When deciding which game to develop, the business owner must assess the demand for a future project. How to do it right, — Alexander Bezobrazov, Marketing Director of Social Quantum, tells in the academic material.

At the beginning of August, we published a short version of the study. Now we offer to get acquainted with the original work.

Alexander Bezobrazov

A bit of boring theory

What is “market saturation”?

According to the Cambridge Business English Dictionary, Market saturation is “a situation where it is impossible to sell more products or services due to the lack of possible consumers.” The term can be associated with the Theory of natural limits and other boring things that you remember only at university, and then forget. If we talk about the gaming industry, we can find mention of market saturation in articles about the collapse of the video game market in 1983 (Video game crash of 1983) – a full–scale market recession between 1983 and 1985.

The affairs of bygone days are, of course, interesting, but this article demonstrates a much more pragmatic approach. If we want to create a product for a specific market, it is reasonable to learn more about it: size, consumption levels and competition. If we are operating a game in any market, it is necessary to closely monitor trends, understand whether it has reached saturation, and then act accordingly on it.

Saturation of the mobile F2P games market

What does market saturation look like in the real world? The mobile games market has been growing for several years – it doesn’t matter if you measure it in revenue or in the number of installations. According to forecasts, the growth will continue. Most reports focus on the market as a whole. However, all companies compete in selected niches, and do not try to “hold” the entire market.

For such niches, whether genre or audience, market dynamics may differ from the “average hospital temperature” in the mobile gaming industry.

If we take a Tier-1 country, for example, the USA, sooner or later we will reach the “plateau” stage: the MAU/WAU/DAU for some market segment will stop growing. This, in turn, will increase competition for the attention of a limited audience, companies will invest in retention activities and try to involve existing users more. Sooner or later, the market will reach a point where players are not ready to spend more time in games. Competition for users will increase, as will CPI values, which will reach the limit due to the level of revenue.

Given this, we can evaluate the lifecycle of a niche or market using a number of metrics: active user base, revenue, volume of installations/downloads, time in applications and “derived” metrics, for example, ARPMAU/ARPDAU.

The US market for frituplay games in the genre of culinary time managers (tycoon/crafting)

For the purposes of the article, I will formulate the market framework as “the market of IAP-monetized fritupley restaurant simulators on Android (Google Play) in the USA.” Such a definition will help me illustrate techniques and approaches that can be applied to study the market, assess the stage of its life cycle and make a data-based decision to enter the market in principle.

The niche of restaurant simulators (hereinafter culinary time managers) is most often determined either through the Tycoon/Crafting genre, or through the Time Management genre. Niches within these genres range from farm simulators to bodybuilders, from “tycoons” to “cookings”. The main monetization model is usually through IAP (in-app purchases) with a complementary level of advertising monetization.

Top-grossing culinary Time Managers in the USA in June 2019

The assessment of the mobile games market in the United States in June 2019 amounted to almost $427 million. The top 100 most earning games “make” about $290 million, which is 67.9% of the market. Top 500 games – 91.8% of the market, they earned $392 million.

The first thing we can take out of here is the lack of cafe simulators in the top 100.

But there are representatives of the genres tycoon / crafting and time management. But there are also a few of them — only two. And they generated only 2.28% of the total revenue of the top 100. The top 500 includes 22 games related to the genres of tycoon / crafting and time management. They generated 2.76% of revenue totaling $10.8 million.

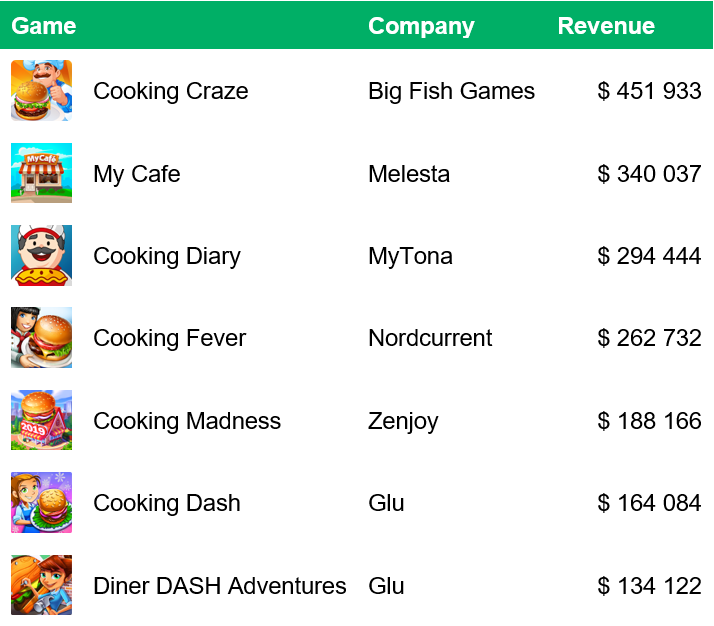

There are culinary time managers in the top 500 US box office games on Google Play. In June 2019, 7 similar games entered the chart, earning a total of $1.83 million in a month:

Estimated revenue of culinary Time Managers (Google Play, USA, June 2019)

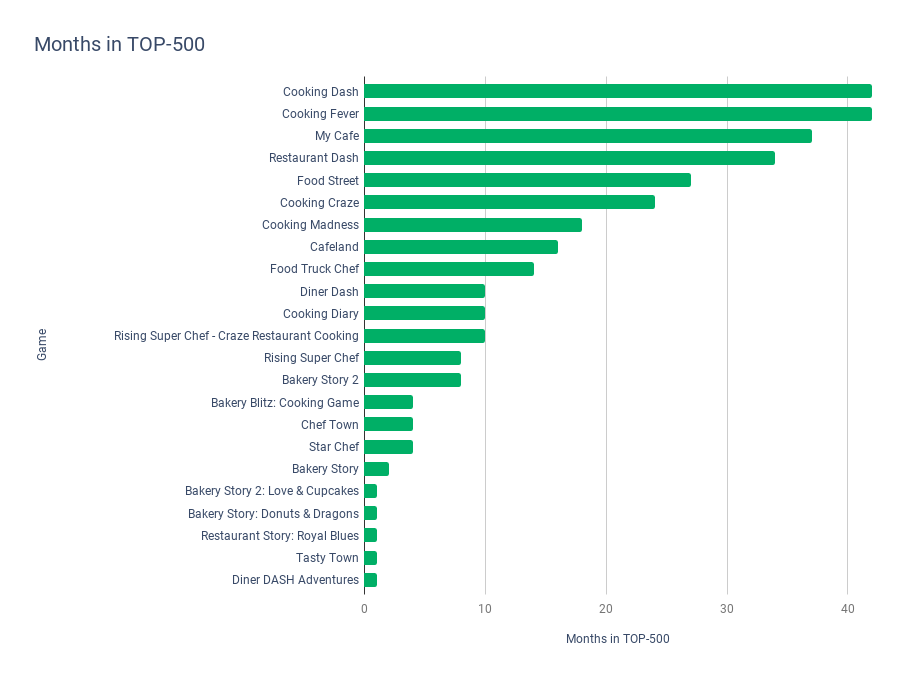

The highest-grossing games in the genre of culinary time manager in the USA from January 2016 to June 2019

Since January 2016, only 23 cafe simulators have been in the top 500 box office games at least once:

Top culinary time managers by the number of months spent in the top 500 (Google Play, USA) since January 2016

These games (let’s call them TopCooks) will make up a sample on which we will evaluate the market. It is absolutely certain that this is not an exhaustive list of all titles, and in a real situation, it is better to expand the sample to assess the market by increasing the number of games in it.

Throughout the entire period of time under consideration, the leaders were mostly the same. Only two newcomers have recently been able to join the leaders of the genre: Cooking Diary from Mytona and Diner DASH Adventures from Glu. Without them, we could say that the market is divided between only 3-5 applications. There is also an unstable group of applicants who rise and fall. Based on the trend, Cooking Diary is clearly a rising star, but it’s too early to draw far–reaching conclusions with Diner DASH Adventures.

Assessment of market saturation

MAU, downloads, revenue

The first thing we will evaluate is the base of active users of the genre, as well as the dynamics of revenue and downloads.

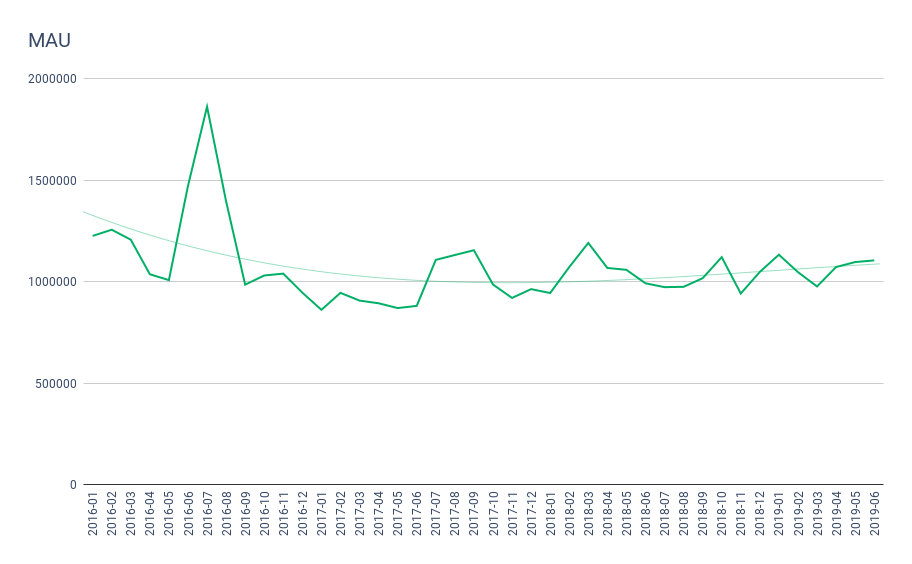

Dynamics of the cumulative MAU of culinary time managers from the top 500 (Google Play, USA, January 2016 — June 2019)

The Monthly Active Users (MAU) metric for TopCooks has reached a kind of “plateau” of about 1.1 million active users per month. It should also be noted that there are certain inaccuracies in the data – the graph shows an aggregated MAU for 22 titles. This is convenient for scheduling purposes, but in reality there is no guarantee that players do not play two or more games within a single month. Thus, it would be reasonable to assume that the genre’s MAU is actually even lower.

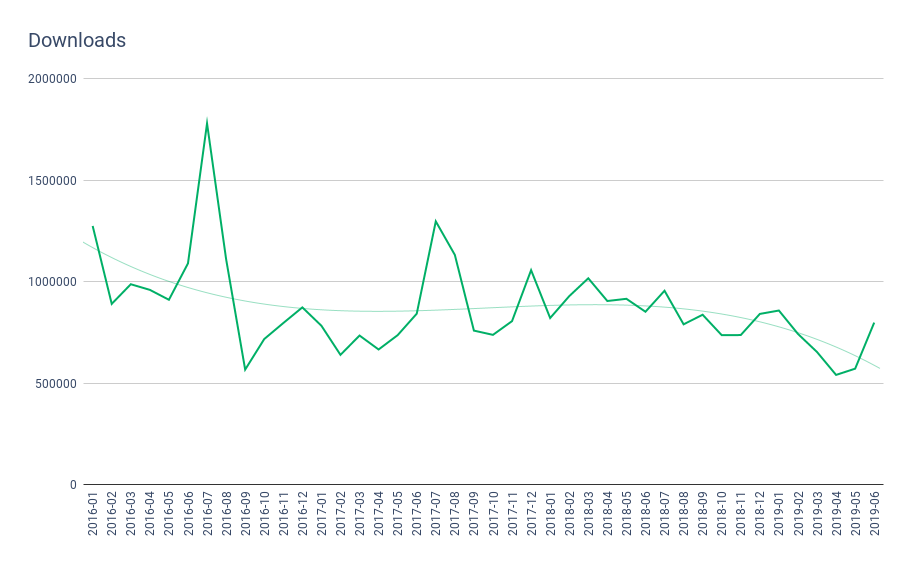

Dynamics of downloads of culinary time managers from the top 500 (Google Play, USA, January 2016 — June 2019)

Aggregated downloads for TopCooks have not been growing for at least the last two years. Bursts can be attributed to Restaurant Dash in July 2016 and Cooking Craze in July 2017. The total volume of downloads for the market can be expected on average in the region of 800-1000 thousand installations per month.

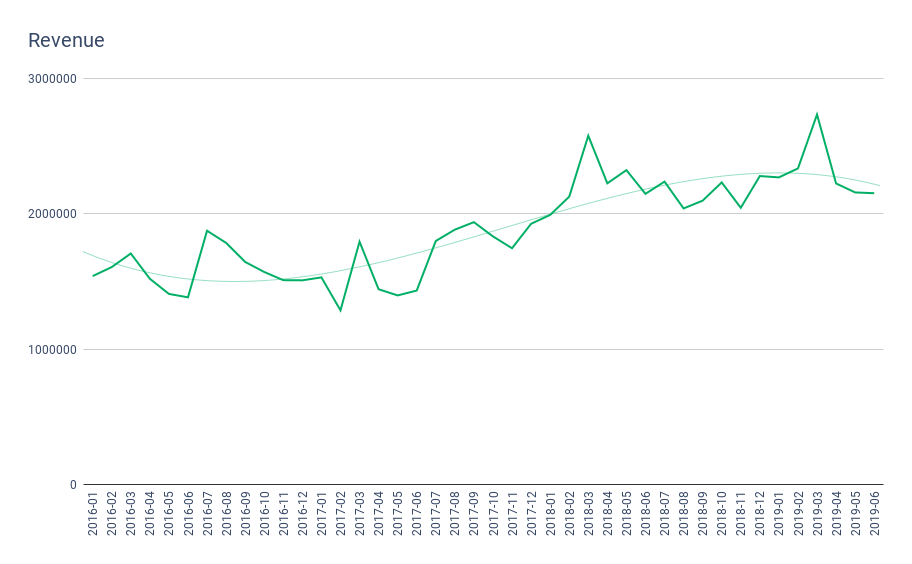

Dynamics of total revenue with IAP in culinary time managers from the top 500 (Google Play, USA, January 2016 — June 2019)

The first “good news” for the market segment limited to TopCooks is stable revenue growth over the past two years. Coupled with the previous data, we can assume that either there has been an increase in the purchasing power of the average player, or games now have better monetization than two years ago.

ARPMAU and Total Time

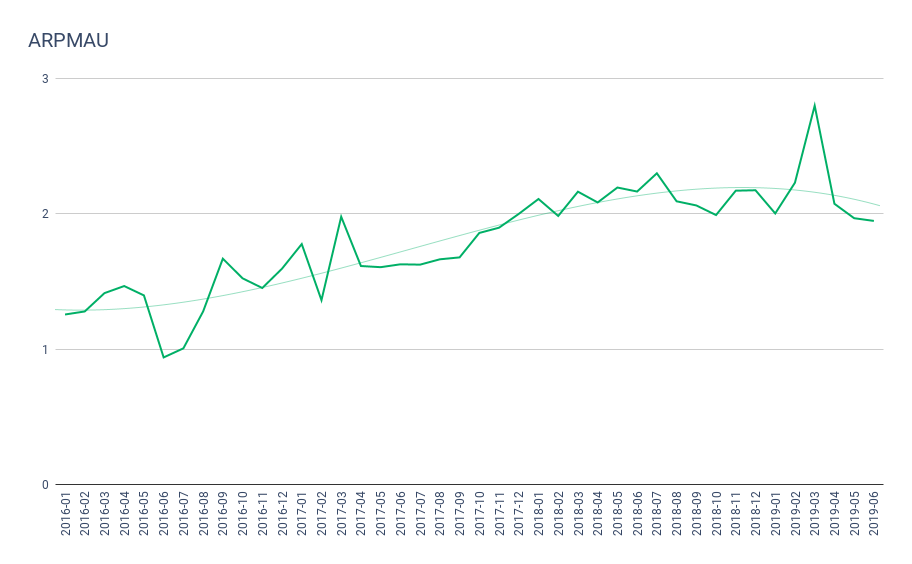

ARPMAU dynamics in culinary time managers from the top 500 (Google Play, USA, January 2016 — June 2019)

The ARPMAU graph confirms the second hypothesis about revenue growth. If we dig deeper into the charts, we will see that revenue growth in a significant part is due to the appearance of Cooking Craze (launched in 2017) and Cooking Diary (launched in 2018). These two applications are now leading the market, while the previous leaders – for example, Cooking Fever – by and large have not suffered. With this in mind, we can assume that the market growth was due to less strong participants, and this may indicate, roughly speaking, “consolidation” of the market.

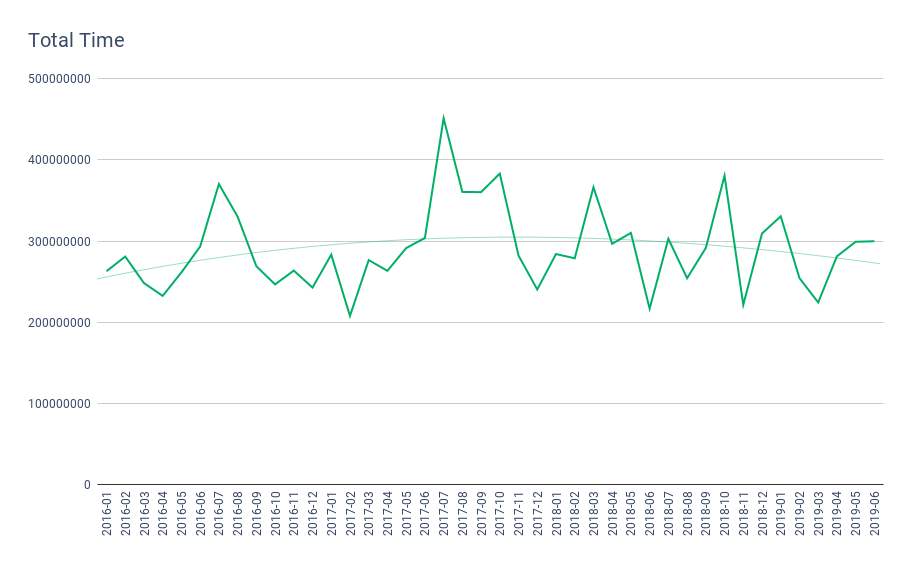

Dynamics of cumulative time spent by players in culinary time managers from the top 500 (Google Play, USA, January 2016 — June 2019)

One of the most interesting engagement metrics you can find in App Annie is Total time. This is an estimate of the total time that users have played the game (or used the app) in minutes. In my opinion, this metric is even more interesting for evaluating the market than the number of active users. We can see that the aggregated number of minutes for the market is around 282 million minutes/month this year. If minutes were money, then we could say that the market has reached saturation in this part; it does not seem that users are willing to spend more time in genre games on a regular basis than at the moment.

Conclusion

Summarizing the information above, we can conclude that the cafe simulator market in the USA (Google Play):

- it is not growing in terms of the active user base or the number of downloads (for example, installations on new devices);

- shows steadily increasing revenue on a constant-sized user base;

- probably reached saturation in the amount of time that players are willing to spend in games of this genre.

There is also a possibility of “consolidation” of the market, since it seems that the revenue growth of the TopCooks group (see the definition above) is due to weak applications.

As can be seen from the launches of Diner DASH Adventures and Cooking Diary, it is still possible to launch commercially successful games on the market. In terms of revenue, the market has not yet reached saturation. However, if we take into account the lack of growth in the active user base or time spent in games, we will have to conclude that early indicators indicate a significant increase in competition, which, in turn, will affect the CPI, ROI and economic feasibility of entering the market in the future.