We continue to publish videos of presentations (plus transcripts) from the "Gaming Industry" conference held in July. Up next is the presentation by Alexander Shchevelev, CEO of the Maningame studio. He shared how and how much one can earn today on free-to-play games in Russia.

The next "Gaming Industry" conference will take place on October 15-16 in Moscow. Learn about its speakers and buy tickets here.

My presentation is about earning money from games in Russia. It’s primarily for those who love making games but don’t want to move to Cyprus or Kazakhstan, and for those whose main audience is in Russia.

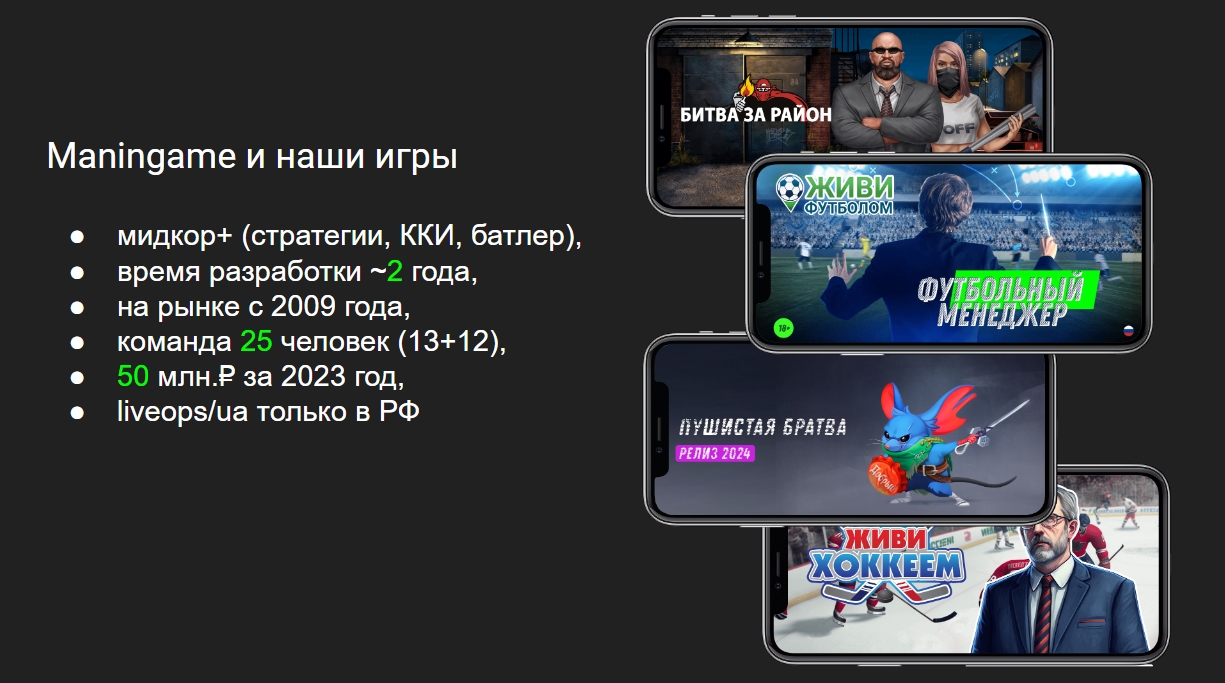

A bit about us. We've been in the market for a long time. We made our first game 15 years ago, the second one 10 years ago. In general, we work on games for a long time, thoroughly. We specialize in midcore games. Our team is small. Our core team in Moscow consists of 13 people. Another 12 work remotely. Last year, our studio's games earned about 50 million rubles.

So, in 2022, the rules of the market changed significantly. The ability to enter the Facebook Ads panel or the TikTok Ads panel or the Google Ads panel and press the magic "Start Promotion" button to earn millions of dollars disappeared. Vertical scaling stopped working.

However, this does not mean that you can no longer earn from the local market. You can. Moreover, you can earn just as much as before. There is money, there are platforms, you just need to change your approach to a horizontal one.

How to understand how to promote under current conditions?

Let’s start with assessing the niche and competitors.

But I’ll say right away that hyper-casual projects in Russia will not be promoted. Don't make simple games. This doesn’t work as a business.

Let me explain.

There are young individuals who develop such projects solo and earn millions from them. But they're like slaves on a galley. They are forced to release game after game constantly.

That is also a path. You can earn from it. However, if you want your business to scale, it's better to make more complex projects—with meta, with IAP, so they can be worked on long term.

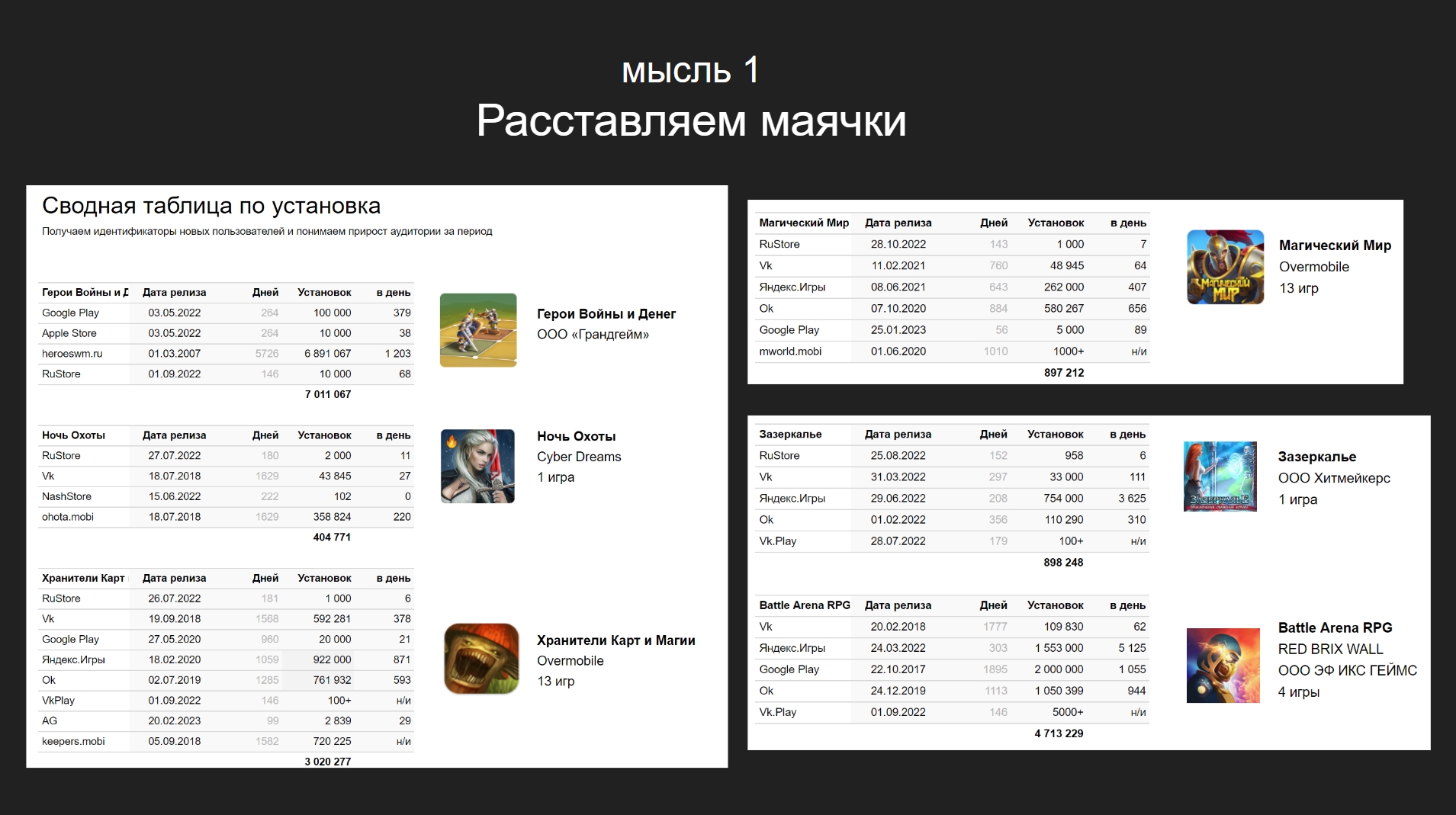

Now about assessing niches and competitors.

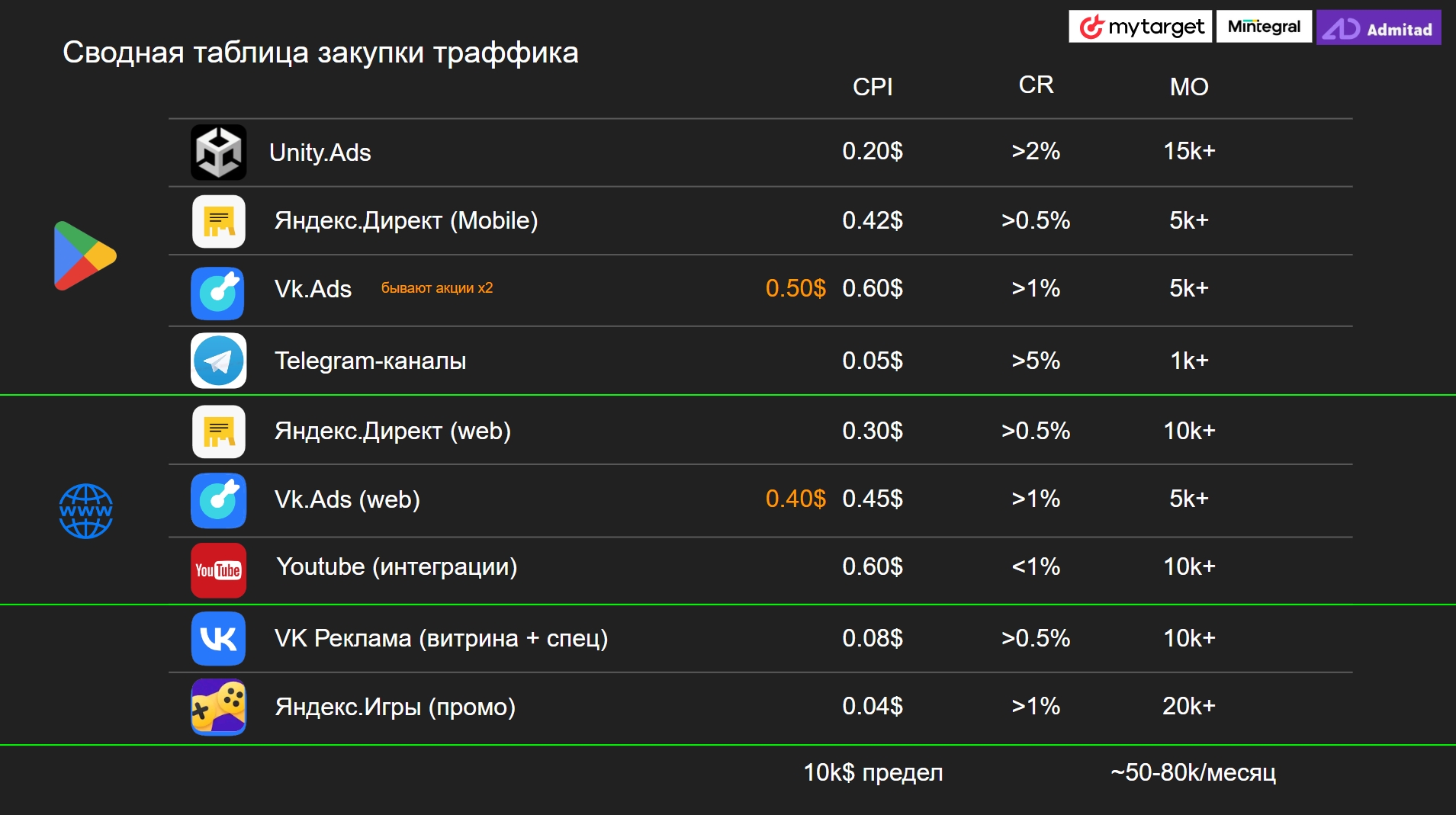

We choose a niche, say we are interested in midcore. Then we select a couple of projects that we consider our competitors. Next, we look at which platforms they are represented on, write down their release dates and number of installs. After that, we can estimate how many downloads each platform can generate for us per day.

To jump ahead, in Russia, a midcore title today can achieve 10-15 thousand installs a month. A casual game will naturally generate two to three times more.

How to find out the number of installs?

What I will tell you now isn’t proprietary know-how. Everyone on the market does it this way.

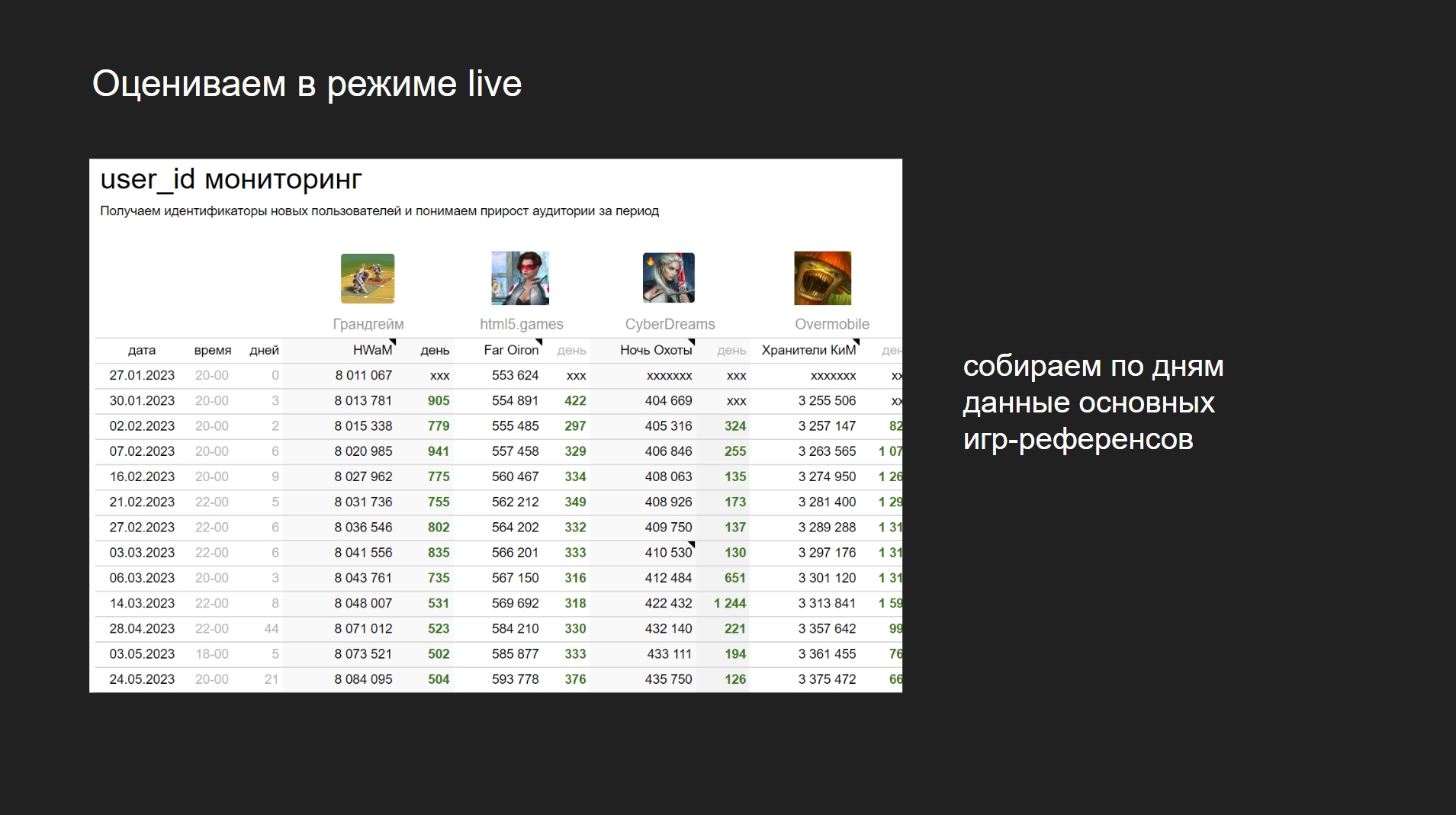

So, you take a competitor's game, register, and get a user id. In midcore, all installs go in the backend. You can extract the necessary numbers there. Then you log in the next day, register a new account, and get a new user id. From it, you learn how many downloads the competitor received over a specific time frame.

This can be parsed to then know about peaks and correlate them with features on specific platforms. Plus, of course, this will allow you to find out the distribution of app downloads across stores and evaluate their revenue, which we will talk about a bit later.

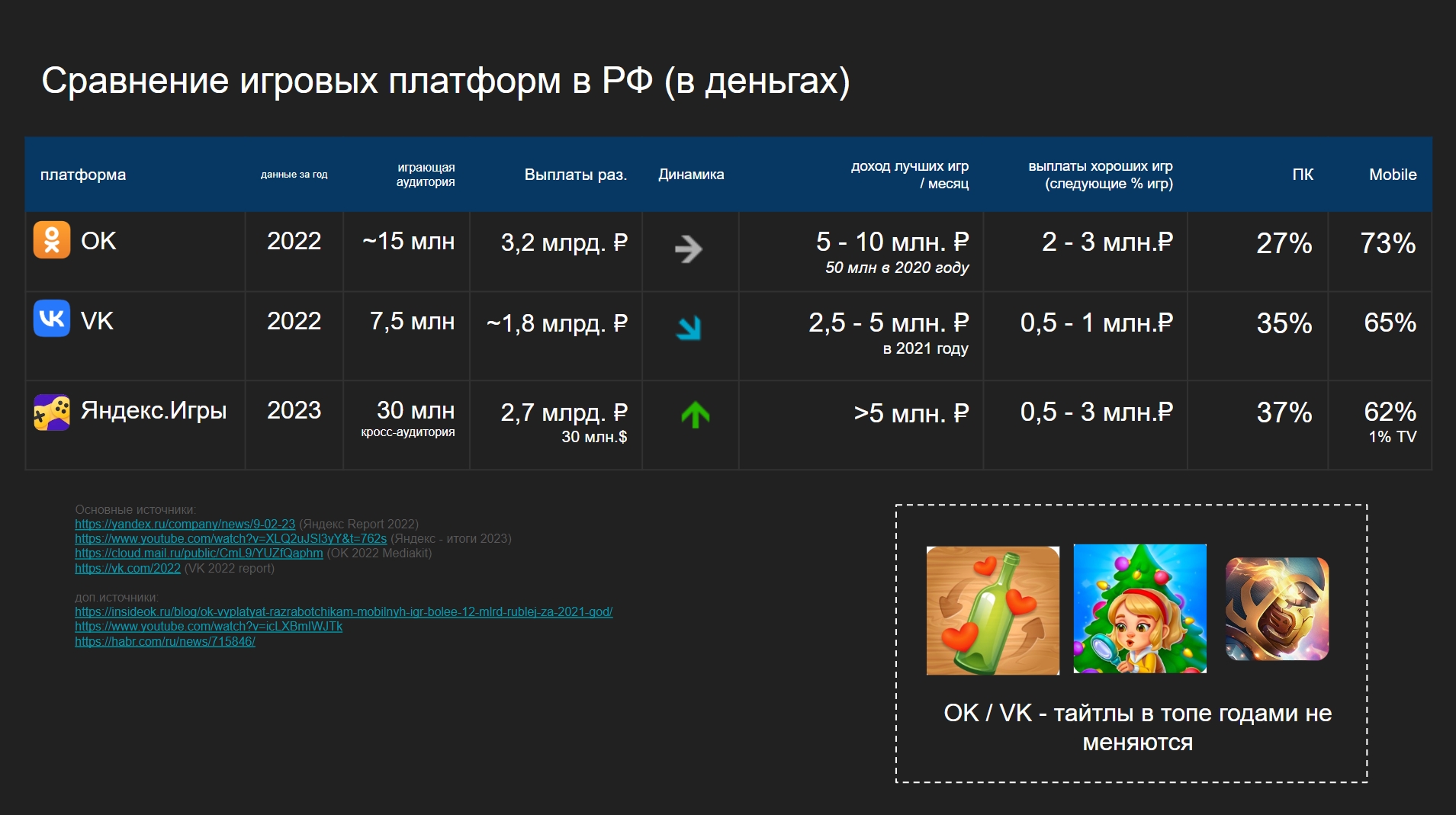

Now let's talk about platforms. There are three main ones in Russia: "Odnoklassniki," "Yandex Games," and "VK." But in fact, for most market participants, there are only two platforms.

Why?

There is a lot of money in "Odnoklassniki," but it's all distributed among the top 10-20 titles. Beyond the top 30, there is no money on the platform.

But "Yandex Games" and "VK" do have money. If you make a decent game, you can easily earn between 100 thousand and 500 thousand rubles a month. A serious project can expect revenue of one and a half to two million rubles per month. As for the leaders, they earn 5-10 million rubles a month on these platforms. But don’t look at the top, those are games made over 10 years ago. They earn these amounts thanks to their loyal core audience.

Now let's talk in detail about each platform individually, about horizontal scaling on them, and explore the most interesting options.

"VK"

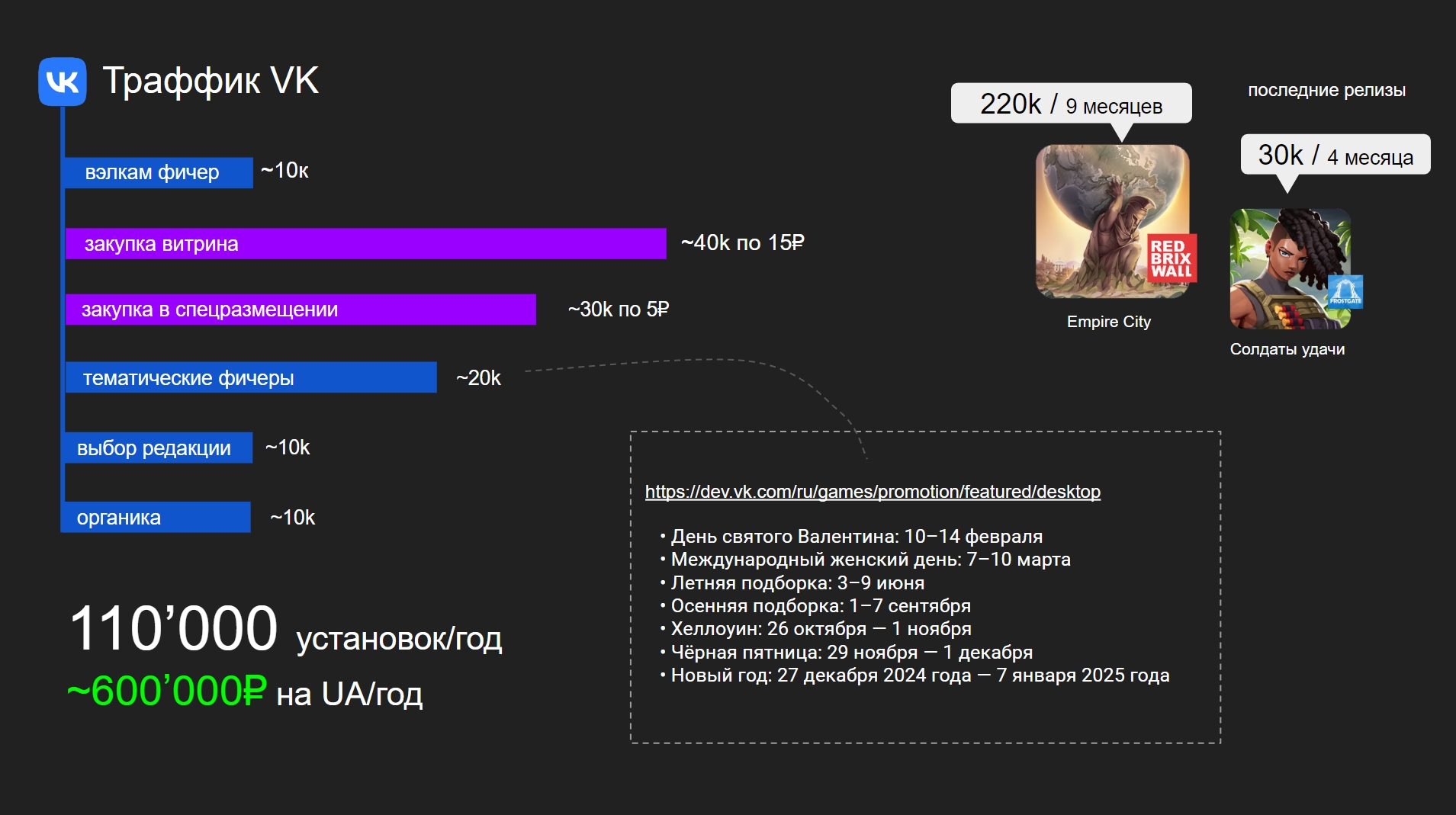

In "VK," your traffic structure is distributed approximately like this:

Half of your traffic will be organic thanks to:

- thematic features;

- welcome features;

- editor’s choice;

- ordinary organic traffic.

Plus, you can purchase traffic. This is a very important point. In "VK," you can buy cheap and high-quality traffic. For example, we buy about 70,000 installs there.

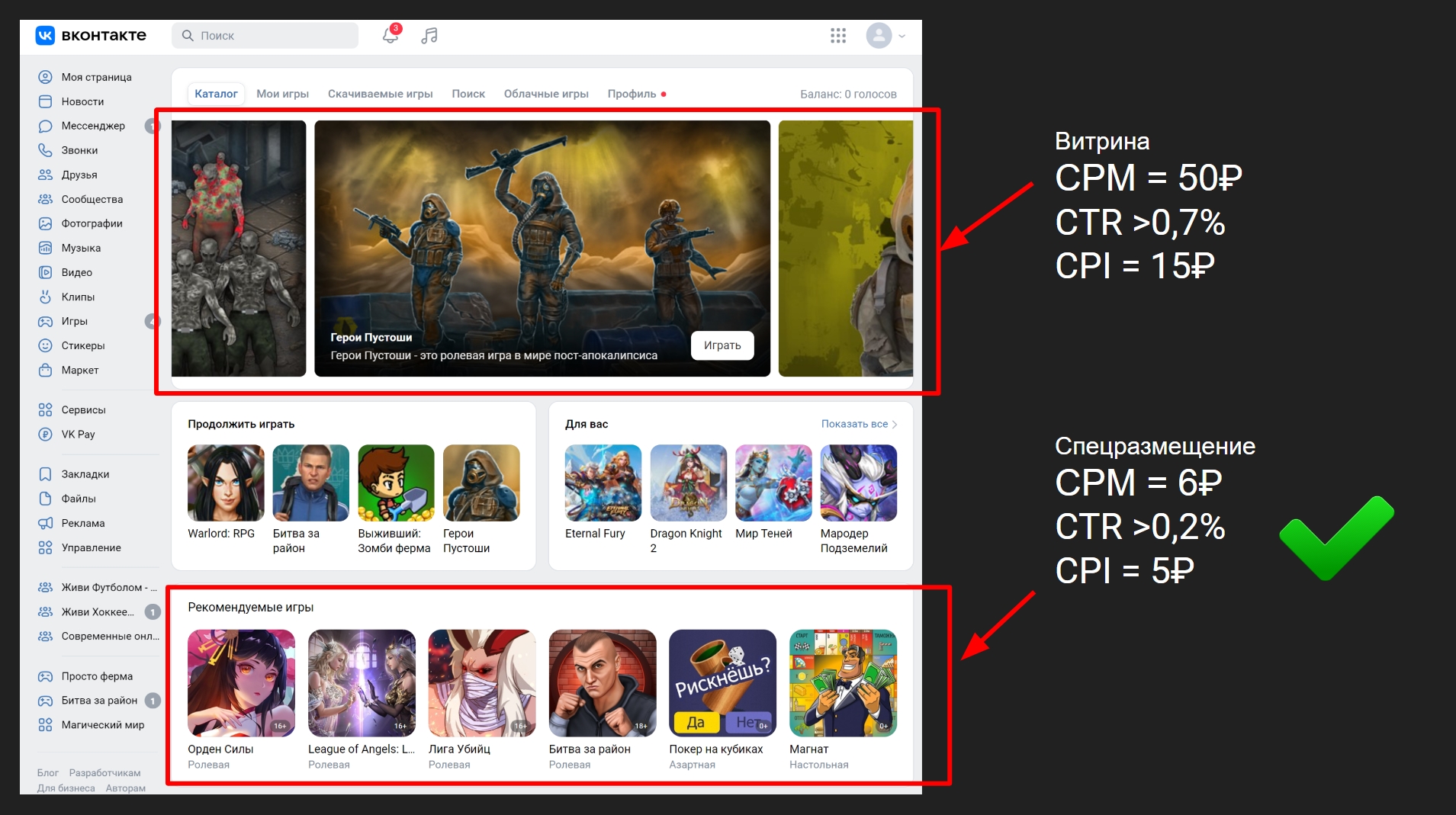

There are two types of placements in "VK."

There is a games feature panel where you can buy your advertising. The CPI on the top shelf will cost 15 rubles. Of course, the cost depends on ASO, on screenshots, but plus or minus, you can buy installs for 15 rubles.

You can also buy ads in the "Recommended Games" section (special placements). Here, the CPI will cost 5 rubles.

You purchase both through the old "VK" panel. Developers promised to transfer this tool to the new panel. I don’t know if they have, but in the old one, this opportunity still exists.

Where does this lead?

Nowhere else in "VK" do you need to buy traffic. Only here.

In total, if you made a quality game in six months to a year with a team of five people, you can expect 100,000 installs, 70% of which will come from purchased traffic.

You won't spend much on advertising—about 600,000 a year. That's 50,000 rubles a month.

For example, here are the following midcore releases:

- Empire City collected 220,000 installs in nine months;

- "Soldiers of Fortune" collected 30,000 installs in four months.

What conclusion can be drawn from this?

There is traffic in "VK." You can both get it and buy it.

This link contains information on thematic features on the social network. They also generate traffic.

I want to note here that promoting a game is not only about buying ads but also working with the platform. You need to apply to participate in these features, and the platforms themselves can also feature you.

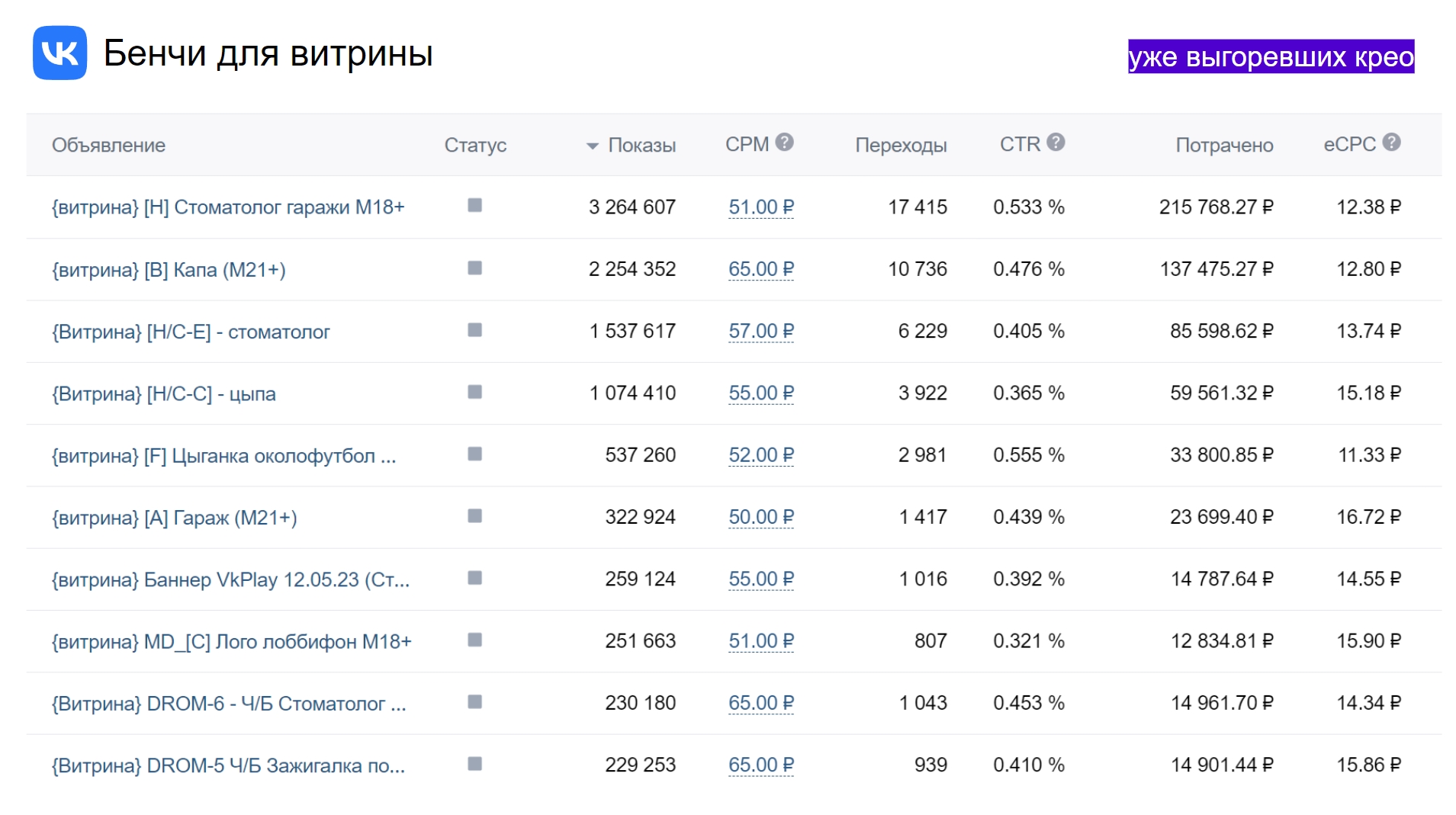

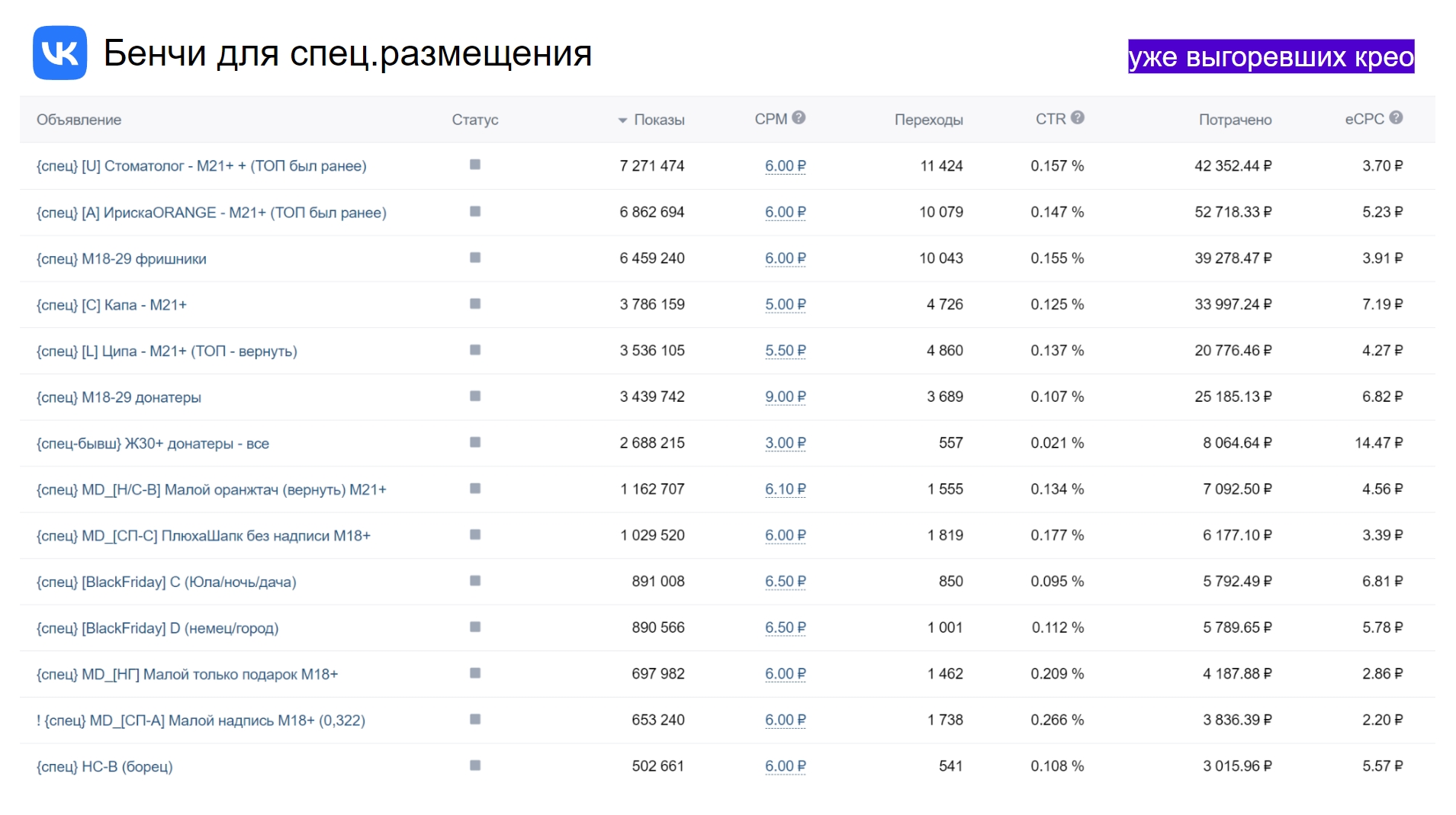

The next two slides are benchmarks for purchasing from burnt-out creatives, so you at least have something to refer to when buying.

"Yandex Games"

This is one of the most traffic-generating platforms. There is a lot of money there. The audience is substantial. But there are nuances.

One major nuance is that the platform's traffic is mixed with children. On one hand, there are many paying substantial users over 35. On the other, there is a non-paying children's audience. Thus, on our projects, we, for example, get lowered retention. All our marketing metrics turn out to be understated.

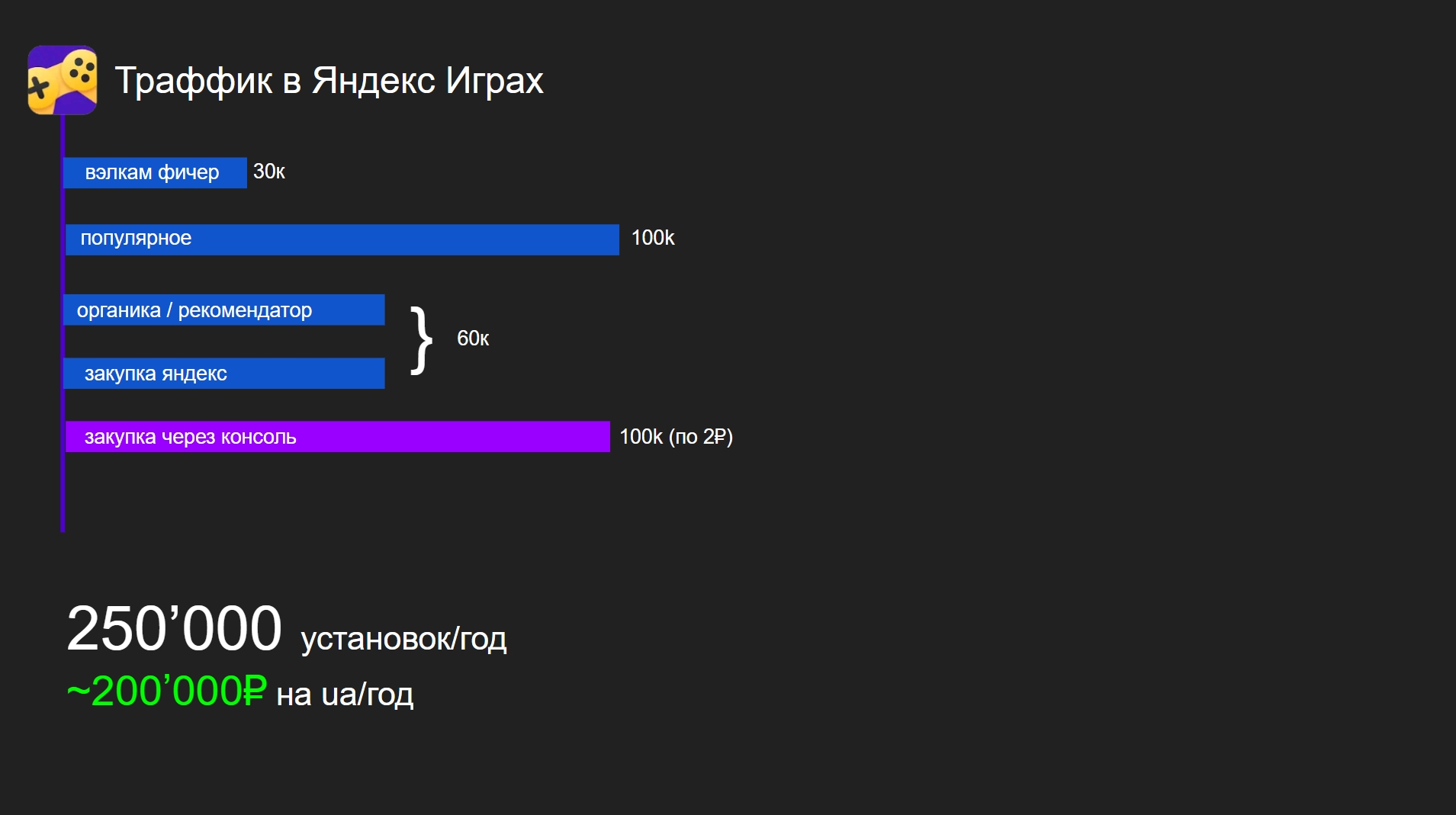

It is realistic to get 250,000 installs per year from "Yandex Games" with marketing expenses of about 200,000 rubles.

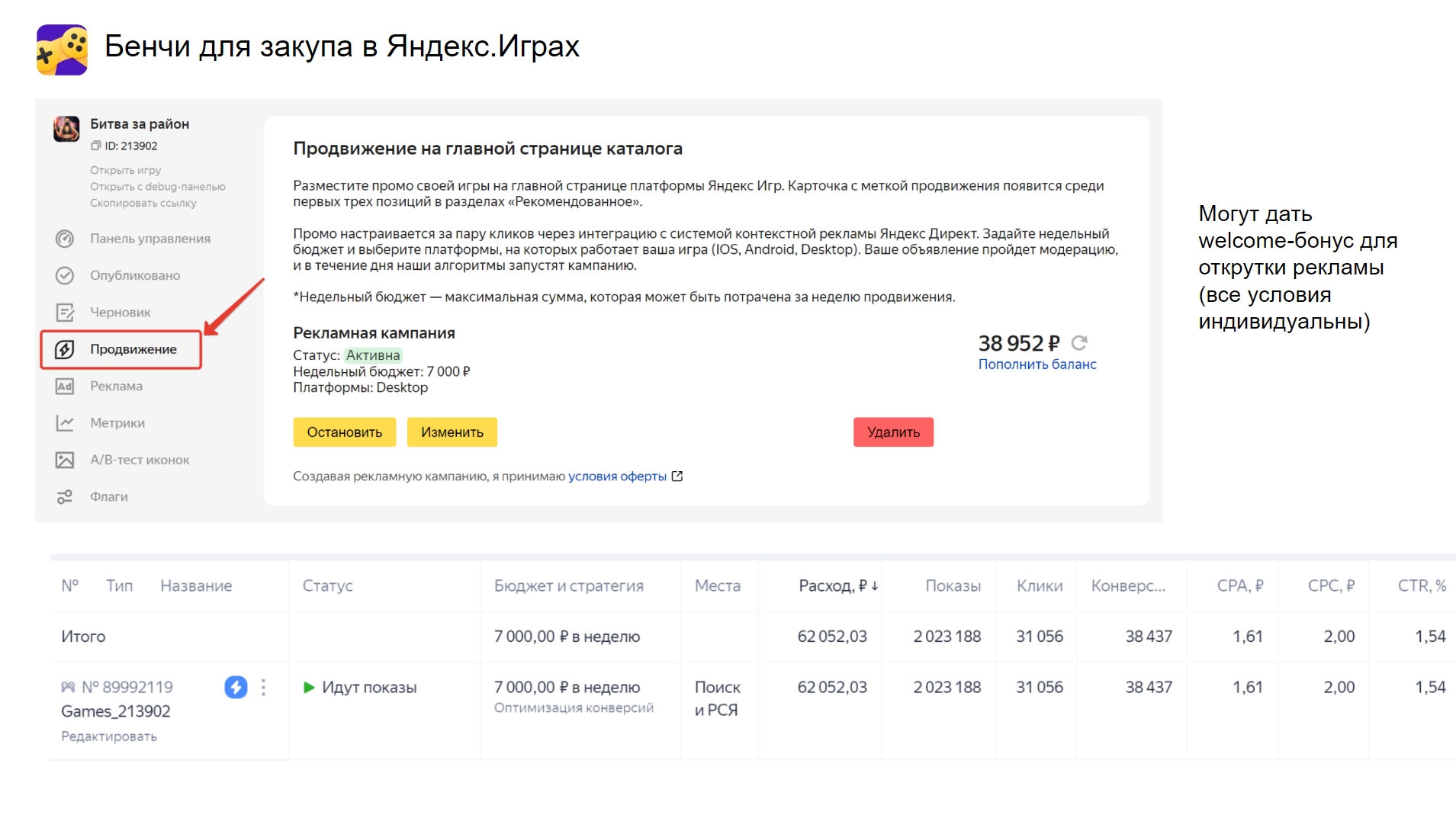

User Acquisition on "Yandex Games" can only be conducted within this platform. Do not promote your game on "Yandex Direct." The CPI for a midcore game costs us roughly 2 rubles. For casual games, it is even cheaper—50-60 kopecks.

Now let’s talk about other platforms.

VK Play

Many criticize VK Play for the lack of traffic.

Indeed, there is very little traffic there. We have received around five thousand installs or even less for the entire time of operation.

But there is a very lucrative audience. ARPPU in the store is 84 dollars. There are also many whales. LTV in VK Play is 2-3 dollars. This is an excellent indicator. No other platform in Russia shows such values.

Another plus is the readiness to actively feature web games within their platform.

RuStore

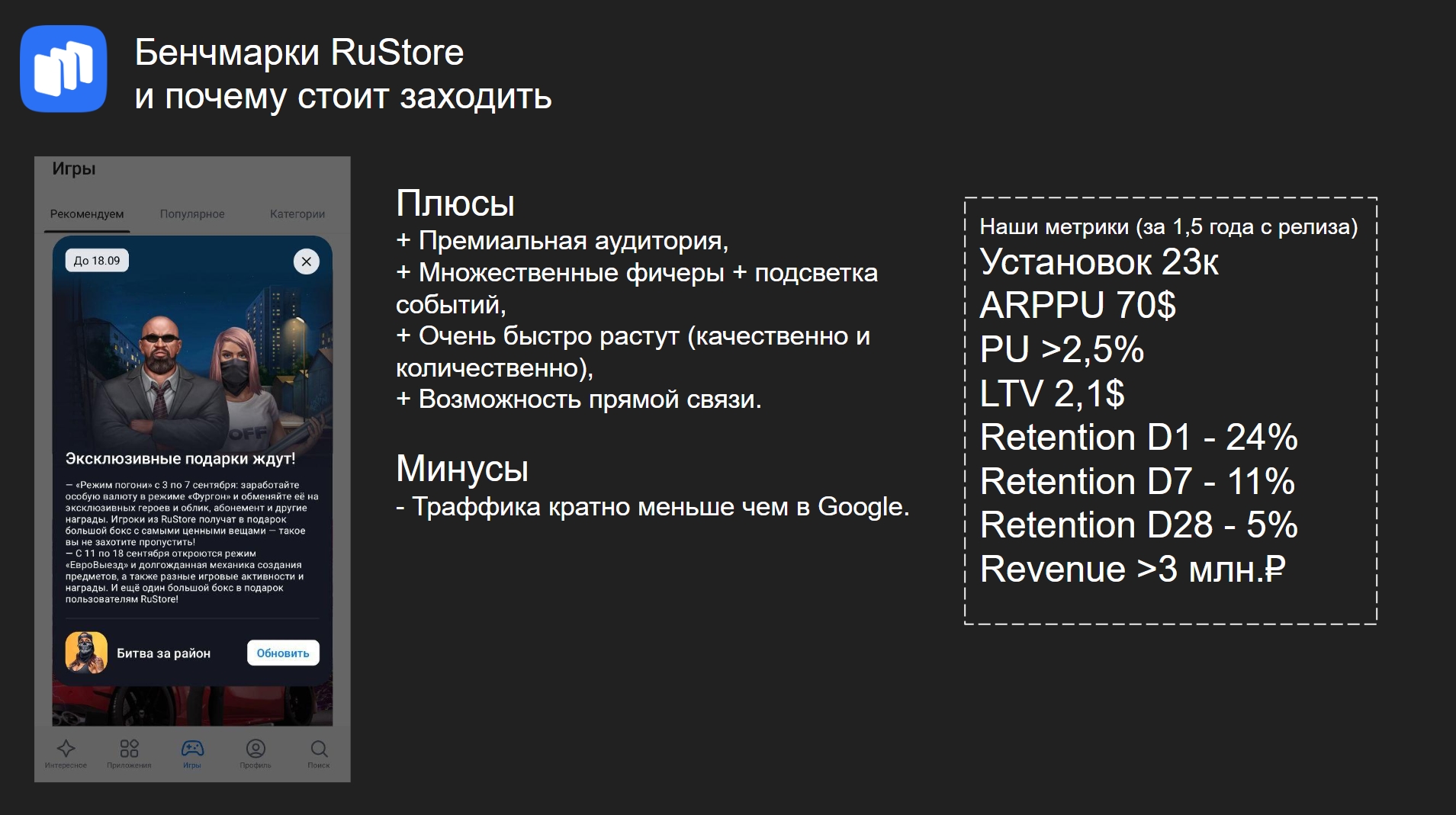

A very interesting story that no one initially believed in.

It didn't cost us anything to try working with the platform back then. We simply uploaded a game and then earned 2.2 million rubles from it in the store over a year (the revenue has now reached 3 million).

ARPPU here reaches 70 dollars, with LTV also showing very good figures of 2 dollars.

Yes, there are not many installs. The platform generated 23 thousand installs over a year. If it were a hyper-casual project, you wouldn't make money here, but with a casual project with IAP or, more so, with midcore—it's a different story.

Plus, the guys provide a feature.

Browser-based Games

This is probably one of the main points of my presentation: many have forgotten there are browser-based games. Browser-based games are regular web games. You create a domain and purchase traffic for it in "Yandex Direct" and "VK."

This is very substantial traffic. It monetizes well. But there is a ceiling. You won’t buy traffic for more than 200-500 thousand rubles.

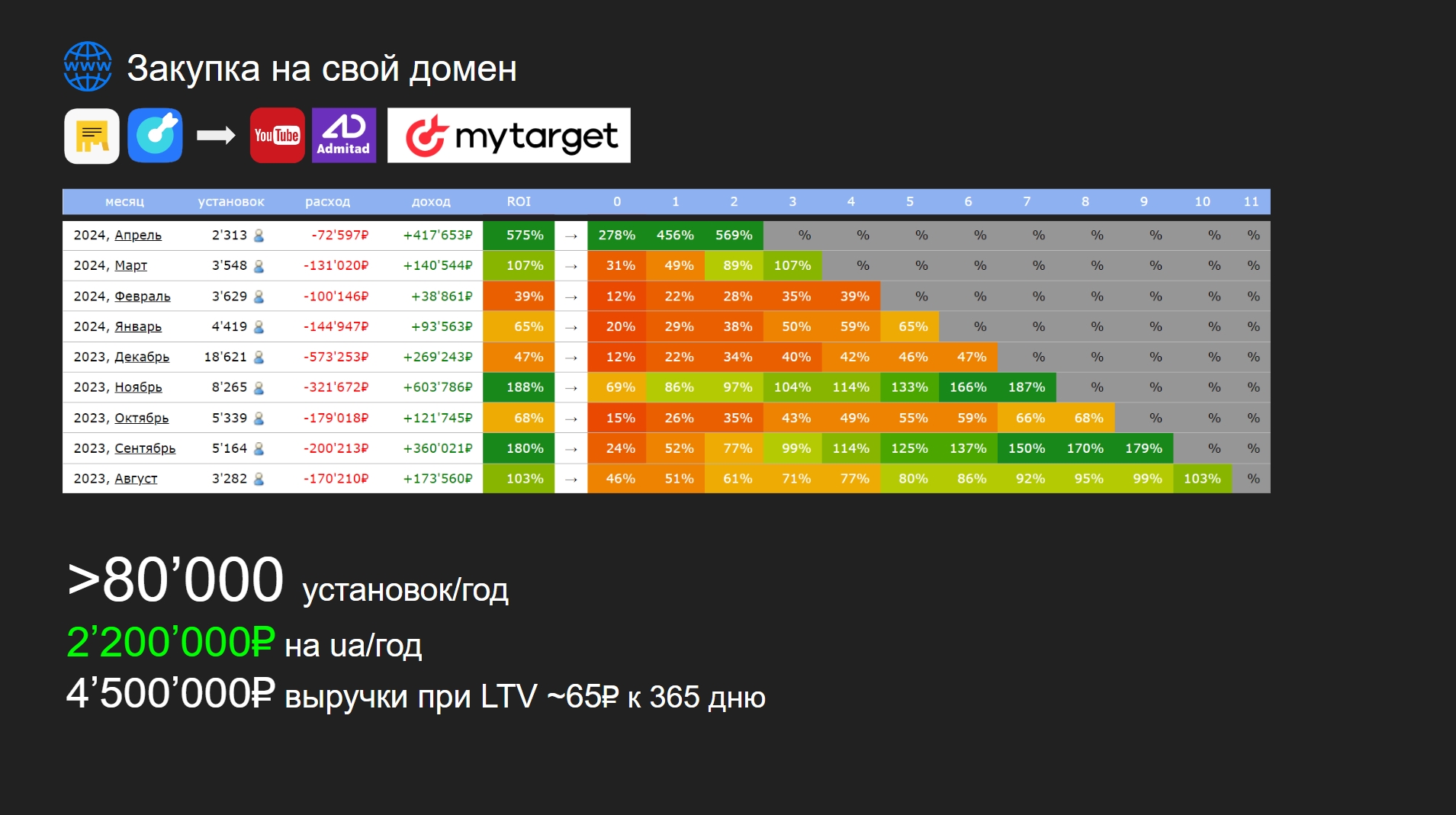

In the table below, ROAS is by month. For example, you spent 100 thousand rubles and recovered 30% of the traffic in a month. Our breakeven point is usually the ninth or tenth month.

By spending 2.2 million rubles on 80 thousand installs over a year (through "Yandex Direct," "VK," and other networks), we earned 4.5 million rubles from this cohort (LTV from a paying user was 65 rubles by day 365).

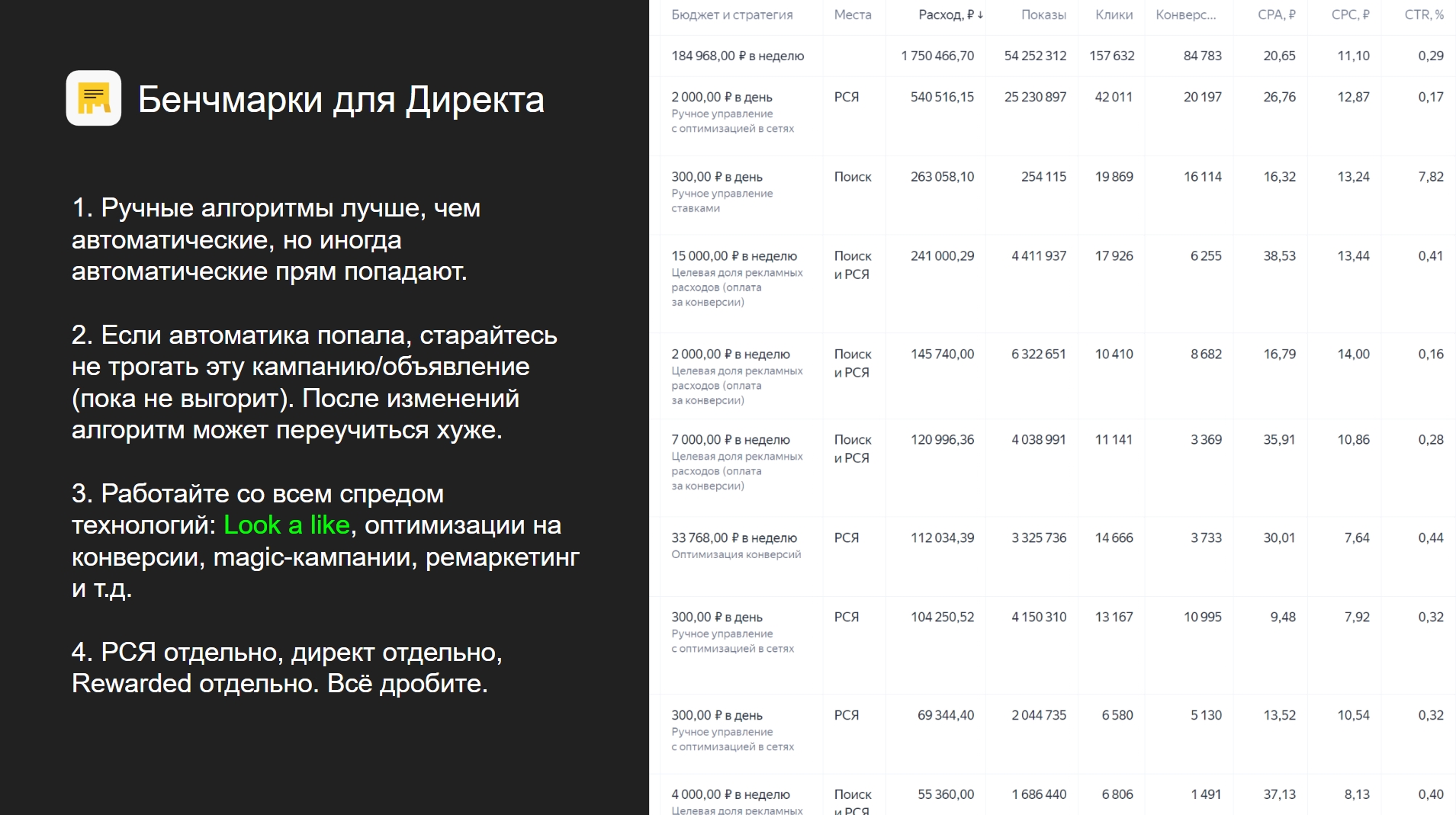

Here are benchmarks for "Yandex Direct":

Regarding "Yandex Direct," let me share the following: of course, you can rely on their automatic algorithms, but if you manually set it up, create the right targets, and work with look-alike audiences, it will work better than their algorithms.

Now let me tell you a bit about look-alike audiences. This is when:

- you insert a zero pixel in your game that processes its entire audience;

- then you go to "Yandex Audience" and use the Affinity index to find users similar to those who made payments in the game (our cohort totaled 10 thousand people);

- the platform selects, say, an audience of 100 thousand similar users;

- you target this audience with advertising through "Yandex Direct."

With proper setup, you will get a wildly performing campaign with very high LTV, ARPPU, and a very targeted audience. Yes, there won’t be much audience, yes, over time it will erode, and in two to three years, it will be much harder to make a purchase for a new project from a look-alike.

Important: in "Yandex Direct," never lump everything together. The advertising network and the search engine are separate. Break everything down, segment everything for each audience, for each advertising campaign.

And I want to emphasize another important point: purchase is the most important if you create games for the long term. The fact is, during the purchase, you not only get directly bought new users, but you also receive an organic boost, because with downloads, the game rises higher in the catalogs, and with good metrics, the platform may start promoting you in features. If one platform highlights you, others will notice you, come to you, offer traffic. No special conditions will be discussed, but they will give you downloads, and they will give you a lot.

This, however, will not happen if your project is not good. In that case, sorry, nothing I discuss can help you. But a regular game with correct monetization and decent metrics can be scaled, and you can earn with it.

Telegram

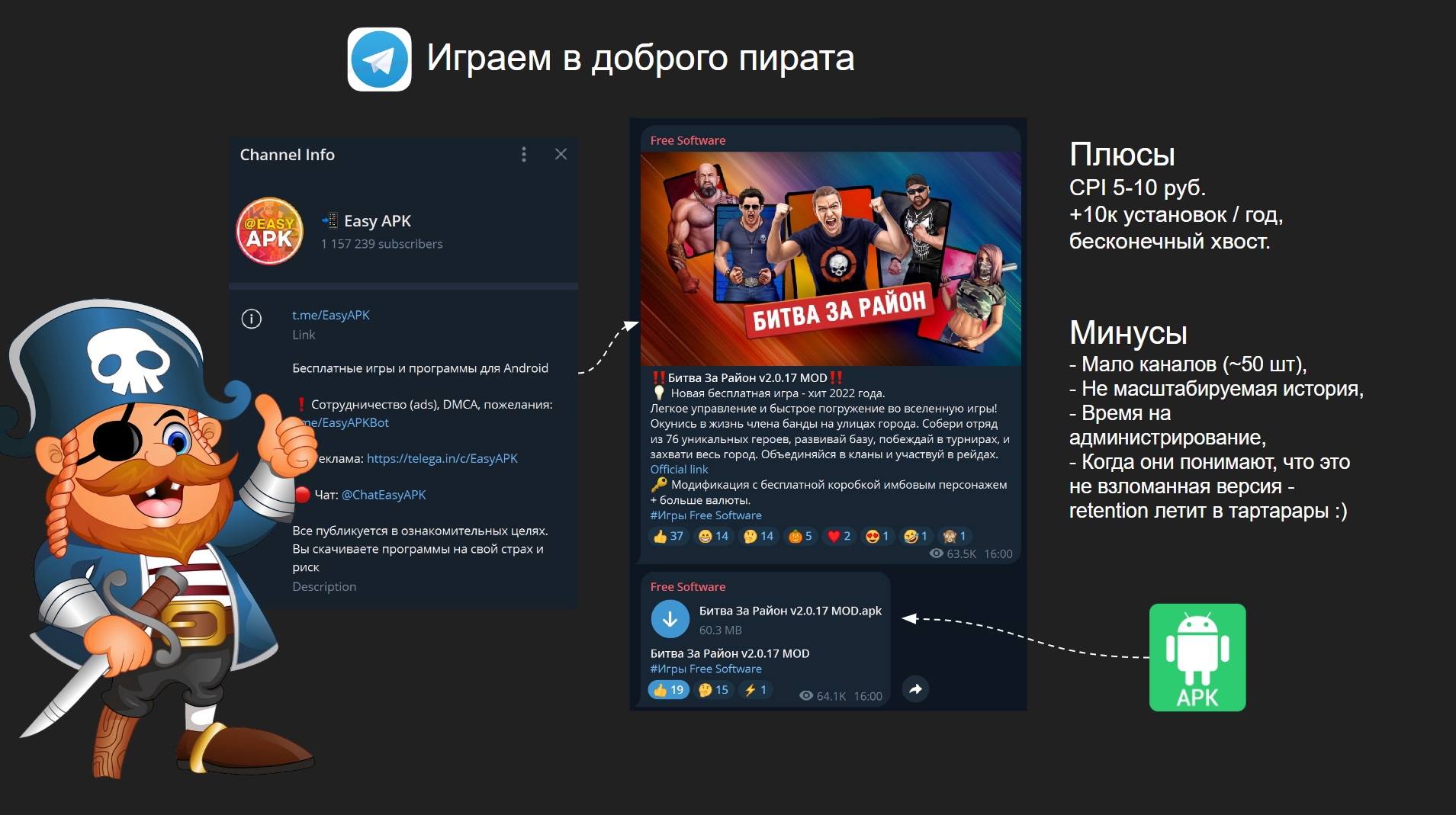

If your game has an APK, you can promote it on Telegram. This is our discovery. How does this promotion work?

We find Telegram channels with cracked APKs. We place our game's APK there under the pretense that it's cracked. The differences from the usual version should be minimal. We offer a bit more soft currency, hard currency, additional superheroes at the start. Then in these channels, we claim it’s a new cracked game, urging users to download it. And users run, download, play. Moreover, they donate.

Thanks to this approach, we received 10 thousand installs from Telegram over the year. Installs with this type of promotion are very cheap, costing around 5 rubles.

One of the benefits is the endless tail of installs. In Telegram channels, these posts are periodically found, shared, reposted in stories, or elsewhere. As a result, we receive several downloads per day.

Overall Promotion Strategy

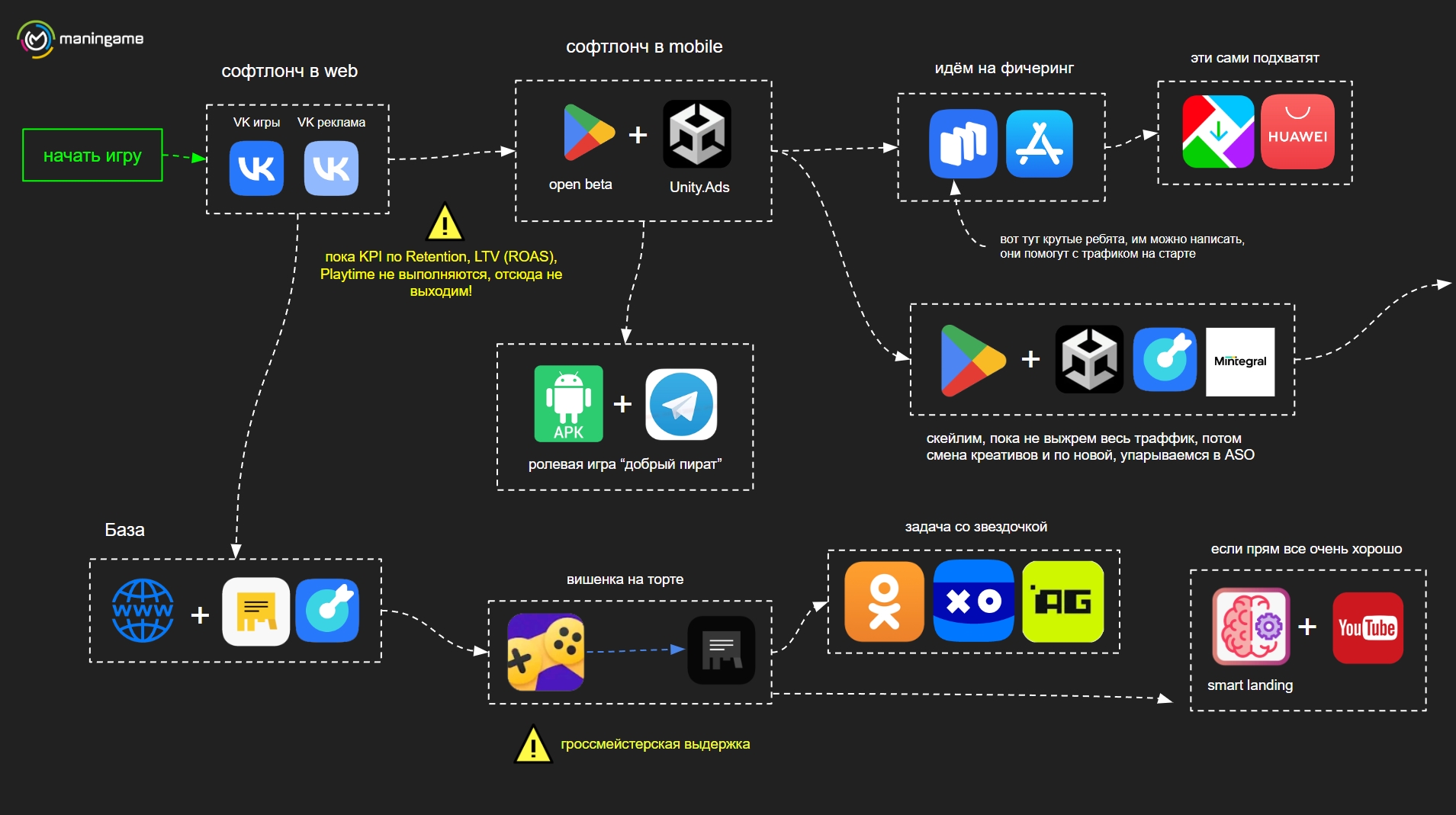

Below is a slide on the best way to launch.

If you have only mobile, then go to the App Store, Google Play, RuStore, and HUAWEI AppGallery.

If you have a web game, then things get more interesting. It’s better to start with a soft launch in "VK."

Why?

The point is that "VK" doesn’t automatically feature, so it’s easy to take metrics. So, you make a game, release it, buy a thousand installs, take metrics. If there's something wrong with them, adjust, buy another thousand, take metrics… and so on until the metrics reach the desired values.

After that, release the project as a browser game and start pushing it. Why? Because the "fattest" is here. In the framework of a web version, you don’t share revenue with anyone, no commission, you get 97.5% of the money from the product (only the payment system takes a few percent).

Only after you have exhausted this audience—it's time to publish the game in third-party stores ("Yandex Games," "VK," VK Play, and others).

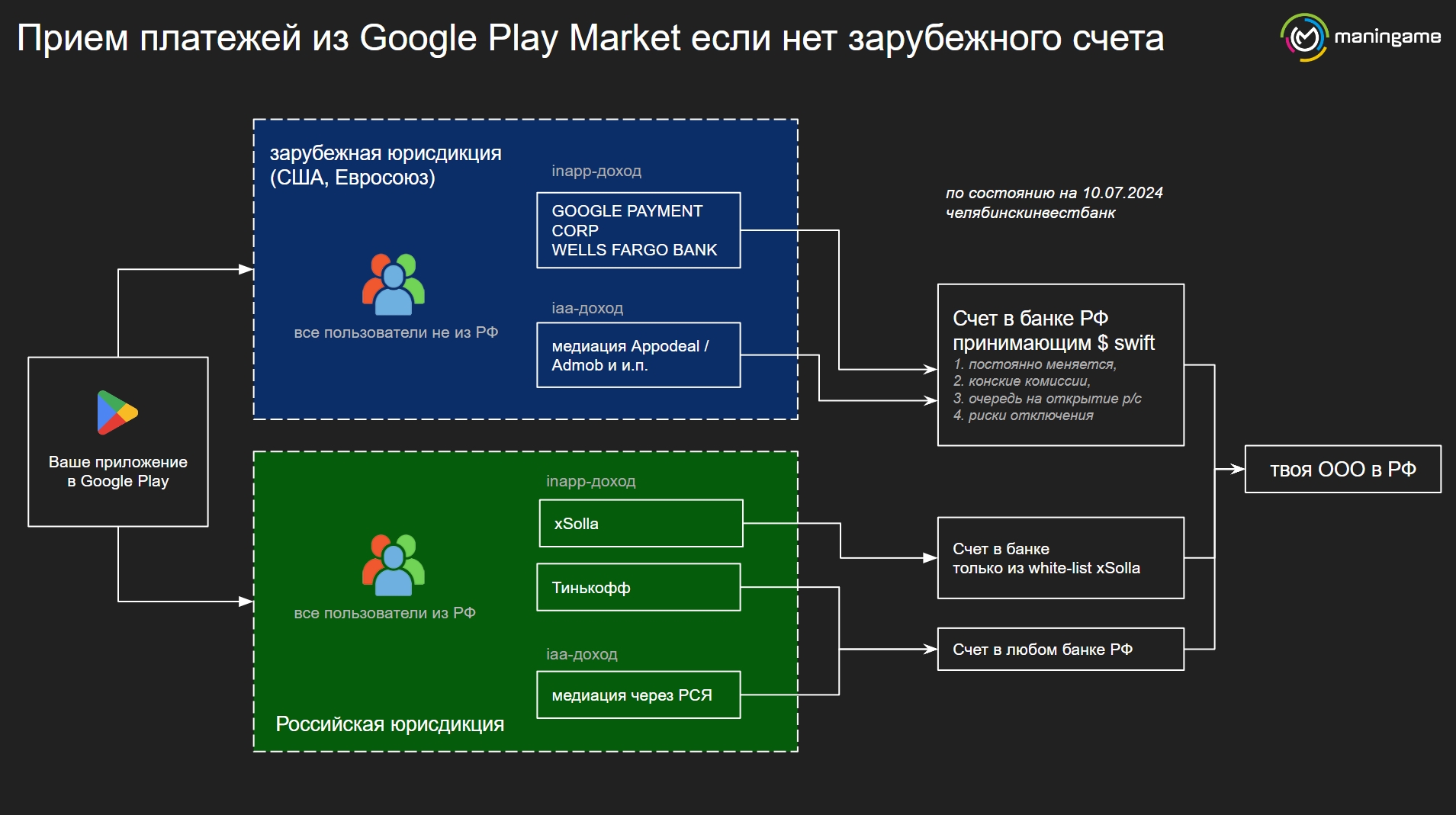

Receiving Payments from Google Play

The last point I wanted to discuss in this presentation.

Many still do not know that you can still earn from Google Play in Russia. The scheme looks like this:

That's all.