A spat between Activision Blizzard and Bungie can lead to unexpected consequences. Pomerantz law firm took over the investigation of the event. She admits that Activision Blizzard management is involved in fraudulent securities transactions or other illegal business practices.

Pomerantz is acting on behalf of Activision Blizzard investors. However, it is not known whether any of them actually contacted the firm. At the moment, Pomerantz publicly advises investors to get in touch with her.

The suspicions of Pomerantz or its possible clients are related to the fact that the publisher has not only parted ways with Bungie, but is also ready to transfer all rights to the project to the developer. The company recalls that the first part of the game collected $325 million in the first five days of sales alone. She also emphasizes that such a move led to a serious drop in Activision Blizzard shares.

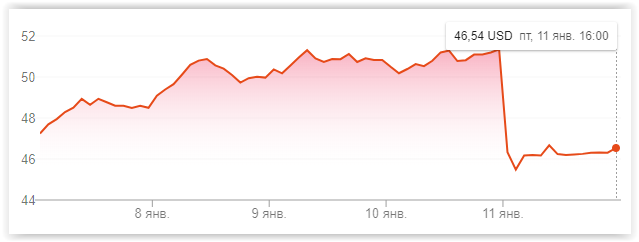

The price of Activision Blizzard’s securities really collapsed last Friday after it became known that it would no longer work on Destiny with Bungie — from $51 to $45.

Dynamics of Activision Blizzard stock price over the past five days

However, the company has been experiencing a drop in shares since September.

It all started in October, when the sales of Call of Duty: Black Ops 4 did not meet the expectations of investors, and continued with the market reaction to the unsuccessful announcement of Diablo Immortal and the low performance of Destiny 2: Forsaken. At the beginning of October, Activision Blizzard was given more than $80 per share.

Dynamics of Activision Blizzard stock price over the past six monthsAlso on the topic:

- Bungie splits with Activision and keeps Destiny for itself

- Activision Blizzard lost 7% of revenue in the third quarter

- Activision Blizzard shares sank 6.7% after the announcement of Diablo Immortal