We continue to summarize the results of 2023 with gaming (or related to the gaming industry) teams. Next up is an interview with Kirill and Roman Gursky, managing directors of the gaming business of the GEM Capital investment group.

What was the year like for the company? What have you done that you would like to highlight in terms of achievements?

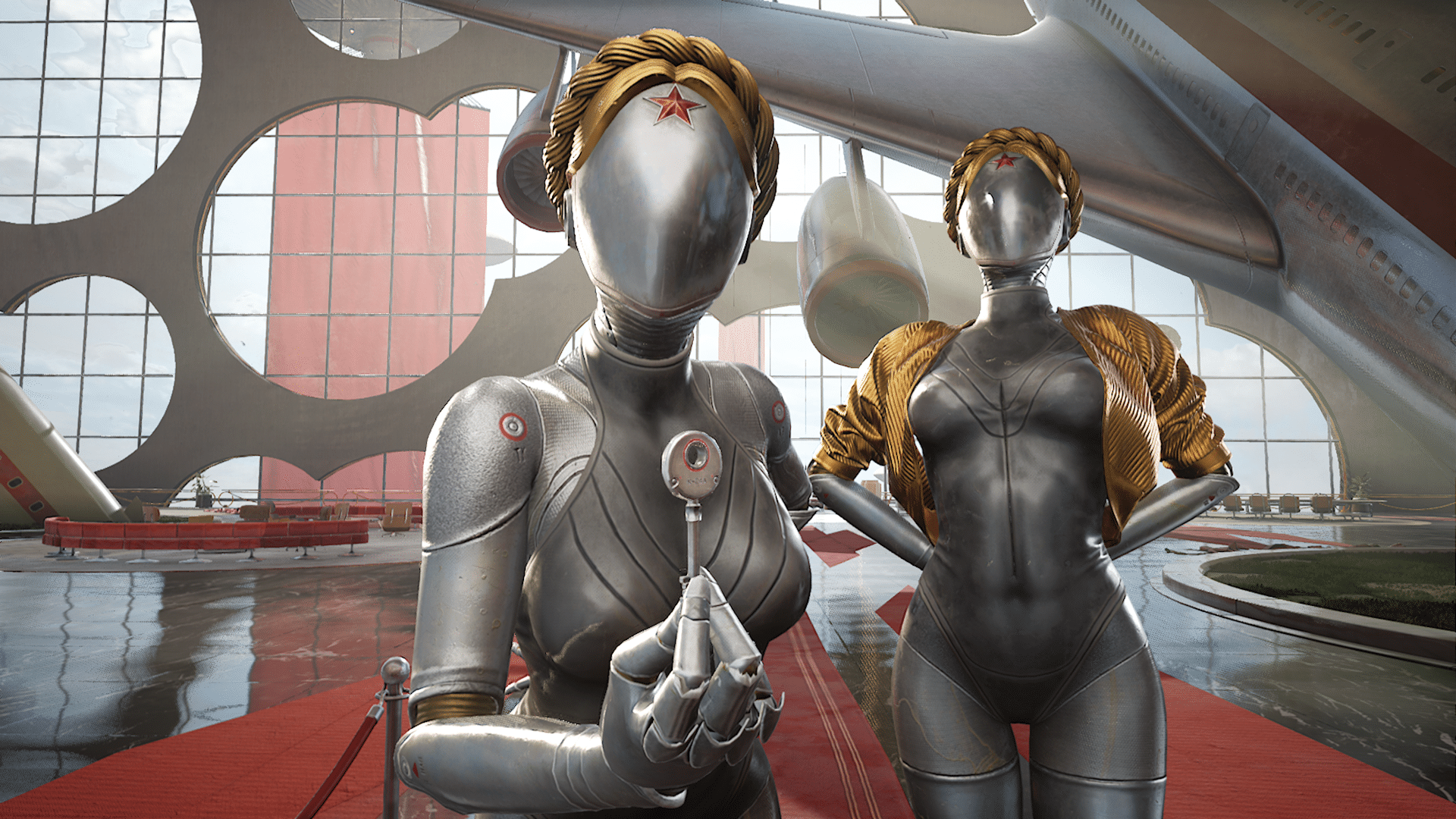

Roma: The past year has been difficult for us and for the entire gaming industry. Many international companies have announced layoffs, some have closed down, and people have lost their jobs. However, despite all the global difficulties, 2023 was the most successful year for GEM Capital since the foundation of the investment in gaming and digital entertainment in 2019, as it already seems far away. We never tire of repeating that our achievements are, first of all, the successes of our portfolio companies, and in this regard, few people in the market can boast of a similar track record. This year, GEM Capital studios made several deals with the largest market players, their projects entered the reputation ratings, we raised a new fund and, of course, Atomic Heart from Mundfish came out. The game received good reviews (Steam rating of 84% and Metacritic rating of 75%) and became one of the most high-profile and successful global releases. The studio officially announced that in the first three weeks alone, more than five million users played the project. Atomic Heart has become one of the most successful releases on Xbox and the most talked about title on Metacritic. Users highly appreciated the unique visual style, gameplay, soundtrack and scale of the Mundfish creation. The game entered the global top 10 most popular games of 2023 on Google. The Atomic Heart soundtrack is still at the top of streaming platforms and was deservedly nominated by Hollywood Music in Media Awards for the best OST in a video game along with Assassin's Creed Mirage, Diablo IV, Baldur's Gate 3, New World and Final Fantasy XVI. I can say for myself that OST Atomic Heart is playing in my headphones on repeat, and I am absolutely sure that I am not the only one, and my admiration is shared by millions of fans around the world. Elon Musk's tweets and the almost iconic status of the Twin Ballerinas pleasantly complement the picture of the overall success and phenomenon of the game.

Kirill: It is very important to emphasize that all this success occurred in a year with one of the highest densities of AAA titles releases for the entire existence of the game market. Hogwarts Legacy, Baldur's Gate 3, Star Wars Jedi: Survivor, Spider-Man 2, The Legend of Zelda: Tears of the Kingdom, Diablo IV, Resident Evil 4, Final Fantasy XVI, Alan Wake 2 – this is not a complete list of mastodons who fought for the attention and love of users this year. It is customary to say about such periods "a year in two" – such crazy competition was on the market! Also note that all of the above games either have an ordinal number in the title and, accordingly, continue a successful series, or are based on a very strong and recognizable third-party IP (for example, the Hogwarts Legacy game based on the Harry Potter universe created by J.K. Rowling). This makes new fresh franchises with global ambitions even more valuable on the market, and their creation is tantamount to a feat. Only by understanding all these factors can you fully and with dignity appreciate the creation of Mundfish. GEM Capital was one of the first investors of the studio, we always supported, helped and believed in the guys! We are proud of the path we have walked side by side together, and we are glad that this year the entire industry and millions of players have shared our delight and love for Atomic Heart! Now we can safely say that a new Mundfish star has lit up on the global PC/console market. Further – even bigger, bigger and more ambitious!

Roma: This year we also entered the rating of the most active investment funds in the gaming market in the world from InvestGame. According to the latest Global Gaming Deals Activity Report Q1-Q3’23, in the first nine months of 2023, we ranked fourth in terms of the number of transactions and seventh in terms of the size of transactions in the world (and first among investors with a focus on Cyprus, Eastern Europe and MENA).

We are proud that Sad Cat (Replaced game), Red Rover Interactive (Project Coltrane game) and Made on Earth Games (Everbright game) joined our gaming family this year and are grateful to the founders and teams for their trust in us! Welcome to GEM family!

Kirill: Players from all over the world are waiting for the projects of our portfolio companies. For example, Replaced by Sad Cat was included by KOTAKU in the list of the most anticipated games of 2024. It is noteworthy that only three games on the list, including Replaced, are new IP, and not sequels of famous series. We believe that this says a lot about the potential of Sad Cat and the skill of the studio!

Another important event for us is the announcement by Weappy, the creators of the legendary This is The Police series, of their new Hollywood Animal title. The IGN video was very warmly received by the studio's fans, and Destructoid, known for their critical approach to games, even wrote that they do not remember the last time they saw such a great trailer! In addition, some of our studios have concluded outstanding publishing and investment deals with leading market players this year. There is still a lot that I really want to share, both from the truly significant achievements of our portfolio companies and from new deals, but we will do it already in 2024! Stay tuned!

Roma: The success of our portfolio companies has helped us attract new $50 million to GEM II to continue implementing the strategy to support the most promising founders and the best teams in Cyprus, Eastern Europe and MENA. The launch of GEM II was widely covered by leading specialized media (VentureBeat, GamesIndustry.biz, Pocket Gamer, App2Top, EU-Startups) and, frankly, we are pleased that the successes of our portfolio studios are known all over the world! The international investment market is currently in a difficult situation due to global uncertainty and shocks. However, as our experience shows, investors are happy to support funds if there is a confident track record confirmed by auditors.

How has the market changed for investment companies that invest in games?

KIRILL: Despite the fact that the gaming market has returned to growth (according to Newzoo, by the end of 2023 the market volume will amount to $ 187.7 billion, which is 2.6% more than last year's level), investors are still very selective in choosing potential targets. Their appetite is negatively affected by the current situation in the global investment market. According to the KPMG Venture Pulse Q3 2023 report, the global venture capital market fell to its lowest level in the last 16 quarters in the third quarter of 2023. The VC market is feeling the pressure of global economic and geopolitical uncertainty, ongoing concerns about declining valuations, as well as a prolonged lack of exit opportunities.

Roma: Unfortunately, gaming venture deals also do not stand aside from global trends. According to InvestGame, the volume of early-stage transactions in the first nine months of 2023 amounted to $400 million, which is significantly less than the similar periods of 2022 ($641 million) and 2021 ($945 million). In other words, investors are lying low and waiting for positive market signals. It is difficult to say what will happen next, but let's add a little optimism, this situation cannot last forever, since investors have obligations to their LP to place funds and then return them within a certain period of time.

Kirill: Speaking of trends, I would also like to recall our interview with App2Top at the end of 2022, in which we said that we expect (i) the share of near-gaming startups (including AI) in the structure of game fund portfolios to gradually grow and that (ii) investors will pay more attention to studios developing projects for PC and consoles. The outgoing year confirmed both of our forecasts and we really saw a lot of deals in these areas, and the British Collins English Dictionary even chose AI as the word of 2023. It is always nice to anticipate the main trends and market movements. On the negative side, investors are now more conservative about studios developing mobile titles. The regulatory policy of the platforms regarding user data and the saturation of the market are affected. At the same time, the most promising teams are still successfully raising investment rounds even in such unfavorable conditions, as, for example, our deal with the previously mentioned Made on Earth Games showed!

Roma: Among other trends that we would like to note, as we emphasized in a recent article Major Trends In Gaming: An Investor's Take for Forbes, we also still see huge potential in cross-platform games and think that more and more mobile games with strong PC/console IP will appear on the market. A successful global IP should be present on all platforms so that users can enjoy their favorite game, characters and the whole universe whenever they want: on the way to work, during lunch or at home with their family. A well–known IP is also one of the ways to overcome the current user acquisition problems caused by IDFA in the mobile gaming market.

What has changed in the investment plan for game studios?

KIRILL: The state of the investment market and the mood of funds inevitably have an impact on game studios. Unfortunately, in terms of fundraising, the situation has not improved compared to 2022, and all the tips that we gave in our interview last year continue to be relevant. Try to show track record and product metrics as quickly as possible, start working with the community at the earliest stages, think over your marketing strategy in advance and try to stretch the runway as much as possible. In the current conditions, the issue of finding a reliable investor with deep industry expertise, who is able to correctly assess risks, has the necessary financial resources and, together with the team, is moving towards a common goal despite temporary turbulence, is even more urgent for game studios and startups. Since 2019, when GEM Capital started investing in gaming, none of our portfolio companies have been closed. We thank all our investments for excellent results and reliable partnership!

What are the company's plans for next year?

Roma: Our team still sees huge potential in the gaming market and will continue to bet on it! At GEM, we think that if we look globally at the entire entertainment market, then games are the new Marvel. Since the release of the first "Iron Man" in 2008, superheroes have been the most important pillar of popular culture for a dozen years. Each new film was eagerly awaited by hundreds of millions of people around the world and Avengers: Endgame, which grossed $2.8 billion and became the second highest-grossing film in the world after Avatar, was the culmination of this trend. Now we see that the public consciousness is tired of superheroes and is increasingly turning to video games. Only this year, for example, the TV series The Last of Us, Twisted Metal and The Witcher: Season 3, the films The Super Mario Bros. saw the light. Movie, Gran Turismo, Five Nights at Freddy's, and before that the whole world watched Arcane, Uncharted and Cyberpunk: Edgerunners. We think this trend will continue to develop and we will see even more cool projects based on gaming IP. The game market and the movie and TV series markets will continue to converge and synergistically feed each other, strengthening the attitude towards games as the main form of entertainment in popular culture. The gaming market is more relevant than ever.

Kirill: After five years, we can say with confidence that our vision has been justified both in terms of a strategic bet on the gaming sector and in terms of choosing the most promising companies to invest in. We still see huge potential in Eastern Europe, Cyprus and MENA and will continue to focus on these regions. In a recent article Hidden Gems: Investing In Games Emerging Markets in Forbes, we share the main reasons why GEM prioritizes emerging gaming markets. In the next two years, we plan to fully deploy the $50 million raised this year. Paradoxically, GEM Capital does not invest in games. We invest in people. In 2024, we will continue to support the best founders and the most ambitious teams striving to create something unique and change the gaming and digital entertainment market forever!