A column by the Director of Product Marketing at Xsolla on the importance of a strong payment tool.

Natalya Sobakina, Director of Product Marketing at Xsolla, is responsible for market entry, marketing, and the development of the company’s product line, including Web Shop, Payments, Anti-Fraud, Publishing Suite, expert content, and special projects such as release weeks and the Xsolla World Map.

Natalya joined Xsolla in 2016 and is celebrating ten years with the company this year. During this time, she has worked as an analyst and later as the head of a department focused on new payment systems within the fundamental product—payments, where she handled market expansion from Europe to Japan and India. For the past five years, she has been leading the product marketing team.

Natalya Sobakina

Most of what Xsolla is building today are Direct-to-Consumer solutions, tools that allow sales directly to users. This includes webshops for mobile games, direct in-app purchases, largely as a response to recent regulatory changes, and monetization with PC game distribution. However, the secret is that Direct-to-Consumer experience, in principle, cannot be built without payments. For some Xsolla partners, a strong payment tool is a key differentiator in the D2C solution; for others, it remains in the background. Ultimately, profitability is always important to a business, and profitability directly depends on how stable and successfully a payment is processed.

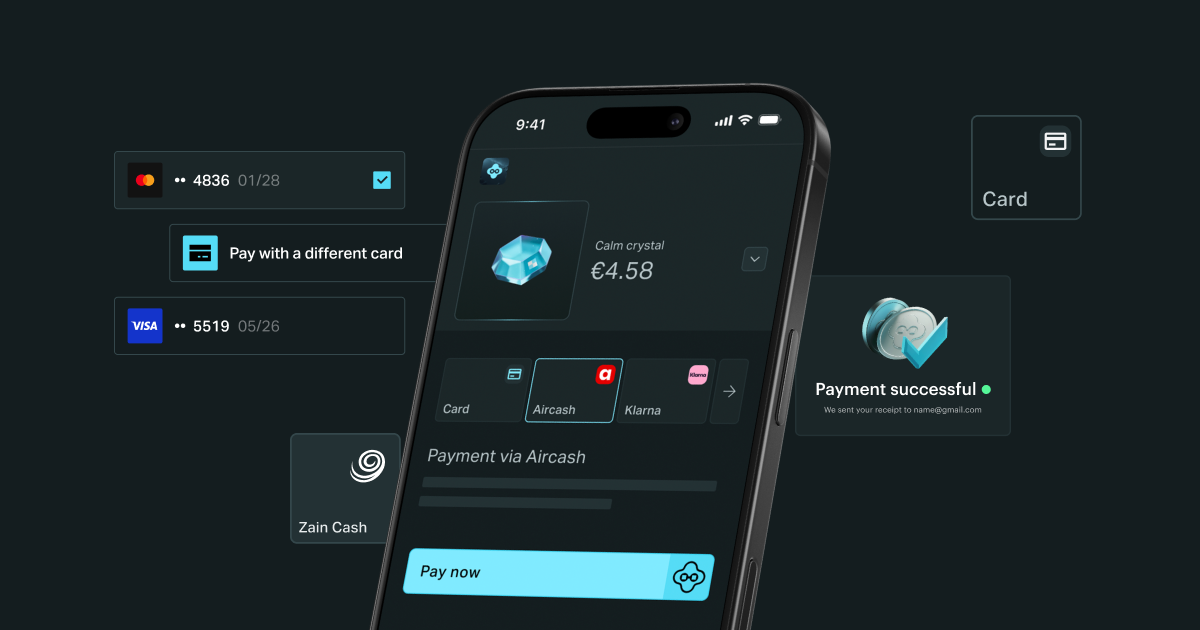

A strong payment tool is undoubtedly one that ensures the largest number of successful transactions, but in practice, it is slightly more complex than it seems. Service stability plays a key role if you focus on users who have already started a payment. But it's equally important to consider those users who could have paid but didn’t for some reason. Perhaps they didn’t find a familiar payment method, the checkout was poorly adapted to the device they were using, or the payment process information was not transparent enough. Payment is a very delicate moment in the user experience, and there are quite a few factors that can shatter the intention to purchase.

The simplest example is prices in dollars instead of local currency. In such a situation, a user may simply not understand the final cost of the purchase and risks paying more than expected. Especially in economies with unstable exchange rates, such as several Latin American countries, this can reduce the number of successful payments by more than half.

You can look at payments from different angles. For instance, they can reveal a lot about a company's strategy—by the list of available payment methods, it is immediately clear which regions are their focus. Businesses rarely prioritize countries where there are no paying customers. However, the number of such customers could likely increase significantly if they saw more than just credit cards at checkout. A wide range of payment methods can at least serve as a good tool for testing possibilities in a particular country. More payment methods mean more markets covered, more experiments, and more opportunities for local placement.

Both the gaming and payment industries have enough regulations and other non-legal nuances. Therefore, it is important to assess your capabilities wisely. A deeper understanding of the market can help: its size, internet and mobile device availability, platform share distribution, and the level of distribution and UA development in the region. One of my favorite projects of the past year is the Xsolla World Map, an open knowledge library on markets that helps get a top-level understanding of where to look and what to delve into.

Operating payment methods can be challenging due to the structure of fees and payout flows, but this is also a solvable infrastructure question. It all depends on what teams are ready to handle internally and what they would like to delegate. Next, there’s the choice of a regional partner: a local publisher, consulting firm, or MoR, to whom you can entrust most of the local details. And, of course, it's not always necessary to go all in—many markets are open to simple tests.

While direct-to-consumer sales are a global trend today, D2C in different regions is at varying levels of development. It also directly depends on the overall level of development of the gaming industry and local providers in these markets. The specifics manifest in everything, from local UX and design to various LiveOps mechanics, which work better or worse in different regions. But investing in D2C will be justified—in "emerging" regions, it can become a competitive advantage because the market is not yet saturated with offers from other studios, and in mature markets, it simplifies the mechanic of game-to-web transfer.

Xsolla often speaks about optionality, and this is precisely it—having the ability to try different things with minimal invested resources, and then making a decision that suits the specific studio. Each case is individual, but there is a D2C strategy for everyone.