We continue to summarize the results of 2021 together with top managers and experts of the gaming industry (and related ones). Next up is an interview with Mikhail Katz and Sergey Evdokimov from the consulting Aream & Co.

Mikhail Katz and Sergey EvdokimovHow did 2021 go for the company?

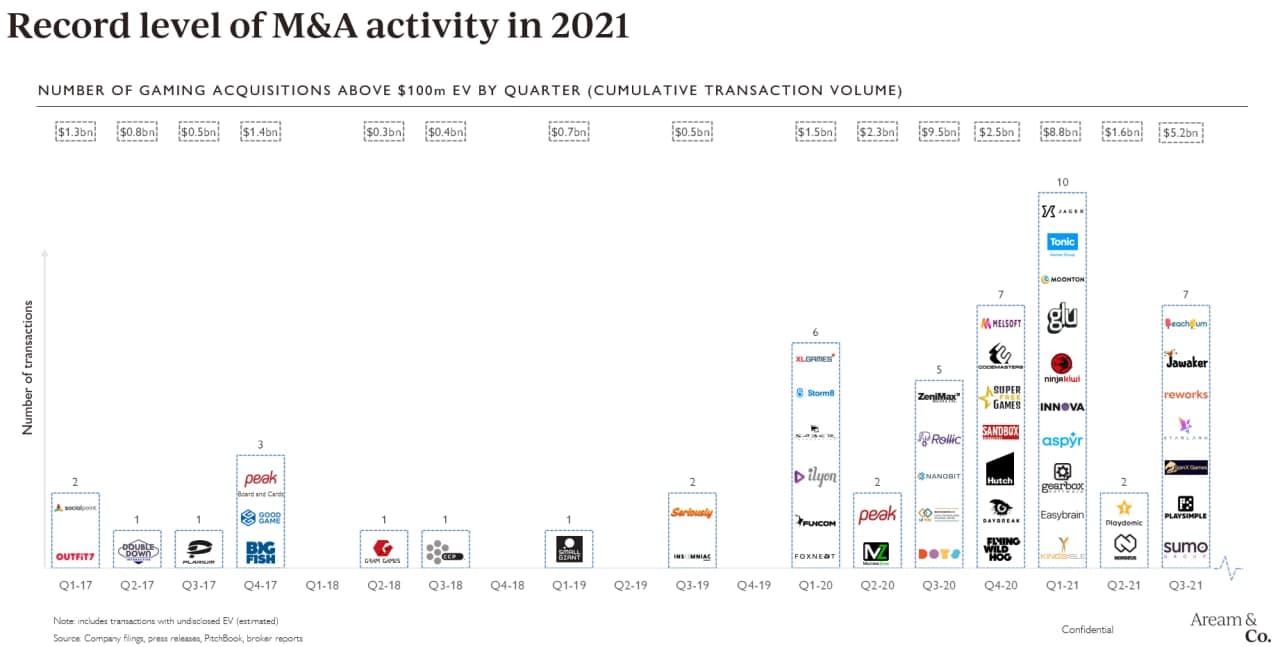

Mikhail: In 2021, Aream & Co., like last year, saw a significant increase in M&A activity in the gaming industry.

Over the past twelve months alone, we have helped more than 14 gaming companies find new strategic partners. Here we are talking, among other things, about consultations on the sale of a business, and about attracting financing. The total value of all transactions closed with our participation this year amounted to over $3 billion (and this is only those whose value was announced). The largest of them are cross–border transactions with a public strategic buyer. Among them:

- sale of the Cyprus company Easybrain, known for puzzles and logical mobile games, to the Swedish holding Embracer Group for $765 million*;

- sale of the American developer Unknown Worlds, known for the game Subnautica, to the South Korean company Krafton for $750 million*;

- sale of the Finnish mobile game studio Reworks, known for the Redecor simulator, to the Israeli Playtika for $600 million*;

- The sale of the Chinese mobile studio StarLark, known for the Golf Rival game, to the American company Zynga for $ 525 million.

Note: the transaction amount is indicated taking into account additional maximum payments (earn-out) if certain conditions are met.

Over the past few years, we have held a leading position in the market on mergers and acquisitions of gaming companies. We successfully close more than half of all transactions in the gaming sector with the participation of consultants on the seller’s side.

This year, many gaming companies have approached us on the issue of attracting external financing and selling a minority stake. Most of these deals will be announced in the next couple of months. Of the closed and announced deals, we can also name the one that concerns Ubitus, a company engaged in cloud gaming technologies. She attracted investments from Tencent (lead investor), Sony, Square Enix, etc.

What event or trend of 2021 do you consider central within your niche?

Sergei: I’ll split the answer into segments. Within the framework of each, I will note what trends we notice.

Mobile

Here we see that strategic buyers are interested in buying studios (including small ones) with strong expertise in a particular niche, as well as in large studios with profitable, well-known evergreen franchises that can become independent business units. Due to the observed shortage of high-quality mobile assets on the market, studios with games that demonstrate excellent metrics within the softlonch and the potential for subsequent growth in the leader of the genre, more often observe the interest of strategists in buying a business, even operating with relatively small budgets for the purchase of traffic.

PC/Consoles

There is an increased interest in developers and publishers of games for PC and consoles, as buyers seek to expand the product portfolio for their audience in order to increase the time spent and user spending within their ecosystem. Most strategy buyers use their own distribution platforms or have advanced game publishing capabilities.

AdTech

An increasing number of gaming companies are acquiring AdTech expertise to improve marketing efficiency and optimize risks, taking into account the changes associated with IDFA. In turn, AdTech platforms acquire gaming assets to extract additional benefits through the use of their own solutions for advertising monetization and effective traffic procurement. At the same time, there is a consolidation of the AdTech market, where market leaders (AppLovin, Vunge, ironSource) expand their core expertise through acquisitions and mergers with competitors and integrations of their complementary solutions.

What will be the stake in the development of the company in 2022?

Mikhail: Every year we try not only to expand the geography of our presence (Eastern Europe – Melsoft, Easybrain, Game Labs, Flying Wild Gog, Snapshot; China – StarLark; Japan – Ubitus; Israel – CrazyLabs; UAE – Jawaker; India – PlaySimple), but also expertise in various areas of the gaming sector – cloud gaming, AdTech, game engines, esports and other areas of the gaming market.

One of the most sensational trends of recent times has been the rapid growth of studios engaged in the development and operation of blockchain games, which attract huge rounds to scale the business. Of course, this area is interesting for our company, and we are closely monitoring its development.