Now AppMagic has its own podcast (the service launched it with the assistance of WN Media Group). It’s called Games and Names. It is led by Stas Minasov, Vice President of Product at AppMagic. As part of the first issue, he was joined by Daniel Ahmad, a well-known Asian market expert from Niko Partners, and Kirill Vaganov, business development manager at AppMagic. We publish a brief extract.

You can listen to it on the following platforms:

The issue can be conditionally divided into several semantic parts. Let’s go through their main theses.

About merge-2

- The total monthly revenue of games in the merge-2 genre for 2022 increased by 102%: from $7 million to almost $ 15 million in the developed countries of the West. For comparison, the drop in revenue over the same period in certain genres reached 10%.

- The main drivers of niche growth were three titles: Chef Merge from Higgs Studio, as well as Gossip Harbor and Seaside Escape from Micro Fun.

Sales dynamics of Chef Merge, Gossip Harbor and Seaside Escape over the past year

- According to Ahmad, megre-2 indicators have also doubled in Asia. Only here the growth occurred primarily due to the success of Merge Mansion from Metacore and Merge Count from Microfun in Japan and South Korea.

- The participants called the global trend of the emergence of merge mechanics in games of other genres (for example, in expeditions and idlers). This has already led to the emergence of new hybrid directions.

- Also, merge mechanics began to actively appear in the titles of the match-3 genre as special events. The reason for the latter was called the fact that they are well integrated into casual titles.

- A separate trend was called the appearance of simplified merge games (too complex to call them hyper-casual, but still too simple to classify them as hybrid-casual). The heroes of the release attributed Merge Studio from Paxie Games and Makeover Merge from Lion Studios to such simplified titles. For both games, the main monetization tool is advertising (recall that classic games in the merge-2 genre earn on IAP).

About Tile match-3

- We are talking about a separate subgenre of match games, which became widespread in 2021 thanks to games in the spirit of Match Triple 3D from Lihuhu. The entry threshold for tile match-3 is even lower than for classic match-3. And they are easier to develop.

- In terms of gameplay, they vaguely resemble mahjong. The player’s task: to clear the field. This happens as follows: the player finds the same objects on the field and collects them in his hand. As soon as a group of three identical objects is formed in the hand, it disappears.

Match Triple 3D

- Despite its youth, several milestones can be noted in the history of the subgenre. For example, Zen Match from Moon Active was the first title in a niche with a decorative meta: the player furnished rooms with the currency received for completing levels.

- In 2022, the main hit in the subgenre was Triple Match 3D from Boombox Games. The developers have added an order system to the game and the ability to buy amplifiers and extra lives. The monthly revenue of the game reached the level of $ 10 million, and RPD — $ 14 in the developed countries of the West.

Dynamics of Triple Match 3D sales over the past year

- By the way, largely due to the success of this particular game, the earnings of the subgenre in 2022 increased by 85%.

- According to Niko Partners, tile match-3 is very successful in Asia as well. Last year, the total revenue of games of this subgenre in the region tripled.

About Survivor.io

- Launched last summer Survivor.io — another big hit in the portfolio of Habby, formerly famous for Archero. The game is very popular in Asia, where China is responsible for most of its revenue.

- According to Ahmad, one of the reasons for the success of the title is a successful combination of casual gameplay and complex elements of roglike, which could interest both, in fact, casual and midcore audiences.

- The recipe for success is adding advanced mechanics to a simple proven concept. This allowed us to give the game depth without complicating it.

- There are a huge number of clones Survivor.io , trying to repeat its success. However, even the closest competitors do not manage to earn 10% of what the game receives per month.

- For understanding, for April Survivor.io earned $16.3 million. As for Heroes vs trying to repeat it. Hordes from Moon Studio and Lonely Survivor from Cobby Labs, then together they could not earn a million in the same period.

Sales dynamics Survivor.io , Heroes vs. Hordes and Lonely Survivor for this year

About core games and IP

- According to the podcast hosts, the niche of core games entered a black streak in 2022, despite the appearance of Diablo Immortal from Activision Blizzard (the game earned $165 million in 2022) and Marvel Snap from Nuverse (the game earned $27 million in 2022).

Sales and downloads of Diablo Immortal and Marvel Snap last year

- One of the reasons is Apple’s new data privacy policy, which made it impossible to accurately target when buying traffic. First of all, this policy has hit the marketing of role-playing and strategy games.

- The way out of the impasse, as I think the heroes of the release, is the development of a game based on a large franchise. Having an IP that is popular outside of the mobile market can attract a suitable audience.

- This is a working scheme not only for the western, but also for the eastern market. “If you look at the games launched in China in 2022, analyze which of them have achieved the greatest success, it will quickly become obvious: the highest-grossing of them were those that were built on any IP,” Ahmad said.

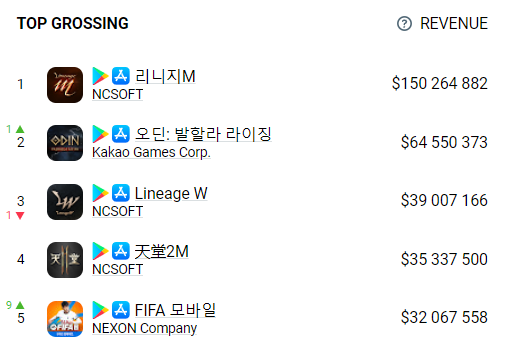

- Moreover, this rule also works for relatively closed Asian markets. For example, South Korea is a country dominated by local teams. Three of the five highest-grossing games of last year are operated there under the Lineage brand.

Top-grossing games of South Korea last year (1,3 and 4 positions behind the games of the Lineage series)

***

More about the situation on the mobile market is in the one—hour debut issue of Games and Names.