budget of the Russian Federation for the past calendar year, the amount of which exceeds 25% of the book value of the applicant’s assets.

What documents are required to submit an application?

The applicant investor is independently engaged in the formation of a package of documents for the application for the conclusion of an agreement on the implementation of investment activities.

The application consists of the following documents:

- completed Application form;

- copies of constituent documents (for legal entities);

- business plan;

- the schedule for the implementation of the investment project, which includes the division of the investment project into stages with the distribution of the total investment volume for the project and the number of jobs created;

- certificate of registration with the tax authority;

- certificate of the tax authority on the absence of arrears;

- the applicant’s accounting statements for the previous 3 years (or for the period of activity if the activity is carried out for less than three years);

- planned staffing;

- the volume of tax revenues from the implementation of the investment project to the federal, regional and local budgets.

The package of application documentation is submitted through the personal account of the future investor on the website investarctic.com . The application is submitted for consideration by the Management Company “Capital of the Arctic” (a subsidiary of the United Development Institute – the Corporation for the Development of the Far East and the Arctic).

How long can I become a resident of the Arctic zone?

The deadline for consideration of the application is no more than 10 working days. Then it takes another 10 days to prepare an investment agreement and conclude it.

- The CC considers the application within 10 working days.

- If a decision is made on the possibility of concluding an investment agreement based on the application, the CC notifies the applicant within 5 working days after the approval of the application.

- Within 10 working days after the approval of the application, the CC sends the applicant a draft agreement on investment activities.

In addition, it should be borne in mind that before obtaining the status of a resident, it will take time to register a company in the Murmansk region, develop a business plan and build a schedule for the implementation of an investment project.

What companies might be interested in moving to the Murmansk region?

A comparative analysis of the features of the tax regime of the Arctic zone of the Russian Federation and separately of the Murmansk region allows us to confidently say that the region will suit small and medium-sized businesses, to which the SEZ regime of the Kaliningrad region, on the contrary, does not suit.

- There are no special preferences for small and medium-sized businesses in the SEZ of the Kaliningrad region. All companies – residents of the SEZ of the Kaliningrad region – pay the same amount of insurance premiums to extra-budgetary funds.

- In the Murmansk region, on the contrary, the volume of insurance premiums for SMEs – residents of the Arctic zone – is two times less than for large companies, and is only 3.75% — the lowest rate in Russia.

- Also, small and medium-sized businesses that have the status of a resident of the Arctic zone are given special attention in terms of the use of the USN. There are no such preferences in the Kaliningrad Region – companies on the USN cannot become residents of the Kaliningrad SEZ at all.

- Loyal attitude to the companies-residents of the Arctic zone using the USN is an advantage for SME companies from the point of view of long–term tax planning – after the end of the grace period of six years.

- Unlike the SEZ of the Kaliningrad region, individual entrepreneurs can also become residents of the Arctic zone of the Russian Federation.

Which is more profitable: to apply federal benefits, a regional regime, or to use the “Arctic package”?

Federal benefits

Recall that from January 1, 2021, the “tax maneuver” in the IT industry allows IT companies to reduce the total tax burden on insurance premiums to 7.6%, and income tax to 3%. In order to receive federal benefits, it is necessary to comply with the formal conditions:

- the company must get into the register of accredited IT companies and the register of Russian software;

- the company’s staff cannot be less than 7 people;

- at least 90% of the company’s revenue should come from software development.

Regional regime

There are no specific restrictions for IT companies in the Murmansk Region in order to apply the regional tax regime. Thus, the income of an IT company can be generated both through the distribution of advertising, the placement of commercial offers and the conclusion of transactions, and through the development of software. At the same time, income from software development is not a priority in percentage terms compared to income from advertising and other commercial activities.

When registering as a legal entity, a company can immediately switch to the USN and pay either 1% in the “income” mode or 5% in the “income minus expenses” mode until 2022. At the same time, the tax rate on the USN will cover income tax, property tax on business objects (except retail and office real estate) and VAT.

What to pay attention to:

- As a general rule, the USN cannot be used by an organization that has branches – it does not matter in which region.

- Attractive USN rates in the Murmansk Region are valid only until 2022 inclusive. It is unlikely that after 2022, the Murmansk Region will maintain these values and enter into competition with the regime of the Arctic zone of the Russian Federation, to which it belongs.

What is the difference between the preferential regime of the Arctic zone of the Russian Federation and the territory of advanced development (TOP) “Capital of the Arctic”?

In May 2020, by Decree of the Government of the Russian Federation, the TOP “Capital of the Arctic” was created. Its borders included the lands of the municipal formation “Kola district” and the urban district “City of Murmansk” of the Murmansk region.

We did not focus on the TOP “Capital of the Arctic” within the framework of this article, since its main specialization is port activities, industrial construction and logistics. But in general, the list of permissible OKVED does not prohibit IT companies from obtaining the status of a resident of the TOP “Capital of the Arctic”.

Despite the fact that the minimum amount of capital investment in an investment project is only 500 thousand rubles, the conditions of the tax regime of the TOP “Capital of the Arctic” are collectively less favorable than the benefits of the Arctic zone of the Russian Federation, and do not establish specific advantages for companies operating on the USN.

Clearly:

General conclusion

The Arctic zone can be a good option for individual entrepreneurs and IT companies that:

- have a significant staff (small businesses can have up to 100 employees, and medium–sized businesses – from 100 to 200 employees) – SMEs can save well on social contributions;

- they are going to use the USN in their activities;

- they plan to implement an investment project in the field of data collection and processing (this area is a priority in the Arctic zone).

However, there are nuances in the implementation of an investment project.

- The company may carry out activities not provided for by the investment project, but then this activity will be beyond the scope of support measures provided for in the Arctic zone. For example, if an IT company will work on the implementation of an investment project, but at the same time produce third-party products and advertising, then taxes from this activity will need to be paid at the federal or regional rate and keep separate accounting.

- A resident of the Arctic zone does not have the right to transfer his rights and obligations under the investment agreement to another person.

Thus, the Murmansk Region and the Arctic zone of the Russian Federation do not have clear advantages for IT companies that could compete with the “tax maneuver” at the federal level.

- Firstly, federal benefits are more predictable and stable than Murmansk USN rates, which will change in 2022 and are likely to be higher than USN rates for residents of the Arctic zone.

- Secondly, it is easier to fulfill the conditions for obtaining federal benefits than to obtain the status of a resident of the Arctic zone of the Russian Federation and invest at least 1 million rubles in an investment project.

- Thirdly, the Arctic zone of the Russian Federation itself is not a profitable location for IT companies – compared to the SEZ of the Kaliningrad region, where companies can benefit from both the support of the Government of the Kaliningrad Region and the relocation program of qualified personnel. The Arctic zone of the Russian Federation does not focus the “Arctic package” on IT companies, given that the results of the activities of IT companies go beyond the Arctic zone. This specificity is not taken into account in the current regulatory framework concerning the development of the Arctic zone.

To date, only one IT company has become a resident of the Arctic zone – LLC “Data Center Arctic–2“, which implements an investment project for the construction of a data center in Karelia and equipping it with all the necessary equipment and software with the involvement of 895 million rubles as investments.

Nevertheless, it is interesting to follow the development of the region. We hope for the adoption of a new package of benefits.