The other day Unity published a Mobile Game Monetization Report. In it, the company spoke about the state of affairs with the monetization of mobile games at the end of 2019. We have highlighted the main points of the study.

The main thing

- revenue from advertising in mobile games increased by 30.1 in 2019%;

- in some genres, advertising has become the main source of earnings (in arcades and word games, it is responsible for 82% of revenue);

- In Asia, the share of gaming revenue from advertising is greater than in other regions (China is the leader, where advertising is responsible for 59% of total revenue);

- there is a correlation between the presence of advertising and retention in games (but it all depends on the genre, in some for the better, in others for the worse);

- in half of mobile games, the conversion to a paying player is 1% or less;

- advertising increases the conversion to a paying user, but reduces the average income from the same user;

- 26.4% of mobile gamers view at least one ad per day.

Methodology

During the preparation, Unity Technologies attracted data from 300 thousand applications using the advertising service Unity Ads. The data was collected from January to December 2019. Only data related to interstitial ads and rewarded videos were taken into account.

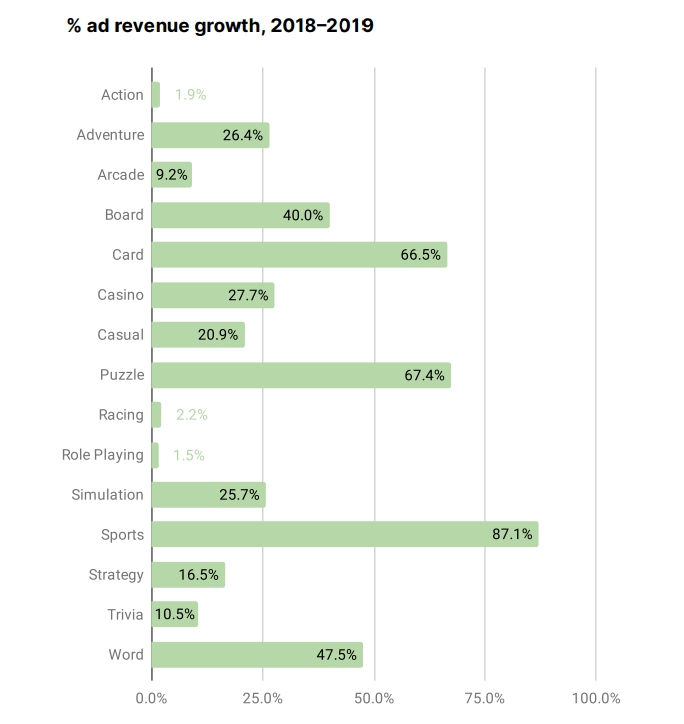

1. Revenue from advertising in mobile games increased by 30.1 in 2019%

The greatest growth was shown by advertising in sports games (87.1%), puzzles (67.4%) and card projects (66.5%). Such rates are primarily due to the fact that in these categories only recently began to focus on a similar method of monetization.

Dynamics of revenue growth from advertising by genre (indicators of 2019 compared with 2018)

The relatively modest dynamics of casinos and casual games is due to the fact that advertising has been actively used in these niches for a long time and therefore the growth is more calm than, for example, puzzles.

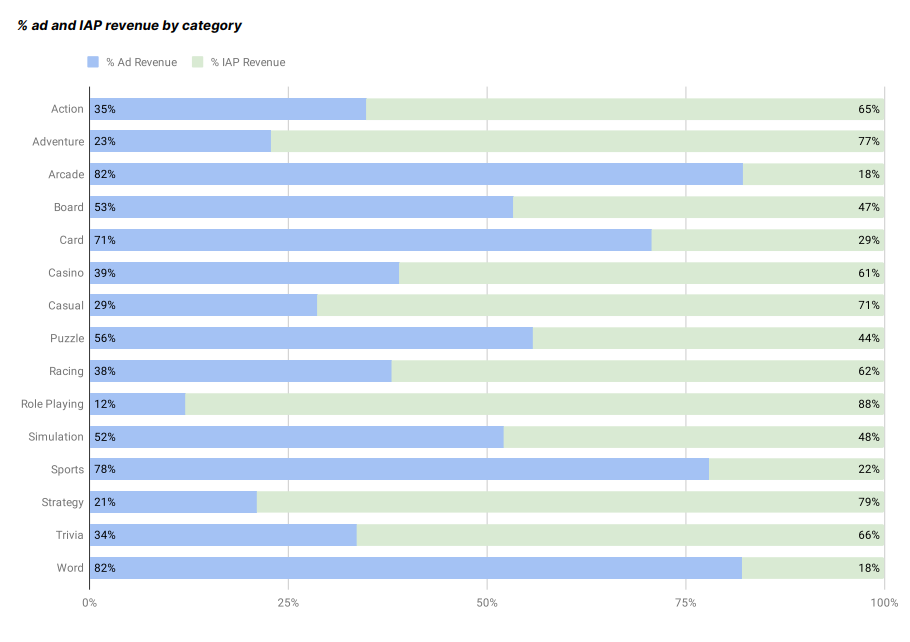

2. In some genres, advertising has become the main source of earnings

In arcades, advertising is responsible for 82% of earnings. Such a bias is associated with the popularization of hyper-casual products, which usually fall into the category of arcades.

Word games also earn about 82% of advertising revenue. They have the main monetization built on it. These games are one of the main platforms for full—screen banners that are shown to the player after his turn.

The ratio of revenue from advertising and from IAP by genre

Unity explains the low share of advertising earnings in midcore genres (role-playing games, strategies) by the fact that in them the choice of advertising is limited to banners and rewarding videos. The problem with full-screen banners is that they cannot be shown often in such projects, otherwise paying users may lose interest in the game.

By the way, the number of games where advertising is responsible for 61-80% of earnings increased by 4.2% in 2019, and the number of games where advertising accounts for 0-20%, on the contrary, fell by 3.8%.

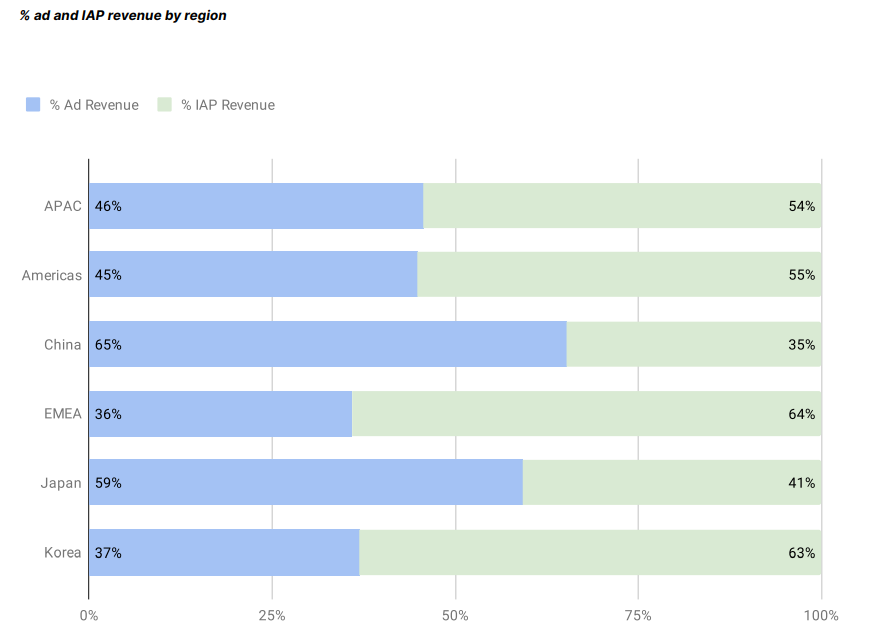

3. In Asia, the share of gaming revenue from advertising is greater than in other regions

For the Asian market, advertising is the most important and profitable channel for monetization of games. In China, for example, it accounts for 65% of all gaming revenue, and in Japan — 59%.

The ratio of revenue from advertising and from IAP by country/region

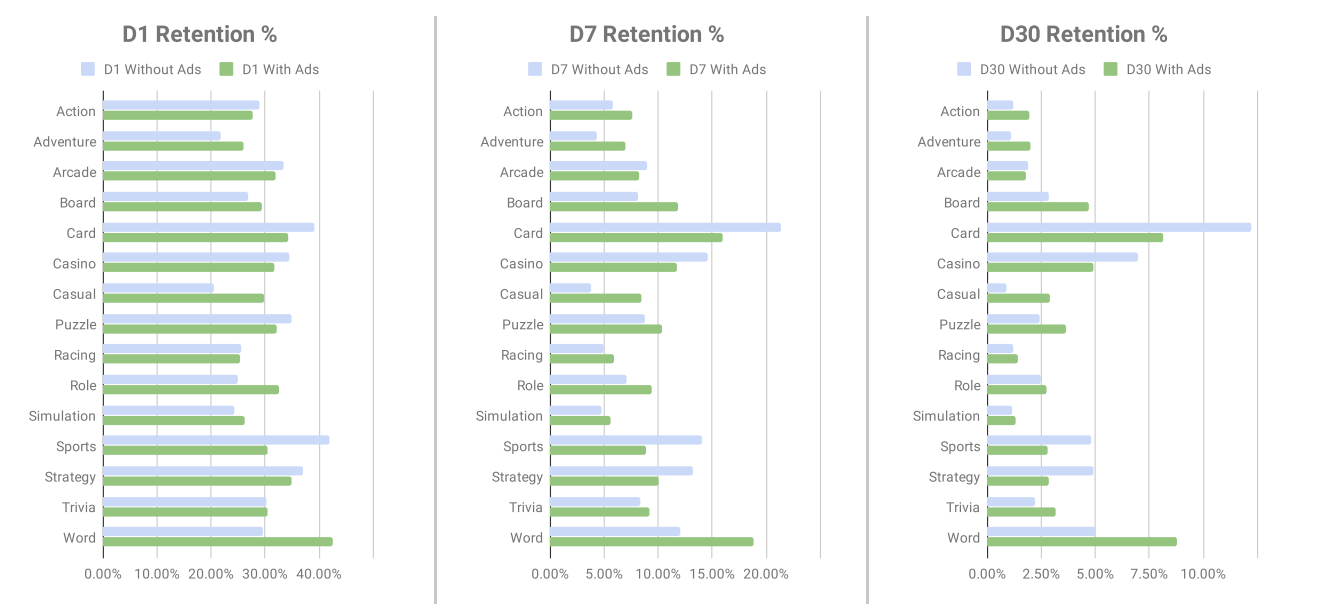

4. There is a correlation between the presence of advertising and the amount of retention in games

Unity calls a myth a situation where engagement drops when advertising is integrated. However, the company makes a reservation — advertising should be implemented wisely.

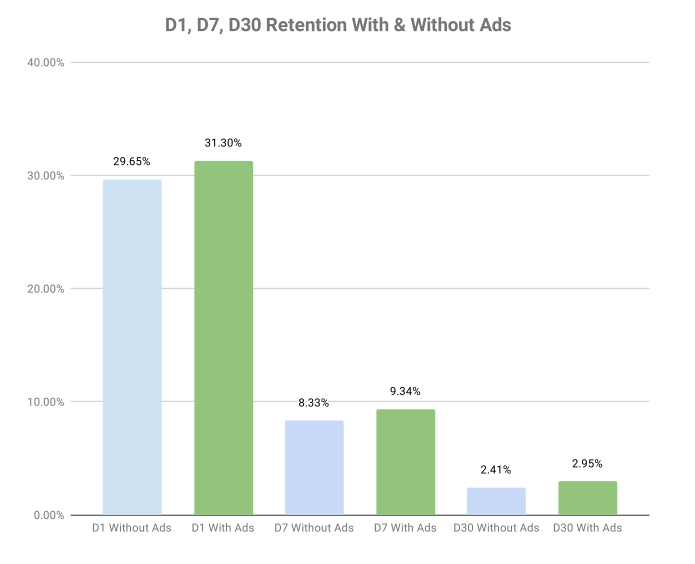

On average, apps with ads have 1-2 percentage points higher retention in the market:

- D1 is 1.65 percentage points higher (5.3% growth);

- D7 is 1.01 percentage points higher (11.8% growth);

- D30 is 0.54 percentage points higher (an increase of 19.4%).

Comparison of retention in games with and without ads

But the situation depends on the genre. For example, games in genres such as casinos, cards and strategies show, on average, higher retention without advertising. Word games, on the contrary, involve players better if they are monetized through advertising.

Comparison of retention in games with and without ads (by day)

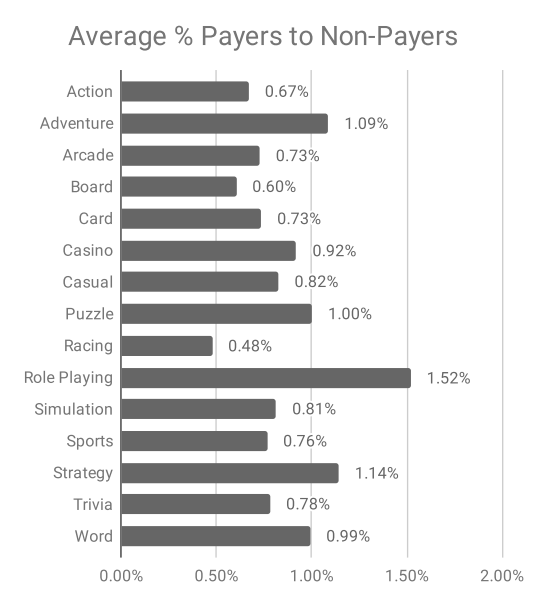

5. In half of mobile games, the conversion to a paying player is 1% or less

Unity calls the conversion rate from 2% successful. At the same time, the average level by genre is much lower than that shown by market leaders.

The ratio of the average number of paying players to non-paying ones

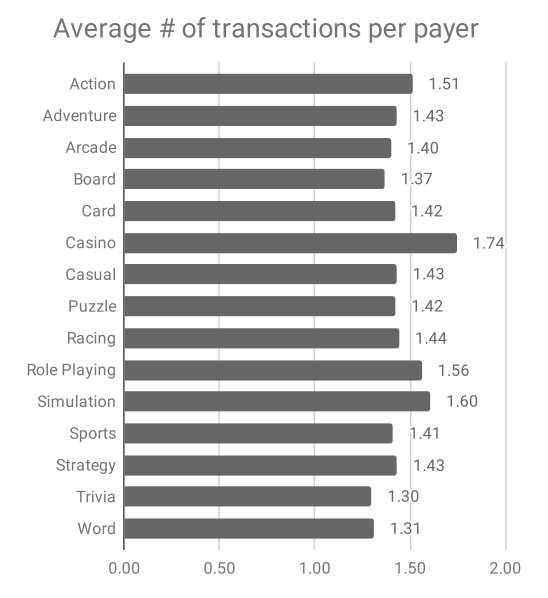

By the number of payments per paying player, the casino is in the lead. Simulators and sports games are also highlighted. However, on average in the market, the paying player makes about 1.4 payments.

Average number of payments per paying player

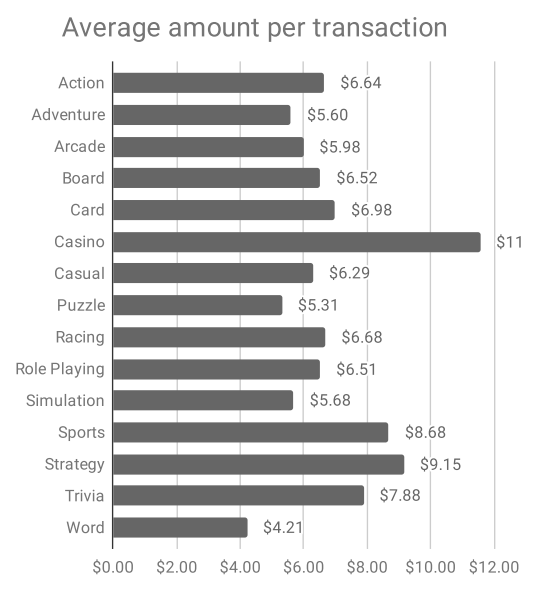

The average payment varies greatly depending on the genre. Leader — casino. The smallest average translation is for word games, which, recall, are mainly monetized on advertising.

Average amount of payment

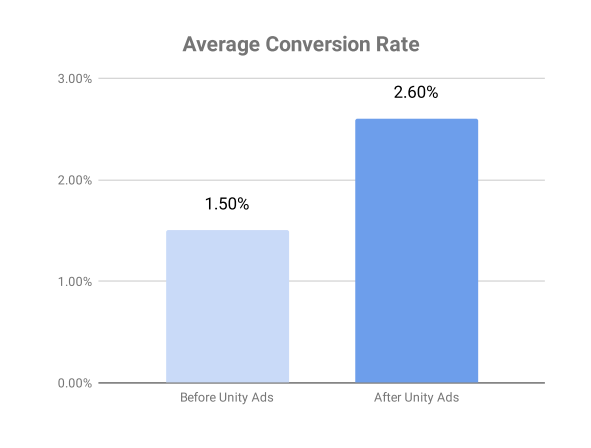

6. Advertising increases conversion to a paying user, but reduces earnings from the same user

On average, after the introduction of advertising (in this case Unity Ads), the average conversion rate increases by one percentage point (this is a lot).

Average conversion rate before and after ad activation

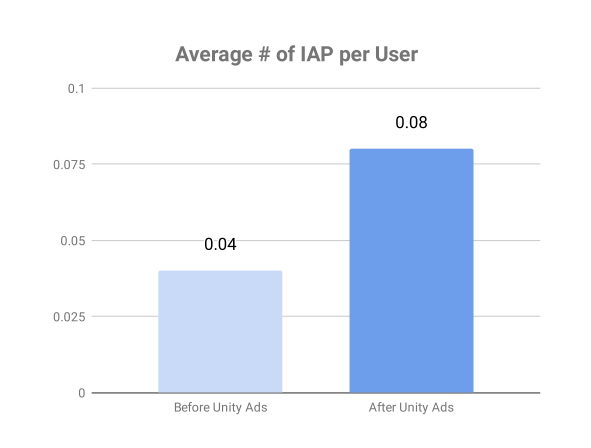

The number of micropayments made is also doubling.

Average number of payments per user before and after ad activation

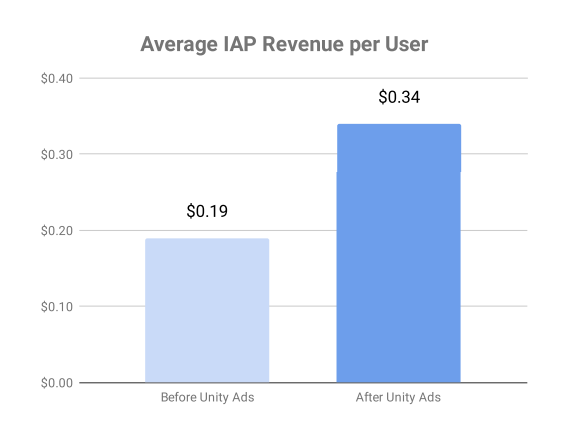

The average revenue from IAP per user grows by 15 cents.

Average revenue from IAP per user before and after enabling advertising

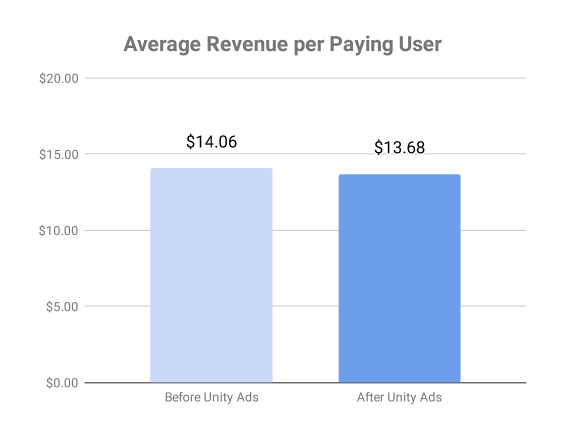

At the same time, the average revenue from a paying user, on the contrary, falls by 38 cents.

Average revenue per paying user before and after enabling advertising

7. 26.4% of mobile gamers view at least one ad per day

But on average, regardless of the gaming category, a user views about three or four ads in mobile games every day.

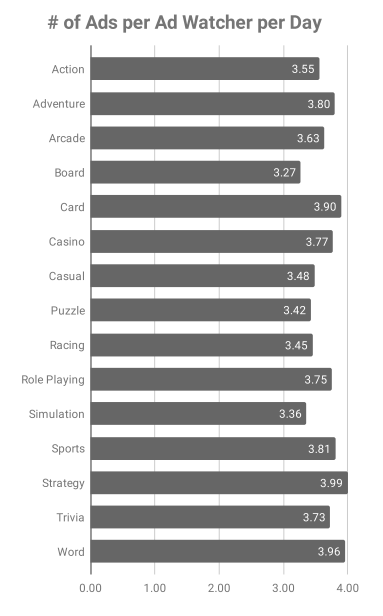

The number of ads per viewer every day by genre

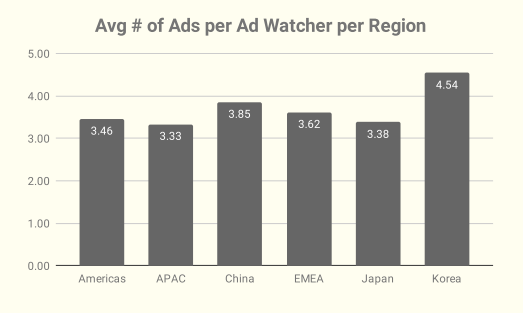

The average number of views also has a slight effect on the region. For example, the leader in the number of average views per player is South Korea.

Number of ads per viewer every day by region

From an interesting point: the number of players who view from five commercials per session increased by 9.4% last year. In other words, people are getting used to the format and are ready to watch more and more videos.

Is there any news? Share it with us, write to press@app2top.ru