Eric Benjamin Seufert, a leading marketer at Wooga, shared his thoughts on who we should thank for the high prices for mobile advertising.

The original version of the material can be found on Mobile Dev Memo, a website dedicated to the mobile industry, run by Eric Seferth himself, author of the book Freemium Economics.

Mobile analytics network Fiksu recently reported that in July, the average user price within the platform increased by 9% compared to the same period last year and amounted to $ 1.97. This is the second highest mark in the entire history of Fiksu monitoring the price of a loyal user [Recall that Fiksu calls those who have logged into the application at least three times a loyal user, – approx. editorial offices]. Chartboost, another mobile advertising network, revealed that its average CPI for the iPhone jumped by 21% from June to August, eventually amounting to $2.56.

Last week, a number of popular business publications concluded that mobile gaming startups pumped up with investment money are responsible for most of Facebook’s revenue from mobile advertising. For this reason, the company does not disclose what percentage of mobile revenue (which accounted for 62% of all advertising revenue in the second quarter of 2014) is generated from mobile advertising of app installations.

The essence of the question about mobile advertising installations is not about Facebook, but about the stability of the current ecosystem of mobile advertising in relation to games, and takes the right to ask the question: why are mobile marketing costs growing.

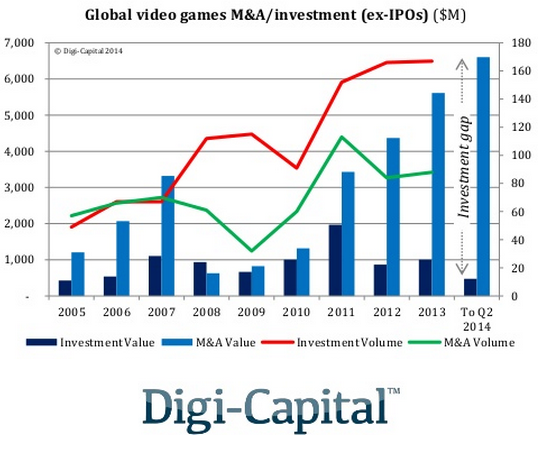

The statement that gaming startups funded by venture capitalists lead the advertising market to overheating does not correspond to the facts. According to the Digi Capital report for the 2nd quarter of this year, VC investment in the gaming sector actually decreased by 6% compared to the same indicators for 2013.

Moreover, the number of investments made decreased by 49% in the first half of 2014. These data do not correlate with the idea that game companies subsidized by venture funds raise the cost of advertising, especially when compared with the huge amounts of money spent on it by the largest game developers. King, for example, in its report for the second fiscal quarter stated that the company’s marketing budget for this year will be about $ 400 million.

It is more likely that the culprit for the continued growth of CPI prices is not the insane spending of VC-subsidized gaming companies, but the maturing economy of mobile applications, considered within the framework of two phenomena.

1. The great divide has made the top downloads even more competitive

Operators of large platforms have started releasing applications that they can raise to the top without the support of marketing campaigns. Facebook, for example, had 3 apps in the Top 20 free downloads (iPhone, USA) at the time of writing, Google had 2 apps, Apple had 1 app, and only 3 apps out of the top twenty are games [at the time of translation of the article, the situation has changed, to put it mildly, Facebook has 3 apps, Google has 1 app, Apple has 6, games – 3 pieces, – approx. editorial offices].

A recent study found that 70% of the unique views of the top 20 apps come from apps published by just four companies: Facebook, Apple, Google and Yahoo!. The consequence of this displacement was a decrease in the effectiveness of advertising in relation to positioning in the chart.

In other words, before Facebook split into two apps, one of which is promoted within the other, the chart position where it is located was achievable. But since Facebook can convert its gigantic user base into a constant stream of daily downloads of Messanger, this position is, in fact, occupied for a short period of time (actually, until the installations go down). This is inflating the Top chart with downloads: the number of installations that was necessary to reach the Messanger position now allows you to reach only the position below it.

2. Non-gaming companies are now competing for advertising inventory

Last week, the advertising company Criteo unveiled its new Travel Flash Report, according to which the number of travel orders made via a mobile device in the 1st quarter of 2014 increased by 20% compared to the first quarter of 2013, the number of mobile travel orders made by Americans increased by 40%, and the number of hotel bookings made by 21%. using a mobile device. This increase in orders could hardly have happened without the purchase of advertising, but even so, this is an excellent reason for travel companies to increase their mobile layout budget [in our opinion, the same trend is observed here at number one: large travel companies simply transfer their audience to mobile rails, – approx. editorial offices].

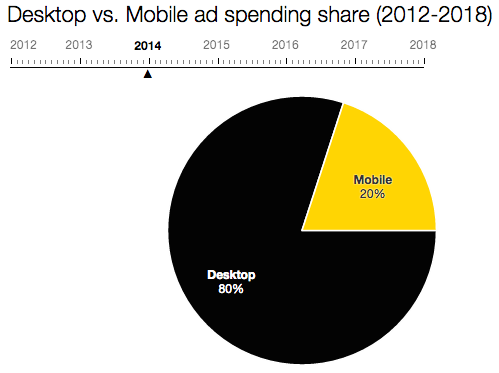

Again, digital spending by advertising agencies has already begun to shift towards mobile: advertising analytics company Magna Global expects that the advertising industry’s spending on the mobile market in 2014 will increase by 61% and amount to $ 27.1 billion. The mobile share of digital advertising spending will also increase to 20% this year (in 2013 it was 14%). It is expected that in 2015 it will be 25%, and in 2018 – 35%.

Conclusion

Why Facebook decided not to show the distribution of its revenue from mobile advertising generated mainly by advertising app downloads is likely to become clear soon (this analysis has a plausible explanation).

If, perhaps, the reason is related to advertising expenses of mobile gaming companies, these expenses are unlikely to be funded by venture capital: the largest developers spend so generously on acquiring users that a campaign to launch games funded from the pocket of venture funds cannot affect the cost of CPI.

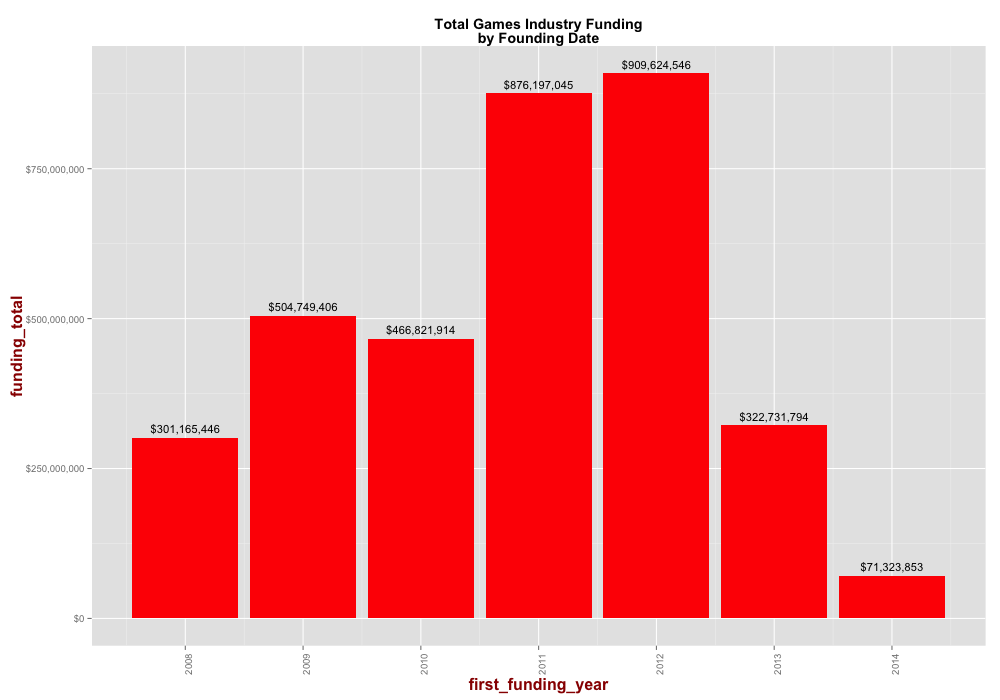

In any case, the last infusions are definitely not capable. This chart, with information collected by Crunchbase, demonstrates the subsidization of venture funds into the gaming industry over the past seven years. The trend is obvious: a lot of money was raised by mobile gaming companies when free-to-play was a new idea acceptable for investment – in 2011-2012. Nowadays, it is unlikely that a mobile gaming company is able to raise a significant amount of money without a viable marketing strategy.

A source: http://mobiledevmemo.com/why-mobile-marketing-costs-rising/