Analytical companies App Annie and AppsFlyer have prepared a voluminous study of the Latin American mobile market based on the results of the first quarter of 2021. In the report: data on player spending, downloads and marketing indicators. We have chosen the most important thing.

It is important to note: analysts have divided Latin America into two parts — Portuguese-speaking (Brazil) and Spanish-speaking (the rest of the countries). The phrase “Latin America” will then be understood only as Spanish-speaking countries, excluding Brazil.

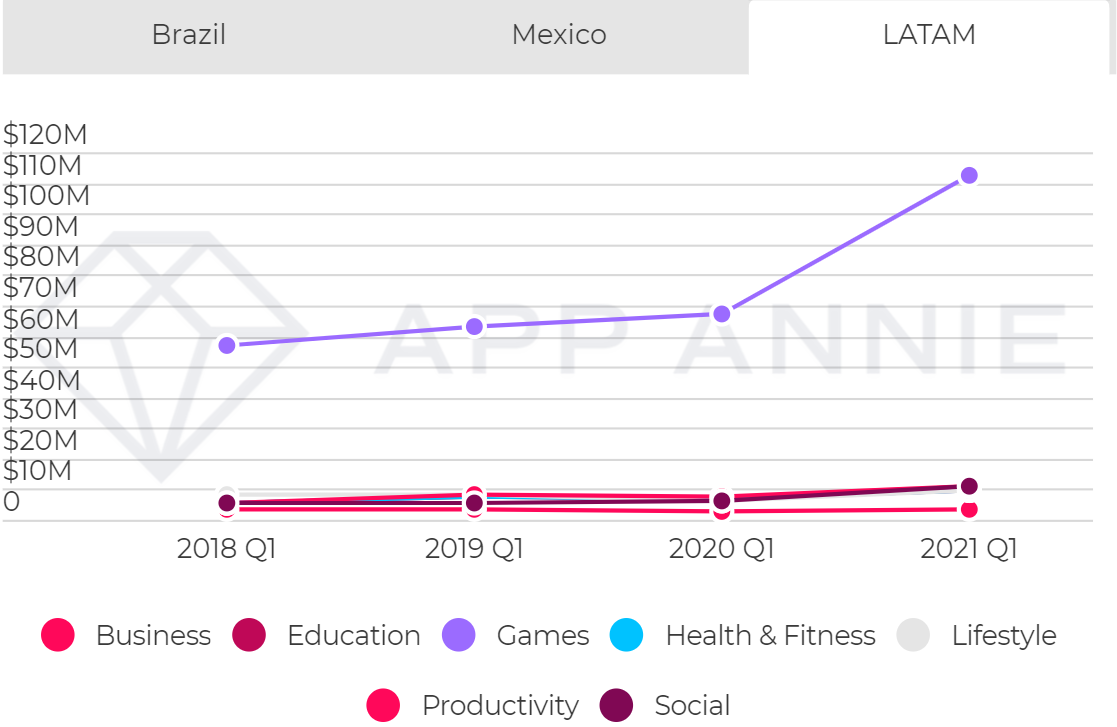

Revenue

1. Spending by mobile gamers from Latin America increased dramatically in early 2021. They jumped by 53% compared to last year to $112.4 million. In Brazil, user spending increased even more — by 70% to $141 million.

2. In the first quarter of 2021, Brazilians made in-game purchases 64% more often than in 2020.

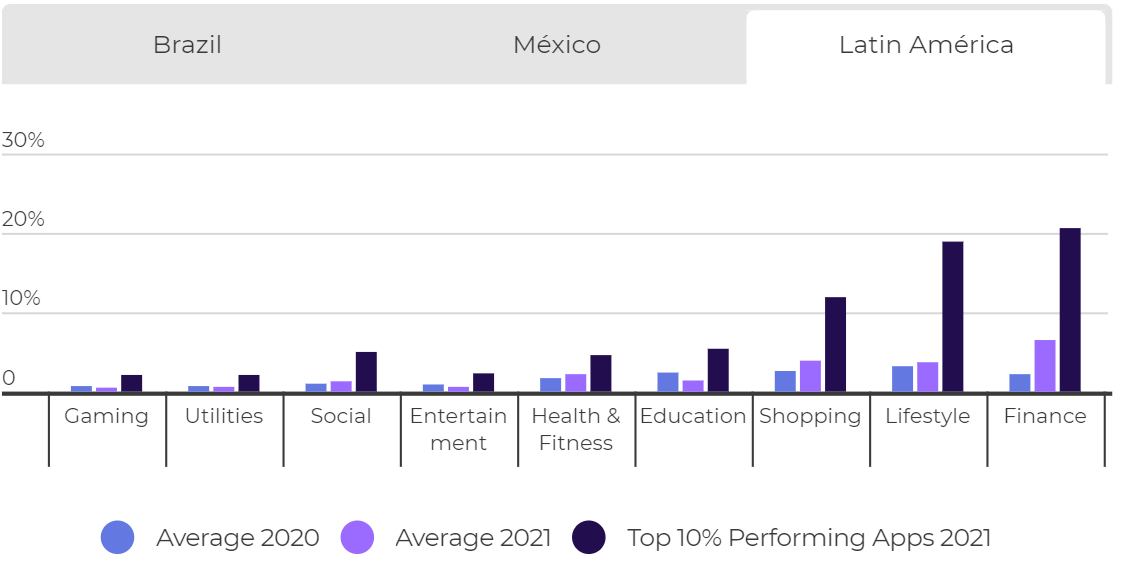

3. In 2021, the number of paying players in Latin America was 0.5%. For comparison, a year ago they were 0.7%. If we talk about Brazil, the situation there is slightly better – 0.57% and 0.52%, respectively.

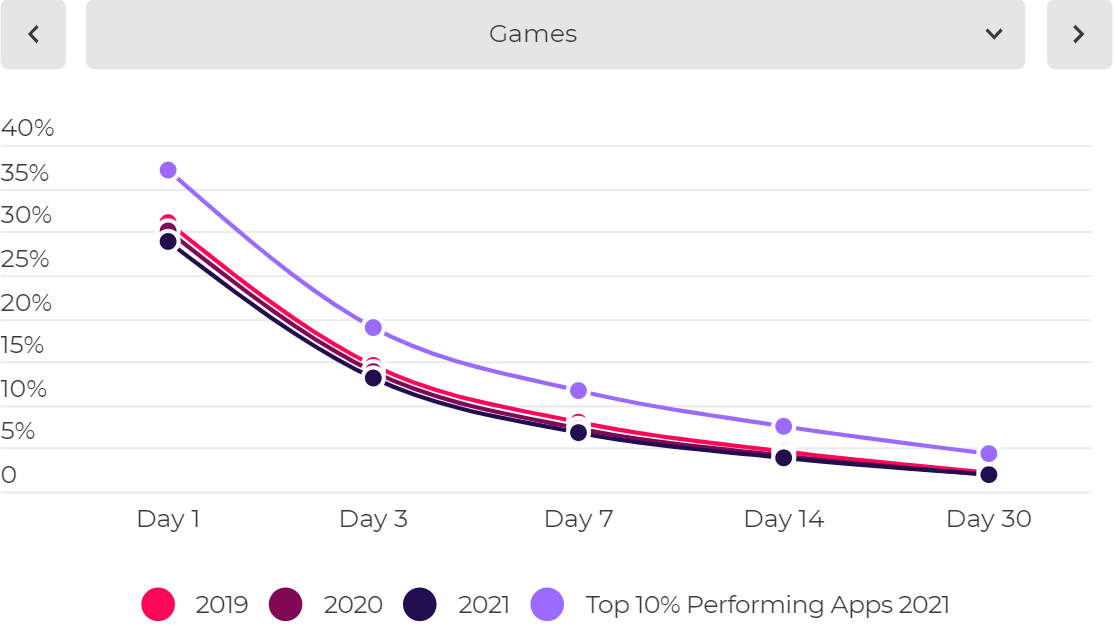

4. Retention rate for 10% of the best Latin American games: D1 — 37%, D3 — 18.95%, D7 -11.69%, D14 — 7.47%, D30 — 4.3%. The figures in Brazil are practically the same.

Downloads and Marketing

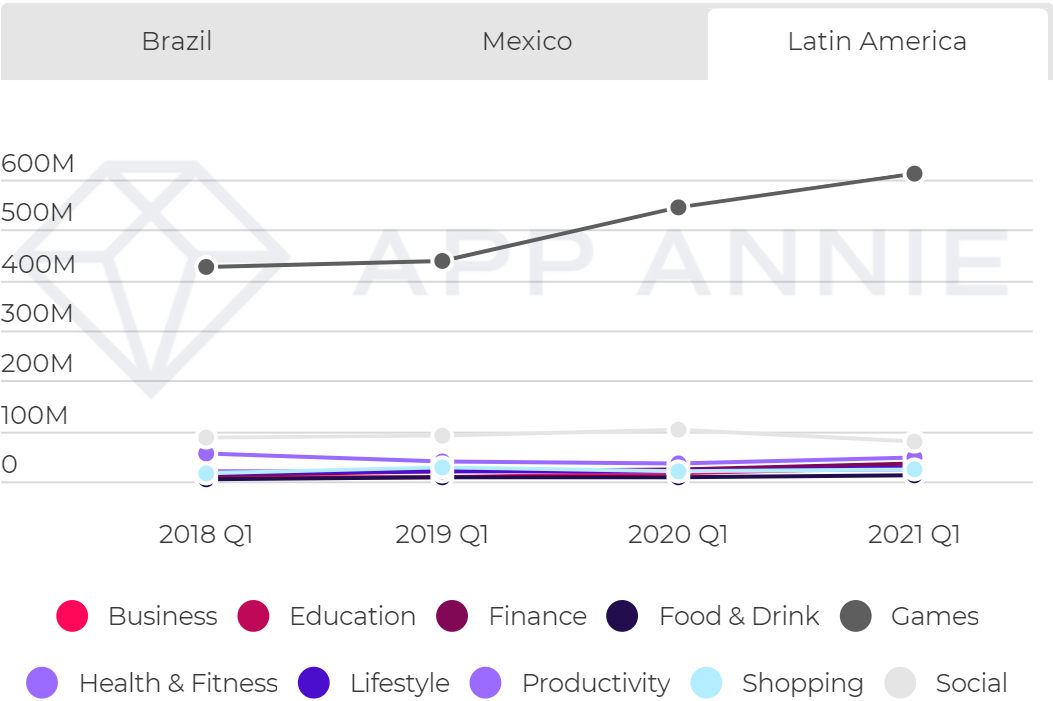

1. In the first months of 2021, Latin Americans downloaded mobile games in the App Store and Google Play Store 612 million times – 30% more than at the same time a year ago. Moreover, Mexicans were especially zealous, who accounted for 593.5 million downloads. As for Brazilians, they have another 1.1 billion downloads on their account.

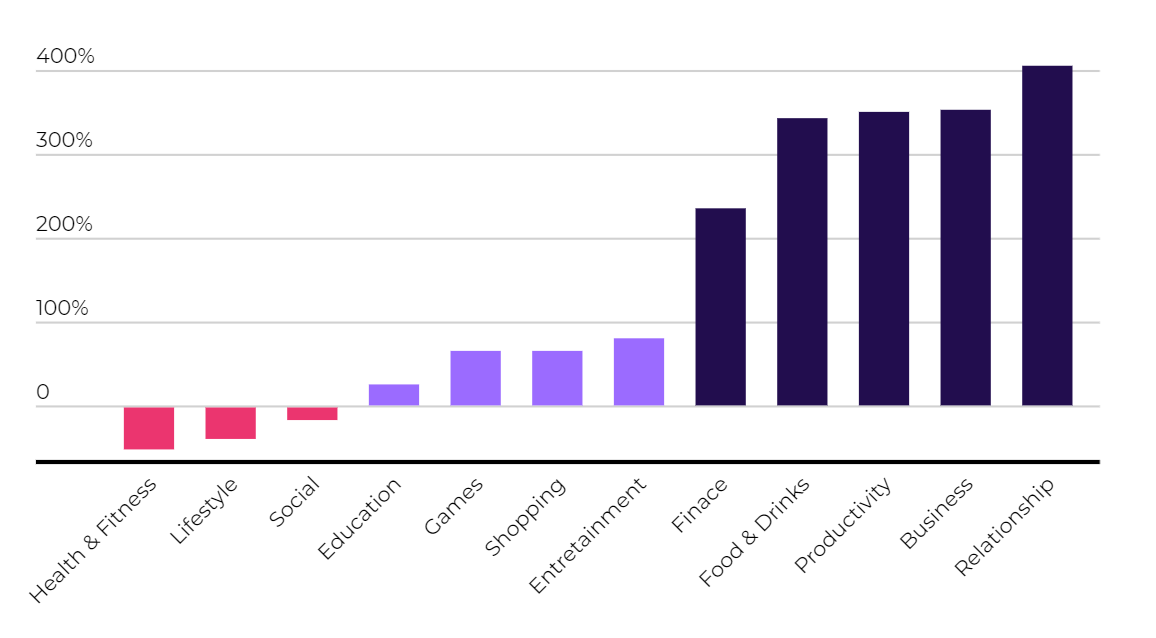

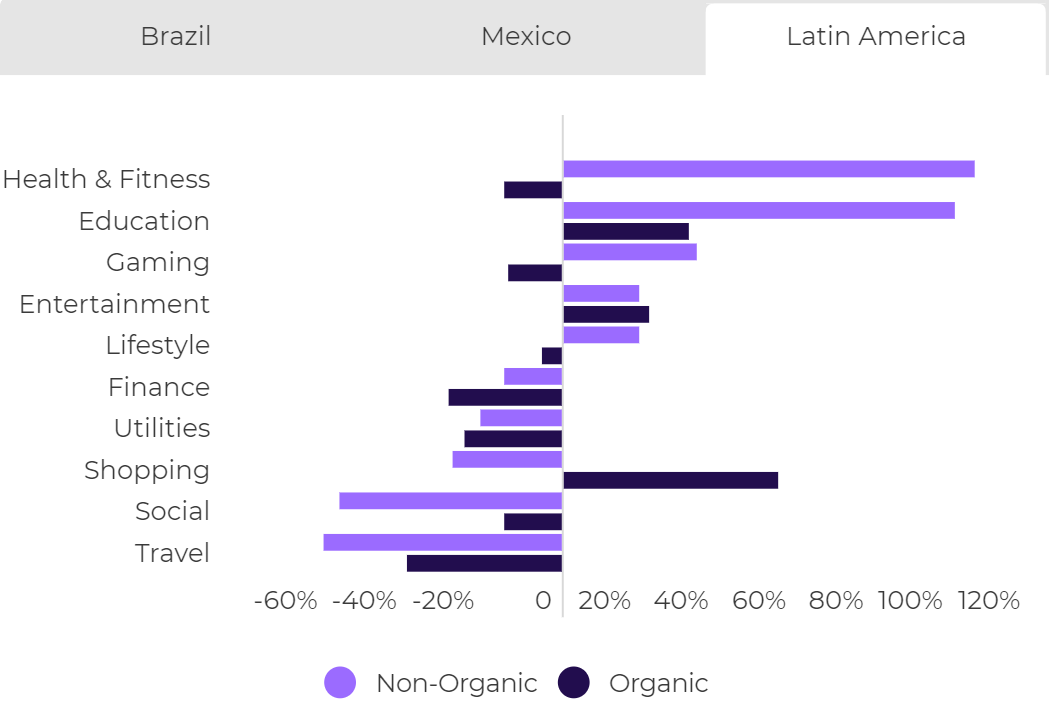

2. Non-organic traffic in games increased by 34% in the quarter compared to last year. But organic fell by 14%. Note that App Annie and AppsFlyer looked at the situation only in those projects whose marketing budget in the reporting period was at least $ 3 thousand.

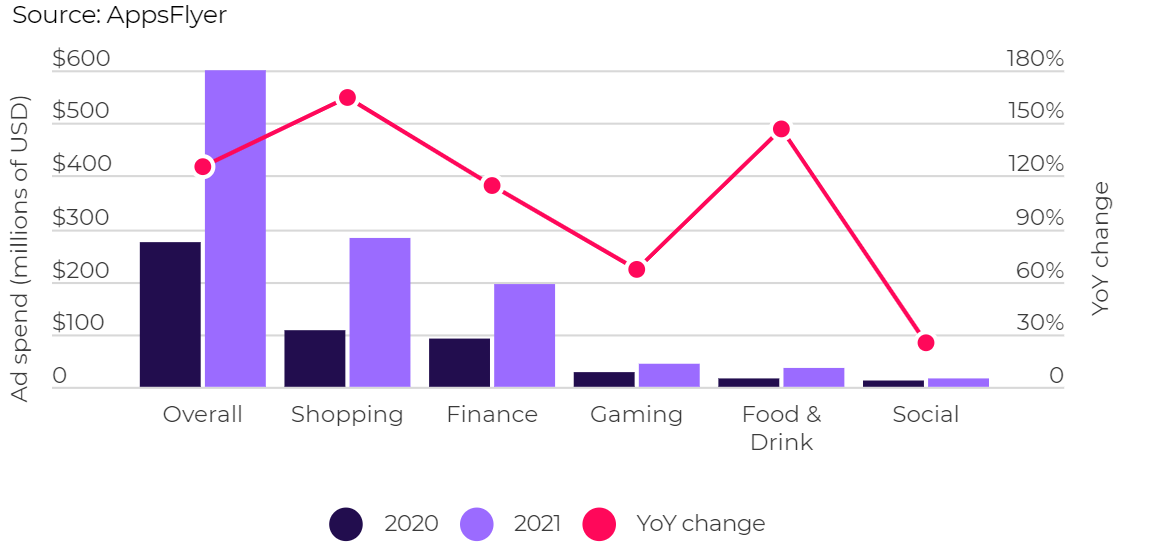

3. It is not surprising that advertising expenses have increased over the year. Analysts did not provide general statistics, but noted: in Brazil, advertising costs increased by 67% to $ 45 million, and in Mexico by 99%.

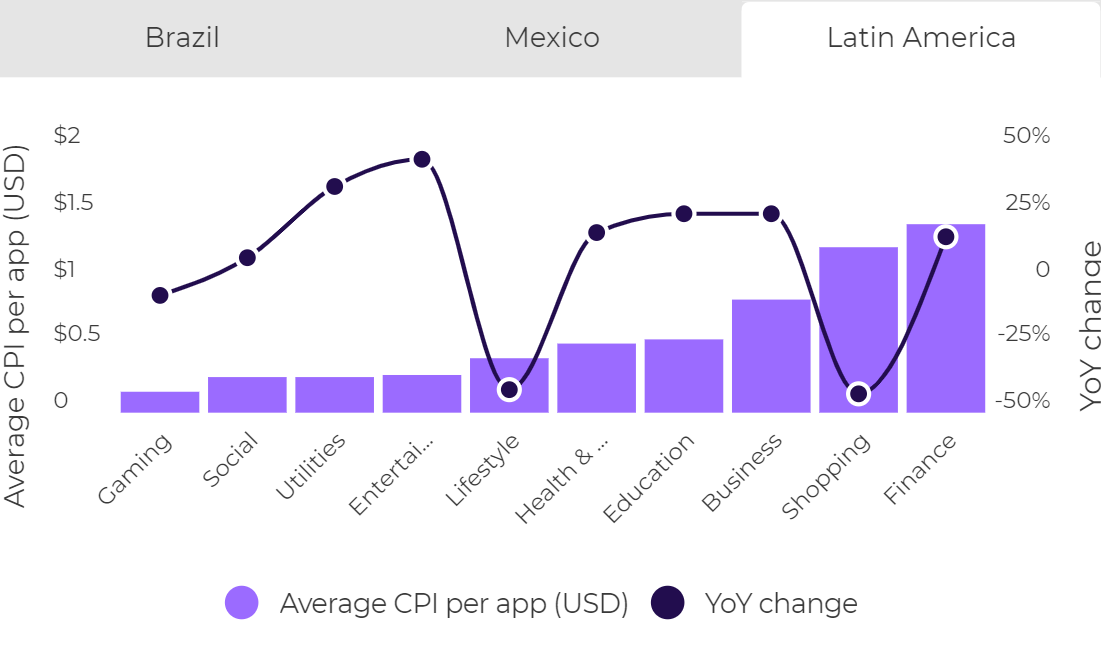

4. CPI (cost per installation) averaged $0.15 for Latin America. This is 6% lower than in the first quarter of 2020. But in Brazil, the CPI rose 7% to $0.16.

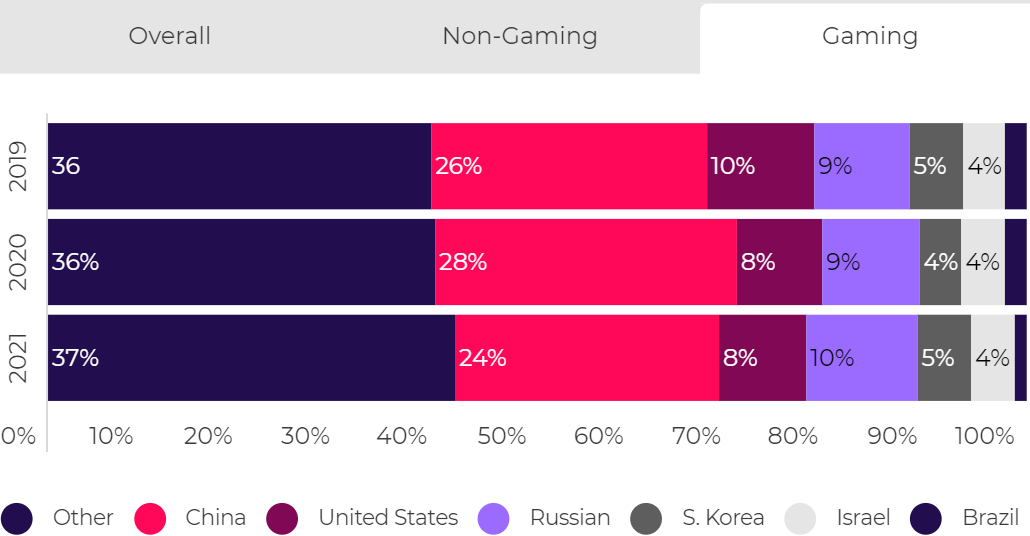

5. Analysts also wrote which games from which countries collected the most downloads in Brazil. The most popular were the projects of Chinese developers — 24% (although their share decreased by four points over the year). They were followed by titles from Russia — 10%, the USA — 8%, South Korea — 5%, Israel – 4% and Brazil itself — 1%.