The private equity fund of Goldman Sachs, one of the world’s largest investment banks, turned its attention to the gaming market and invested $200 million in the French developer and publisher of mobile games Voodoo.

The interest of a large financial conglomerate, known simply as “The Firm” among economists, is not surprising: in 2017, the annual turnover of the mobile gaming market amounted to $100 billion and continues to grow rapidly. The Goldman Sachs private equity fund itself raised $7 billion last year.

The choice of Goldman Sachs fell on the company Voodoo, founded in 2013 in Paris. Voodoo develops and publishes free mobile games with monetization through advertising, which the user can disable by registering a premium account. Voodoo titles, such as Helix Jump, Paper.io and Splashy!, are among the leaders in downloads on the App Store and Google Play. In 2017, the total number of downloads of Voodoo games amounted to almost 300 million, the company competes on an equal footing with other French players in the market — Ketchapp and Gameloft.

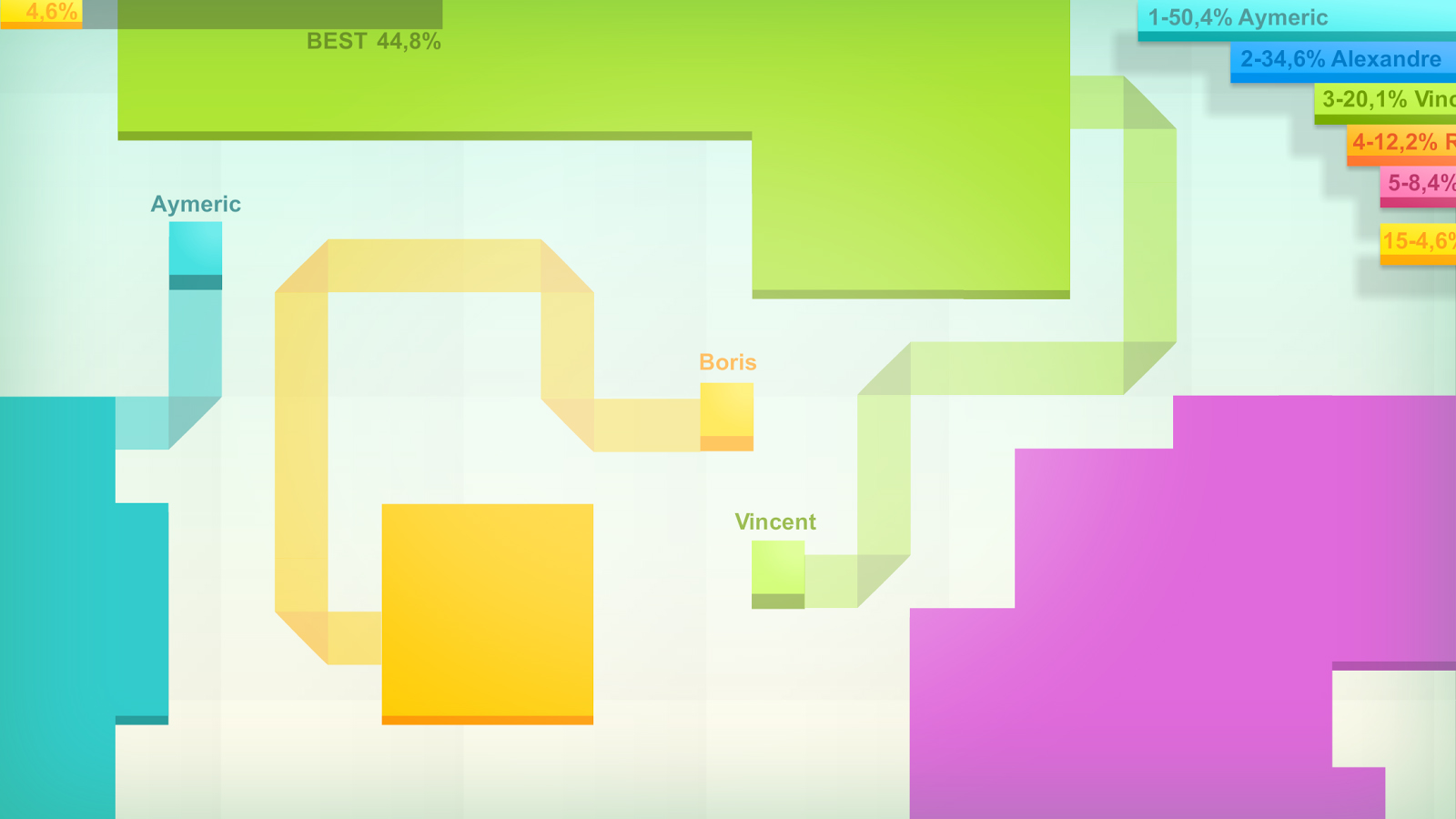

Gameplay Paper.io

According to the terms of the deal with Goldman Sachs, the co-founders of the company Alexander Yazdi and Laurent Ritter will remain the main shareholders of Voodoo, writes

Reuters.

According to Yazdi, having received $ 200 million, the company intends first of all to double the number of its employees — up to 150 people. First of all, Voodoo will be looking for talented programmers and managers to develop new tools for communicating with players and using the collected data on user activity. The company is also considering opening a marketing department in the United States in order to cooperate more actively with Google and Apple.