It has become much more difficult to start a company abroad. According to the new presidential decree, residents of the Russian Federation are now prohibited from paying shares, shares and deposits to foreign legal entities. We talked to legal experts about the new law.

First, a little more about the decree itself. It is called the decree “On additional temporary measures of an economic nature to ensure the financial stability of the Russian Federation in the field of currency regulation”“. Number 126 is assigned to him.

It was published and entered into force today, March 18, 2022.

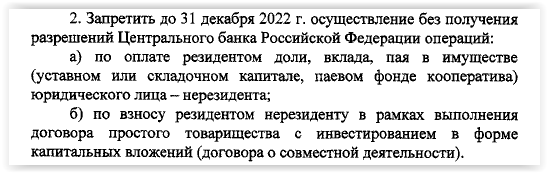

The key point of the decree is the second. Here is its full wording:

We understood it as follows: residents (that is, citizens of the Russian Federation) were banned from buying foreign companies. And in fact to start them.

We asked three law firms if they had interpreted it correctly. Here’s how they responded to the request.

Roman Lukyanov, Managing Partner of Semenov&Pevzner Law Firm

The preliminary answer is yes.

This is a ban on the purchase of foreign companies.

But it is unclear whether this is a ban on the setup of foreign companies? On the one hand, the payment of shares occurs at the time of setup, when the availability of authorized capital is required by the relevant national legislation. On the other hand, setup is not always associated with the payment of the authorized capital (not all jurisdictions require this).

For example, somewhere in the UAE, where the authorized capital is not a mandatory requirement (for most types of activities) – the setup of a legal entity will not violate this provision of the decree.

Alina Davletshina, Senior Lawyer of VERSUS.legal

It is not a direct ban, but a requirement to coordinate transactions with the Central Bank, but in fact this is a strong obstacle to foreign incorporation.

Now we have received a restriction on the payment of shares, but not on the very opening of companies and the opportunity to be a beneficiary: therefore, legally, ways to create or enter a foreign company remain.

The most interesting thing is that the responsibility is unclear, there are no clarifications on this yet. But it is obvious that Russian banks will not make a payment without the approval of the Central Bank with such an appointment.

Vitaly Vetrov, Partner of the law firm “Vetrov and Partners”

To be very precise, then:

- individuals have restrictions on the payment of shares, shares and deposits in foreign companies. Other types of objects (for example, shares) were not included in the restrictions under this decree;

- individuals have no restrictions on the establishment of foreign companies. They can do this if it is not related to payment, or if there are opportunities for postponing payment, or if other property can be deposited instead of money.

Plus there were questions to the Central Bank:

- does the above apply to the stock market (will there be an expansive interpretation?);

- will it be possible to pay for foreign shares in rubles (can the seller of the share/unit convert everything into currency?);

- what will happen to the currency accounts of individuals who now have nowhere to spend their currency?

***

Also, all our speakers noted that it is unclear what kind of residency is being discussed in the decree — tax or currency. Davletshina notes that, most likely, we are talking about currency, as in previous decrees.

It should be noted that “all citizens of the Russian Federation, except diplomats who work abroad, are considered foreign currency residents of the Russian Federation. Foreign citizens and stateless persons with a residence permit in the Russian Federation are foreign currency residents.”