How to make sure that the idea of the game is working, — he told in his column on App2Top.ru Maxim Samorukov, founder of the analytical service AppMagic.

Maxim Samorukov, Founder and Head of AppMagic

Game developers often ask the question: is it possible to assess the potential of a future game based on an idea alone? No one wants to invest months (if not years) in development and end up with a product that no one is interested in and does not need. Unfortunately, it is quite a common story.

Some statistics:

- about 10 thousand new games appear in the App Store and Google Play per month, which were ranked in any category for at least one day (in other words, they were noticed by both stores and users, having gained a couple of thousand installations or a couple of hundred dollars);

- two-thirds of them can be called full-fledged games (in stock: distinct gameplay, original graphics, well-developed UI and at least a diligent development team);

- only 3% of these two-thirds earn $100,000 or more during their entire operation.

What happens to the rest of the projects? They are not noticed at all.

How to increase the chances of your future game success? I suggest starting with an assessment of the commercial prospects of the idea of the game. To do this, you should:

1. Find similar products

Before you start developing, carefully study the market. See if there are games similar to your future title on it, what they are, how they look, how their fate turned out after launch.

You can find similar games using two tools:

- standard search in mobile stores (type in keywords and get the result);

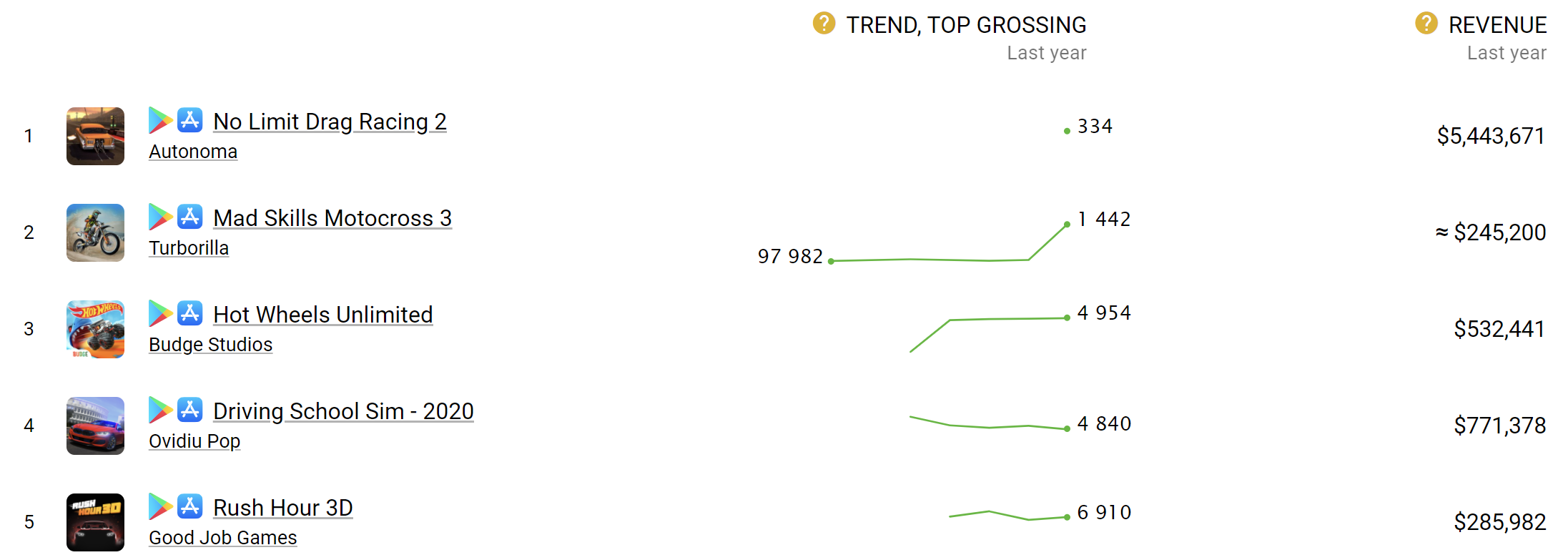

Google Play search works well. For example, if you are interested in creating a game somewhat reminiscent of Archero (on the cover), then this request leads to the issuance of almost 300 games. Unfortunately, this method is not suitable for all games. Search results take into account the competition between marketers for the specified keyword. Therefore, it is very possible that the search will give out products that are not related to the niche of interest.

- search by subgenre in analytical services.

App Annie has such an opportunity (but it is paid and very expensive), GameIntel (you can see 5 top applications of the subgenre for free according to the top free applications in the USA) and AppMagic (free and unlimited).

2. Analyze competitors

Suppose you’ve found the right games, what’s next?

You should make a list of them, and then carefully analyze each project from the segment that you are interested in.

What will it give?

Only then will you be able to understand:

- how original is your idea;

- what solutions in the field of game design, monetization, art and UI correlate with success;

- are you able to create a product that at least will not be inferior to the most successful of the found references.

Important: it is not worth looking for games exclusively on the tops of the tops. It doesn’t make much sense. You risk making a survivor’s mistake. Therefore, it is very important to pay attention to a wide range of other applications, perhaps much less successful.

A very good example here is the same Archero. The original game is very popular. But only she. Everyone who tried to follow in her footsteps did not succeed.

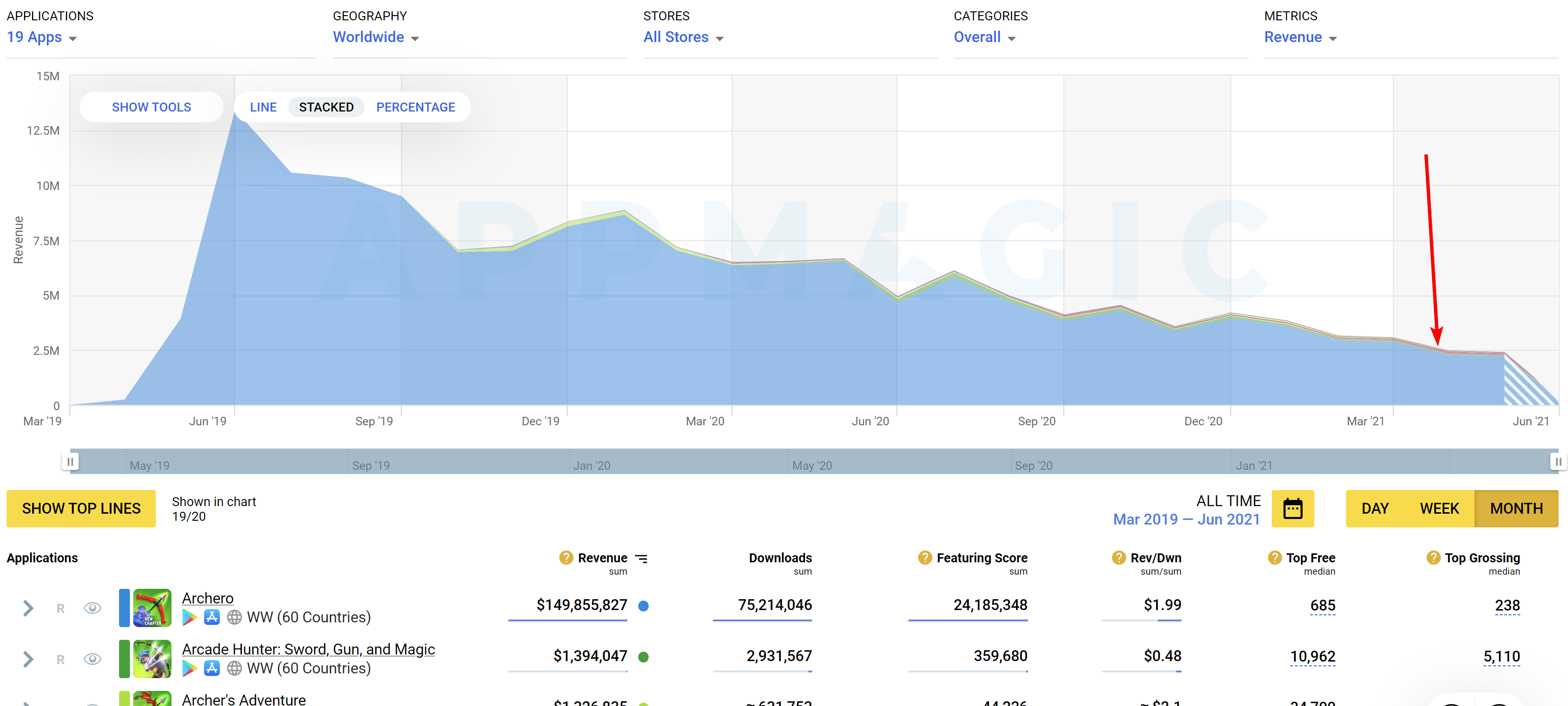

The graph shows the dynamics of Archero’s revenue and 18 of its most notable imitators. Archero’s share of income is blue, and a thin mottled ribbon is the total income of all imitators.

Impressive, right?

Most likely, each of the developers had a vision, hypotheses, they thought they could bring something unique to the format, tried, spent money and time. But no one succeeded, no one even managed to make a minimal Archero competition.

What does this mean? First of all, that developing a game in such a genre is a dangerous undertaking.

Of course, the graph will not tell you why it happened. However, after reading it carefully, it is easy to see exactly which ideas and innovations did not work. Thus, he will warn against mistakes, help save a lot of time, money and nerves.

The graph above is made in the paid version of AppMagic, in which you can compare the revenue of many applications on the graph. But you can also use the free version by comparing the position of games in the top of the highest-grossing applications.

Important: the position of the game in the top box office games is affected only by revenue from payments, subscriptions and paid games. Revenue from advertising monetization does not affect it in any way. Unfortunately, none of the analytics services is yet able to give an acceptably accurate estimate of advertising revenue.

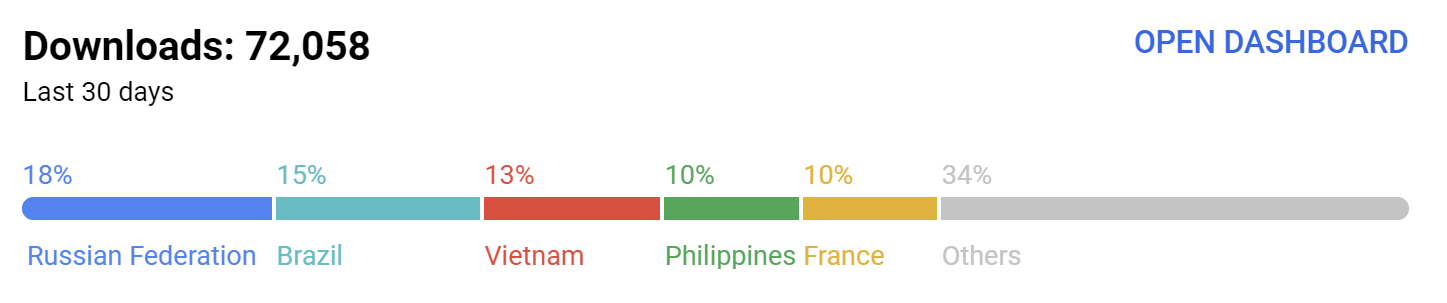

However, some information about advertising revenue can be gleaned from an analysis of how app downloads are distributed across countries.

Advertising revenue from the user in countries such as India and Vietnam, with the correct monetization setup, is $ 0.01-0.05 (depending on the country, retention, audience and monetization of the game), in Russia and Brazil — 3-5 times more. Advertising revenue in the richest countries can reach $1-$2 per user.

In other words, if you see a game with a lot of downloads, be sure to pay attention to the countries where the bulk of the traffic comes from. If the main contribution is made by countries with low GDP per capita (India, Cambodia or Brazil), then it is not necessary to count on high revenue from advertising revenue: with a million installations in India, you can get only $10-$20 thousand.

3. Take a closer look at the genre

Sometimes you need to look wider. Not only pay attention to the format in which you are going to work, but also to the whole genre. It also reduces risks.

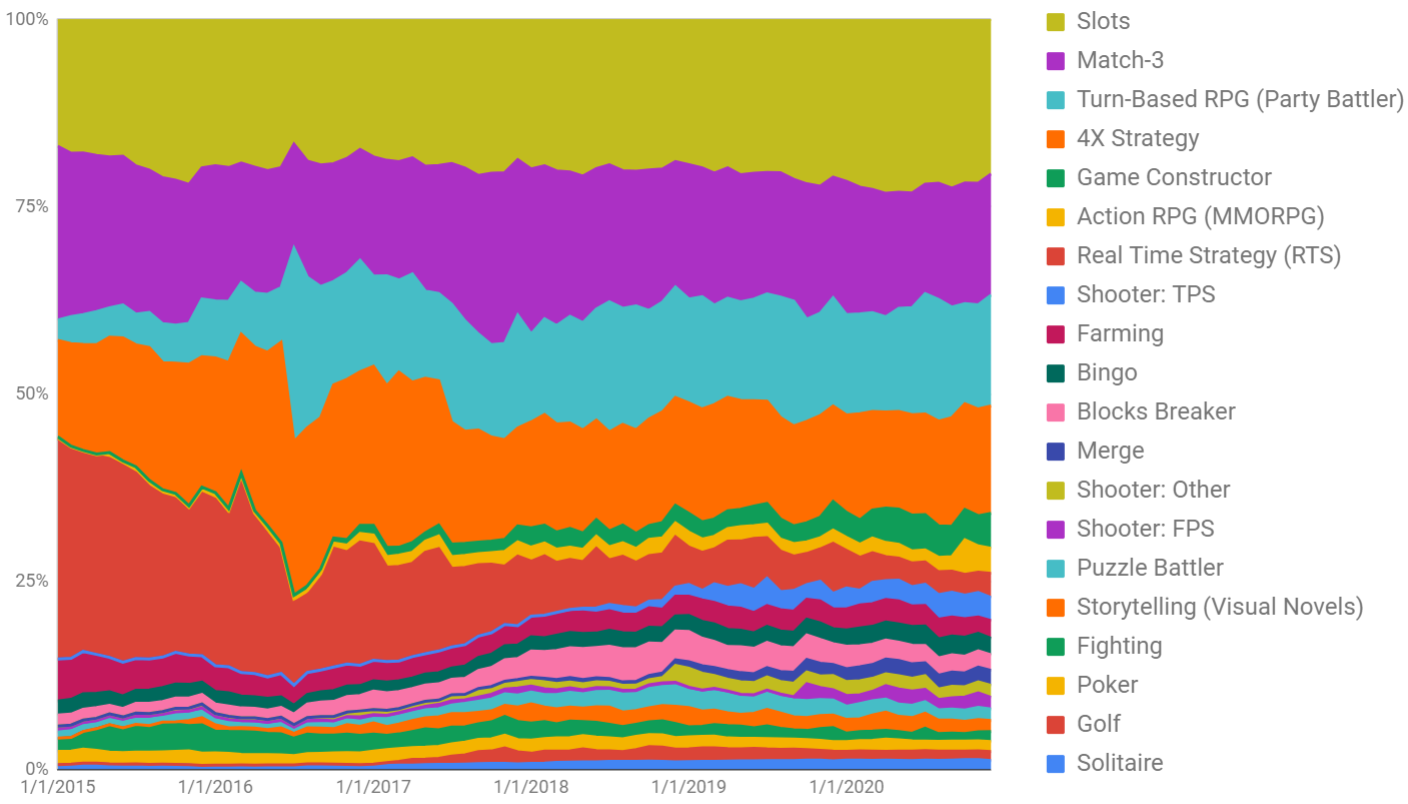

The best illustration is the story of RTS on mobile platforms.

There are no classic RTS in mobile (in the spirit of C&C, Age of Empires and StarCraft). Here, this term is usually understood as PvP games with an asynchronous combat system associated with an attack on an enemy base (a classic example is Clash of Clans).

In recent years, the popularity of the genre, as well as its financial indicators, have been falling. To see this, it is enough to see how its share in the total revenue of mobile games in the West has changed.

Why are games of this genre losing market share so quickly? Maybe they don’t make new games in this genre? Are doing. Maybe they are of poor quality? No, a lot of great ones. So what’s the matter?

When the genre does not grow or even decreases, the reason is usually the same: it does not work to buy traffic in ROMI volumes sufficient for growth. This means that games of other genres with the same target audience are able to pay significantly more for installation. They take the traffic.

Important: when scaling purchases, all other things being equal, the cost of one installation increases. Therefore, a genre with a higher LTV will not take all the traffic. However, the balance will be shifted: whoever pays more gets more. Yes, games with low LTV can also buy traffic. But their LTV often turns out to be so low that it does not justify the cost of even supporting the game.

Seeing the rate at which the share of RTS games decreased, it becomes clear that at its current stage of development, this genre has lost the battle for traffic on mobile platforms, which means it is risky to start developing a game in this genre.

It is not necessary to put an end to the genre. From time to time, revolutions occur in niches, which open up new great prospects. Therefore, it is necessary to constantly monitor successful novelties in different genres if you do not want to miss the window of opportunity.

How to track successful new products? To do this, there are special tools for tracking recently released and fast-growing applications: GameIntel (you can see 5 applications of the subgenre for free in the top free applications in the USA) and AppMagic (for free, without restrictions).

Or maybe: “To hell with your analytics, trush gamers will find my game, evaluate it, tell their friends, so we will win!”

No. It doesn’t work that way in mobile. There is little free traffic in the stores. The one that exists will not allow you to collect enough installations or earn money.

Of course, you can continue to rely on non-contractual features and recommendation traffic from stores. But we must understand that times have changed a long time ago. Neither the first nor the second will give a sufficient number of installations to get into the tops, and they themselves no longer play such a significant role.

Viral success is still possible. But this is now almost always an exceptional story, occurring well, if once a year, plus, as a rule, concerning essentially innovative projects. For example, Among Us.

So what to do?

Before developing, make sure that the chosen niche is growing or at least stable, that its leaders change from time to time, new “stars” appear regularly. In this case, your chances of survival are greater.

On the other hand, investing in bold innovations, the search for new tropes, genres, mechanics — sometimes justifies itself many times. Only in this case, prepare for years of experimentation.