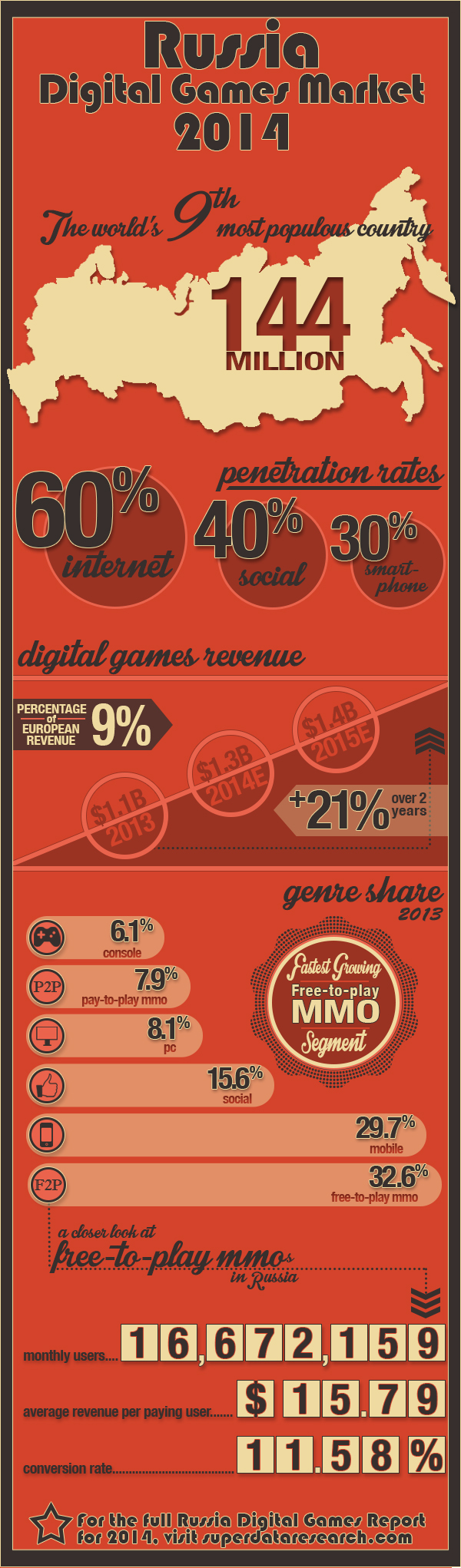

Revenue from digital games in Russia in 2013 amounted to $1.1 billion, according to Superdata in its latest research. The main driver of the market, according to her version, is not mobile games at all.

At the time of retail, Western companies looked at the Russian gaming market without enthusiasm. Getting a lot of revenue was hampered by piracy, which Russian distributors fought by lowering the cost of licensed products.

With the advent of the “digital” era and new methods of monetization, the situation has changed. The money that used to flow into the pocket of the pirates began to go to the developers.

Last year, the Russian digital games market, according to Superdata in its latest research and infogarfics, earned $1.1 billion. This is 9% of the European market.

The most popular game model in Russia is a free-to-play MMO. 32.6% of players prefer to spend time behind them.

“The fact that F2P is the most popular model in the CIS seems to me to be a fait accompli that does not need deep analysis for a couple of years,” Sergey Babaev, creative director of GD–Team, comments on the report.

Sergey Babaev

According to him, “there is a lot of debate going on now, criticism of F2P is often expressed, and the opinion is also given that players would be willing to pay for a subscription, but some conspirators specifically do not give such projects, putting everyone on the F2P needle.

In fact, publishers and developers would calmly multiply the number of active players by the subscription price further if the purchase barrier did not scare off a really large number of users.”

“It is unclear exactly which projects are included in the concept of F2P MMO – are MOBA projects also united under this heading? Do analysts consider such a mega-popular project as WoT – MMO or a session online project? In other words, the terminology leaves a number of questions. Also, according to infographics, it seems that such a cross-section of projects as browser strategies has been lost, and F2P MMO implies exclusively online client projects,” Sergey also noted.

The total MAU of free-to-play MMO in Russia, according to Superdata, is 16.6 million, the average ARPPU is $15.79, the average conversion is 11.58%.

Sergey found these figures fair, but noticed that “the total MAU seems somewhat underestimated, but it is difficult to say something exact in contrast without understanding the details of the sample.”

In an official Superdata press release, Tony Watkins, head of Electronic Arts Russia, stated that the main driver of the Russian market is online: “We believe that the Russian PC and console market will grow significantly due to the release of new game consoles, but the online market will be the main driver of growth.”

Tony Watkins

By the way, among the curious features of the Russian digital market, Superdata noted a relatively small number of transactions (6 per month) and the prevalence of payments through payment terminals.

The infographic presented by Superdata can be found just below.