Especially for App2Top.ru Yulia Nabieva has prepared a material about the main app stores and ways of pre-release promotion in Hanguk.

Korea’s mobile market is less fragmented compared to China’s. The volume of users is more than 20 million active subscribers. According to IDC, in 2015, the turnover of mobile content in Korea will amount to $2.5 billion. Of these, $ 1.3 billion will fall on the gaming segment, according to representatives of Statista.

The widespread use of mobile devices and the availability of 4G networks have brought Korea to the top among other regions and in terms of audience quality. The player’s life cycle in Korea averages 14.3 weeks, which is 5 weeks longer than in the USA. About 83% of the adult population of South Korea use more than 3 mobile applications on their devices.

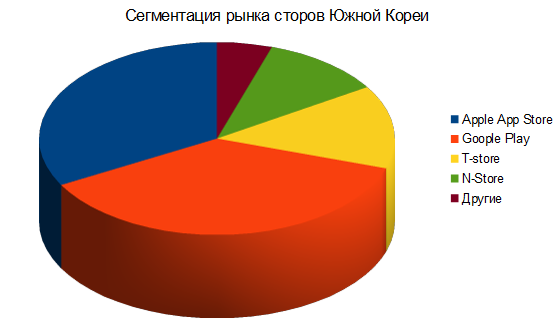

Main App Stores

The main platform in South Korea is Android. Gadgets on it are used by more than 60% of users. Previously, the dominance of this OS was absolute. But over the past few years, the situation has changed. Today, about 33% of the Korean audience uses Apple products running on iOS. Such a shift was made possible by the release of the iPhone with a large screen diagonal.

Among Android platforms, three stores stand out:

- Google Play

- T-store (operated by the mobile operator SK Telecom)

- Naver Appstore (aka N-Store, a platform with a portal of games from the Naver search engine)

The market shares are as follows:

- Goople Play 37%

- Apple App Store 33%

- T-store 14%

- N-Store 11%

- Other 5%

Each of the Android stores in South Korea has its own specifics. I will not dwell on each in detail now, I will note only the most important features and trends associated with them.

- T-store is preinstalled on mobile devices sold with a contract of the mobile operator SK Telecom. At the moment, the market share of the T-store is falling in relation to Google Play and the Apple App Store.

- T-store and N-store, due to the peculiarities of development, differ in hardcore audience, while casual games show good results in Google Play and Apple App Store in integration with the social network and the Kakao Talk short messaging platform.

- In 2014, Kakao Corp. took a course for midcore players by launching a store selling Android games g.kakao.com . But at the moment the store has not become popular. So the main income of the gaming division of Kakao Corp. accounts for games published with Kakao Talk integrations in Google Play and the Apple App Store.

- The average ARPU in South Korea for hardcore games in the N-store reaches $1.5-$3.

- The average ARPU in South Korea for casual games with Kakao Talk integration on Google Play ranges from $0.8 to $1.2.

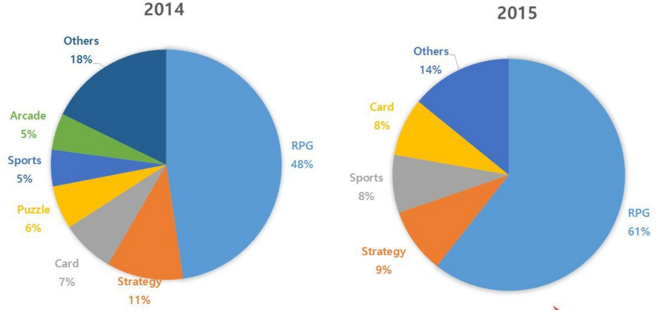

If we talk about the genres of games, then every year there are more and more role-playing games on it:

According to the Adways report, the trend with the growth of the role segment will continue in the future.

Promotion of games in South Korea

The release of every successful game in South Korea is accompanied by a carefully planned marketing campaign. This already at the start allows projects to earn decently.

For example, Nexon, known for its large online games, released the HIT mobile role-playing game in the second half of 2015. On the day of release, she earned $1 million.

Or here’s another example: the Webzen company with the MU Origin game earned $700 thousand on the first day of sales only on the T-store site.

Here’s what I was told about the stages of preparing games for release in Korea by the managing director of the agency Eidetic Marketing Ashley S Jang and the head of the international marketing service of the company Eidetic Marketing Michael Ji.

Ashley With Jang and Michael Gee

Speaking about marketing in South Korea, there are three main stages that all games go through: activity before the release of the game, activity at the time of release and activity after the immediate release.

Let’s focus on the pre-release phase.

In Korea, there is a unique approach to preparing the game for publication. We call this phase “pre-order”. More than 90% of Korean developers launch pre-order campaigns two to three weeks before the official release of the product, regardless of how the project will be distributed.

Players, as a rule, can make a pre-order in three ways: directly through the store, through specialized channels for pre-ordering mobile applications, as well as through the landing page that companies prepare themselves for the release of the game.

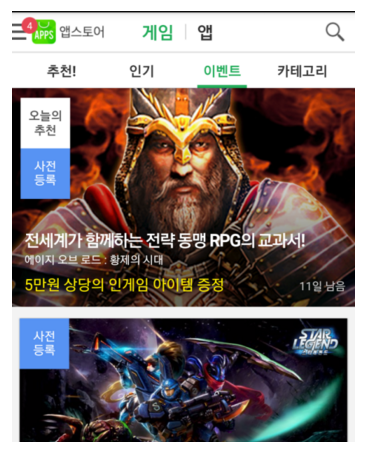

Pre-ordering through the store is typical for the T-Store, N-Store platforms. It works as follows: every month, players choose, looking at videos / screenshots of games that have not yet been released, what they want to get. At the time of the release of the selected games, users receive alerts.

The applications participating in the pre-order are selected by the content selection managers of a particular store and placed as banners on the portal home page.

In total, 40-50 thousand installations can be expected from this activity, 35% of which will not only install the game, but will also play for several days.

This is how the campaign for pre-ordering the Age of Lords game in the Naver store looked like:

But the main platforms for promoting games and generating interest in them today are specialized channels for pre-orders.

As a rule, these sites have a large user base with loyalty programs and send coupons for pre-order. Below is a list of the most authoritative:

- Game Shuttle

- Mobi

- Booking Top 10

- Game Fat

- Game Booking

Most of these channels charge a fixed price for a pre-order campaign, but some of them work by installations, and you can track the quality of installations through Tune’s MAT toolkit, the most popular of foreign marketing tools in Korea.

By the way, users from Korea are used to receiving bonuses in the game for participating in the pre-order program, so you should take care of this in advance.

In addition to the campaigns described above, you can also create a website dedicated to the release of the game and promote it through advertising networks.

You must collect users’ phones at the time of pre-registration on the site in order to be able to notify users by SMS at the time of the release of the game: this will give a cumulative effect.

If your marketing budget is not limited to standard channels for attracting users, we recommend that you turn to outdoor advertising on transport. She is very popular in Korea right now. It is also called “bus wrap”.

This type of advertising works well among a young audience and is characterized by great virality. Plus, it costs much cheaper than the classic outdoor advertising. Young people often post photos on social networks of branded vehicles plying to the center of Seoul during rush hour.

Also, any campaign can be supported by publications in professional blogs and on the pages of news portals. In Korea, you are guaranteed to get 30-40 publications for $3000.

Of course, you can release your game without support in the first days, as most European companies do. But, as a rule, if they receive installations, it is only due to the interest of a young audience in everything Western.

Promotion prices

Installation by pre-registration will cost $ 1, but in experience they are no different from motivated installations and have a low conversion to active users.

This is because marketing agencies often place pre-orders not only in popular and reputable resources, but also simply in networks selling motivated traffic, where the user receives money for installation. Be careful when choosing a partner, otherwise such a campaign can lead to a bad start and negative reviews from users in Google Play or Apple App Store, who, for example, did not receive a reward for installation.

Attracting a high-quality user in one of the leading advertising networks will cost $3-5 (according to the advertising network cashslide.co.kr ), but none of them can guarantee a large volume of installations.

So we come to the conclusion that Korean users do not actually differ in cost from American ones. At the same time, the South Korean market is smaller, and the revenue per user is close to the same in the United States.

It is noteworthy that there is no publishing market in Korea as such. Periodically, large local developers take on foreign brands for publication, but this is the exception rather than the rule. The intermediary market is also scarce. The only thing they can provide is a feature of the game at the start in one of the networks on pre-order for a percentage of income. They do not spend real money on the acquisition of users.

One of the most reasonable approaches, taking all this into account, is the release of the product on its own with the integration of the Kakao Talk SDK network (all product presentations by the Kakao Corp. team accepts in a special form by link).

The initial marketing budget can range from $30 to $100,000. If you adhere to a more conservative (budget) strategy, you can release the game by accompanying the release with publications in industrial resources. Then collect statistics on revenue and audience quality and later increase the number of users.

We will talk about what methods of product support are adopted in Korea after the release next time.

SEE ALSO:

- Guide to integrating the Kakao SDK into the game from the authors of Shadow Fight 2

- Alawar’s story about how they ported the Korean game to the Russian market

- A detailed analysis of what are the ways to enter the Chinese market from Yulia Nabieva