Why conduct marketing research before the start of development, as well as how to choose the genre and setting of the future game, – Game Insight producer Ilya Eremeev tells on the pages of App2Top.

The report “Just do it! The Meaning and tools of Marketing Analysis” was first read at White Nights Prague 2017. With Ilya’s kind permission, we are publishing a printed version of it.

An essential part of my work at Game Insight is analyzing the market and competitors. My task is to determine what is happening in the market, what trends are developing at the moment, where windows of opportunity may appear.

In this article, I want to share some techniques and practices that will allow you to make a meaningful approach to choosing a new product and ways to develop already launched ones.

I often encounter situations where developers start a new project without knowing:

- who is their target audience;

- what is their position in the market.

After the release, this leads to:

- facing tough competition;

- the high cost of attracting users;

- limiting the audience and niche of a product designed for the mass market;

- the discrepancy between the monetization model and the audience of the game.

In addition, there are cases when the setting and mechanics do not fit together. It also happens when a game comes out, and the market is already oversaturated, tired of products in the chosen genre or setting.

In order for a developer to avoid such problems, and for publishers and investors to minimize the risks in partnerships, it is very useful to conduct marketing research before starting development or cooperation.

This will not reduce risks to zero, does not guarantee success, but will help you make the right decisions and increase the success of your products.

Let’s start with setting a goal.

Our goal is to find a gap in the market, a niche in which there is the greatest demand and the least pressure from competitors.

What parameters should be taken into account when starting a new project?

- Audience demographics

- Audience size and compatibility of setting and genre

- Trends

- Competitors’ products

While you don’t have a launched product, you can analyze the market using the Fermi method and publicly available data on games from other developers.

One of the most frequent “problems” that I encounter in conversations with developers sounds something like this: “our game is unique and has no analogues, we have no one to rely on in research.”

In reality, for almost any game, you can find references on gameplay, setting, and visual style.

So we will need to find some games that are similar to ours in mechanics or other basic parameters.

To do this, we will be helped by a manual study of the store by categories and keywords and the App Annie charts.

The relative success of these games can be traced by comparing their historical position in the download charts and rhubarb. It is worth taking games that are not below the Top 100 in the category.

Games on the first lines, especially in mass genres, should be treated with caution, since the audience in such games includes all users in general. It will be difficult to get useful insights based on them in the study.

It makes no sense to study the demographics of Candy Crush Saga – everyone played it.

First of all, we will investigate the demographics of these products. The wonderful Facebook Audience Insights tool will help us with this.

To conduct the analysis, we enter a title of one of our test subjects into the field of interest and get a demographic distribution among people who liked the game page, as well as a comparison with the general audience of the social network.

Naturally, the distribution in the group does not match 100% with the audience of the game, but in my experience, these data are quite accurate.

In addition to demographics, you can see what other products and topics users of this game like.

It is worth checking both each analyzed product and their intersections, specifying several titles at once in the interests.

This research will give you an idea of which category of players you can potentially be interested in your product, who you need to focus on in making design decisions.

It is also worth clarifying the search by specifying paying users in the search parameter (Advanced >Behaviors > > FB Payments). This does not guarantee that these people paid specifically in this game, but in general it will show more objective data on the core of the audience.

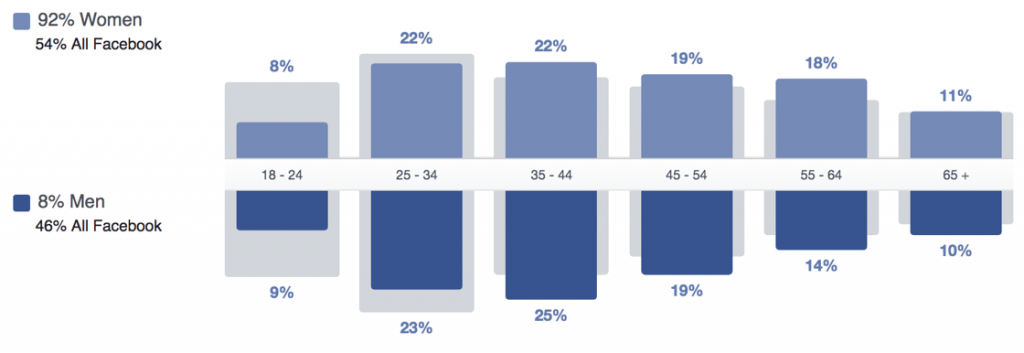

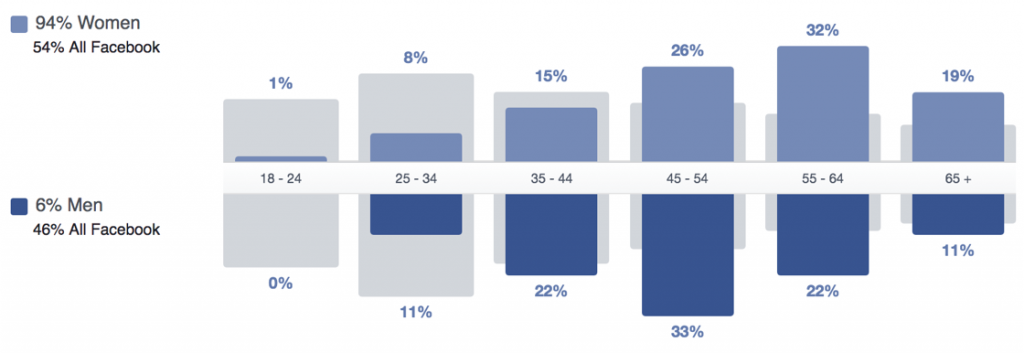

General audiencePaying audience

Sometimes the picture for all players and only for the paying ones is radically different.

Keep this in mind when choosing a monetization model.

Additional information can be obtained from the analysis of target game communities, some communities have statistics open, some can be processed manually. You can read about the tools at this address: https://vk.com/page-43503600_49056860.

Try to analyze data from all sources and get a picture of your potential target audience.

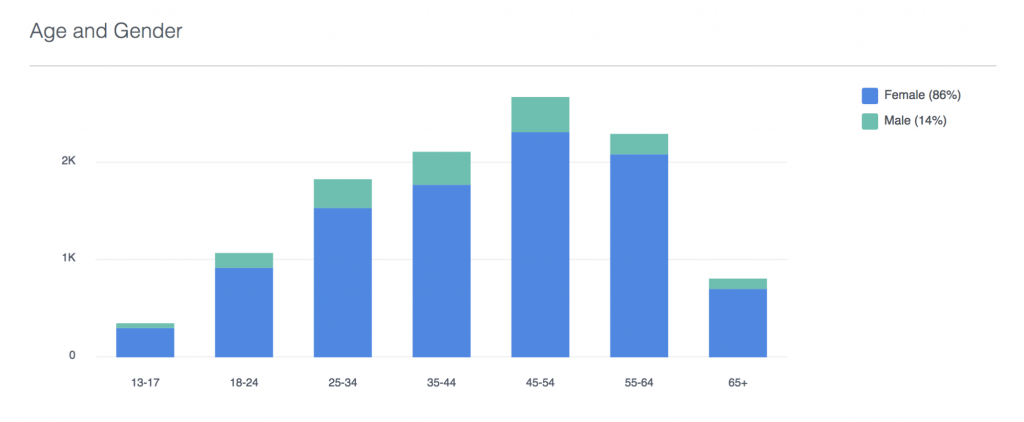

For your games, when Facebook is integrated into the application, you can use internal, more reliable information about demographics, segmented by custom events.

The next thing you should pay attention to is the potential size of the audience.

Again, we can only get indirect data, but it can help to get information about the relative size of the audience.

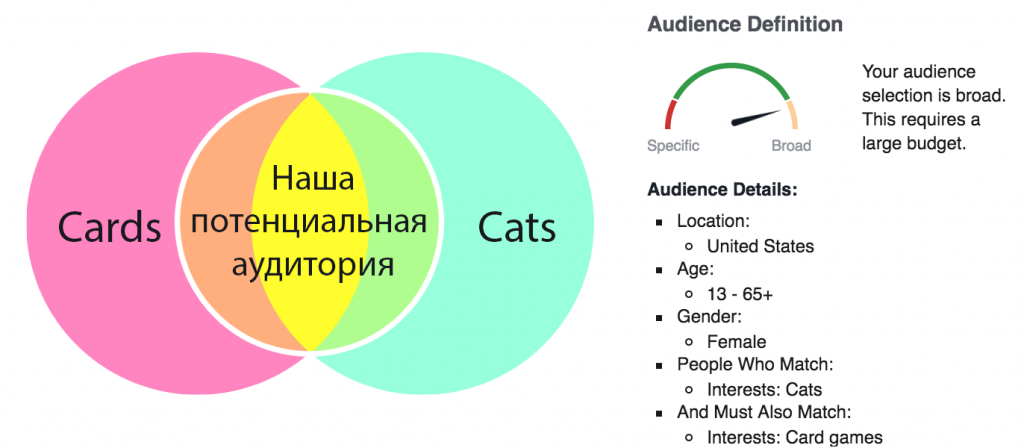

To do this, we can use another tool from Facebook – the advertising manager.

There we can substitute the data obtained from the previous study and deduce the potential audience coverage. Try adding different interests and keywords to see how relevant they are to the selected target audience.

For example, who is more: fans of machtree + zombies or fans of machtree+pirates?

So you can see which settings have the greatest potential for a particular genre and vice versa.

Potential reach: 4,200,000 people

Experiment with other demographic groups, genres, and settings as well.

Perhaps you will find a potentially wide niche of overlapping interests.

It is also important to follow the trends of interest in settings and genres. Interest in settings develops cyclically. At certain moments, various topics come into focus. At one moment, science fiction can be especially popular, at another – pirates, at a third – dinosaurs, and so on.

The film industry helps to track trends. Tracking the calendar of premieres for the next year or two will give a fairly clear understanding of the upcoming trends in popular culture.

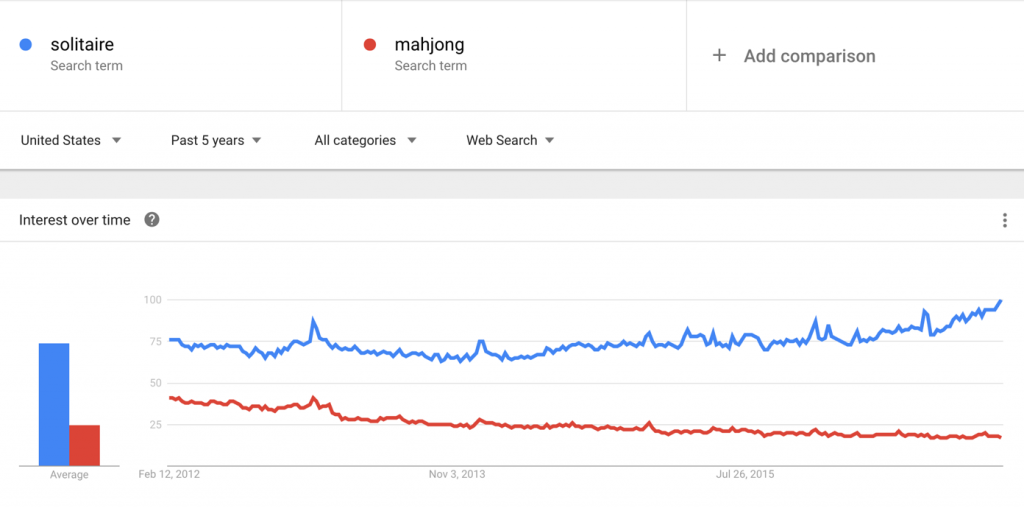

In addition, it is useful to use the Google Trends tool (including for choosing the genre of a new game). Google Trends can help determine, for example, whether interest in mahjong is falling, as well as which is more popular – yachts or motorcycles?

Knowing the audience of our product, we can find a niche with high interest. It remains to find out how high the competition is in it.

We need to collect a list of potential competitors now and analyze them.

We can use data from App Annie or any other analytical platform to find out the position in the charts and assume ARPI and the number of downloads of competitors.

It is definitely worth conducting a SWOT analysis (http://powerbranding.ru/biznes-analiz/swot ) competitors and their potential product. This will help structure the vision of your position in the market, help shape your strategy for attracting users and monetization, form a USP and determine why players will have to choose your product.

Conclusion

Marketing research will not give you the answers to all your questions, but it will significantly increase your chances of survival and protect you from unpleasant surprises.

But please be guided in your decisions not only by numbers, but also by the competencies and desire of the team, since even in the richest and most free niche, success can be achieved only if the team is burning with the project.