All the gaming deals for the past week in one material.

The material was prepared specifically for App2Top.ru Sergey Evdokimov, Investment Manager Mail.Ru Games Ventures and the author of the telegram channel Gaming – M&As and Investments.

Sergey Evdokimov

1. AT&T is going to sell the gaming division to Warner Bros.

Against the background of numerous debts, the telecommunications company AT&T is looking for a buyer for the Warner Bros. gaming asset, which includes companies such as TT Games, Rocksteady Studios, NetherRealm Studios, Monolith Productions, Portkey Games, Avalanche Software and three studios of WB Games studios itself.

Initially, there were rumors that the group of companies would leave for $4 billion. However, it later became known that the price of the issue was $2 billion. The asset’s problem is that despite the high quality and good sales of Warner Bros. games, most of them were created under someone else’s licenses.

Mortal Kombat 11 — development of one of the Warner game studios

2. NetEase has entered the IPO for the second time. This time in Hong Kong

Now there are strained relations between the US and China. Because of this, the attitude towards public companies from China deteriorates on American stock exchanges, it becomes more difficult for the latter to work there. As a result, some companies conduct secondary listings.

NetEase is one of them. Last week, it officially went public on the Hong Kong Stock Exchange. During this placement, the company managed to raise $2.7 billion.

Knives Out is one of the central hits of NetEase

3. Wave VR startup raised $30 million during the next round

Wave is not one of the standard technical VR companies. His development of the same name does not offer a game or a virtual chat. Wave’s desire is to create a popular venue for live music concerts.

The founders’ ideas resonate with investors. The investment round “B” took place last week. In its course, the company raised $30 million. Previously, Wave “collected” much smaller amounts — $6 million in 2018 and $4 million in 2017.

Funny fact. Such a big deal happened after the successful concert of rapper Travis Scott (Travis Scott) in Fortnite.

Performance of the singer Tinashe on the Wave platform

4. Kahoot Educational Test Designer raised $28 million

Kahoot is both a constructor and a platform that allows you to collect and place educational tests and games.

It has been present on the stock exchange for a long time. But on June 11, 7.5 million of its shares were additionally placed on the market. This allowed her to earn $28 million.

In total, it has raised $110 million so far. Its market value is estimated at $1.39 billion. Among the investors are Disney and Microsoft.

Comprehensive webinar on the work of Kahoot

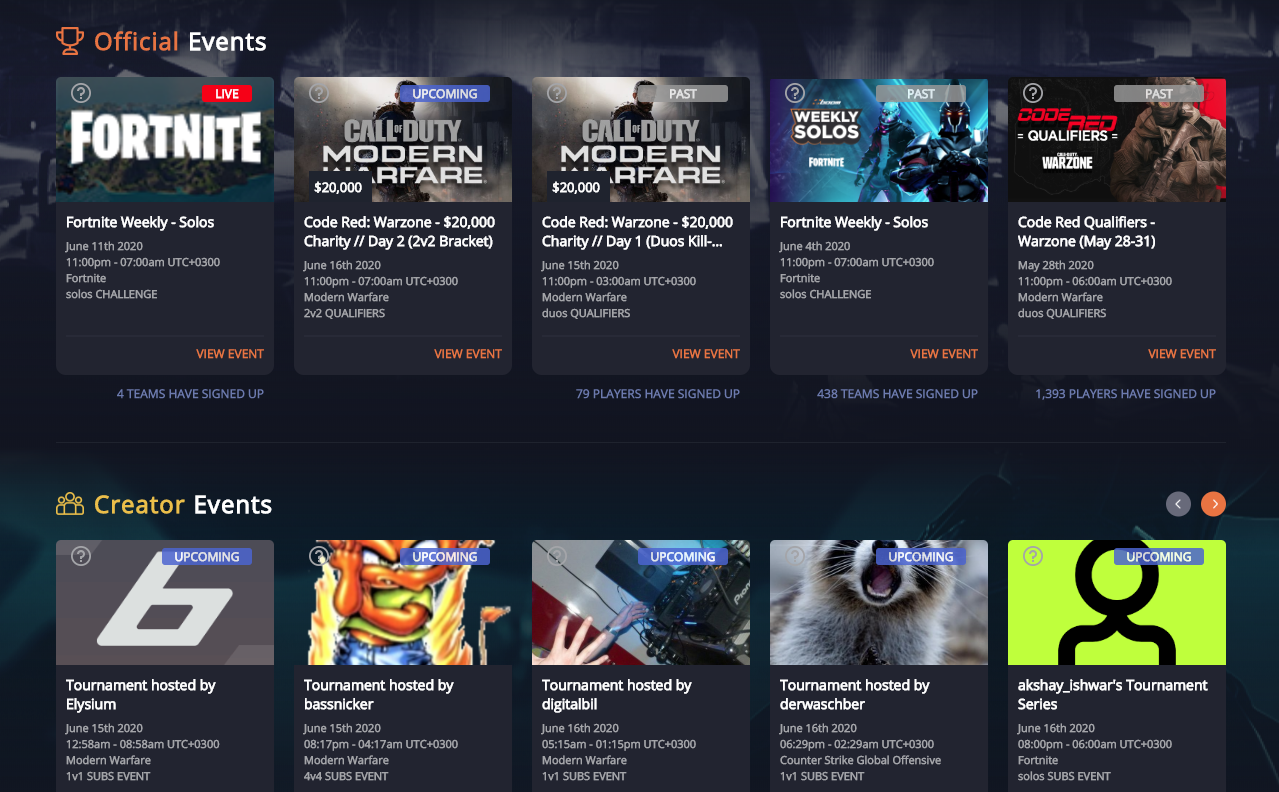

5. BoomTV has raised $10 million for the development of an esports entertainment platform

On June 9, a series of investments “A” from the California-based BoomTV, which develops tools for conducting esports tournaments, ended. During the round, $10 million was raised.

Previously, the startup has already “raised” money. In December 2016, $3.5 million was invested in it at the seed stage. Then the company was valued at a total of $ 8 million.

BoomTV

6. Playable Worlds raised $10 million to create a cloud MMO

Galaxy Interactive continues to actively invest in “dark horses”. The venture company, together with its partners, invested $10 million in Playable Worlds.

The latter is creating an MMO sandbox that will work “in the cloud” and promises a new unique experience, a game that will feel more real and immersive than anything before.

Perhaps investors trust the CEO of this gaming company. His name is Raph Koster, previously he was responsible for the game design of games such as Ultima Online and Star Wars Galaxies.

Star Wars Galaxies is one of the first successful and popular MMO, only it has been closed for 9 years

7. Kalypso Media is now a full-fledged owner of Gaming Minds Studios

Previously, German Kalypso Media had only 60% of Gaming Minds Studios. On June 9, she officially bought the remaining 40%. Now the developer of Patrician IV and Port Royale 3 is completely at the mercy of the publisher for whom he previously created projects. The amount of the transaction is not specified.

Port Royale 3

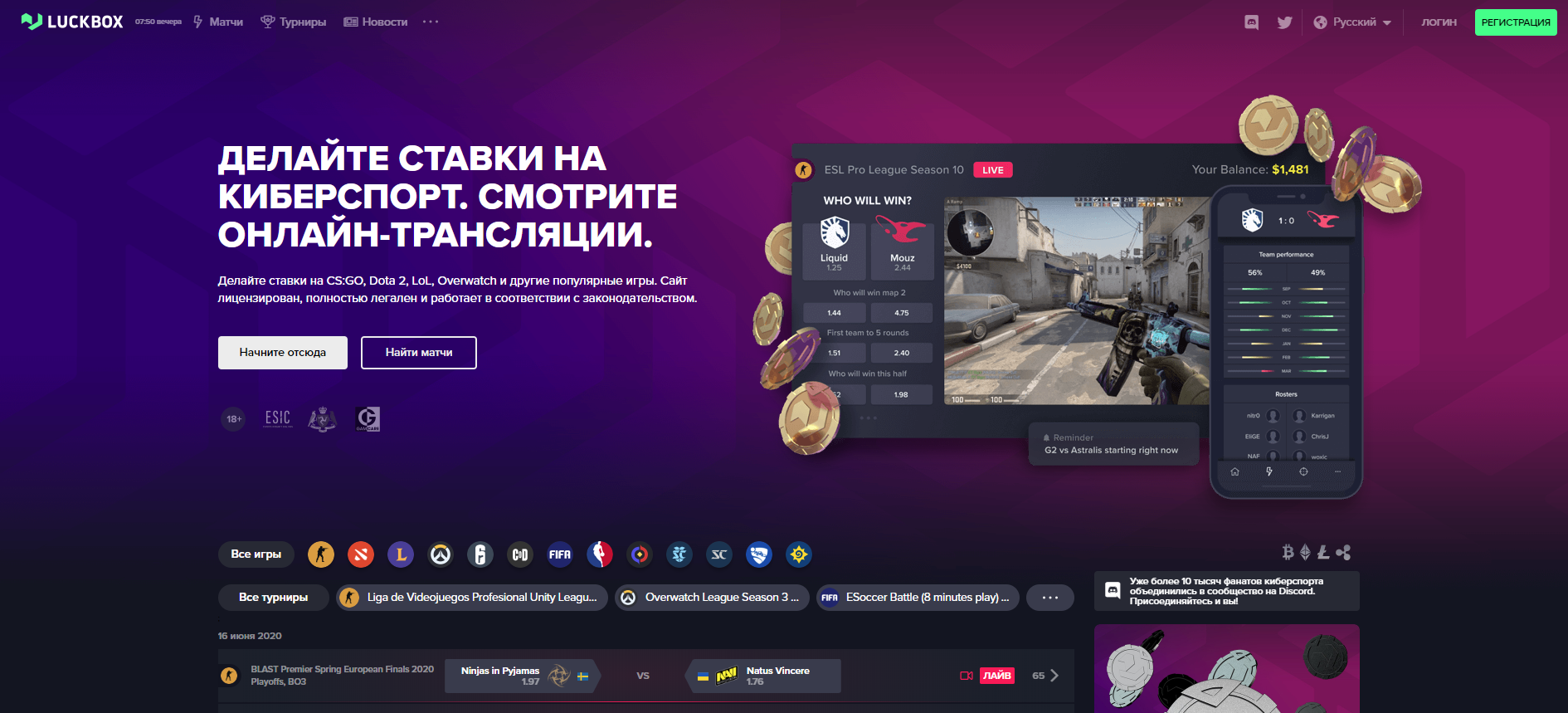

8. The Luckbox real betting platform is preparing for an IPO

The Irish Luckbox, which specializes in real bets in esports disciplines, is going to become a public company this summer. To do this, she raised a tranche of $2.8 million.

Luckbox

9. Animoca Brands has finalized a deal to transfer its portfolio of projects to another company

Animoca Brands, the publisher and developer of mobile games, agreed with iCandy in 2017 to transfer 318 games to it for $3.8 million (plus $2.2, depending on the results of the games themselves). The process was completed only at the beginning of this June.

The transaction is not the simplest and most transparent. The fact is that we are talking about an agreement between an Australian asset Animoca Brands, which is officially a Chinese company, and the Australian asset of iCandy, which also operates in Malaysia and Singapore.

Moreover, Animoca Brands does not transfer titles under the iCandy label. The latter goes to the operators of specific series (for example, the Malaysian Web Prancer, which is responsible for the Garfield series).

Doraemon Repair Shop Seasons — one of the sold projects

10. GDC has launched a fund to support developers

The organizers of the GDC conference have established a fund of the same name aimed at supporting indie teams that have suffered as a result of the cancellation of GDC 2020. He must compensate companies for the costs of booked hotels, flights and missed business opportunities.

In the fund’s bank — $ 290 thousand. Most of the amount ($150 thousand) will be distributed among 177 developers. The remaining money will go to a 15-day online mentoring program.

Is there any news? Share it with us, write to press@app2top.ru