In recent years, there has been a surge of activity in the web games market. This is true for Russia as well, where this segment has historically held a strong position. App2Top spoke to market experts Alexander Shchevelev, Eduard Kumykov, and Yan Yankelowitz about what drives developers' interest in web games and how much one can earn from such games.

What does the web games market in Russia look like today?

Alexander Shchevelev — CEO — Maningame

As of today, the web games market in Russia can be compared to the mobile games market abroad in terms of competition, but with a very tangible ceiling on revenue levels. This means that by releasing a decent game or a quality clone of any top mobile game, you have a high probability of earning thousands of dollars a month. However, to increase your earnings to the next level (more than $10,000), you need to move to a professional workflow, similar to developing a standard mobile game. Therefore, launching on web platforms becomes just a part of the strategy alongside focusing on mobile stores.

Eduard Kumykov — CEO — Itking.pro

Today, in Russia, there are several main platforms: "Yandex Games," "Odnoklassniki," and VK. These platforms have been around for a long time, so significant market development isn't the expectation. The market can already be considered established: there are major players, long-standing projects with large audiences, and the competition complicates access to substantial earnings for new and inexperienced teams.

Meanwhile, the market is improving step by step each year. It's growing and evolving. Some of the growth drivers are new tools for developers on the aforementioned platforms.

For more extensive development, the market primarily lacks access to a global audience.

An important development is the launch of a gaming platform on "Pikabu." As a result, developers have gained access to one of the largest audiences in Runet. "Pikabu Games" was launched recently, but it is developing much faster than the others. The number of games on it is already quite substantial. In the future, I believe it will become a significant project for "Pikabu," allowing the UGC platform to earn well. It's nice to see the "Pikabu Games" team actively helping to promote projects on "Pikabu," advertising them in various ways on the site feed.

Yan Yankelowitz — Business Development Director — Overmobile

Today, the web games market is an actively developing segment of game dev, featuring both large and medium-sized teams as well as numerous small developers trying to transfer popular mechanics and trends from the mobile market.

The market has major players with traffic for all genres — such as VK Direct Games, "Odnoklassniki," "Yandex Games," as well as emerging platforms like "Pikabu Games" and Gamepush that are experiencing significant growth. Large ecosystems like banks and telecom operators show interest as well, but mostly in terms of gamification rather than full-fledged gaming platforms, contrary to what Beeline has done, for instance.

I see many young teams and mobile companies actively migrating to the web. What is behind this interest?

Alexander Shchevelev — CEO — Maningame

The main reason is technological progress, which has enabled anyone to create games without specialized education. Key changes include:

- improvements in the Unity engine, greatly enhancing the performance of web builds;

- the development of asset stores;

- the advancement of vibe coding capabilities.

Thus, there is no longer a need to know how to draw, code, or be a UX specialist, among others. If you want to create a game, you can use assets, neural networks, and Unity (or Construct) to put together a game in just a couple of days.

Eduard Kumykov — CEO — Itking.pro

When it comes to young teams (within the Russian Federation), I think it is related to simple and convenient tools for release and earning profits. You can quickly release a game on the web and receive payouts as a self-employed person registered in just five minutes.

However, when discussing larger players, for them, it's merely a way to gain additional revenue from the project. I am aware of numerous cases where developers received payouts from platforms just for bringing large franchises to the web.

Important: only the web provides such broad access to the Russian audience. Web platforms have a much wider reach compared to PC and mobile platforms.

Additionally, in response to your question, developers are warming up to the web, forming an active community around it, which, in turn, contributes to the buzz about this topic.

Yan Yankelowitz — Business Development Director — Overmobile

Mobile games already represent an established market where getting any organic reach and, consequently, installs for your game at launch is nearly impossible without marketing. Thus, migrating to the web allows many smaller teams to get fresh players from the platforms almost free of charge through features and placement in new releases.

Modern engines allow for nearly unchanged creation of multi-platform projects, which is why web becomes just another distribution channel for many teams.

What is the peak income from the web in Russia today (even compared to mobile)?

Alexander Shchevelev — CEO — Maningame

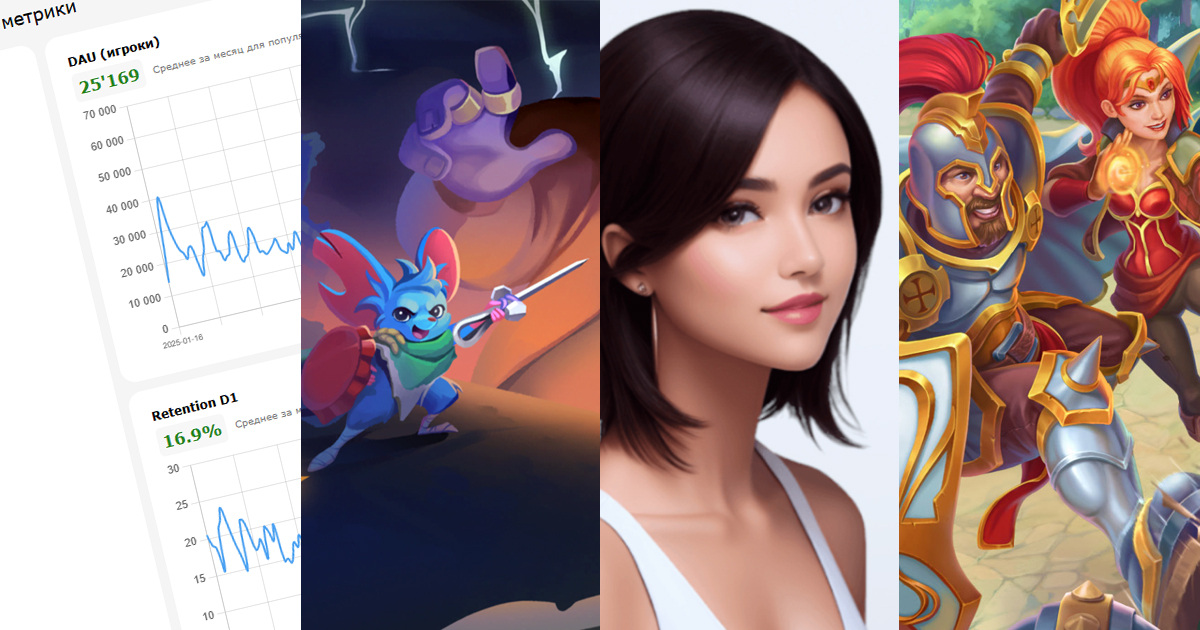

If we look at the context of releases over the last one to two years, excluding "old" web games ("Treasures of Pirates," "Bottles," "Avatar," and other projects that have been operated for over 10 years), the situation is roughly as follows:

Professional studios (10-30 people with salaries, sprints, strategy, and experience of 10+ years) currently earn between 2-8 million rubles per month from any of their titles. Their strategy is extremely simple: one to two quality games a year and simultaneous release on 15+ platforms (“Yandex Games,” VK, “Odnoklassniki,” CrazyGames, GD, “Beeline,” AG, etc.) + mobile platforms (Google Play, App Store, RuStore plus alt stores). They mainly create casual with deep meta, midcore, hypercore, and farm games. In short, anything that can be operated for a long time.

The second part of the market consists of amateur teams (often solo or 2-3 people). Some work 24/7, while others work “for fun when in the mood.” Regarding their income level, it depends on the developer’s exposure and speed. There are two main opportunities: either catch a trend (Labubu, Italian animals, obby, Huggy-Wuggy, Skibidi) and quickly assemble something playable from templates and assets; or quickly clonate hit mobile games or Roblox games that shot to the top. If developers have these skills, then it’s possible to earn between 100,000 and 1.5 million rubles a month (solo). If they lack these skills and try to create something original and creative with assets, their income is fixed at 5 rubles, i.e., a uniform rate.

Eduard Kumykov — CEO — Itking.pro

The best examples I know range from $10,000 to $30,000 a month from all partner platforms or about five percent of revenue from mobile versions.

Yan Yankelowitz — Business Development Director — Overmobile

It’s hard for me to speak for the entire market as there isn’t such transparency in web market analytics services, but based on our experience, a good project can earn from 5 million to 15 million rubles a month and more without marketing costs — purely through organic traffic from web platforms.

Regarding competitiveness. A few years ago, the market entry threshold was low. There weren’t enough projects. You could start earning with a crossword puzzle. What about now?

Alexander Shchevelev — CEO — Maningame

Yes, that's true. Two years ago, you could create a gimmicky game and earn several hundred thousand rubles in a week. Now, the situation has changed. There's a local excess of games, but platforms still lack quality projects. Every platform wants a stable and predictable model for external traffic acquisition. For this reason, platforms have started explaining to developers exactly what they want to see in their catalogs, in terms of genres and mechanics. Platforms are looking at the market with a long-term planning horizon.

As for young developers, they do not have years to spare and want results here and now and so they continue to try to respond to audience moods organically; organically there are mostly kids with all these requests for Labubu and Tralala.

Nevertheless, there is still room in the web for everyone. There is a lot of organic growth. Even if you make a less successful game, you are guaranteed to achieve thousands of organic installs. Depending on product metrics, the platform will either increase traffic to your game or ask you to proceed with developing the next game, cutting off resources.

Eduard Kumykov — CEO — Itking.pro

Now it is much more complicated: the market is already established, and there is both competition and many projects, some of which have been earning for years. This results in a situation familiar from mobile — where users play old games, and developers have to attract them to new titles for financial expenditures. Not everyone can afford this. It may not even be about the cost of traffic but a lack of UA experience, a deficiency of understanding that marketing is an integral part of the development of any project.

Additionally, there is the question of uniqueness. If you release a word game today and provide nothing new, players will question why they should play your probably incomplete game with limited content? In the end, they will return to their old, favorite project, and your game will receive low ratings, reviews, and results. Bringing something new to a verbal game is quite challenging, if only because players themselves do not always need it; they often want to see simple, familiar mechanics that are already implemented in many projects.

Yan Yankelowitz — Business Development Director — Overmobile

Over the past couple of years, competition has intensified. There’s a new significant focus on traffic and the use of IAP monetization. A flood of simple casual games that have streamed onto the web market over the last 2-3 years have significantly affected the eCPM.

Consequently, today many platforms have started to focus not on the number of new projects but on their metrics. Now they pay attention to how well the titles retain players and whether they successfully monetize users.

Given the high competitiveness, can it be said that the cost of web projects in terms of development and LiveOps has almost approached that of mobile?

Alexander Shchevelev — CEO — Maningame

I think that everyone engaged in web games at a professional level simultaneously develops for both mobile and web. Publishing a game on web platforms offers mobile developers two great opportunities:

- hedging their risks of failure in mobile purchases (especially in early tests, if the CPI/LTV ratio fluctuates significantly);

- diversifying income sources from a business perspective.

Hence, I would answer this question in reverse: thanks to the additional income from the web segment, mobile game creators have a splendid opportunity to cut their development costs. In case of success, they gain a new and stable source of traffic and revenue from web platforms.

However, since the toolkit and development pipeline for web games are similar to mobile ones, to keep up with the market, you will have to spend as much as you would on mobile game development.

Eduard Kumykov — CEO — Itking.pro

Yes, but in such a format, it’s unlikely anyone would assess it this way. Usually, everything available in mobile versions also gets into the web. Web porting is inherently assumed as an additional source of profit alongside mobile.

I have not encountered situations where someone estimated the cost of web game development specifically, or viewed the web as the primary platform. Mobile access is always seen as more promising. Everyone understands this.

Yan Yankelowitz — Business Development Director — Overmobile

I wouldn’t say so. Now it's unwise to focus only on the web for a project. Rather, large and medium teams include the web as one of their distribution platforms. Consequently, the cost of web development simply adds to the overall development cost.

What about marketing? How effective and expensive is it in the web today?

Alexander Shchevelev — CEO — Maningame

From a high-level view, web games today operate 99% on pure organic reach. There's so much of it, and any attempt to buy significantly within the platform could lead to cannibalizing one's free traffic. As such, few engage in this due to excess organic traffic.

Attempts to buy traffic outside the platform result in direct competition with fintech and e-commerce, which have much broader purchasing capabilities. Plus, it’s important to note that if your game is of good quality, the platform takes on all the external purchasing. They buy very effectively due to expanded tools and their historical data on purchasing for a wide pool of games.

Returning to self-purchasing, midcore stands out, as it purchases more than half of its traffic independently. This is a very niche story. If interested, you can find a video of my talk on web purchase promotion on App2Top. I cover everything there in detail: figures, channels, and tools.

Eduard Kumykov — CEO — Itking.pro

In my view, the web offers more interesting and experimentation opportunities than mobile. Primarily due to the low cost. On mobile, users are expensive, and the UA error cost there is high. Hence, everyone proceeds cautiously and uses tried and tested methods. In web, the CPI can be very low (I wrote about this in articles here and here). This allows for a lot of testing and yielding good results.

For beginner and particularly creative teams, this is crucial, as it allows them to create very catchy and cool marketing things, thereby attracting a large number of players to the game and achieving high results, something they definitely couldn't do on mobile. "Going viral" thanks to marketing is much easier in the web than on mobile, let alone on PC. I have personally verified this multiple times.

Yan Yankelowitz — Business Development Director — Overmobile

Web game marketing is limited to platforms with quality web traffic. For instance, large networks such as Google Ads or Yandex Advertising Network. Hence, there’s great competition for ad placements with other market players — e-commerce, retail, fintech. But if you have a good product with good monetization, buying traffic at a profit is possible. However, one shouldn’t hope for multi-million dollar budgets like in classic mobile.

What problems and challenges on the web market notably hinder developers?

Alexander Shchevelev — CEO — Maningame

Compared to the problems mobile game developers face, the issues on the web market are so minor that they’re almost embarrassing to discuss. There are enormous opportunities for newcomers on this market, offsetting any obstacles. Only one’s own laziness and unwillingness to learn can stand in the way.

For those who have gained some experience, the main challenge is the perpetual risk of falling into an endless cycle of clone generation. It’s quick and easy money coupled with a simple development cycle. This quickly becomes a habit, making it hard to force oneself to create full-fledged games with unique selling propositions for players (requiring original ideas and higher risks). At some point, one becomes so accustomed to this that they start believing clones of someone else's intellectual work are their hits. As a result, they can be stuck in development for years and fail to advance their expertise to the next level of development.

Eduard Kumykov — CEO — Itking.pro

Optimization and strict control by platform managers — these two things greatly hinder the market and developer growth.

In my opinion, web platforms should be much more liberal. If a developer creates an unoptimized game, primarily the audience should “evaluate” it.

Developers never faced issues releasing projects on Google Play or in the App Store, provided they were adequate projects, with managers rarely influencing or impeding releases. That’s great. This has been wanted in the web space for a long time.

Still, based on my experience, it is inevitable to attract players yourself. So allow more freedom regarding releases. As for managers, it would be better if they primarily focus on whether to promote the game to other platform users.

Thus, talking about the web in Russia, the main point is maintaining tight and excellent relationships with managers. Overall, this isn’t bad, but it shouldn’t be a developer’s priority.

Yan Yankelowitz — Business Development Director — Overmobile

Recently, we've been frequently encountering technical difficulties due to various blockages from the RKN. We have to quickly come up with workarounds to ensure an uninterrupted gaming process.

There are also general challenges in promoting IAP games on the web — obtaining traffic is tough and costly.

We don't see fintech platforms and super-apps of the level of Ozon and "T-Bank" entering the gaming market, apart from a few exceptions. They could add audience to web games and shake up the market.

Which platform presents the most interest, and which should be approached as a secondary option?

Alexander Shchevelev — CEO — Maningame

It really depends on the genre and target audience of the game.

If speaking quite generally, the first level for most genres is "Yandex Games," VK, and "Odnoklassniki."

If there is a foreign legal entity or publisher, then Crazy Games, Poki, Game Distribution, and PlayDeck are options.

The rest depends significantly on the game and platform interest in you. If you show good results somewhere, the platforms themselves may approach you and offer interesting conditions — most often in terms of welcome traffic and features. They can guarantee a certain amount of installs. Some may offer recouping or even discuss individual terms for rev shares, but for this, your game should be a strong hit.

In general, it's sufficient to understand that people work on the platforms. You can openly discuss and negotiate everything with them.

Eduard Kumykov — CEO — Itking.pro

Unambiguously — "Yandex Games," because "Yandex" has the largest advertising network in the RF, and web monetization still largely depends on advertising, excluding major and complex cases like Hero Wars.

Then the path diverges: midcore and hardcore may look at VK, while something casual for the female audience may suit "Odnoklassniki."

Next is the new player — "Pikabu Games" and platforms offering access to audiences outside of Russia (e.g., Poki).

And for the largest non-casual projects — a release on your website if you have sizable budgets for tests and UA.

Yan Yankelowitz — Business Development Director — Overmobile

There is a well-established trio in the web gaming market, which should be the priority:

- VK;

- “Odnoklassniki”;

- “Yandex Games.”

This is a must-have for any developer.

Next, I would explore new platforms:

- “Pikabu Games”;

- Gamepush.

You should also try contacting major traffic sources (telecom, banks) for cooperation. If you have resources for marketing, I advise attracting an audience to your website.

What trends are currently observed in the web games market?

Alexander Shchevelev — CEO — Maningame

The web market quickly adopts all trends from TikTok, Roblox, YouTube, and mobile stores. Everything that appears there is on the web within a week.

Eduard Kumykov — CEO — Itking.pro

I see a very positive trend toward the emergence of high-quality, large, complex, and interesting projects. This is encouraging, even though many of them were ported from mobile or developed with mobile in mind.

This is a positive trend for players, as they must always be the priority. Players should motivate developers to create higher-quality games and dedicate more time to development, rather than chasing quick cash by producing simple or hastily completed projects launched in an attempt to ride a hype wave.

Yan Yankelowitz — Business Development Director — Overmobile

Many large studios are entering the web market with quality projects. Recent examples include Ludus from Top App Games, Warfare 1942 from Fahrenheit Dev, and Pirate Ships from Herocraft.

Such releases drive the market and attract players who want to play web games of the same quality as mobile or PC games. In the case of genuinely multi-platform projects, they can play anywhere.

The influx of simple web games has led to a drop in eCPM. Platforms are increasingly looking towards IAP projects.

We also see interest in the market from major players — representatives of fintech, e-commerce, and operators. However, their primary focus is currently on gamifying their loyalty programs. We, in turn, want to provide users the opportunity to play games without leaving the platform, generating additional ARPU for the platforms.

The Telegram game market has quieted down, with small steps made there failing to result in significant game growth or success for games aimed at traditional monetization methods (i.e., without token issuance and listings on exchanges).

New platforms like “Pikabu Games” are taking cautious, but confident strides. We're seeing their first audience, which is of reasonable quality. I hope their growth continues and that other large players in this segment of the internet discover web games.