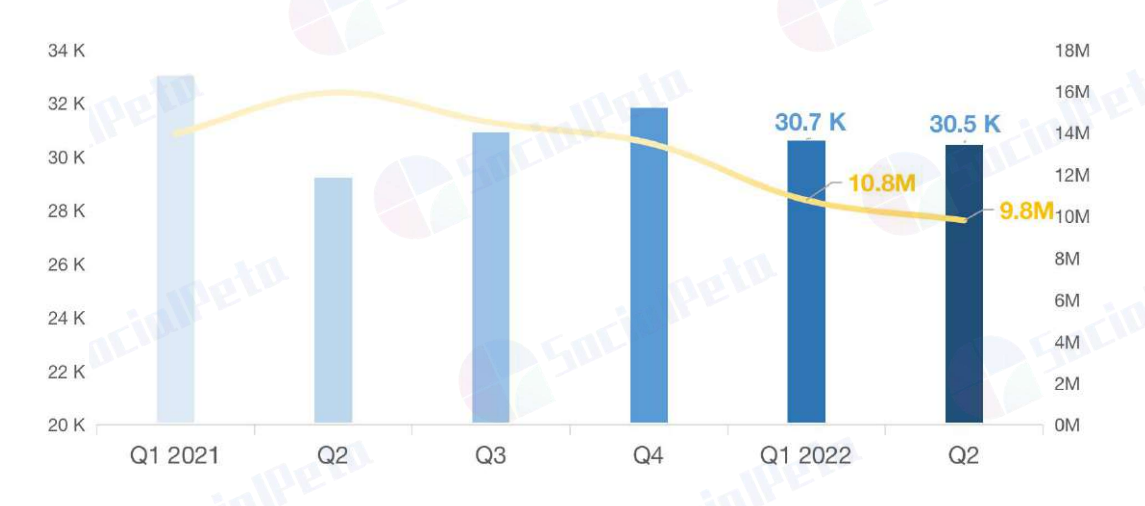

The number of promoted games has also decreased.

This is reported by the analytical company SocialPeta in its latest research “Analytical report on the marketing of mobile games in the first half of 2022“. Just below is a squeeze with key figures from it.

- The number of advertisers in the mobile sector in the first half of 2022 fell by 5.79% compared to the same period last year.

- We remind you, in this case, the advertiser is an application whose advertising is placed in other applications (in other words, we are talking about advertised applications).

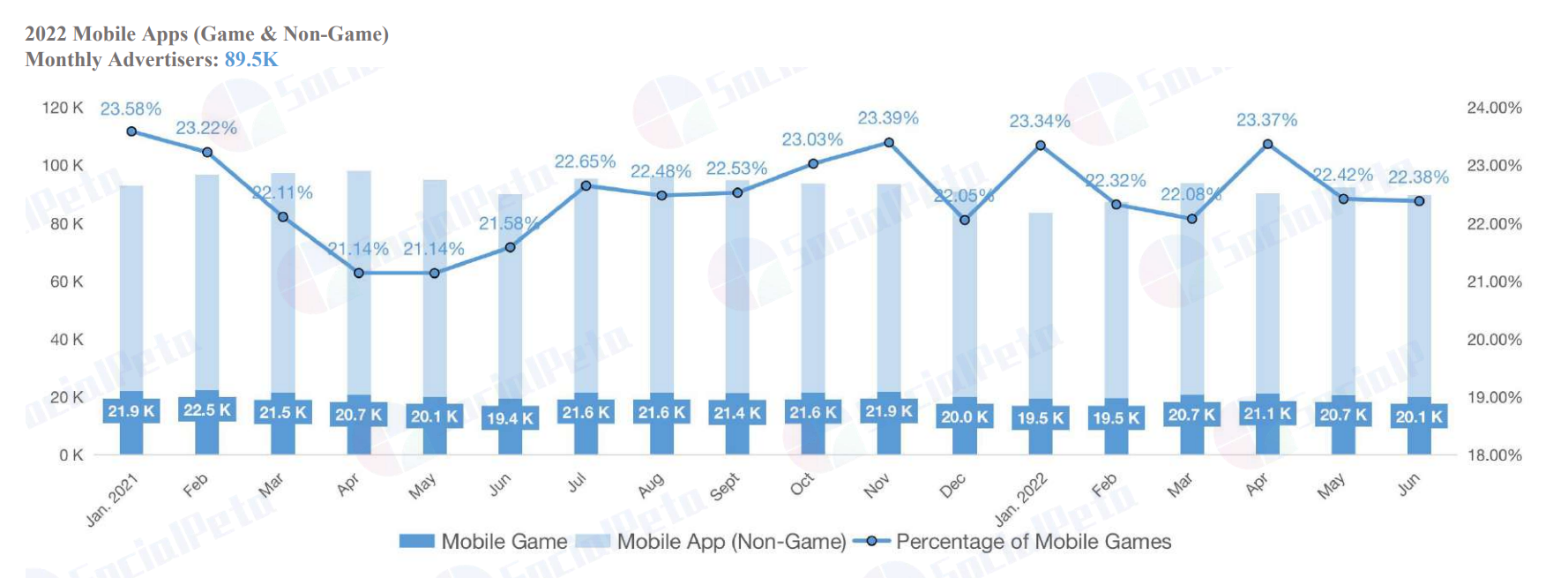

- Of the total number of advertisers, 22.65% are mobile games.

- The number of advertiser games (advertised games) also decreased by 2%.

- The monthly number of advertisers in the gaming sector for the last two years has fluctuated at the level of 19-22 thousand.

Number of advertisers in mobile (January 2021 – June 2022)As it was just noted, out of the total number of advertisers, 22.65% are mobile games.

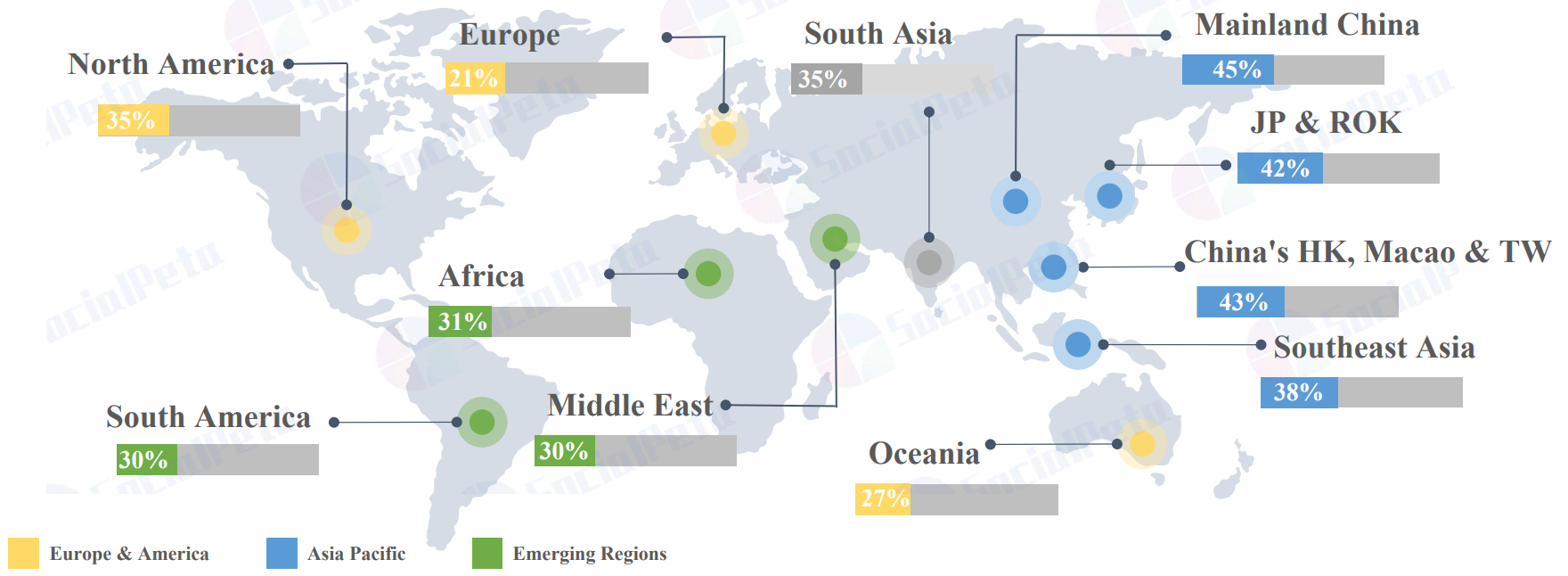

- However, the share of the latter strongly depends on the region. For example, in China they account for 45% of the advertising market, and in Europe — only 21%.

The ratio of game advertisers to apps by regionAlong with the number of advertiser games, the number of published advertising creatives also fell in the first half of the year.

- We are talking about a very strong reduction of them — by 27.8% (from 15.8 million in the first half of last year to 10.8 million this year).

- Moreover, in the second quarter of 2022, the number of published creatives for games turned out to be 38% less than in the second quarter of 2021.

Dynamics of the number of game advertisers and published creatives for games (2021-2022) Out of curiosity: in 2022, the number of game advertisers fell significantly in Oceania (a region that includes Indonesia, the Philippines, Australia) and Europe (in both cases by more than 20%), but seriously jumped in South Asia (India and the Middle East) — 22.1%.

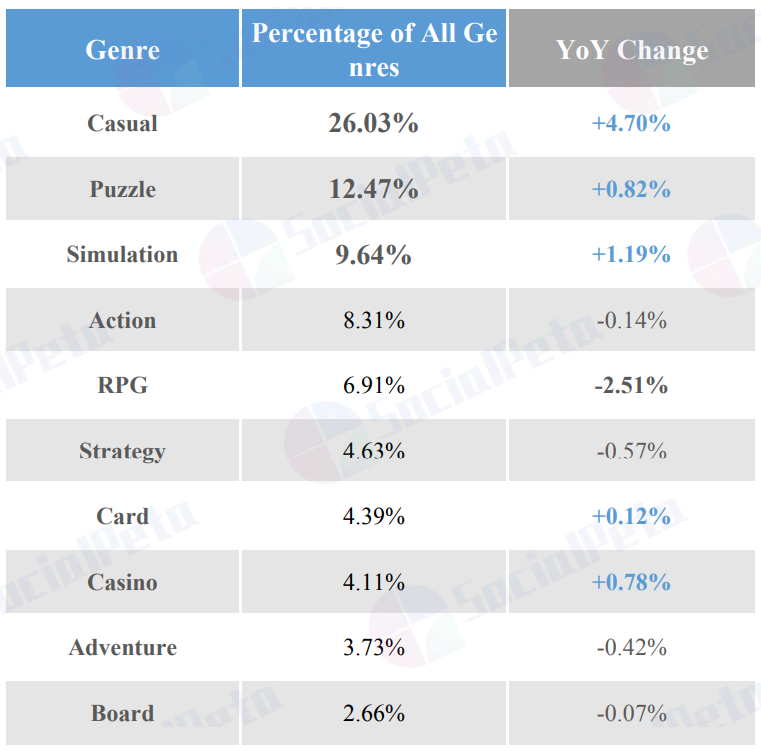

- Most of the advertised games are casual projects (26% of advertisers are games). And their share is only growing.

- At the same time, the share of role-playing projects among the advertised games is seriously decreasing. If a year ago this genre was in the top 3 promoted genres, now it is only in the top five.

- 6.3 thousand casual projects are advertised monthly in mobile stores.

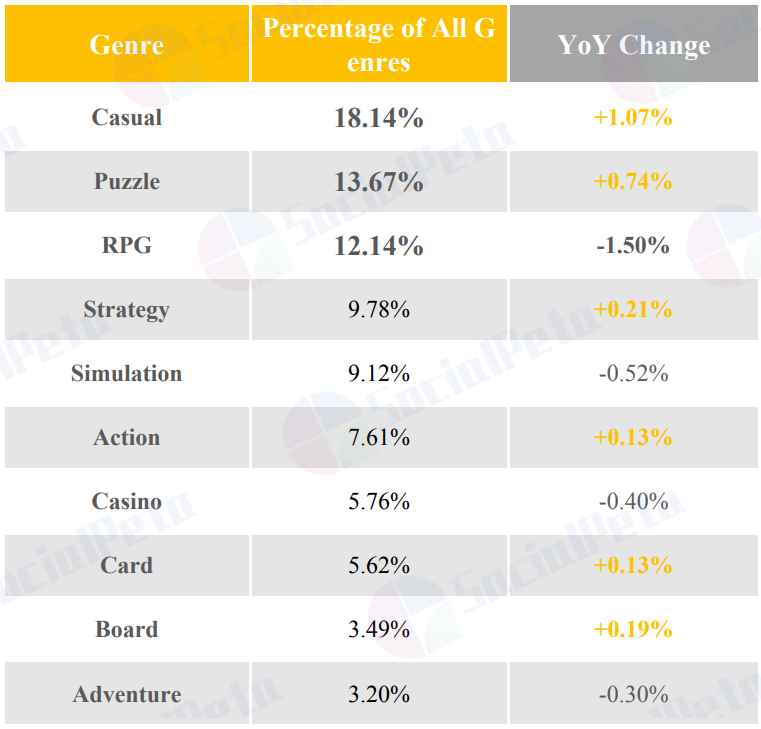

Chart of the most promoted game genres in mobile (by number of games)Most of the published game creatives also account for casual games and puzzles.

- Of all the published game creatives for the first half of 2022, 18.1% were devoted to casual projects, and 13.6% were devoted to puzzles.

- Role—playing games are in third place in terms of the number of published creatives.

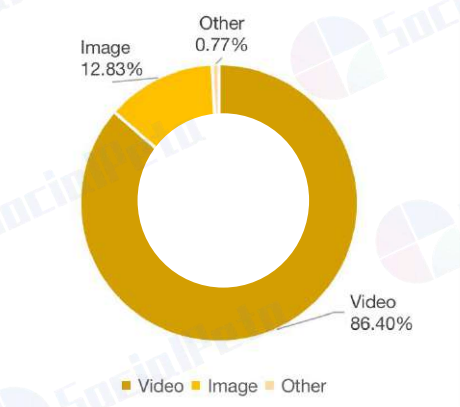

Chart of the most promoted game genres in mobile (by the number of creatives)Most of the game creatives (86.4%) are videos.

The market of advertising creatives by segmentMost of the mobile advertising market falls on Android platforms.

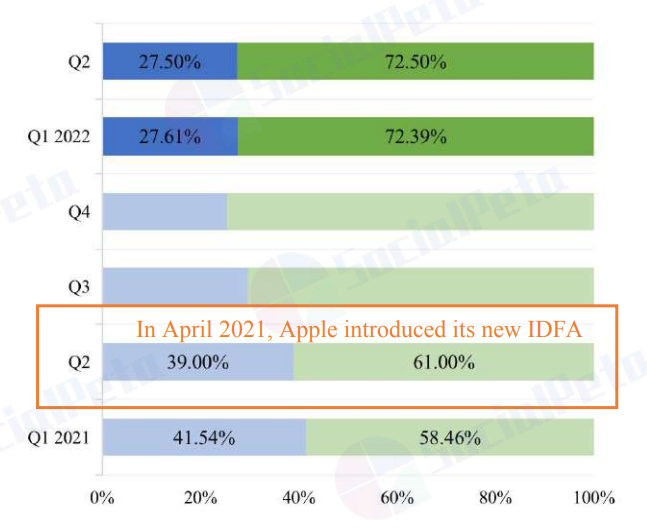

- And their share relative to iOS is only growing.

- To date, 72.5% of all advertising creatives for mobile games are published on Android.

Dynamics of the ratio of published creatives on Android and iOS from 2021 to the second quarter of 2022According to the results of the first half of 2022, the most advertised game by the number of published creatives on iOS is Fishdom.

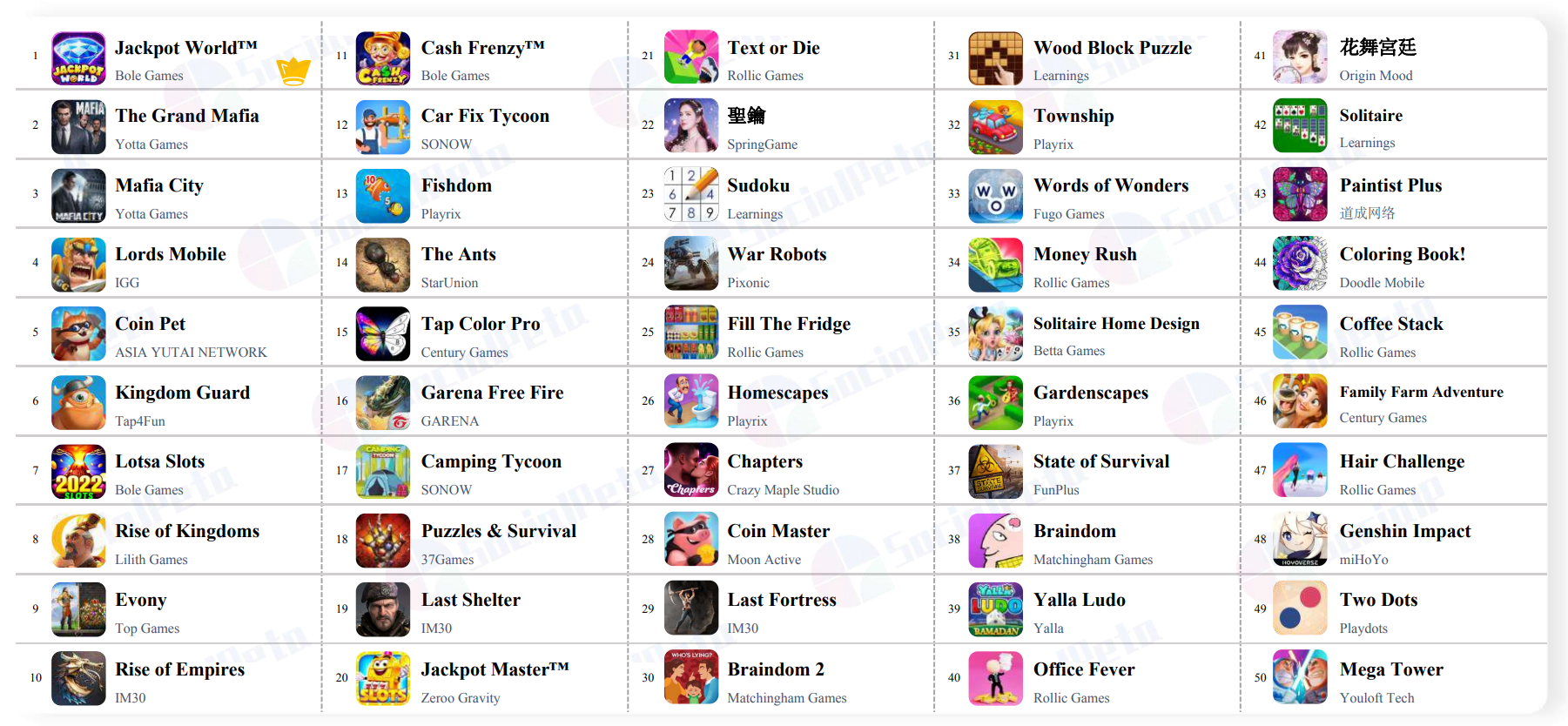

Top Mobile Games advertisers (iOS, first half of 2022)According to the results of the first half of 2022, the most advertised game by the number of published creatives on Android is Jackpot World.

The full version of the study can be found at the link (just in case, we also attach it to the publication below).

There are about a hundred slides in it (we made a squeeze on the first twenty). Among other things there:

- data on the gaming advertising market of China, USA, Japan, South Korea, Turkey, Southeast Asia, Middle East, South America;

- analytics on advertising platforms;

- tops of the most popular gaming influencers;

- CPM, CPC, CTR by country, genre, user age, advertising format (by the way, perhaps we will give a separate material based on these data);

- tops of the most popular advertiser games by genre and platform;

- trends in creatives;

- analysis of the dynamics and earnings of the most popular games by genre.