The marketing company AppsFlyer published a report on mobile app monetization for the third quarter of 2024.

The report examines how games generate revenue on iOS and Android across four of the most common monetization models:

- in-app purchases (IAP);

- in-app advertising (IAA);

- a hybrid model (IAA + IAP);

- and through subscriptions.

It should be noted that AppsFlyer used data from high-income markets, namely North America and Western Europe. Information about emerging markets is promised separately by the analysts.

Below are the key insights from the report on essential metrics.

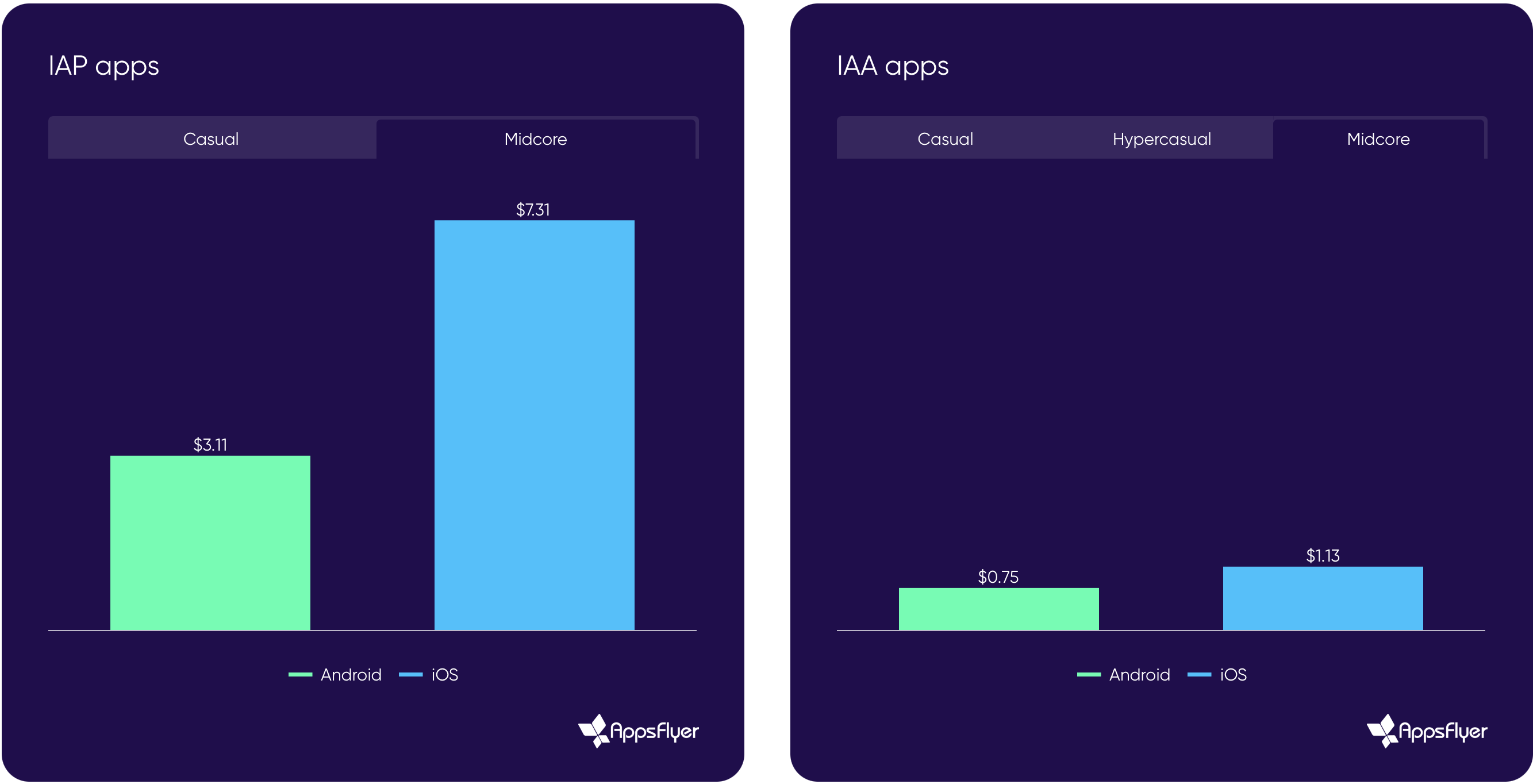

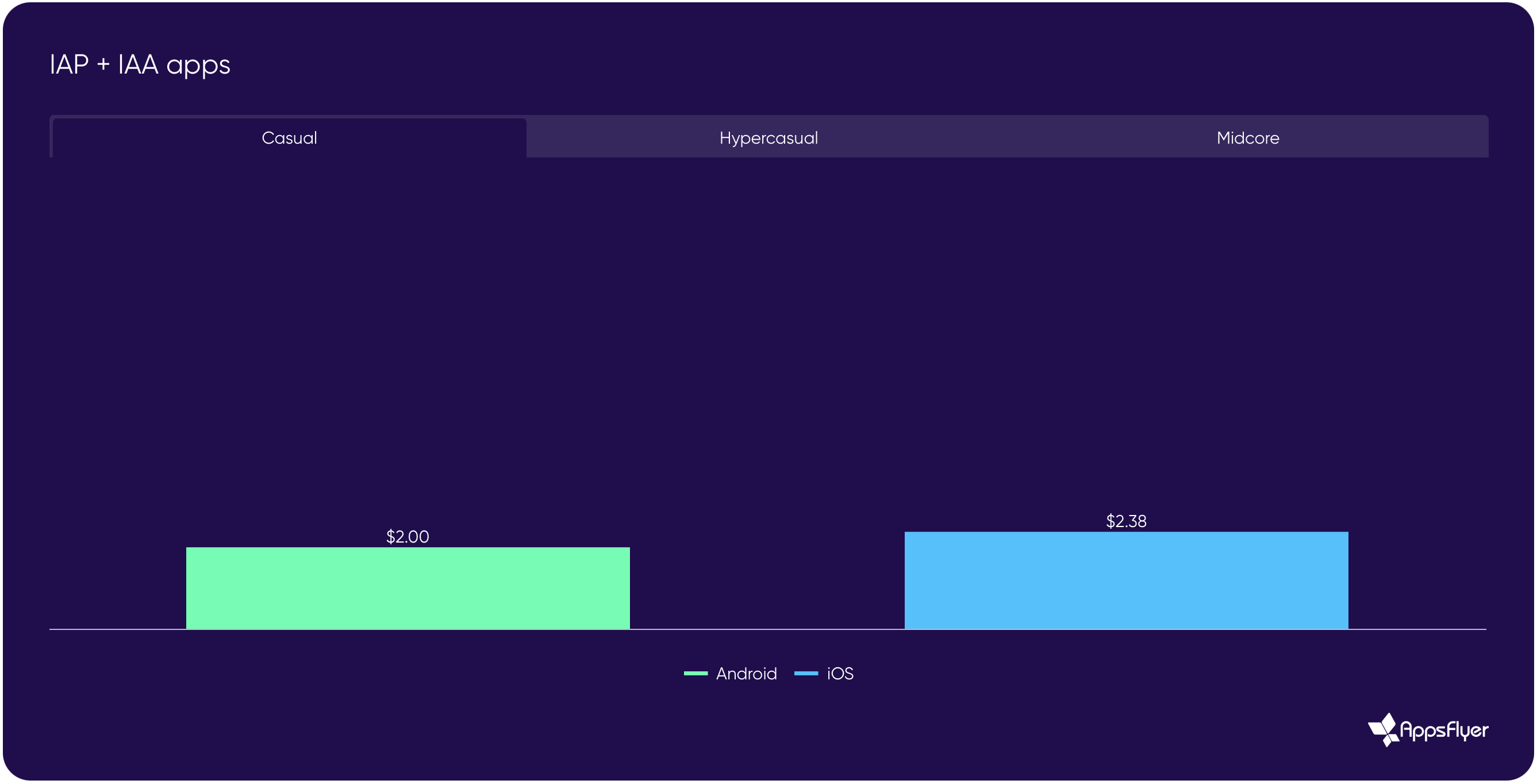

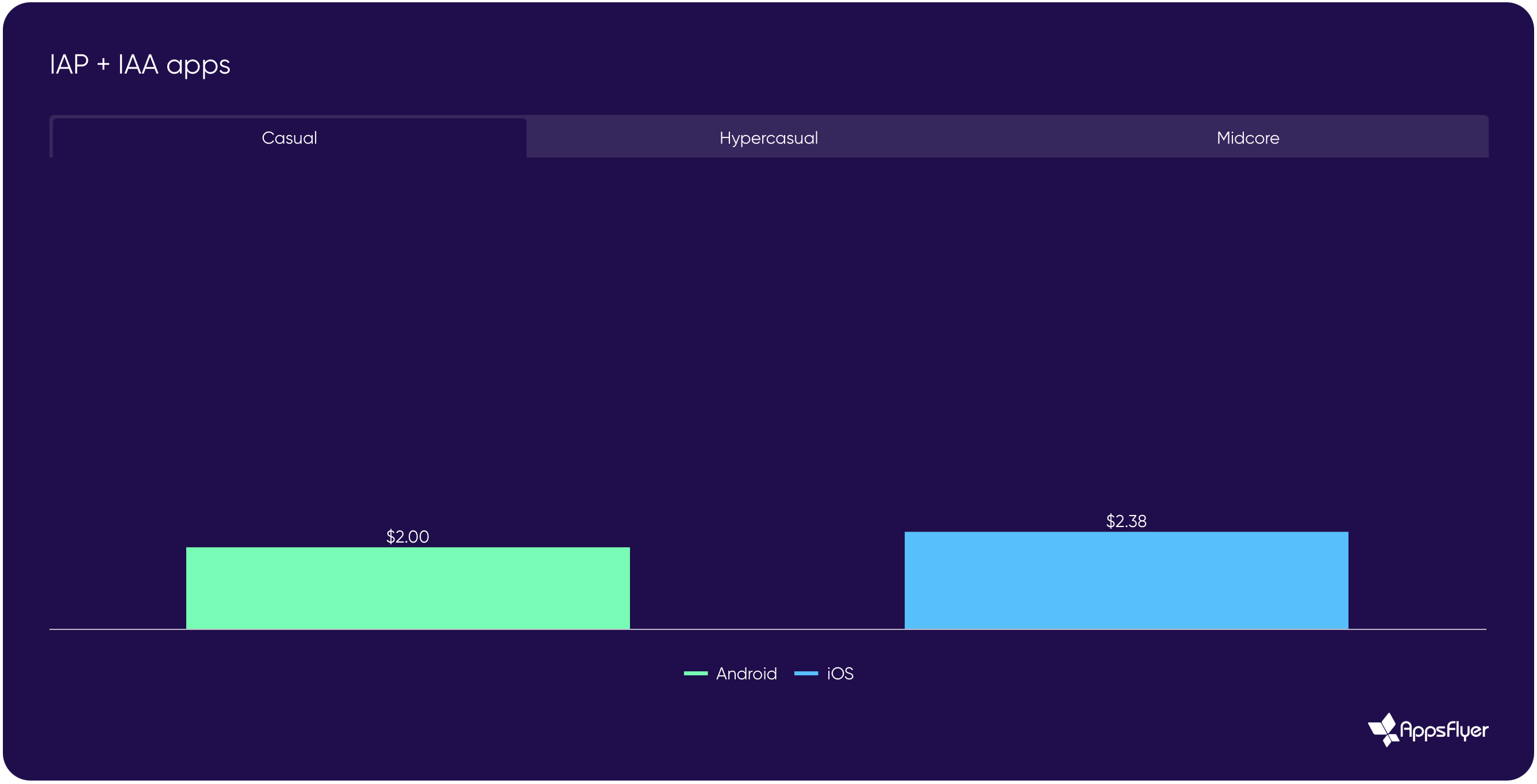

ARPU (Average Revenue Per User)

- Mid-core iOS games lead in this metric regardless of the chosen monetization approach. For games with an IAP model, ARPU was $7.31, and for the hybrid model, it was $9.69.

ARPU for mid-core games with IAP, IAA, and hybrid models

- As for casual games, the pure IAP model remains the most profitable on both Android and iOS.

ARPU for casual games with IAP, IAA, and hybrid models

- In hyper-casual games, ARPU is 28% higher with a hybrid approach than with ads alone: $0.6 vs. $0.47 on Android, and $0.82 vs. $0.71 on iOS. AppsFlyer emphasizes that this genre is characterized by low margins.

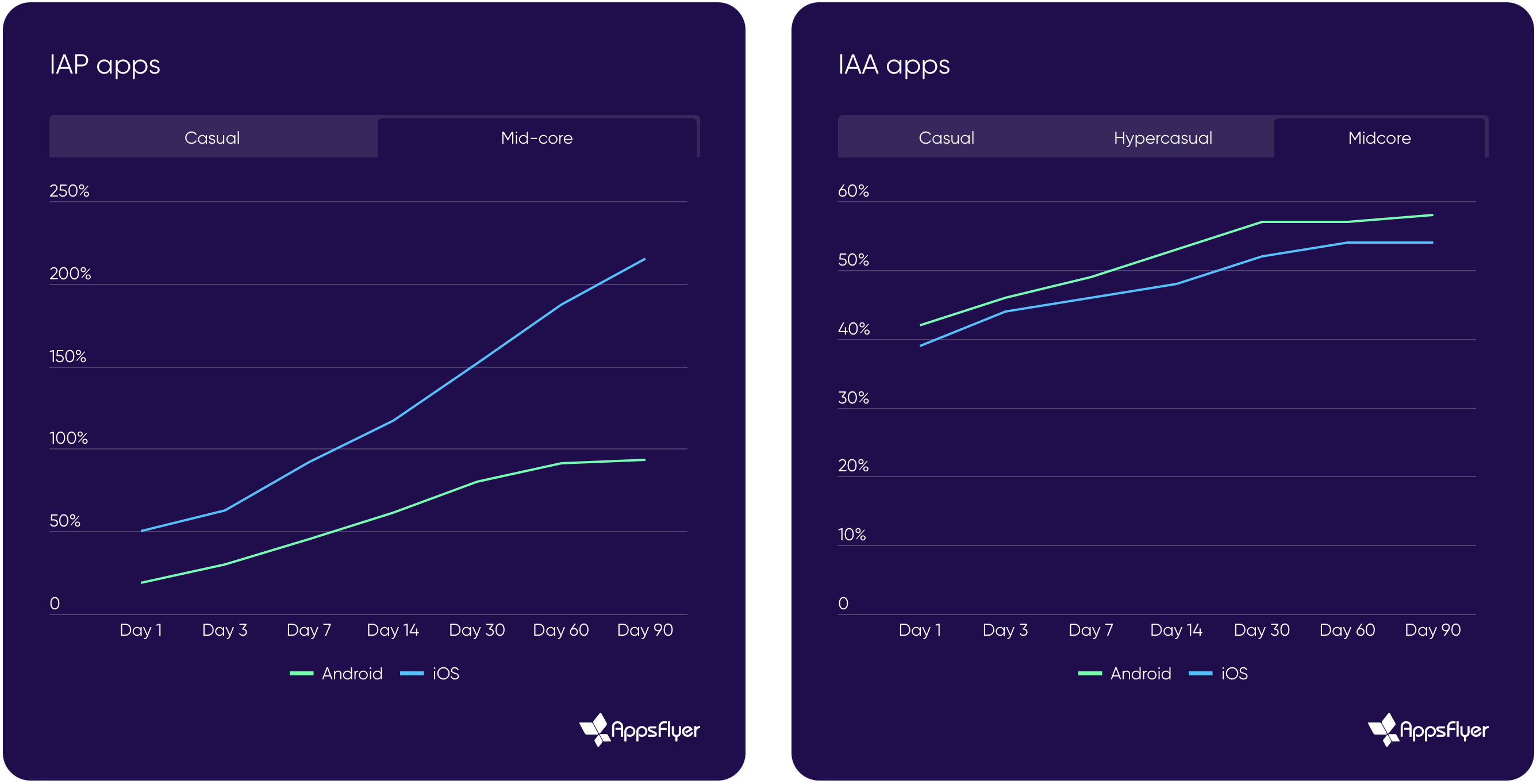

ROAS (Return on Advertising Spend)

- According to AppsFlyer, in the past quarter, the hybrid strategy in mid-core games on Android recouped ad costs on average 57% more effectively than IAP. The average ROAS for the hybrid was 146%, while for IAP, it was only 93%.

- The situation on iOS is different. Here, in mid-core games, the average ROAS reached 215% due to in-app purchases. In the hybrid model, the overall figure stood at 73%.

- For casual and hyper-casual games, breaking even in 90 days with IAP proved impossible. Other models also risk not being profitable. Only hybrid Android casual games managed to break even closer to day 30. A similar situation was observed with hyper-casual titles on iOS, thanks to internal ads.

ROAS dynamics for mid-core games with IAP, IAA, and hybrid models over 90 days

DAU (Daily Active Users)

- AppsFlyer reminds us that DAU and the share of paying users have different dynamics and do not correlate directly. A high DAU does not guarantee substantial revenue.

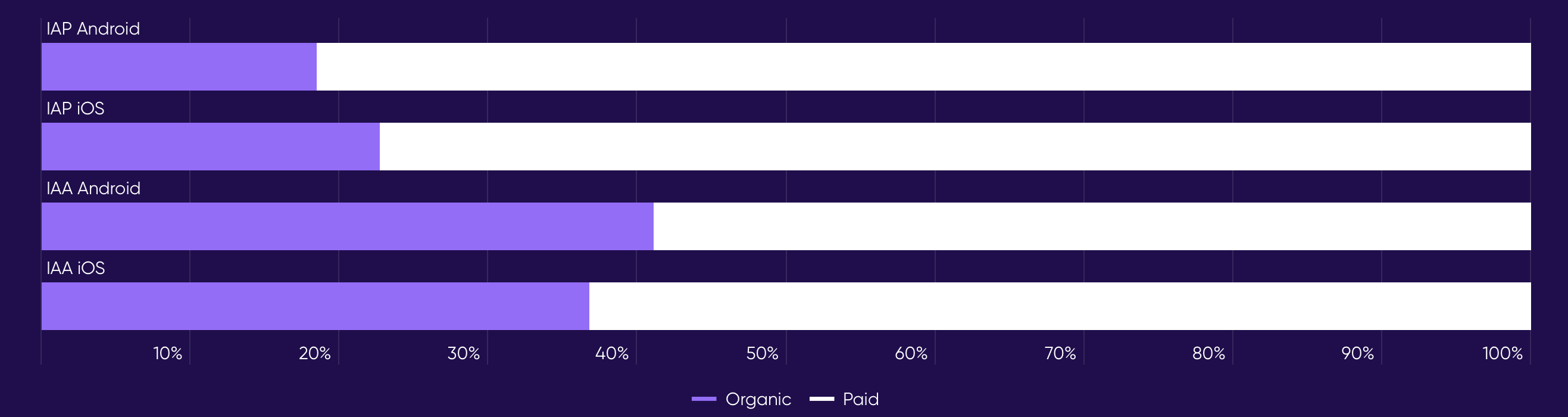

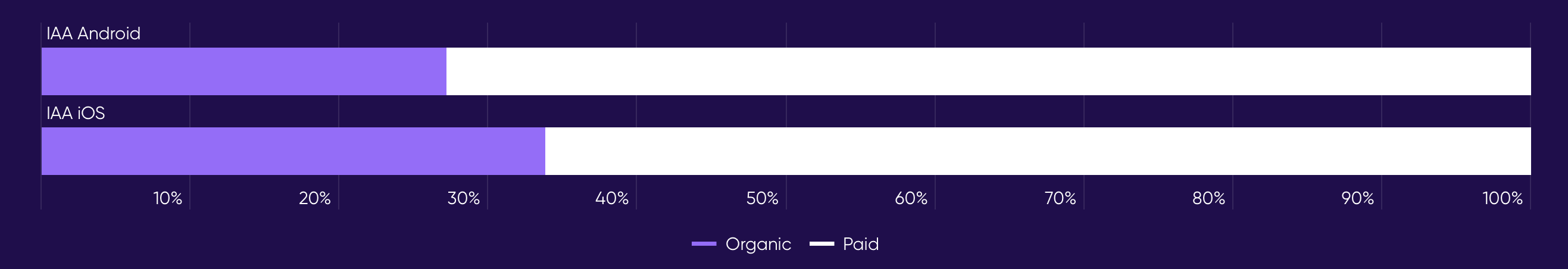

- Finally, due to high competition, casual and hyper-casual games rely more heavily on paid traffic through advertising. On average, it accounts for 73% of total revenue.

Ratio of organic to inorganic traffic for casual games

Ratio of organic to inorganic traffic for hyper-casual games

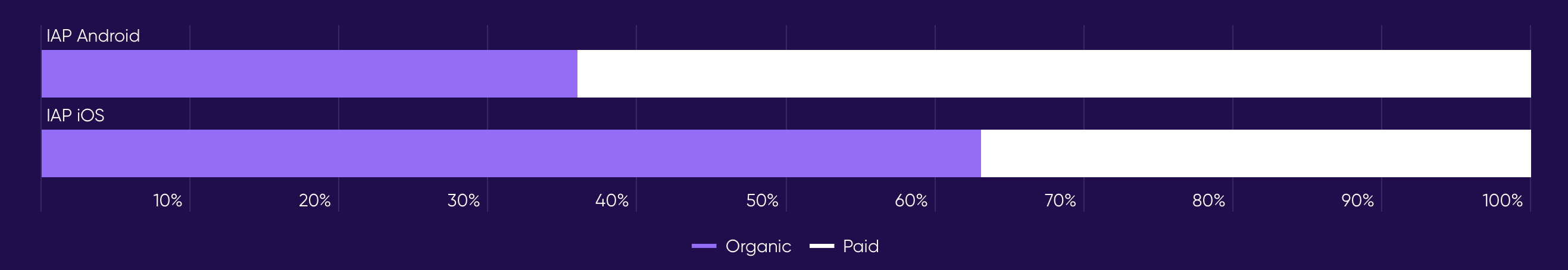

- At the same time, popular mid-core games balance between inorganic and organic installations. On the one hand, players seek familiar games themselves, while on the other, developers need to make additional efforts to re-engage users through IAP.

Ratio of organic to inorganic traffic for mid-core games