The marketing company Adjust has published a benchmark for mobile applications. Among the main conclusions: a decrease in the growth rate of downloads for hyper-casual games and a significant drop in organic content from stores in the market as a whole.

The report is based on data that the company collected from January to December last year. It does not take into account the latest market trends caused by the spread of the coronavirus. However, a separate chapter in the document is devoted to the situation around COVID-19. About her at the end of the material. First, let’s focus on the main points of the main part of the study.

1. “Hyper-growth in the hyper-casual games market is over”

Adjust measures the dynamics of the ratio of the number of downloads divided by MAU. She calls this metric the growth index. It allows you to see the real interest of the audience in a product or niche.

In most cases, a high index value indicates a significant number of installations with a low MAU.

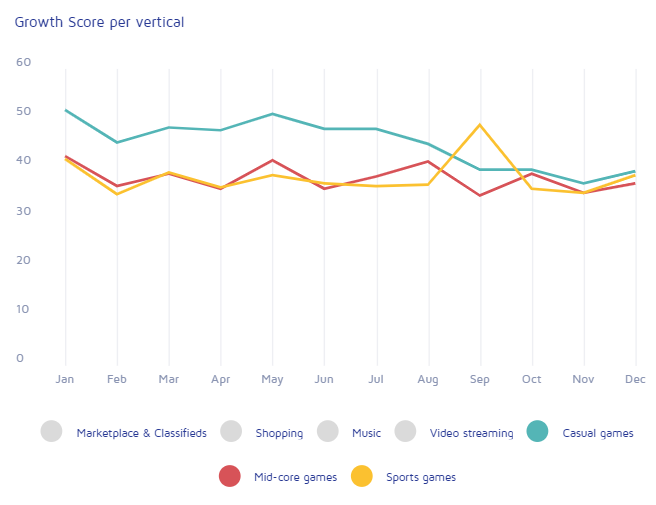

The games have a high index, but it has been falling throughout 2019. In December, the annual decline averaged 15% across the market. This, according to analysts, rather indicates changes in the number of downloads than an increase in MAU, which is generally not typical of the gaming niche, where users regularly try new titles, migrate between games.

The growth index of casual (this includes hyper-casual titles), midcore and sports games

Adjust says that their position correlates with the findings of ironSource, which calculated that the increase in game downloads in 2019 was less than in 2018 (5.3% vs. 7.7%). This allowed ironSource to state that the hyper-growth in terms of game downloads for hyper-casual games has ended. However, Adjust believes that the segment will continue to thrive if it adapts to changes by starting to work on retention.

2. Discoverability in stores is falling

Adjust called one of the central changes in the mobile marketing market a significant drop in organic installations from search. The lists and search results of app stores are more than ever filled with big brands and large studios, which make it increasingly difficult to find applications of small teams. Only the studios that came to the market are responsible for only 8% of the applications that were marked in the top 10 most downloaded applications of the App Store and Google Play.

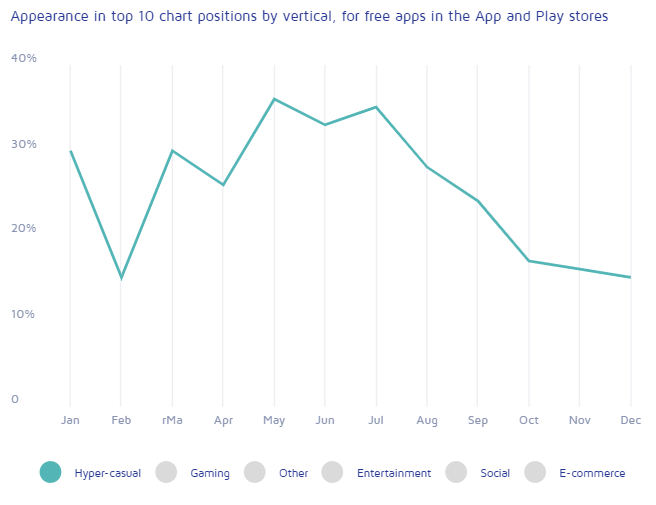

3. The number of games at the top of the tops is decreasing

Speaking specifically about games, their presence in the charts was declining last year. This is especially clearly seen in the dynamics of the presence of hyper-casual projects in the top. If in January 2019 they had 30% of the places in the top 10 free apps, then by the end of the year – 15%.

Dynamics of the share of hyper-casual games in the top 10 free apps in the App Store and Google Play4. The share of paid downloads is growing rapidly

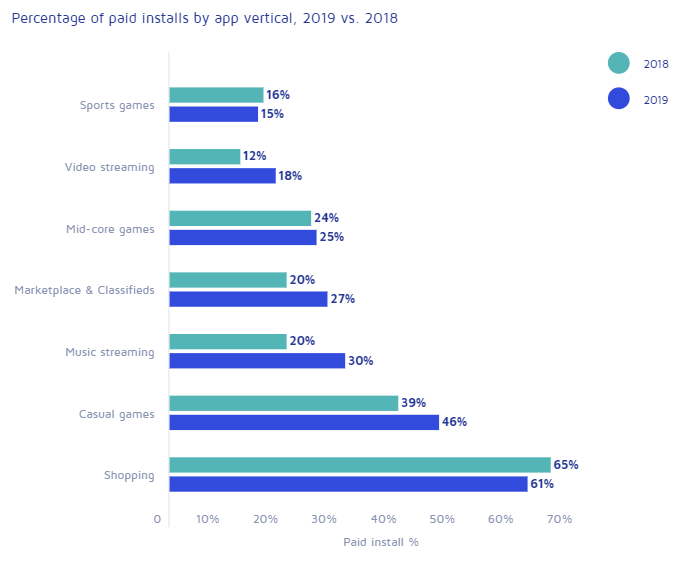

The relationship between organic and paid installations is changing. This is especially clearly seen in the casual games segment, where Adjust includes hyper-casual projects.

Today, on average, 46% of all casual downloads are paid. This is 17% more than a year earlier.

For comparison, in midcore the ratio is radically different — 25%. And it has grown by only 4% in a year.

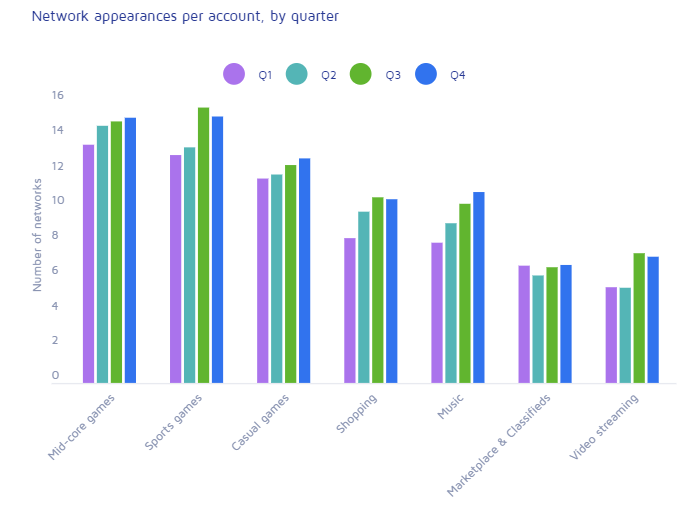

Percentage of paid downloads by vertical5. The number of advertising networks resorted to by developers is growing

Along with the growing demand for traffic, the number of tools used by teams is also growing. This applies to all areas of mobile, and first of all gaming.

Growth in the number of networks linked to developer accountsOther figures

Adjust also shared a number of averages for games.

Average number of sessions per user per day:

- sports games — 2.38;

- casual games — 2.5;

- midcore games — 2.54.

Average session length per day (in minutes):

- sports games — 16.20;

- casual games — 16.37;

- midcore games — 38.47.

Retention:

- sports games: day 1 — 38%, day 3 — 27%, day 7— 19%, day 30— 6%;

- casual games: day 1 — 32%, day 3 — 22%, day 7 — 15%, day 30— 6%;

- midcore games: day 1 — 35%, day 3 — 24%, day 7 — 18%, day 30 — 7%.

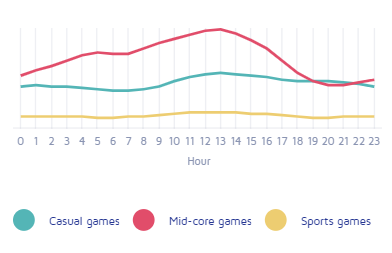

Activity hours:

They depend on genres. In casual games, user activity peaks between 12 and 16 o’clock, but the activity of midcorners increases from five in the morning and reaches a peak at 13.00.

The impact of the pandemic on mobile games in 2020

In general, global game downloads at the beginning of 2020 were significantly higher than a year earlier. However, at the end of March, when a number of countries began to impose a state of emergency, there was a rapid increase in indicators.

Adjust indicates a surge of 132% relative to last year’s figures. In general, in January-March, the number of gaming sessions increased by 47%, and the number of installations by 75% compared to the same period a year earlier.

Game downloads of Q1 2019 and Q1 2020 Is there any news?

Share with us, write to press@app2top.ru