KPMG consulting firm has presented a report on the gaming industry in India. According to analysts, by 2025, the turnover of the local market will double and approach the $4 billion mark. At the same time, the main audience will continue to play on mobile devices.Key data from the report

Analysts predict that in 2021, the turnover of the Indian gaming market will amount to $ 1.83 billion.

- In 2025, revenue will increase to $3.91 billion.Most of this amount will be casual games — $2.28 billion (an increase of 182% compared to 2021).

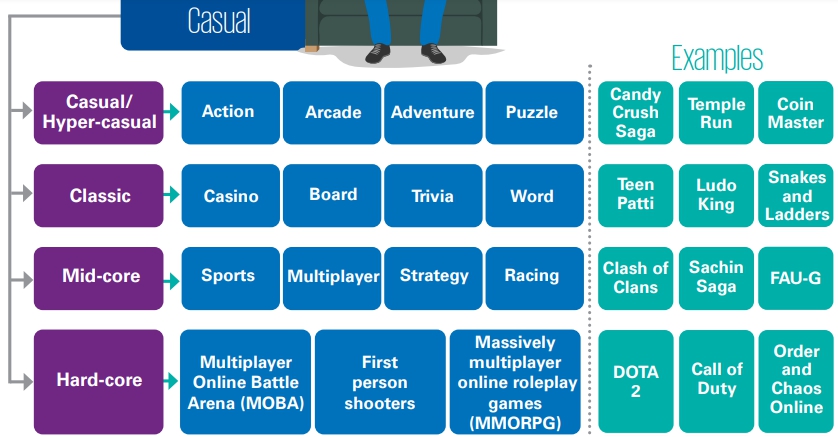

- It is worth noting that KPMG understands casual games as all titles that cannot be played for real money. These can be both mobile projects (Candy Crush) and hardcore PC games (Dota 2).Classification of casual games from KPMG

The second line in revenue in 2025 will be occupied by real money games (card or online casinos) – $830 million.

- The third place will go to fantasy sports (participants formulate virtual teams based on real athletes and compete with each other in tournaments) — $730 million. Esports will still have the smallest share — $77 million.The number of players will increase from 433 million to 657 million people — an increase of 52%.

- At the same time, most of them (94%) prefer to play on mobile devices. The PC and console market is still not developed in India, because now only 9% and 4% of all gamers play on these platforms, respectively.Distribution of players by platform

According to KPMG, 60% of the total revenue of casual games comes from advertising.

- By 2025, the situation will hardly change — then the share of advertising monetization will be 59%.Despite the growing popularity of gaming, the solvency of Indian players remains at a low level.

- The average ARPPU in the country is $5-10 — compared to the global figure of $130-140.Now 54% of Indian players prefer to “pay” for games by watching rewarded ads.

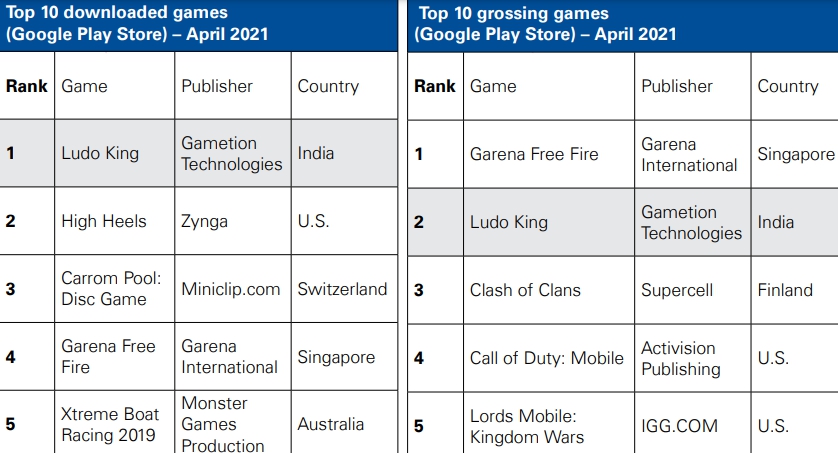

- Only 18% are willing to buy games at full cost, and only 11% of gamers make in-game purchases.The most downloaded and highest-grossing games on Google Play (for April 2021)

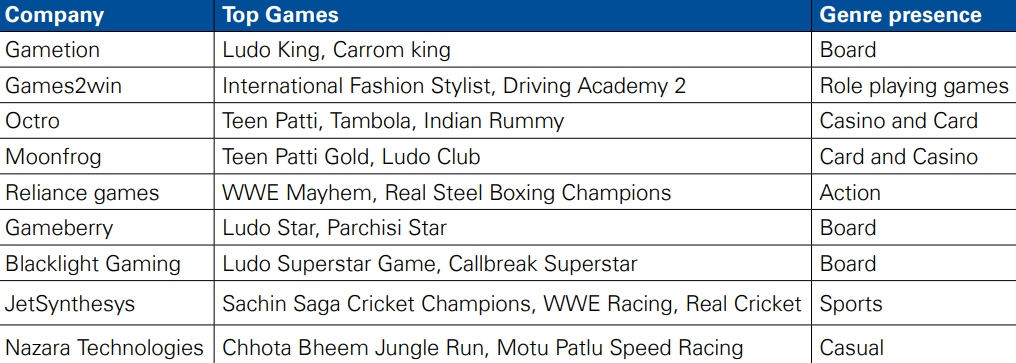

Another problem in the development of the Indian gaming industry remains a small number of local studios that have managed to achieve success in the global market.

- KPMG attributes this to both the low solvency of the population and the lack of government support.The most successful Indian Game Studios

Analysts note that PUBG Mobile has become one of the most successful projects in the Indian market.

- Thanks to its monetization model and aggressive marketing from Tencent, the game has become a big hit. Before it was blocked in the country, it was downloaded 175 million times, and the revenue during the operation amounted to $ 40-50 million. In 2019, PUBG tournaments accounted for 40% of all esports events in India.In general, analysts attribute the growth of the Indian gaming market to the spread of digital payments, the growing popularity of smartphones, digital infrastructure, as well as the emergence of a large number of young gamers.