On March 16, Newzoo published a 58-page report on the state of affairs in the PC and console games market. We have already covered it briefly. It’s time for a detailed analysis. Prepare a mug with more tea, there will be a lot of graphs and numbers.

Results of 2022 — money

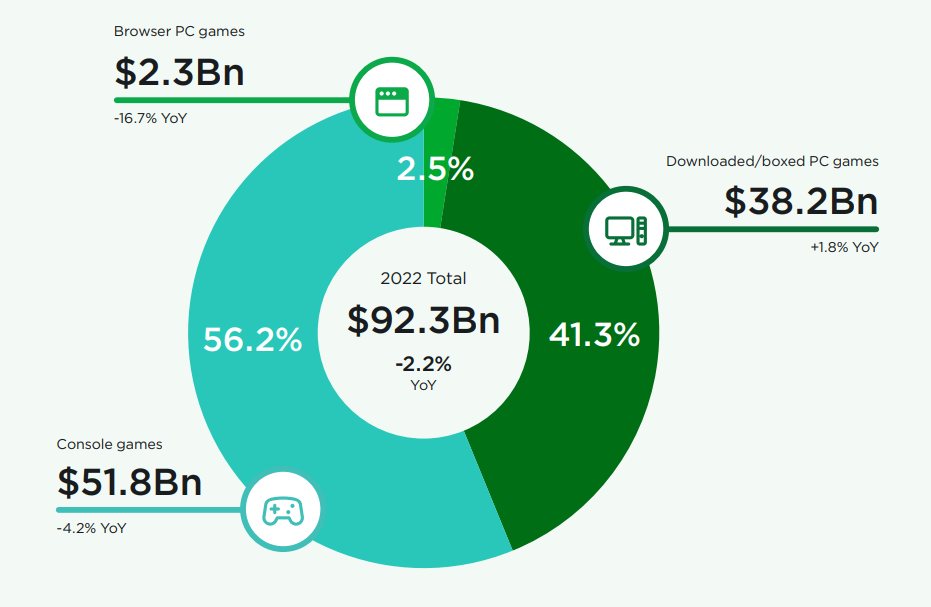

The main figure of the report is $92.3 billion. That’s how much PC and console games combined earned in 2022. This is 2.2% less than a year earlier.

Sales volume of the console and PC games market for 2022 by segment

There are two interesting points here.

The first is the growth of PC revenue. It is explained in Newzoo by the fact that this platform does not depend as much on the release of hits as consoles. That is why the lack of major releases in 2022 did not stop the growth of sales on the PC.

The second point is a significant drop in the browser games segment. It happened just against the background of conversations going on in the industry that players are now increasingly willing to spend money and time on desktop versions of mobile titles.

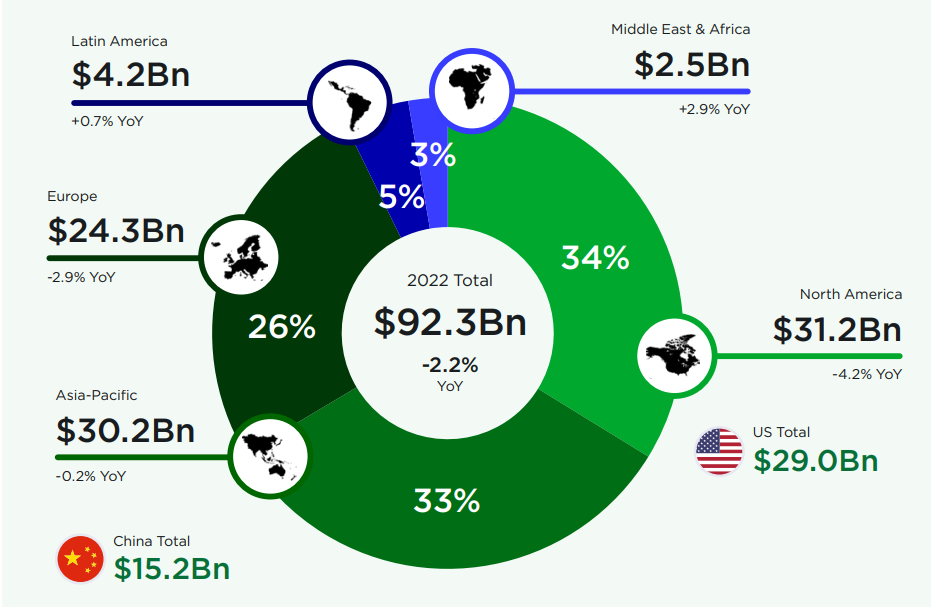

There are no surprises in the regional distribution of revenue. The highest—grossing market is North America (34% of the market), in second place is the Asia-Pacific region (33% of the market).

Sales volume of the console and PC games market for 2022 by region

Attention should be paid here to something else.

The Latin American video game market showed a slight increase at the level of the general decline (by 0.7%), and the Middle East and Africa market grew relative to other markets and not bad at all (by 2.9%).

This is explained by the fact that emerging markets are growing due to the penetration of gaming hardware, the improvement of local payment tools, as well as the growth in the number of players (including secured ones).

This closes the topic with regions in the report for the most part.

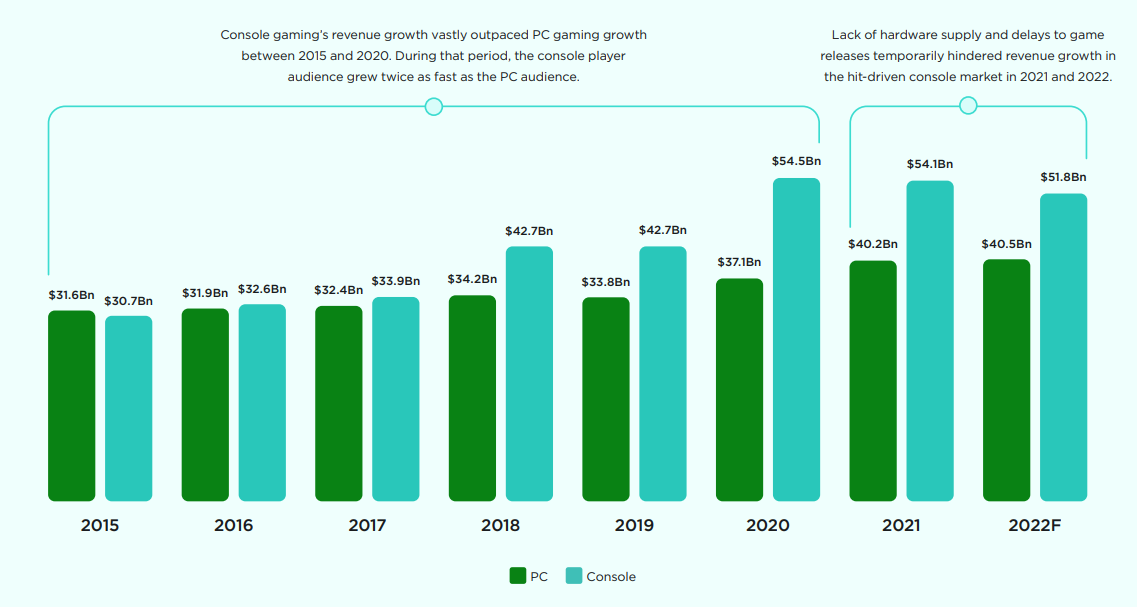

Out of curiosity: the revenue of console games is falling for the third year in a row.

Sales volume of the console and PC games market by year (2015-2022)

Here’s the situation: in 2015, PC games earned more than console games (the difference was around a billion dollars). But in the period from 2015 to 2020, the console audience grew twice as fast as the audience of desktop games. This also led to an increase in revenue. However, since 2021, the console market has been stagnating financially. The reason: interruptions in the supply of consoles and postponements of game releases.

Results 2022 — user activity and games

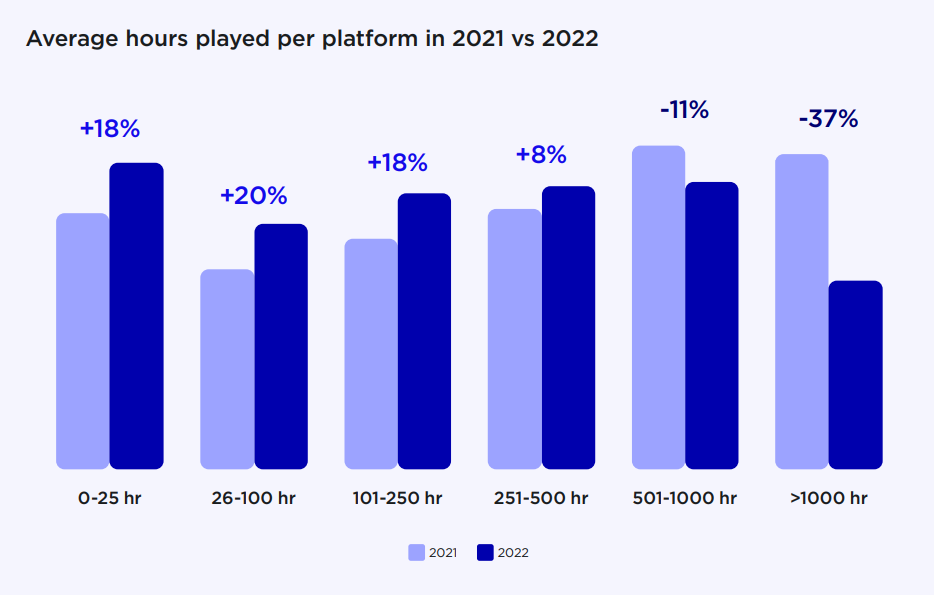

The average time spent playing games on Steam, Xbox and PlayStation platforms fell by 20% in 2022. Analysts call such a turn a repeated correction. The behavioral pattern has shifted in favor of what it was before the pandemic.

There were much fewer users who spent more than 1,000 hours playing games per year (a drop of 37%), and users who spent 501 to 1,000 hours on games per year (a drop of 11%). Accordingly, there are more people who have different gaming habits.

Average number of hours spent by players playing games (comparison of 2021 and 2022)

Next comes a block about specific games and the size of their monthly active audience (MAU).

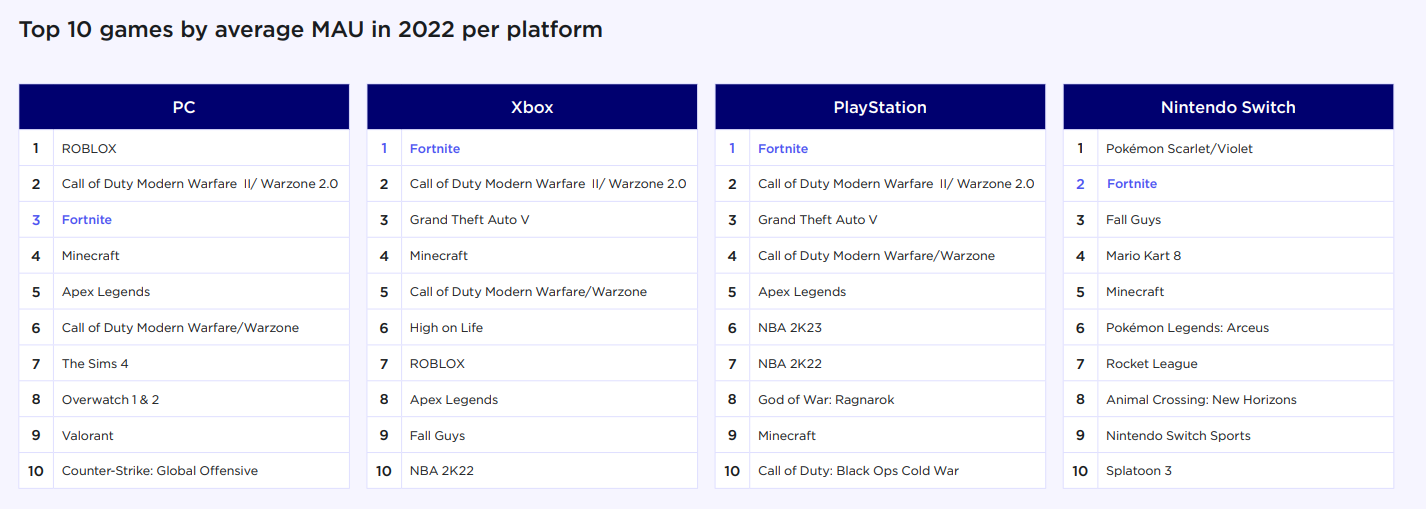

Each platform has its own top games by average MAU. In the “prize three” of each of them is Fortnite.

Top 10 MAU Games by Platform (2022)

Apart from the Nintendo Switch, another clear cross-leader is Call of Duty Modern Warfare II/ Warzone 2.0.

Looking at the top PlayStation games by MAU, you can once again remember that Call of Duty is an extremely important franchise for Sony. Three out of ten positions in the top of the platform are for the games of this series.

Another observation: in the same dozen PlayStation, only one game is exclusive to Sony — God of War: Ragnarok. For comparison, there are six platform-exclusive titles in the top 10 Switch games by average MAU.

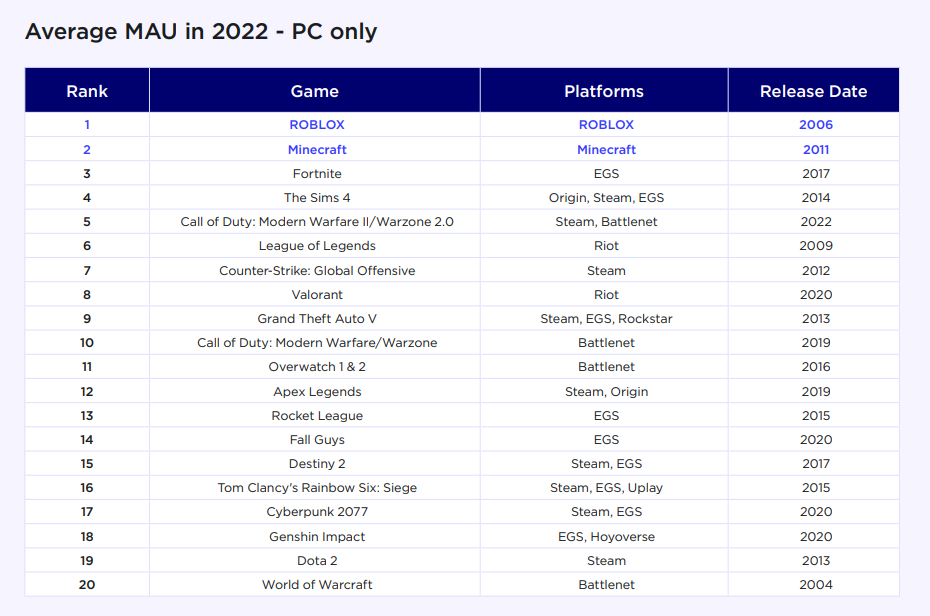

The top 20 PC games by MAU looks interesting. In it, the first two places are for Roblox and Minecraft. By the way, you can also find The Sims 4 and Valorant in the top ten.

Top 20 PC games by MAU (2022)

Newzoo notes that half of the PC games presented in the top by MAU were released before 2016. Three of the top were released in general before 2010.

Important: despite the fact that Steam is the dominant PC platform, only half of the top games can be found in this store, three in the Epic Game Store.

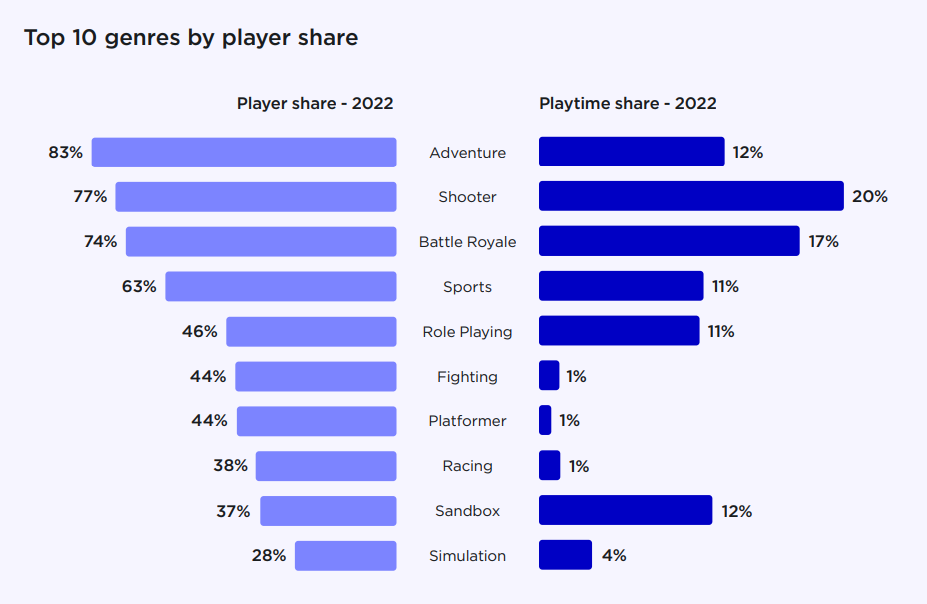

In terms of popularity, the top genre is Adventure. 83% of gamers play games of this genre (it’s just not entirely clear what Newzoo understands by it).

However, if we take all the time spent in games for the year for 100%, then the largest share will fall on shooters (Shooter) — 20%. In second place will be royal battles (Battle Royale) with 17%.

Top 10 genres by the share of players and the share of time spent in them (2022)

The Newzoo report has an idea reminiscent of the one in the Sensor Towe r study. Only it slips in relation to console and PC titles, and not mobile games. The bottom line is that games with a mixed monetization model (the concept of mixed pricing is used here, which means a premium model with micropayments) earn more at the start than premium projects without additional monetization (NBA 2K23 and Call of Duty: Modern Warfare II are given as examples).

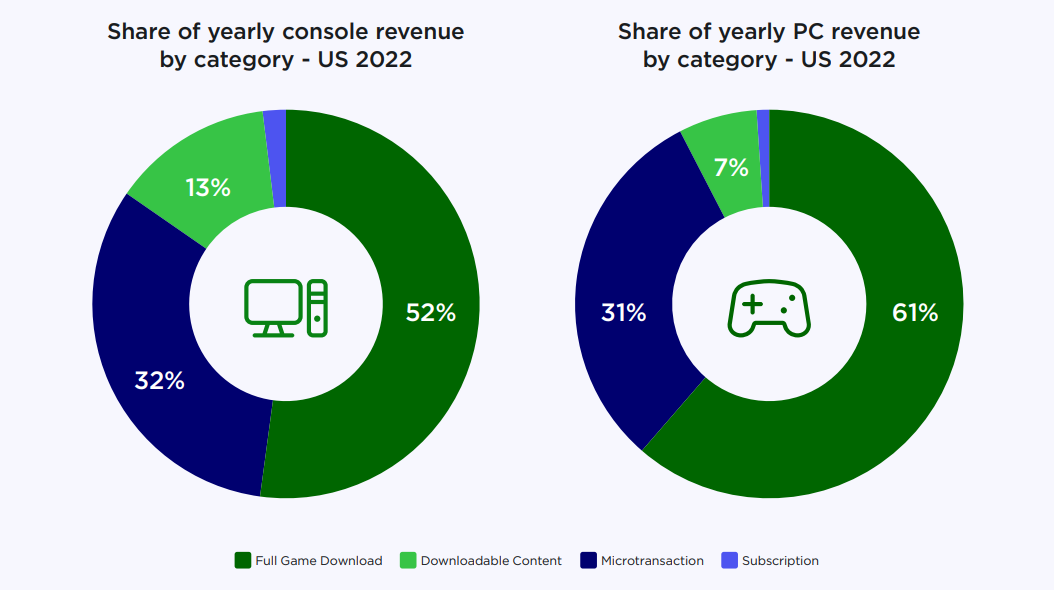

Yes, in-game payments in the United States account for more than 30% of all gaming revenue from PCs and consoles (unfortunately, estimates on the distribution of sales by type of content in the world are not given in a particular case).

Distribution of sales of console and PC games in the United States by type of content

From the non-obvious: PC players spend twice as much on DLC as console players. The reasons are not given, but it is possible that strategies that are actively monetized by game teams today just with the help of DLC contribute here.

Returning to the market as a whole, Newzoo highlights the high popularity of freeplay titles on PC and consoles. More than half of the games from the box office twenty are distributed under the shareware model. 12 of the 20 new top-end free-play games were launched exclusively on PC at the start.

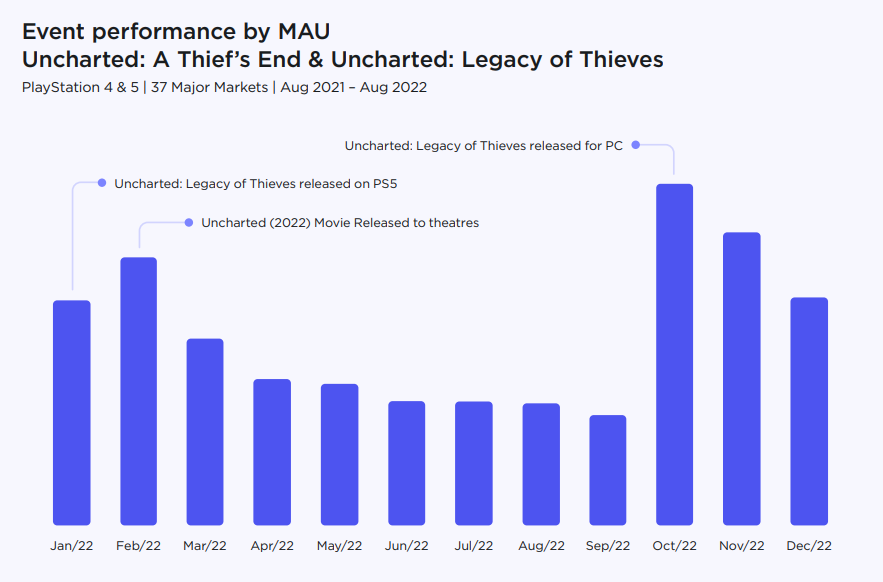

Several separate slides were devoted to the impact of the release of remakes/film adaptations on the MAU of game blockbusters.

The first slide was about how the output affected MAU Uncharted: A Thief’s End (on PlayStation 4 and 5):

- Uncharted: Legacy of Thieves Remaster compilation on PlayStation 5;

- The Uncharted movie;

- the release of the collection on PC.

The impact of new releases on MAU Uncharted: A Thief’s End and Uncharted: Legacy of Thieves on PlayStation 4 and 5 platforms

It is clearly seen that the appearance of the game on PC attracted much more players to the title than the movie starring Tom Holland and Mark Wahlberg.

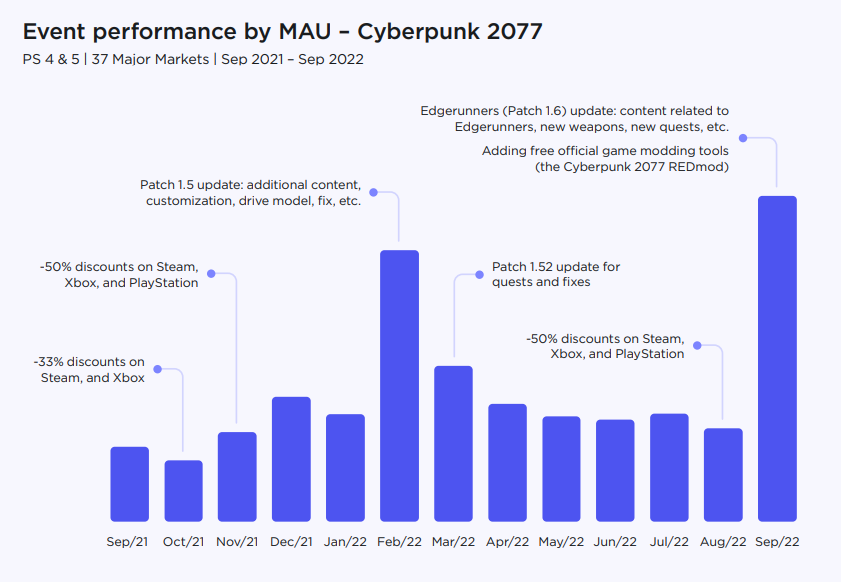

It is more difficult to assess the impact of factors on MAU Cyberpunk 2077.

Impact of new releases on MAU Cyberpunk 2077 on PlayStation 4 and 5 platforms

It can be seen here that patches were a good help in involving users in the game. However, an integrated approach worked best when an important patch, new content, new modification tools, and an animated series based on motives were immediately released for the game.

Results 2022 — players

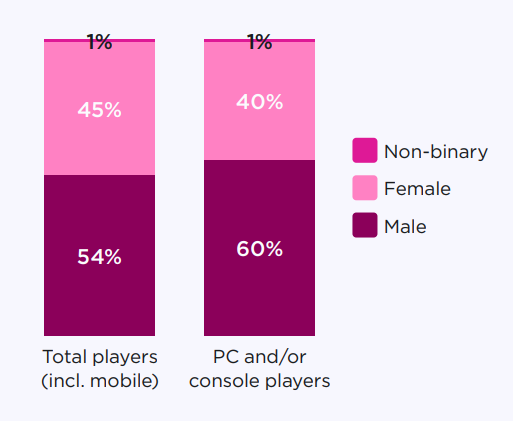

The distribution of players by gender depends on whether the mobile is taken into account. If yes, then the female gender accounts for a larger proportion of players than if we take only the audience of console and PC players (45% vs. 40%).

Segmentation of the playing audience by gender (2022)

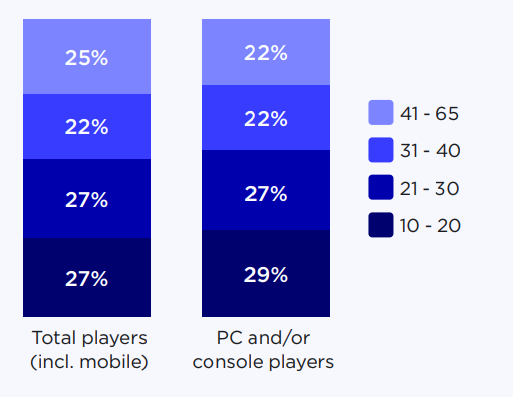

The situation is similar with age segmentation. If we take into account the mobile platform, then the audience of those who are over 41 years old becomes larger among the players and, accordingly, the share of those who are between 10 and 20 years old is smaller.

Segmentation of the playing audience by age (2022)

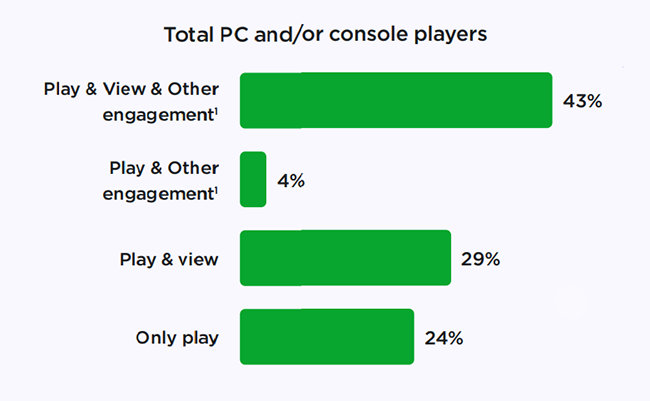

Newzoo writes that most of the players are not only playing. She is broadly involved in the industry: he watches how others play, communicates in thematic communities, discusses games with friends, and so on (75% of the entire gaming audience has accumulated such).

Distribution of players by type of involvement in the industry (2022)

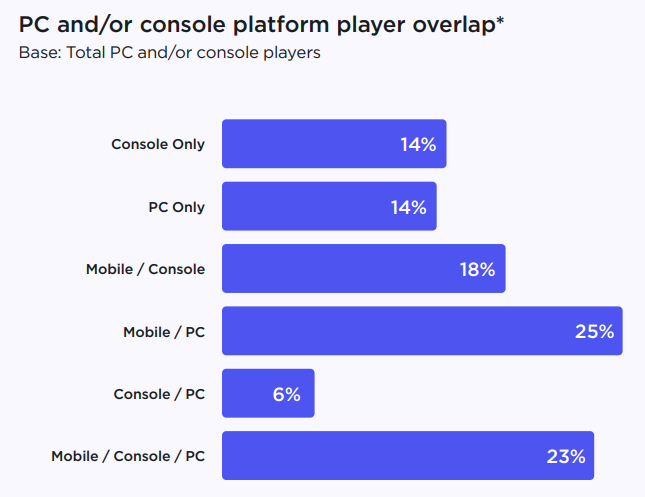

Also, about a quarter of all players (23%) play on three platforms at once (on mobile devices, consoles and PC).

Distribution of the gaming audience by type of interaction with game content (2022)

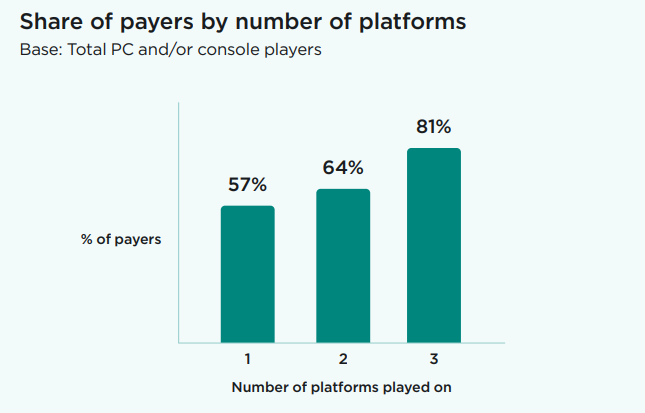

The more platforms a user has, the higher the probability that he belongs to the representatives of the paying audience (for example, among those who play only on one platform, 57% pay, and among those who play on three — 81%).

Percentage of payers in groups with different number of platforms (2022)

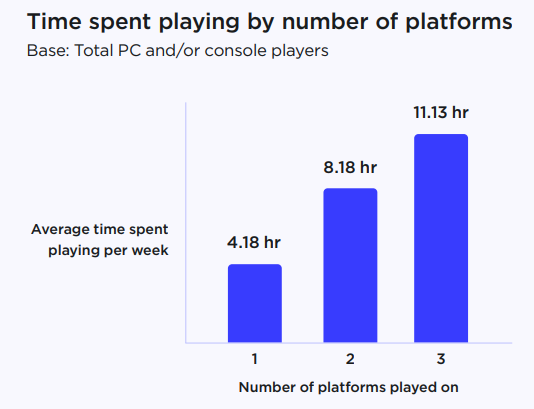

Accordingly, those who prefer not to limit themselves to any one platform spend much more time playing games.

Average amount of time spent playing games per week in groups with different number of platforms (2022)

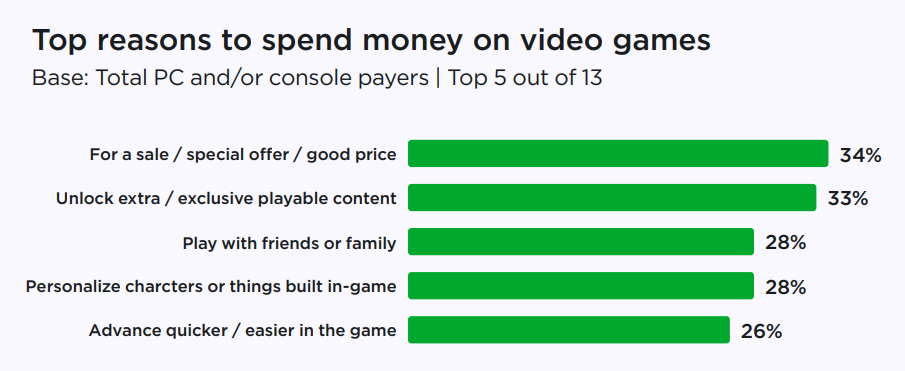

The most common reason to make a purchase (namely games) is a sale or a special offer (34%), it is also important for many to get additional content (33%).

The main reasons for buying a console or PC game

That’s all (from what we thought was important or curious).

The full version of the study can be downloaded here.