G5 Entertainment shares have lost 77% in value over the past year. According to the general director of the company Vlad Suglobov, this does not affect anything except the mood.

Hidden City — the main blockbuster of G5 Entertainment

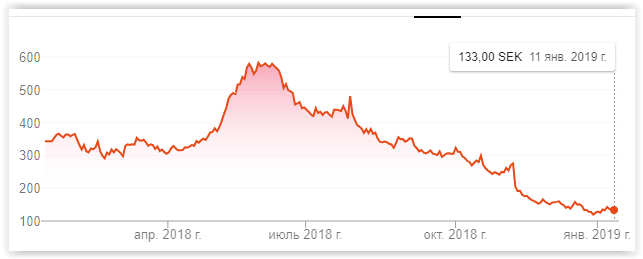

According to open data, 2018 was not very successful for G5 Entertainment in terms of stock indicators.

If in May the share price reached 580 Swedish kronor ($65), by the end of the year it dropped to 130 Swedish kronor ($15).

Dynamics of the value of G5 Entertainment shares

We asked Vlad Suglobov, CEO and one of the founders of the company, to comment on the fall in shares.

Vlad Suglobov

Indeed, the share price dropped from about 600 kronor to about 130 kronor from June to December-a month.

The capitalization of the company, accordingly, has decreased from about $600 million in the summer to about $130 million now.

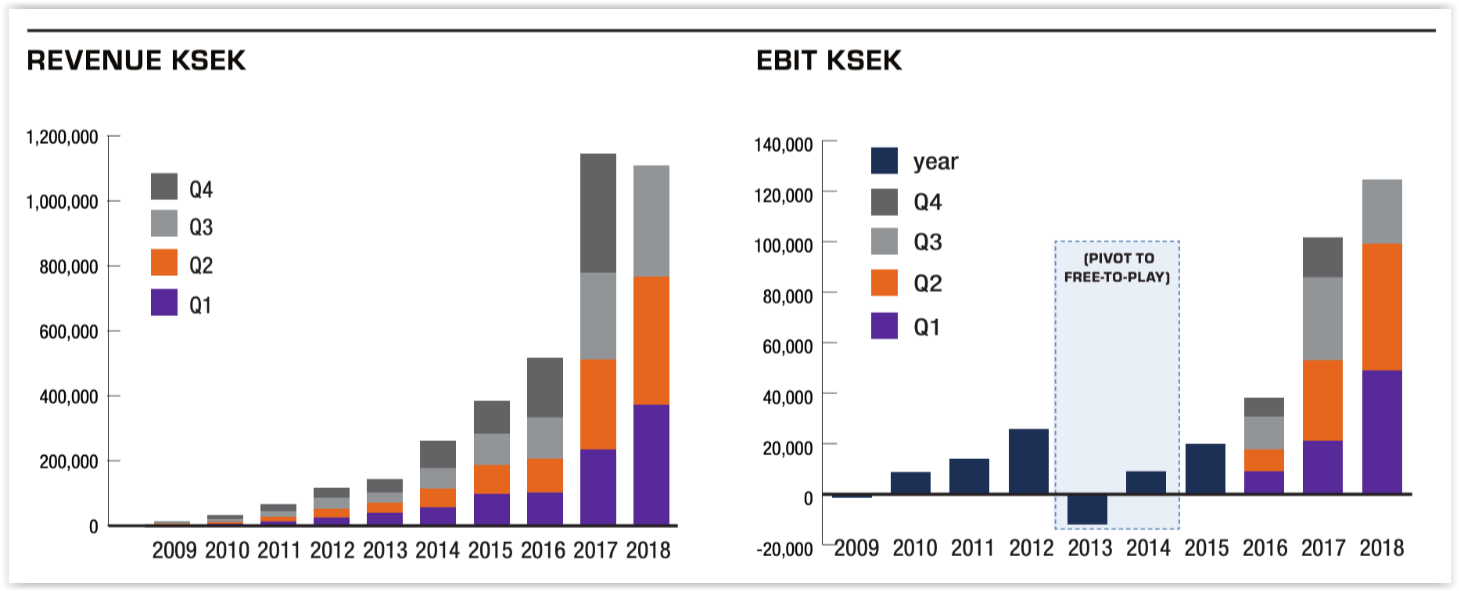

Surprisingly, now the stock price is almost the same as in December 2016. This is despite the fact that the company’s turnover at the end of 2018 is likely to be three times more than in 2016, and the profit is probably four times higher than in 2016.

I attach a picture of the dynamics of the company’s turnover and its profits, for clarity. During the last reporting period, from October 2017 to September 2018, the company’s turnover was about $170 million, and its profit was $15 million.

Dynamics of revenue and EBIT (earnings before interest and taxes) G5 Entertainment

If you understand something about the valuations of companies by Price/Sales and Price/Earnings, then you may be surprised that the only company in Sweden that has been in the Top 50 fastest-growing technology companies in the country for six years in a row, which is growing profitably with a positive cash flow and even pays dividends, is estimated at only 0.75 P/S and at about 9 P/E, that is, the company’s capitalization is much lower than one annual turnover (not even the forecast, but over the past 12 months), and if measured in annual profits, then the capitalization is less than nine profits over the past 12 months.

This is significantly lower than the estimates of Glu or Zynga or any other public gaming company, despite the fact that they are often on the verge of profitability.

Of course, we are somewhat offended that the market currently values our work so low. On the other hand, a few months ago in the summer, an estimate of $ 600 million suited us.

What does it affect and what has changed?

Fortunately, this does not affect anything except our mood. G5 is growing, the company is profitable, with a positive cash flow, without loans, without the need to raise capital, so the stock price does not affect our work in any way.

Even from the point of view of employee options, it turned out well that employees used their options while the rate was high, and received new options when the rate dropped significantly, that is, they were able to earn on old options, and received new ones on favorable terms.

We must continue to work, continue to increase the audience and sales of our games, this will lead to an increase in turnover and profit, and sooner or later the market assessment will shift to a more optimistic side. And the further the assessment shifts to the irrationally negative side now, the faster it will come back later.

The mood of investors, as we see, is changing very quickly, both in one direction and in the other. In the meantime, according to the precepts of Warren Buffett, the market should be viewed as a person who offers you a bad deal: if you don’t want to, don’t sell, you can buy more.

What has changed in just six months (in May, the stock price was at its peak)?

First of all, the macro environment. After the 2008 financial crisis, the Fed’s rate remained at an extremely low level for many years, and only this year it began to be raised. This situation marks the end of the credit cycle, deleveraging begins to occur, and investors begin to sausage.

On the one hand, they are waiting for a slowdown in economic growth, which immediately reduces their valuation of shares of any companies, on the other hand, if they trade on the shoulder (and there are some, especially in small/mid cap companies, whose shares are sometimes bought on the shoulder secured by investments in “blue chips”), they have there is a need to pay more for loans, they begin to take profits, the price falls, causes margin calls from those who, perhaps, did not want to sell, and the spiral spins back. The more leverage investors had, the stronger the pullback could be. This is a complex multi-faceted process.

In general, markets in such a situation may begin to collapse in anticipation of a recession that has not even happened and has not yet begun. Just since August of this year, even the main stock indexes have fallen into a significant correction. The technology sector has suffered even more. Activision, for example, lost 45% of capitalization in just a few months. And small and medium-sized companies always show an even bigger drop at such moments, so we got more. Even in the venture capital market, there were signals that funds were morally preparing their companies for the fact that access to capital could suddenly be significantly limited, as usually happens in times of crisis.

If you look at the mobile gaming industry, the news that the growth of mobile phone sales in the developed world has been at zero since the end of last year does not add optimism to investors. There is a feeling that the fastest phase of market growth is over, and everyone who wanted to buy it has a smartphone. If earlier people came to the market every year who did not have any applications installed, now we have to fight for users who are already playing something. Perhaps the window of opportunity to enter the market is not closing, but it is probably narrowing even more, and the cost of entering the market is growing.

There were also more local reasons for investors to worry. One of the most famous Swedish gaming companies called Starbreeze (the authors of Payday) just a few weeks ago announced its bankruptcy. This has added nervousness to investors in gaming companies. Of course, our business models and theirs were completely different, we worked on different platforms, we didn’t bury many millions of dollars in VR, unlike Starbreeze, it’s very difficult to draw analogies between companies, but suddenly Swedish investors found out that it happens like that, and it became even scarier for them.

It should also be understood that the volatility of G5 shares has always been quite high. Despite the fact that the company is Swedish and the shares are traded on the main market of the Stockholm Stock Exchange, the company’s development offices are concentrated in Russia and Ukraine, so there is a certain country coefficient for this. All investors know where the Paradox office is located in Stockholm, for example, and you can approach and make sure that the sign is hanging and people are working. And we are somewhere far away, in cities and countries where they have not traveled and where they may be afraid to go. The Russian history of recent years has always been the background of our activities, of course, but when things go well, it is forgotten, and when suddenly there are some doubts, it reinforces the negative, and extremely strange comments can appear on investor forums. Nothing can be done, we smile and wave.

G5 has been a public company since 2006. We have been in the gaming industry since 1995. During this time there have been several crises: 1998, 2000 (dot com), 2004 (Russian gaming retail), 2008. We and the global economy as a whole had a fairly quiet period of stable growth from 2009 to 2018. Maybe something will break out in 2019 or 2020. Or maybe not. We’ll wait and see. Gaming companies are less sensitive to recessions compared to other industries. It is believed that in difficult moments, games can even win as a relatively cheap form of entertainment in terms of time. In any case, we will focus on our audience and on making the best games on the market, and the market assessment will follow the results of our work.

Also on the topic: