With the help of video games, Netflix will fight for the attention and free time of users. However, the company will inevitably face a number of challenges along the way. Venture capitalist Matthew Ball analyzed Netflix’s strategy in detail, and also talked about possible pitfalls and competition with other services. We present the key points from the material.

The struggle for users’ free time

With the development of streaming, the main question for users has become “What to do?”.

Many companies have already made this approach their main strategy. As Nintendo noted in 2019, it competes not with Sony or Microsoft, but for people’s free time, for their attention.

Netflix understands this. It is not the first year that they have positioned themselves as a service for leisure, and not just as a platform for video streaming. The company is trying to compete with all kinds of entertainment — whether it’s watching YouTube, reading books, chatting on Facebook or the time that users spend playing video games.

Video games are one of Netflix’s most dangerous competitors. They are not just entertainment leaders in terms of reach or box office. They are also becoming entertainment platforms. Moreover, their capabilities are much broader than films or TV series that offer only a linear narrative and are able to capture the attention of users for a limited number of hours. Games are capable of more. Including endless leisure and socializing with friends.

That is why Netflix names Fortnite among its main competitors, in which tens of millions of people play together, watch movie trailers, attend concerts and other virtual events.

And in the new reality, it’s hard for the company to compete with video games. Netflix spends over $20 billion annually on content for its service, while paying salaries to 12 thousand employees. Games can also be made at much lower cost.

Among Us, whose MAU in November amounted to 500 million users, was initially created by a team of four people. Less than 20 employees were engaged in Fortnite development at the first stages. Even if the team now exceeds 1,000 people, Epic Games still spends less than $1.5 billion a year to support the game. At the same time, the project itself generates about $4 billion annually.

Therefore, it is not surprising that Netflix sees entering the video game market as a necessity, because it wants to remain dominant in the entertainment market.

At the end of August, the first games appeared on Netflix. Now they are available in test mode only for subscribers from Poland. These are simple mobile titles on “Very Strange Things” (Stranger Things) that need to be downloaded via Google Play. So far, the gaming functions of the service are very limited, but this is only the first step of the company in the development of the video game direction.

If Netflix wants to gain a foothold in a new market for itself, it will have to spend huge resources on producing content and fighting for users’ free time. On the way to introducing games into its own ecosystem, the company will inevitably face a number of financial and technological difficulties.

Technological challenges

According to Ball, the following factors influenced the success of Netflix as a service:

- aggressive spending;

- excellence in products and technologies;

- correct prediction;

- competent marketing of your series;

- competitors’ unwillingness to rebuild their own business models in a timely manner.

With the development of the streaming market, the company has lost most of these advantages. She will not be able to achieve them in the gaming market. Both time and opportunities have been missed. And Netflix understands that.

Today, multiplayer and online games are the most popular in the world. If Netflix wants to develop in this direction, it will have to create a whole range of technologies from scratch — from game account systems and matchmaking to achievements and anti-cheat.

The company could give their development to third-party companies or use ready-made solutions from competitors, but then it would not be able to become a full-fledged leader in this direction. In any case, without technology for online titles, Netflix can only count on a small segment of single and non-competitive games.

Another problem is how to distribute games. Netflix is financially unprofitable to make its own console, and therefore games must be run either in the cloud or locally on devices. Since more than two-thirds of subscribers of the service use it on televisions, the company will have to focus on set-top boxes that are not adapted for AAA titles. This significantly narrows down the range of games that Netflix can potentially present to an audience.

Access to other platforms can also become problematic. No manufacturer of large consoles will allow third-party companies to operate freely within their ecosystem. This means that on PlayStation or Xbox Netflix will have to act like a regular publisher, publishing separate games for other platforms.

Difficulties may also arise when developing a business on mobile platforms. To circumvent Apple‘s restrictions, Netflix can distribute games as web applications, or release individual titles in the App Store without microtransactions. However, such a strategy will also not allow the company to achieve a dominant position in the market and become a leader in a new direction for itself.

On the one hand, in this case, Netflix can focus on the PC market, which is free from the aforementioned restrictions. On the other hand, the example of the Epic Games Store, which still remains unprofitable, makes the prospects for such a strategy vague. Other major players like EA and Activision also tried to launch their own launchers, but still could not fully compete with Steam.

Perhaps Netflix will be able to find a way out of the situation in cloud gaming? There are also a lot of pitfalls here. The main difficulty lies in the huge costs required for successful business development in this direction. Netflix does not have its own infrastructure, and therefore it will have to rent capacity from Microsoft, Google or Amazon. And developing your own ecosystem from scratch is likely to be financially unprofitable.

So Netflix is at a crossroads right now. The company has become a leader in the video streaming market because it was a pioneer in this field and promptly offered millions of people a convenient and affordable service. With video games, Netflix is initially in the role of catching up.

Content availability

Netflix has been developing as a D2C business for many years (this means that the company itself produces, promotes and sometimes delivers its product directly to the user without the help of intermediaries). However, games have succeeded much more in this direction. If video streaming services traditionally rely on exclusive content, most of the most successful titles cover the largest possible audience.

“Game of Thrones” (Games of Thrones) greatly helped the development of the HBO service and became successful, including due to its exclusivity. But Fortnite, on the contrary, would only lose from this approach. If the game was available only on Xbox or only on PlayStation, it would never have been able to attract hundreds of millions of users.

There are also quite successful exclusives on the video game market. But usually they are sold at best in a circulation of 20-25 million copies, which is extremely small in comparison with free-duplex multiplatform titles.

That is why the issue of producing or buying content for its platform is acute for Netflix. Now the company has neither a ready-made player base to launch free-to-play games, nor the ability to attract third-party developers to create exclusives for its service.

What is Netflix’s strategy?

In July, Netflix management noted that the company would first focus on creating casual mobile projects. At the same time, they will be free for all subscribers of the service.

This approach can be compared to Apple Arcade, which for $5 a month offers access to about 200 titles for iOS. However, this subscription service is still not very successful. According to Sensor Tower, it is currently used by only about 5 million people, which is only 0.5% of all owners of iOS devices.

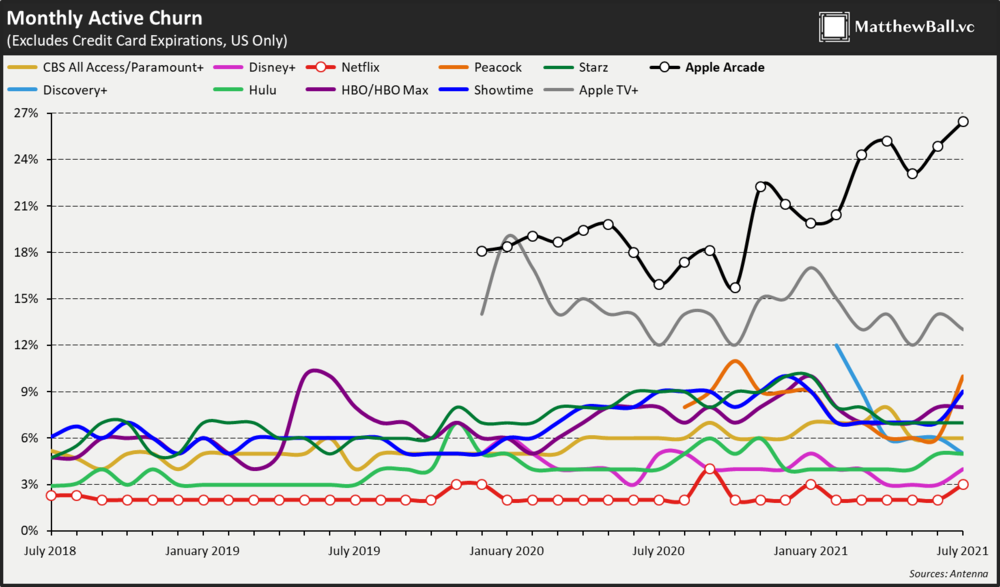

Apple Arcade also loses about 20% of its users every month. The outflow of subscribers is twice as high as HBO’s figures after the finale of “Game of Thrones” — at the same time, this happens with Apple’s service every month.

Outflow of users of various subscription services in the USA

The advantage of Netflix can be a free distribution model of games for existing subscribers. Separately, the company emphasizes that there will be no loot boxes and other microtransactions in the titles for the service.

On the one hand, it can help attract players to the service, since today users are increasingly complaining about the abundance of payments in mobile titles. On the other hand, the very presence of microtransactions does not automatically make the game bad. What matters is how developers introduce them into their projects. In the same Fortnite, most of the “cosmetics” only helps users express themselves, and does not directly affect the gameplay and does not spoil the gaming experience for non-paying gamers.

Apple used a similar argument to promote Arcade. That’s just the lack of in-game payments in itself did not help the service become successful. By rejecting microtransactions, Netflix also deprives itself of additional income necessary for the further development of the gaming business.

In the future, the company will probably have to attract new personnel and create internal studios to develop its own larger titles. But it’s not easy to make even one hit game, especially for a new team. The production of one AA- or AAA-title can take from three to five years. For comparison, an experienced TV studio will be able to produce several projects in half the time.

Ball also notes that there are fewer hits in the gaming industry today. Since the mid-2010s, the number of games sent for review has decreased by 75%. Large AAA studios regularly fail in an attempt to create new franchises and rely mainly on already successful IP.

Netflix can continue to produce only simple casual titles for mobile, which do not require a lot of time. However, in this case, the company will be severely limited in the number of games that it can release inside its application without violating the rules of the same App Store.

If Netflix wants to offer users as many titles as possible right now, it will have to create separate web applications for them, or release them in the store and force users to download them. This will destroy the integrity of the ecosystem and make the use of game functions simply inconvenient. It is unlikely that millions of people would watch TV shows on Netflix if each of them had to be downloaded as a separate application.

Despite the difficulties, the main advantage of the company is still its audience. Currently, 210 million accounts are registered on Netflix, each of which contains an average of 3.5 profiles. This gives the service access to more than 700 million users. Apart from Google and Apple, no one is able to reach a large audience of potential gamers.

That is why entering the gaming market seems quite logical, albeit a risky step. If Netflix does everything right in the long run, it will be easy to imagine millions of people playing conditional match-3 based on hit TV series. In theory, such games can be played by other representatives of the genre, but users will still run them, because they are available directly in the Netflix application. Such an approach will not only contribute to the development of the service, but also reduce the outflow of customers that the company is experiencing today.

Conclusions

The experience of other technology companies suggests that attempts to quickly gain a foothold in the gaming market with the help of spontaneous large expenses almost always turn into failures.

Today, Microsoft is successfully developing the console business as a single ecosystem and convenient service. However, the company’s gaming division was unprofitable for almost a whole decade after the release of the first Xbox.

Amazon has spent billions of dollars on the development of Amazon Game Studios, while facing many postponements and canceled projects. Only last summer, the company managed to release its first potential hit — MMORPG New World. According to The Information, even Twitch still does not bring Amazon enough revenue from displaying ads.

That’s why Netflix’s rather slow strategy may be justified. The focus on small mobile games reduces production costs and avoids direct competition with large platform holders.

The downside is that with this approach, Netflix is unlikely to be able to achieve great success in the gaming market in the coming years. But it will give the company time to establish internal processes, as well as acquire the necessary technologies and personnel.

Today, video games such as Fortnite are actively interacting with other types of media and spreading their brand beyond one industry. That is why Netflix needs to take the opposite step — to add more interactive features to its video service. We are talking, among other things, about the introduction of game functions in their films from the series.

“Imagine if the audience could control the actions of the characters in the movie Cabin in the Woods,” Ball notes. The company has already done something similar in Bandersnatch, but there the interaction of users with videos and the degree of their influence on events were still too limited.

The development of interactivity and gaming can become one of the key components of Netflix’s success in the new race for the attention and free time of users. The company understands this, and therefore intends to act slowly and carefully.