Newzoo analysts have published a forecast for the turnover of the video game market for the current year. The main thing in it is a drop in the dynamics of revenue from mobile. They say China is to blame for this and the situation with game releases is not the most prosperous.

What happened?

The story is like this. In April, Newzoo published the first forecast. According to him, the turnover of the mobile segment of video games was supposed to jump by 25.5% this year to $70.3 billion.

It was a neat assessment*.

* The fact is that the dynamics of 2017 amounted to 23.3%. Then one of the main drivers of the growth of the world market was China, where Honor of Kings was primarily responsible for the cash register. The release of only one mobile version of the super-popular PUBG in the Middle Kingdom, while maintaining the positions of the mentioned mobs, could ** accelerate the growth of the market.

** Honor of Kings alone collected $2 billion in the App Store in China from November 2017 to October 2018 (taking into account local markets, the figure may be twice as much). A project comparable in success could bring no less.

Despite the correctness, the forecast turned out to be overly optimistic.

As Newzoo reported today, on November 2, global revenue from gaming mobile will grow by the end of 2018 not by 25.5%, but by 12.8% — it will not amount to $70.3 billion, but $63.2 billion.

Why did this happen?

The main reason for the decline in dynamics is the political situation in China. Since spring, new identification numbers have not been issued to game publishers in the country, without which no Chinese store allows publishing the game.

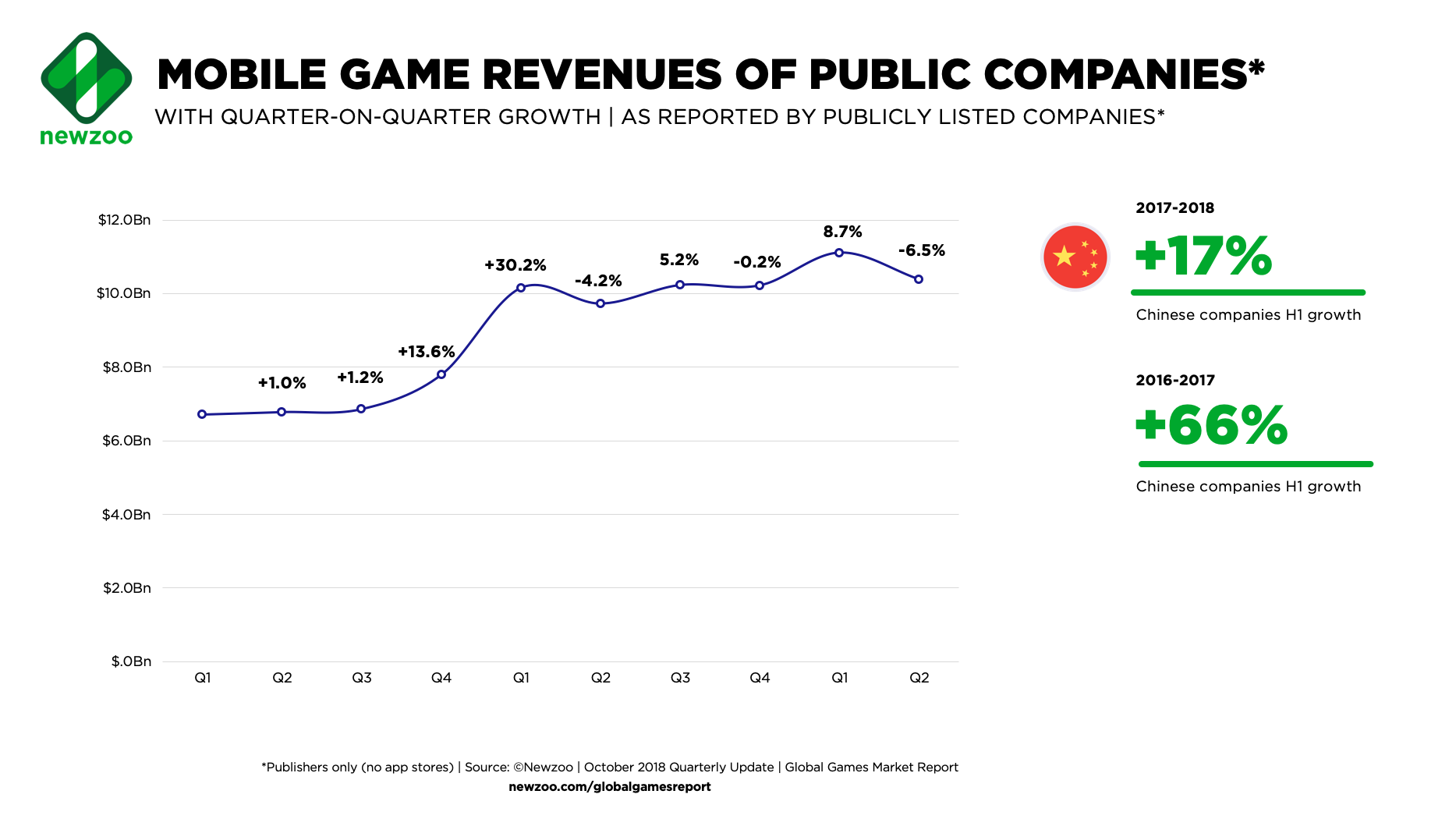

Already in the second quarter of this year, most of the public Chinese gaming companies reported a significant drop in growth rates in the first half of the year compared to last year’s for the same period. Given that the situation with identification numbers in the country does not change, the results of the second half of the year may be even worse.

Quarterly earnings of gaming public Chinese companies

Newzoo expects that in 2018, the Chinese mobile games market, with an annual growth of 10.6%, will amount to $19.4 billion.

The market was expected to grow by 30.7% to $23 billion*.

* Mobile PUBG, by the way, managed to get out, but in the Middle Kingdom it was forbidden to monetize it. So even the Chinese iOS version goes without in-game payments.

Is it just about China?

According to Newzoo, not only in it. In general, the entire top 100 box office mobile games do not demonstrate high dynamics. Analysts explain this for two reasons.

First. Changes in the App Store. Cash collections are less noticeable in the updated store and this affects the revenue of projects.

The second. There are few new blockbuster games. Most of the submitted projects are old—timers or their clones.

***

Newzoo’s overall expectations from the mobile games market are not the most positive right now. Its experts are confident that even by the end of 2019, the market will no longer grow by 20% per year, as before. A likely scenario is a 10-15% window hit.

But, of course, all this is nothing more than forecasts, which must be treated with a certain skepticism. Also note that Newzoo is not new to changing them. A year earlier in November, they also globally revised their assessment. Then the company, on the contrary, noted that the market was growing faster than predicted.

Also on the topic: