Under the sanctions, developers and game publishers from the CIS find it challenging to generate revenue from foreign markets. To address this issue, one can establish a new company abroad that could accept revenue from foreign users. Roman Motorin and Nazar Volkov, lawyers at FUTURA, explained how to approach this and what to pay attention to in their guide for App2Top.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or other professional advice. It is necessary to consider the individual characteristics of each case and consult with relevant specialists before making decisions based on the provided information.

Roman Motorin and Nazar Volkov

What should you consider when choosing a country to register your company?

First of all, we note that there is no universal solution that suits all development studios. The choice of any country and the organization of your corporate and contractual structure will inevitably depend on your individual circumstances and require compromises. In one country, maintaining a company might be more expensive, in another taxes might be higher, and in a third, certain options might be unavailable (such as transferring money to Russia).

Where to incorporate a company depends on several parameters that need to be considered before selecting a country for registration. Specifically, consider the following:

- Passport of the company's founder. The situation is simpler if some of the founders have foreign passports. When opening companies, especially bank accounts abroad, the citizenship of the founders and directors can be significant. In some countries, companies with Russian founders cannot open a bank account, while in others, such companies might face additional compliance procedures, etc.

- Stores for distributing your games. For example, if your game is for PC and distributed on Steam, find a country with a tax treaty with the USA to avoid up to a 30% withholding tax by Valve in the absence of such a treaty.

- Do you need a legal entity in Russia? Consider if you require tax benefits available to IT companies in Russia (such as a 5% income tax, grants, and benefits from Skolkovo, etc.).

- Work format with staff. Are your employees willing to register as sole proprietors/self-employed to work for a foreign company? Or do you need to keep them on employment contracts with a Russian company?

- Does revenue from Russia cover development costs? If not, and you rely on foreign revenue, keep in mind that only from certain countries can you transfer money to the RF. If Russian revenue sufficiently covers development expenses, there are more options for foreign companies to retain revenue for other purposes.

- Relations between your Russian and foreign companies. Contractual and corporate ties between your companies can be organized differently:

- You can make all your companies "sister companies" — distributing shares among the founders;

- A unified holding can be created to own all the companies;

- One founder can be a shareholder in one part of the companies (e.g., Russian), and another can own another part (e.g., all companies in the UAE). Each option has its pros and cons: one structure protects you from losing control or splitting the business, another makes it easier to attract investment, and a third reduces transfer pricing concerns, etc. It's important to consider your needs and these factors when deciding how to organize your business.

- Where would you like to store the rights to your games? Different companies follow various approaches to where they secure the rights to their main assets. Some prefer to register rights with a holding in a safe, stable jurisdiction to avoid risks of nationalization, business capture, or inefficient protection of property rights. Others choose to keep rights where tax benefits require it (such as in Kazakhstan). Many in the 2020s prefer spreading rights across different countries to avoid placing all eggs in one basket.

- Where plan the founders to live in the coming years? The ultimate goal of most companies is to generate money for their founders: through profit creation, "explosive" company growth, and cash-out options, or through other mechanisms. Where, under what visa, and under what rights founders live determine their tax residency status in each country. If a founder moves from Russia to another country, they usually become a tax resident there, bringing several tax implications. For example, if your Russian company pays dividends in Kazakhstan, Russia will withhold 10% from these dividends. If you live in Armenia, you might lose 5% or 10% on Russian taxes depending on various factors. Living in Portugal, you could lose 15%. Moreover, founders are often required to pay taxes in the country they live in while applying various rules on deductions, credits, and adjustments to their personal income tax. For instance, in Kazakhstan, you can offset the withholding tax (10% from the above example) against your IPR in Kazakhstan, but likely not in the USA. In the UAE, there's no personal income tax, for example.

Remember, each case is unique. The above are key questions to answer before proceeding to choose countries for establishing a company.

The answers to these questions should also be communicated to your consultant before they begin proposing options for opening your company.

Currently, among our clients entering foreign markets, the most popular choices are the United Arab Emirates, Kazakhstan, and Cyprus.

Below, we will discuss basic parameters relevant to these countries that influence founders' decisions—taxes and the cost of establishing and maintaining companies.

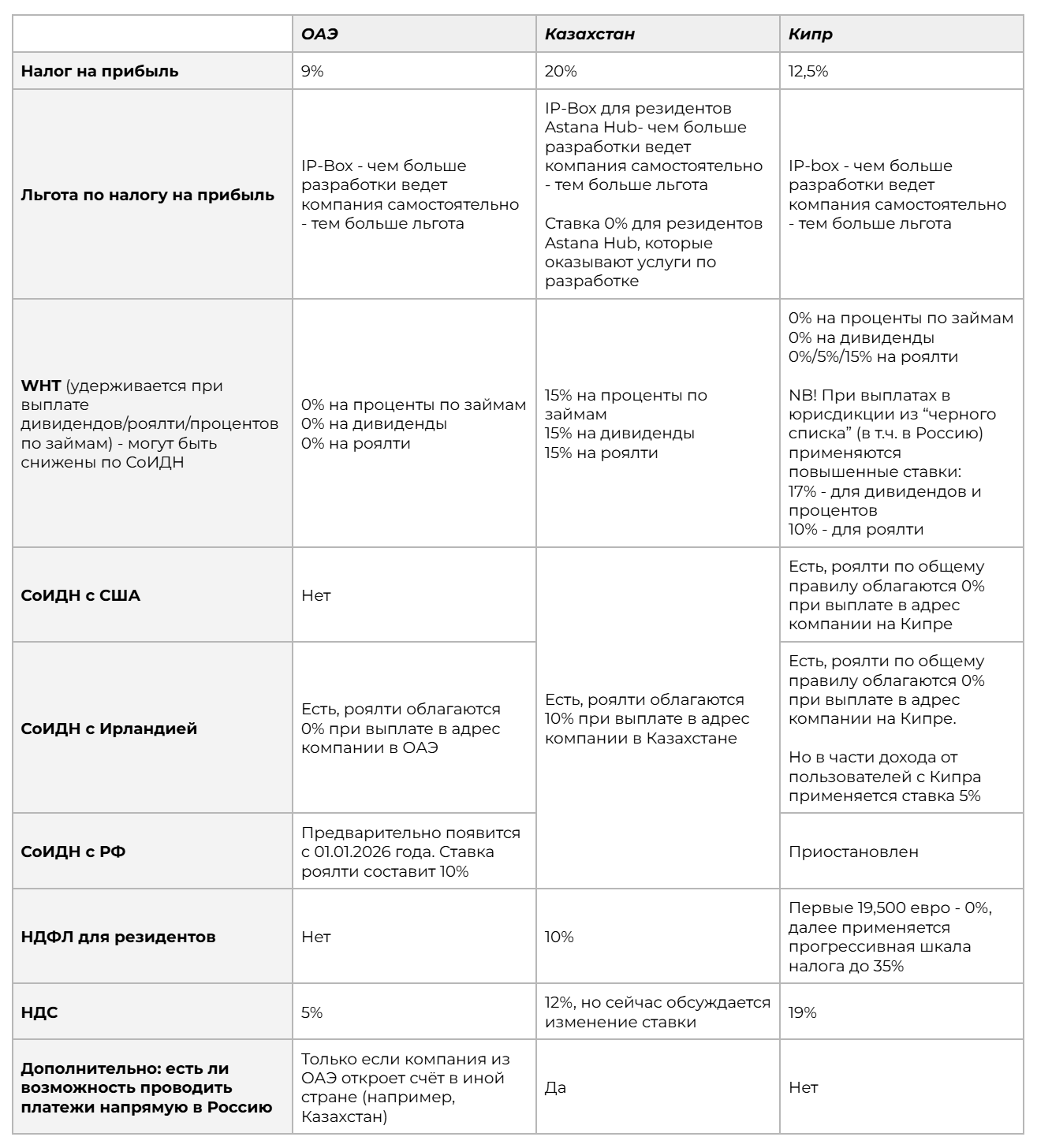

What taxes need to be paid in the UAE, Kazakhstan, Cyprus?

The main tax aspects to consider when choosing countries for opening a company include the following:

- Corporate tax rate. Corporate tax is the primary tax payable to the state budget where the company is established. The tax is calculated as a specific percentage rate on the company's profit (i.e., the difference between its income and expenses).

- Profit tax reliefs. Many countries seek to attract business with various benefits, the most important for the purposes of this article being profit tax relief.

Tax benefits can vary significantly, such as:

- A fixed preferential tax rate requiring special registration or meeting formal criteria (the most striking example is the reduced 5% rate for companies accredited by the Ministry of Digital Development);

- Reducing the amount of profit subject to tax (such as IP-Box in Cyprus or Qualifying intellectual property income in the UAE). This benefit is variable — depending on the portion of development the company undertakes itself versus outsourcing to affiliates;

- Multiplier coefficients for deducting development expenses (for example, if you spent N dollars on development, you could deduct N*2);

- Tax exemptions on profit up to a certain amount (such as Small Business Relief in the UAE) or from certain sources (such as in Hong Kong with its territorial taxation system, where foreign source income unrelated to business in Hong Kong can be tax-exempt under certain conditions).

- Need to pay tax on royalty or dividend payments. Most countries have special rules for withholding tax from foreigners' income, such as royalty, dividends, or interest on loans (withholding tax, WHT).

- Tax treaties. Withholding tax on royalties, dividends, and interest can be legally reduced if countries have a tax treaty to avoid double taxation — usually, tax rates under such treaties are reduced to preferential 0/5/10%, and such treaties offer other benefits, like crediting foreign withholding tax against the national corporate/personal income tax.

The table below outlines these and additional aspects concerning the UAE, Kazakhstan, and Cyprus.

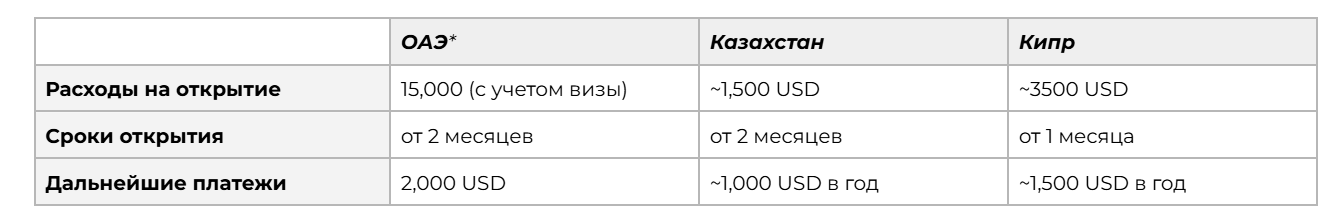

How quickly and for how much can you open companies in the UAE, Kazakhstan, Cyprus?*

When planning a budget for opening a company abroad, several factors should be taken into account:

- Expenses for company setup. To establish a company, generally, you need to pay a state duty, capital outlay for legal entity capital, pay for local provider services, open a company bank account, and perform several other actions.

- Ongoing expenses. Beyond the company's registration expenses, there will be ongoing expenses for its maintenance—such as office rental, secretarial service, accounting, and tax reporting, among others.

In the table, we indicated the cost and timeframes for setting up companies in relation to the UAE, Kazakhstan, and Cyprus.

Note that the parameters in the table are approximate and may change over time.

They do not include expenses for consultants assisting with setting up and maintaining the company, registration costs in preferential zones like Astana Hub in Kazakhstan, nor transportation expenses (for example, to open a company in Kazakhstan, founders must be present in person).

*parameters might differ depending on the territories within the UAE where the company is registered.

What agreements need to be signed to start operating a group of companies?

Once you've registered a company and opened an account, you're ready to establish relationships between your companies.

Quite often, between the new company and the company in Russia, several agreements are needed to:

- allocate responsibilities — who handles distribution, development, holds rights to your games, etc.;

- authorize the new company to collect revenue from foreign platforms;

- configure financial flows between companies.

In most cases, this can be settled with publishing agreements, detailing the interactions between companies.

You also need to conclude contracts with employees involved in development through the new company. This also applies to other employees interacting with the Russian company (if contracts are not already in place). Contracts should include clauses stating that all rights to the company's products belong to the company.

Remember: the main asset of a growing IT business is its intellectual property. Do not neglect properly formalizing your developments and rights distribution. Unfortunately, ignoring this may negatively impact the business's growth later on — for example, lowering its valuation during a sale to investors.

What next?

Legal issues do not conclude after opening a company abroad and setting up financial flows. Game companies continually encounter them when distributing their products, for example:

- What content and advertising rules apply in different countries, and must they be observed?

- How to protect your brand from market competitors?

- Can you register a game to secure rights to it?

- How to employ remote workers, and what are the tax implications?

- How to properly integrate third-party products into your game?

- Can you legally make different game versions for different markets?

- How to document agreements between company founders?

- How to set up a stock option plan to incentivize top employees?

- How to establish relationships with new investors?

- How to properly sell your company stake or issue new shares to a new partner?

- How to collect debts from a counterparty?

Paying attention to such legal details helps you avoid many additional risks, creating a solid foundation for growth and stability in the international market. Assistance in these matters can be sought from FUTURA specialists, which can be ordered on the WN Hub platform.