We are talking about a cashless transaction. If it takes place, then there will be an exchange of shares.

According to the official press release, AppLovin proposed the following scheme to Unity Software management:

- Each issued Unity share will be exchanged for 1,152 voting issued AppLovin Class A share and non-voting Class C share;

- during the merger, Unity shareholders will receive 55% of the issued shares of the combined company and 49% of the voting securities;

- Unity CEO John Riccitiello will become CEO of the combined company.

As part of the deal, Applovin values each Unity Software share at $58.85 (18% more expensive than it was worth at the end of trading on Monday), and the entire company at $20 billion.

Applovin management is confident that the united company will offer the market “the most universal solution for the development and development of applications.”

The adjusted EBITDA of the new business by the end of 2024 will amount to $3 billion,” AppLovin’s management assures and insists that the shareholders of both companies will be happy with the deal.

In the event that Unity accepts the offer, the deal with ironSource will be canceled.

Analyst Eric Seufert explains such an initiative on the part of AppLovin by the deterioration of the situation in the mobile advertising market. The market is shrinking against the background of stricter privacy policy and a number of external factors.

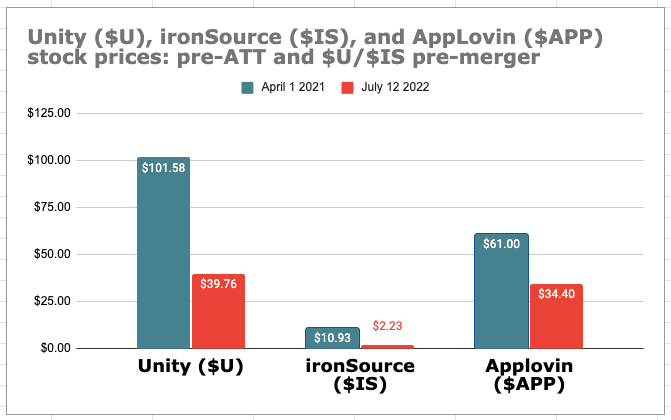

Against the background of general destabilization, the value of all three companies (Unity, ironSource and Applovin) has been falling over the past year. For example, ironSource shares have lost 80% in value over the period from spring 2021 to summer 2022.

And the situation may only get worse in the near future. The same Google is going to introduce its analogue IDFA, and also introduces rules prohibiting annoying ads in applications (it is possible that the latter will lead to shocks in the hyper-casual games market).

The merger of major players is just the answer to the challenges of the market.

After the announcement was published, AppLovin shares fell by 11%, and Unity shares rose by 12%.