Sensor Tower analysts shared a report on the state of the mobile advertising market in the American App Store in 2020. Among other things, they noted that one of the main advertisers on the market is Playrix.

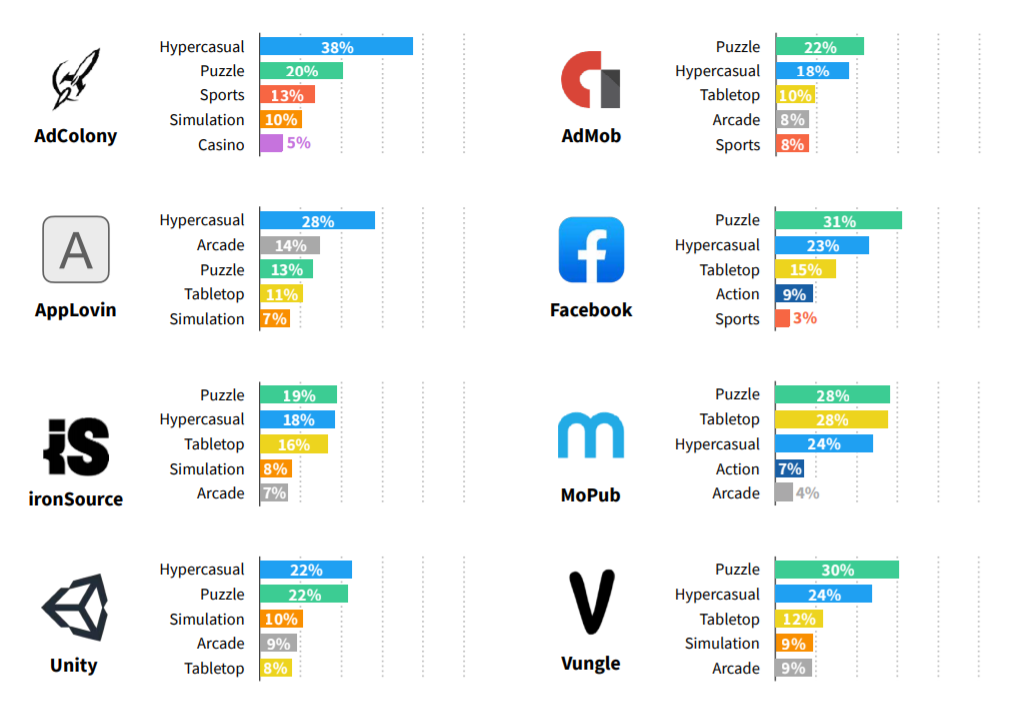

Gardenscapes Hyper-casual games and puzzles – the main publishers

Most of the advertising creatives over the past year were placed in puzzles.

Their share was the largest in five of the eight advertising networks identified by analysts: AdMob, Facebook, ironSource, MoPub and Vungle.

Hyper-casual games were also frequently requested for advertising. In three networks (AdColony, AppLovin and Unity), they bypassed all other genres in terms of volume. In four more, hyper-casuals took the second place after puzzles. The only network that put hypercausals in third place in terms of the share of requests received is MoPub.

As indicated in Sensor Tower, this means that these genres are particularly dependent on advertising in the context of revenue.

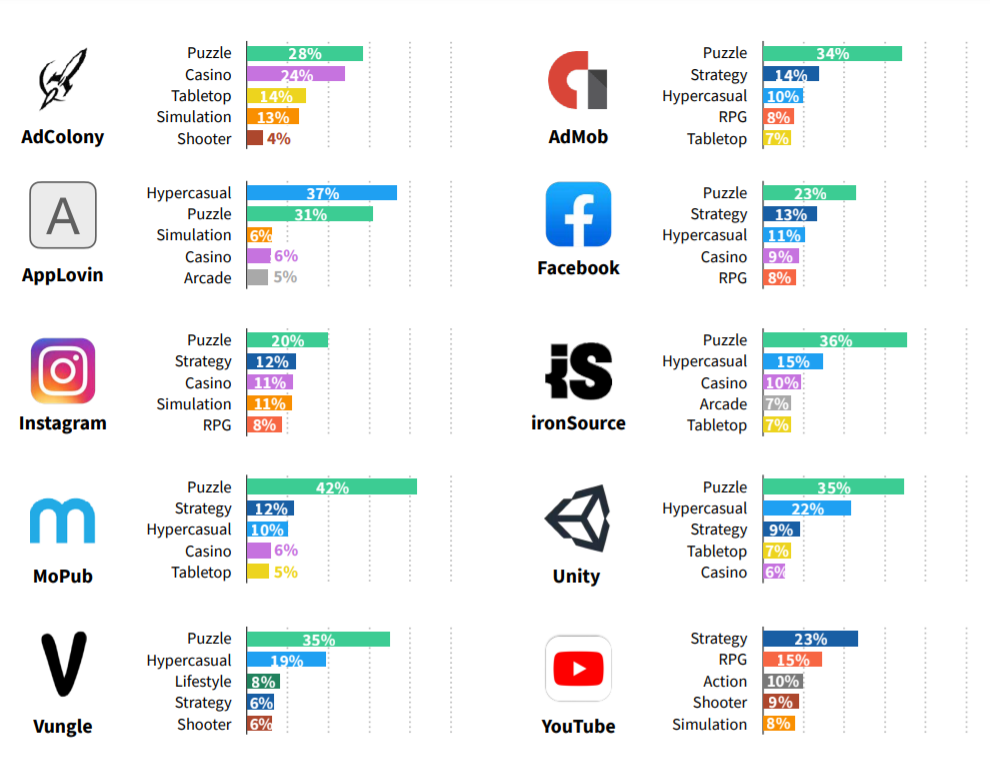

Top 5 publishers in advertising networks for 2020Puzzles are the main advertisers on the market

Most of the mobile game advertising falls on puzzles. Their developers are the most active advertisers. In six out of eight networks, puzzles accounted for over 30% of placements.

Strategies and hyper-casual games are also actively promoted. Most of the creatives in AppLovin (37%) were devoted to hyper-casuals. Strategies became the leader on YouTube (23%).

Top 5 advertisers in advertising networks for 2020What else?

- AppLovin and Activision Blizzard in the USA are among the top five developers in terms of the number of advertising publications in their games (according to AdMob, AppLovin, Facebook, Unity, Vungle and ironSource);

- Playrix remains one of the leading advertisers in the United States, leading in impressions in Adcolony, AdMob, MoPub and Vungle. His Homescapes was the most common creative in each of these networks, as well as in Unity. Two other games of the company were also popular: Gardenscapes and Fishdom;

- The number of creatives advertising Zynga games increased dramatically in the fourth quarter of last year after its purchase of the Turkish studio Rollic Games. Although the number of creatives dropped slightly in the first quarter of 2021, it is still higher than before the deal with the Turks.