Sensor Tower analysts told how things were going with the monetization of App Store games in 2020. Among the observations is the strengthening of the subscription model and the growth in the number of teams earning exclusively from advertising.

Rise of KingdomsThe main thing from the report:

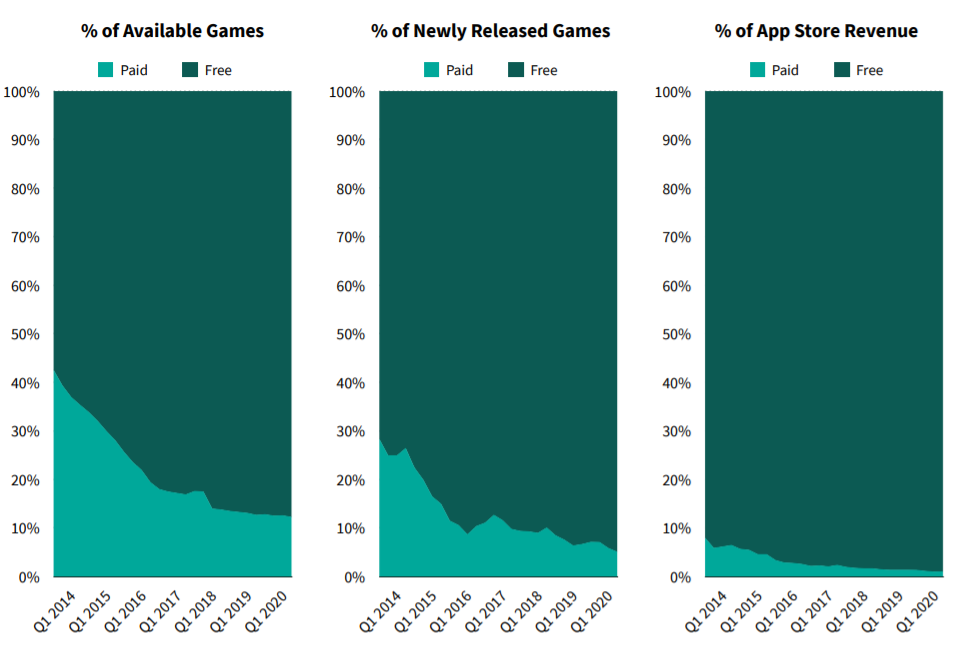

- premium games began to seriously lose ground to freeplay titles back in 2014. This trend continues to this day. By the fourth quarter of 2020, only 5% of new games in the App Store were paid, whereas in 2014, such games accounted for about 30% of newly released titles;

- also at the end of last year, premium games accounted for only 1% of gaming revenue in the App Store;

Share of paid and free games in the App Storethe subscription model has become one of the important sources of income not only for non-gaming applications.

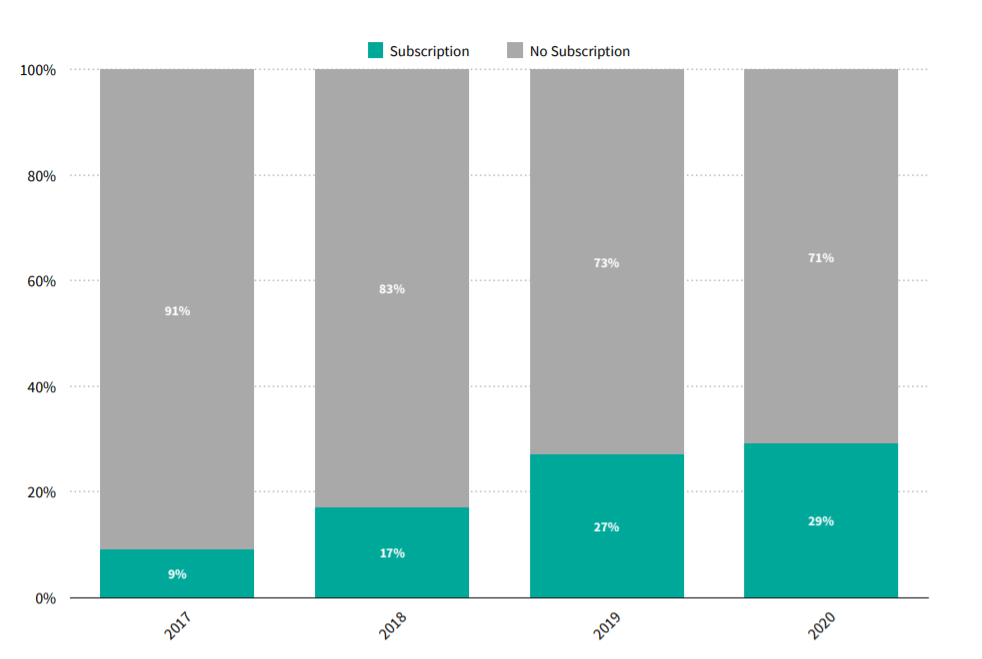

- By 2020, 29 games in the top 100 at the box office in the American App Store had a subscription. In 2017, there were only nine top subscription games there;

Subscriptions in games in 2017-2020However, traditional IAPs remain the more popular monetization model.

- In 2020, games that successfully implemented subscriptions, as a rule, continued to receive the bulk of revenue from in-game purchases;

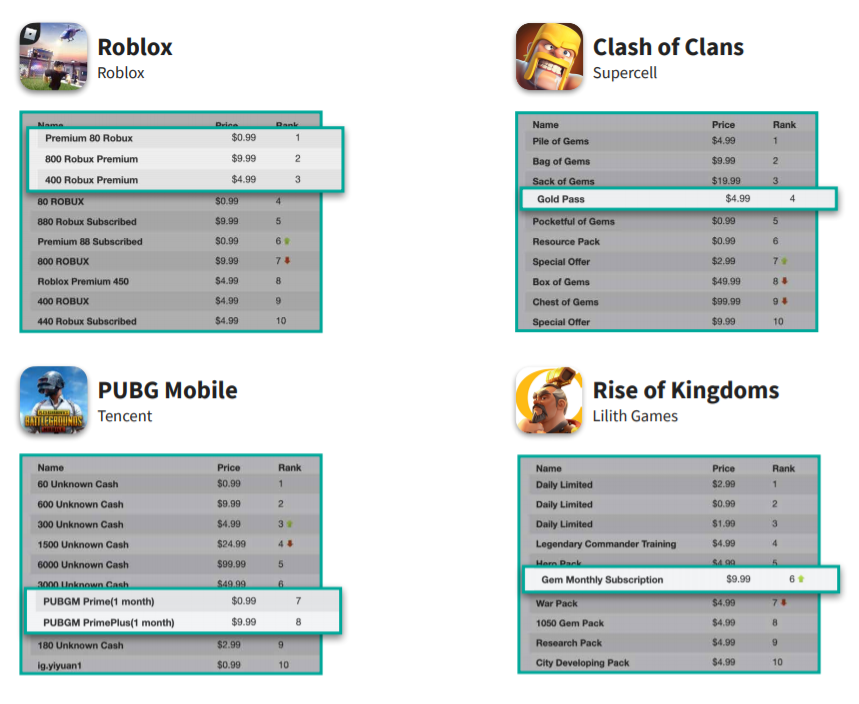

- an exception can be called Roblox — three monthly subscription options in it bring more money than the rest of the IAPs. Although other top-grossing games, such as Clash of Clans, PUBG Mobile and Rise of Kingdoms, have a subscription at best among the ten most effective IAPs, but not in the top three;

Top 10 IAPs in Roblox, Clash of Clans, PUBG Mobile and Rise of Kingdomsmore and more games earn exclusively from advertising.

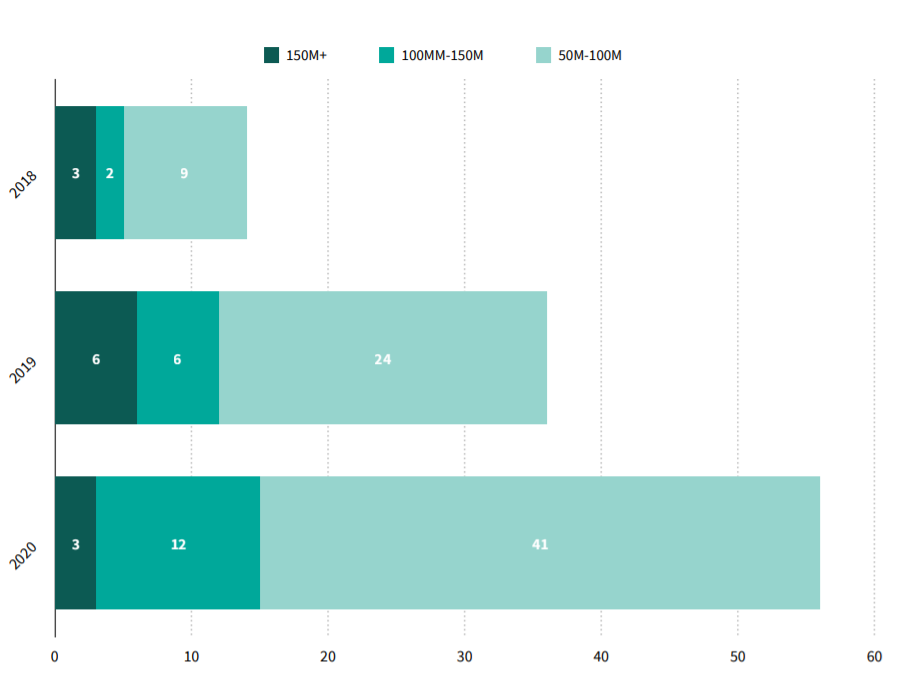

- This has become noticeable due to the rapid growth of hypercausal titles. Last year, 56 hyper-casuals crossed the threshold of 50 million downloads (and 3 of them collected over 150 million downloads). In 2018, only 14 titles in this category were downloaded more than 500 million times. But the launch of Apple‘s new privacy policy, which allows gamers to block the IDFA ID, could change the situation.

The number of hyper-casual games with downloads over 50 million in 2018-2020