We continue the series of interviews in which we summarize the results of the year together with experts and top managers of the gaming industry (and related ones). This time we talked with Kirill and Roman Gursky, the leaders of the gaming direction of the GEM Capital investment group.

Tell us, what was the year for you personally?

Kirill: I think 2022 has become a record year for us in terms of the number of business trips and conferences.

Google Gaming Summit in Dubai, Gamescom in Cologne, Mobidictum in Istanbul, TechIsland Summit, Reflect Festival, Best Invest Congress and TikTok Summit in Limassol, our partner-mentor program with the gaming accelerator Quickload from Turin, WN in Tel Aviv – this is even an incomplete list of events where we performed and which we attended.

In addition, we have established strong partnerships with Abu Dhabi Gaming and twofour54, a gaming cluster with a mission to make Abu Dhabi one of the world’s gaming capitals. By the way, some of our portfolio companies have already opened offices there.

Games are a global industry that brings joy and unites people. It is very important to communicate and share opinions and expertise with partners around the world. It’s especially nice when what you do helps your colleagues on the shop floor. For example, we received very warm feedback on our lecture about investing at the WN in Istanbul.

We understand that not everyone has the opportunity to attend such performances, so this year we also started to maintain a GEM Capital page on Medium, where we share our thoughts on the gaming market, its trends and prospects for individual segments.

It was especially nice that the guys from Google invited us to participate in the closing panel discussion of the Google Gaming Summit Dubai. The topic of discussion was “Hidden Gems for the Gaming Industry in Emerging Markets“. As we joked among ourselves with other speakers, the word “Gems“ was used in the title as a homage to GEM Capital for our success in investing in emerging markets.

The outgoing year was undoubtedly difficult, but we are looking forward to 2023 with hope!

What was the year for the foundation? What have you done, what would you like to highlight in terms of achievements in general?

Roman: Since 2019, when GEM Capital opened the investment direction in gaming, none of our portfolio companies has been closed. Even in the current difficult conditions. This is our common achievement with the founders and the result of joint efforts, according to which we can draw preliminary conclusions about how carefully we select investments, how reliable a partner we are. Not every investor in the market can boast of such a result.

Kirill: Continuing the themes of our achievements. It so happened that both last year and this year, studios specializing in titles for PC and consoles made a significant contribution to our success. Last year was marked for us by the release of Pathfinder: Wrath of the Righteous by Owlcat Games, which was nominated for DICE and Golden Joystick Awards. This year, in turn, the release date of Atomic Heart was announced – February 21, 2023. Many journalists have already played the game and given a very positive feedback. We have high hopes for the product and wish the team good luck! GEM Capital was one of the first investors of Mundfish and we are very proud of the result of the work and the path that we went through together with the guys.

Unlike many gaming VC, we have never bypassed the direction of PC and console games. we have very successful cases in this direction.

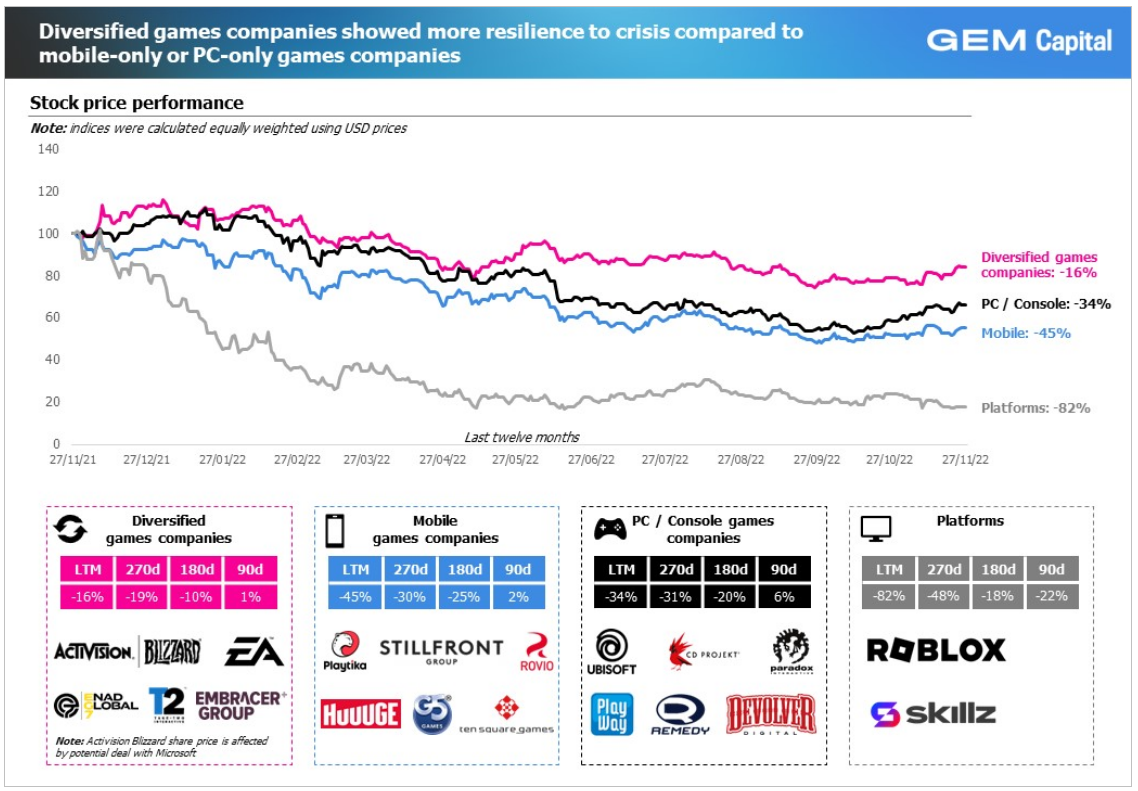

Recently, in our Medium, we compared the dynamics of stock quotes of public gaming companies for 2022. Based on the results of the analysis, we came to the conclusion that diversified corporations have shown greater resistance to market decline than firms that produce only mobile or PC and console products. This fact confirms the strategy we adopted four years ago to create an investment portfolio diversified by platforms, genres and regions. Now we see that many gaming investors are also starting to consider investing in games for PC and consoles. We can say that we anticipated the trend to some extent.

Roman: We also entered the ranking of the top 15 gaming VC in the world by activity in the games market (No. 12 worldwide and No. 1 in MENA and Eastern Europe), according to the Gaming Deals Activity Report from InvestGame. This year we have closed more than 10 deals. The GEM Capital gaming family, in particular, has been joined by: an application for quick and easy search for Skich games, Hypemasters studio, which develops World War Armies, and Eschatology Entertainment studio, which is working on an unannounced shooter in the Wild West setting.

How has the market changed directly for venture gaming companies over the year (a la, has it become more comfortable for them to work or, for example, increased risks)?

Kirill: The outgoing year is unique. I mean, the global revenue of the video game market is falling for the first time in a very long time (if not for the first time at all). Newzoo predicts that by the end of 2022, the market volume will be $184.4 billion, which is 4.3% less than last year’s level. Of course, this cannot but affect the mood of investors. Accordingly, investors have become more careful in choosing targets and making investment decisions.

What has changed in terms of venture capital from the perspective of gaming companies that are looking for investments?

Roman: The general change in investor sentiment, of course, is reflected in gaming companies. According to what we see on the market, it has become much more difficult to attract investments than, for example, in 2021. Any funder raising an investment round now is in the very center of the storm. We give our portfolio companies some tips that, in our opinion, will facilitate the fundraising process.

- First, try to get the first metrics as early as possible. Now it has become much more difficult to sell an idea. VC needs numbers to confirm the potential of the product.

- Secondly, think over your marketing strategy in advance. IDFA has radically changed the landscape of UA and now it is important to develop a game promotion plan in advance.

- Thirdly, start working with the community at the earliest stages. Absolutely everything matters here: a YouTube channel, a Discord server, social media pages, a Reddit channel, a Twitter account. It is important for you to show investors the potential audience size of your product.

Finally, try to have a budget for 12-18 months. In the current conditions, the investment round may take a considerable time and it is necessary to form reserves in order to reach the closing of the round.

What would you single out as new promising areas in gaming venture or closely related to it?

Kirill: We see great potential in near-game stories: applications in the field of social communication and game search, infrastructure startups, services for game developers, AI solutions, etc. Historically, gaming VCS have paid more attention to content. We think that the share of near-gaming startups in the structure of game fund portfolios will gradually grow.

What are the foundation’s plans for next year?

Roman: A real magician never reveals his secrets.

Seriously, we have big plans for 2023. We are waiting for the release of Atomic Heart from Mundfish and Wanted: Dead from 110 Industries.

We plan to increase investments in mobile game developers and near-gaming startups.

Let’s open a little secret: now we have four transactions in the process of approving and preparing documents. Most likely, we will publicly announce them in 2023.

What is invariably in our strategy and approach is the focus on supporting the most promising founders and the best teams!