InvestGame analysts have calculated the volume of investments, public offerings and completed M&A transactions in the gaming market over the past nine months. They amounted to $57.7 billion. This is 72% more than a year earlier for the same period.

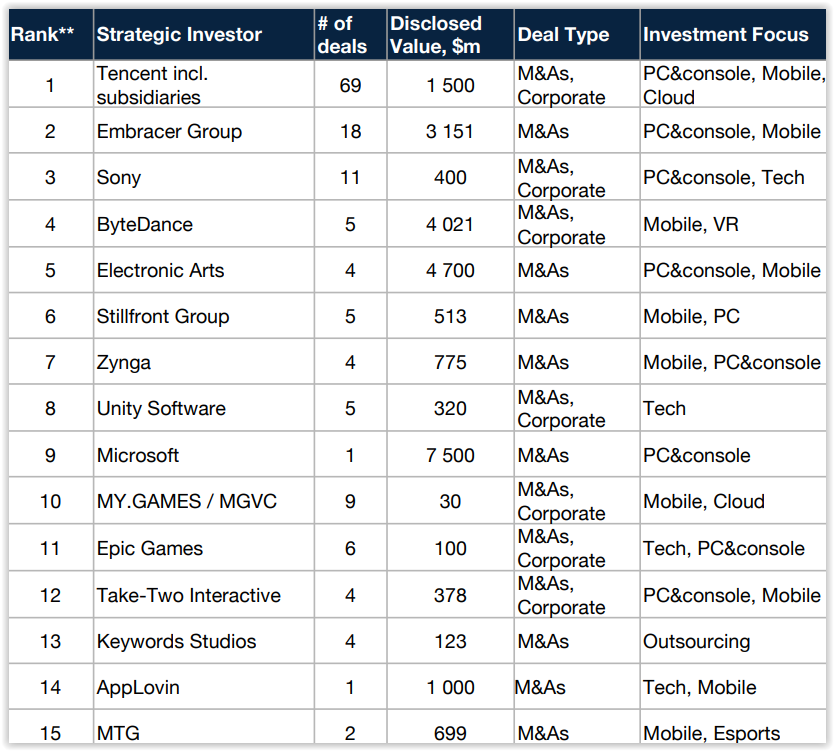

Basic

- In total, 667 operations related to the gaming business were carried out in the first 9 months of the year. For comparison, a year earlier, 457 transactions were carried out in the same three quarters.

- Of these 667 transactions, slightly more than half, 57% or 382 transactions, were related directly to gaming companies. 164 transactions (25%) were related to transactions of companies engaged in gaming platforms and technologies. Another 84 transactions (13%) related to esports.

- The most common operations are private investments (57% or 384). Mergers and acquisitions are in second place in frequency (34% or 224), and stock market entry is in third place (9% or 59).

- As already noted above, the total cost of all these operations amounted to $57.7 billion. A year earlier, the amount was significantly less — $22.7 billion.

- In monetary terms, transactions with gaming companies accounted for the largest share of the gaming investment market — 75% or $43.3 billion. $9.9 billion (18%) went to platforms and technologies, and esports attracted only $721 million (around one percent).

- In terms of money, mergers and acquisitions accounted for the most ($27 billion or 48%). In second place are public offerings (37% or $21.2 billion), and in third place are private investments (15% or $8.6 billion).

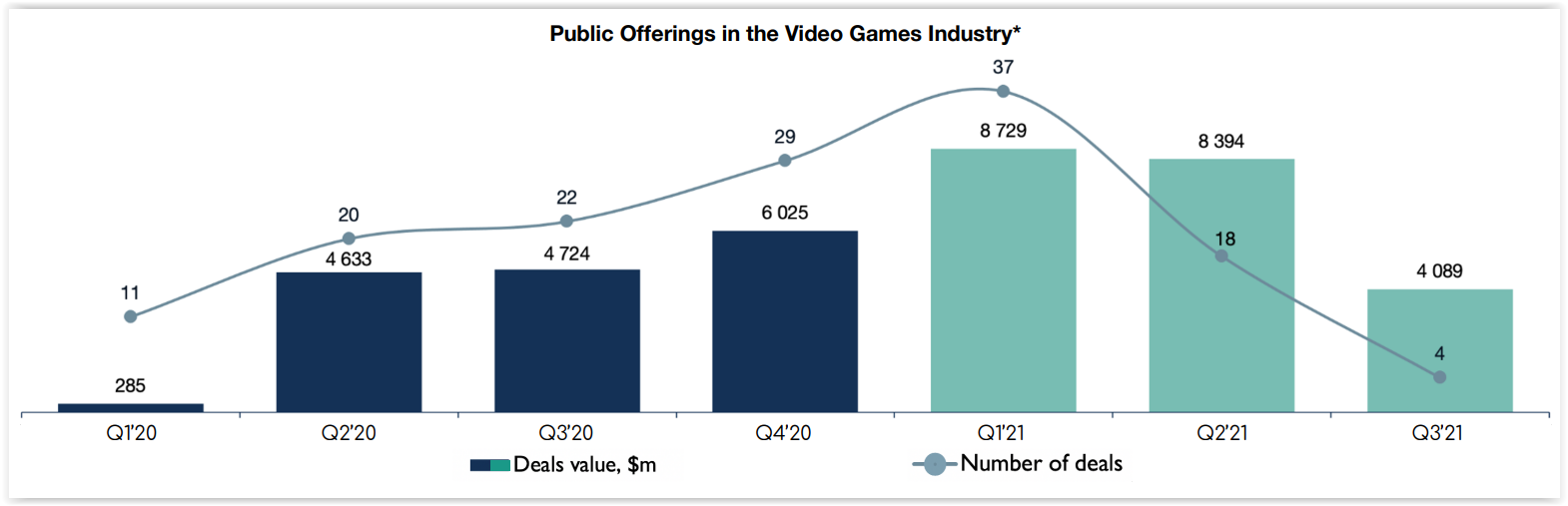

IPO

- As noted above, the total value of all initial gaming placements on the stock market for the first three quarters of this year amounted to $21.2 billion. For comparison, a year earlier for the same period, this figure was significantly less — $9.6 billion.

- If in the first quarter gaming companies actively entered the stock market as never before, then by the third quarter the number of such operations fell significantly (from 37 operations at the beginning of the year to 4 at the end).

- This happened against the background of a fall in the value of shares of most gaming companies that went on the stock exchange during the current calendar year.

- The largest placements this year are: Krafton ($3.75 billion), Bilibili ($2.6 billion), ironSource ($2.3 billion), AppLovin ($2 billion) and Playtika ($1.9 billion).

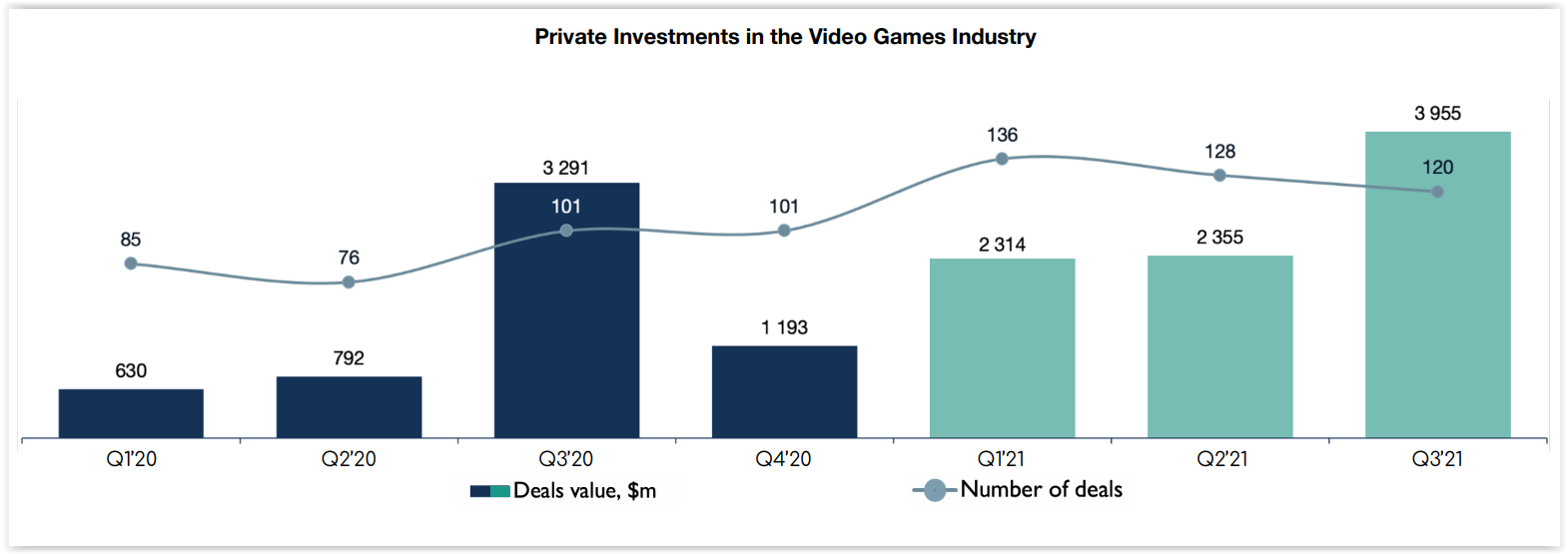

Private investment

- From the beginning of the year to the third quarter inclusive, private investment in gaming or game-related companies amounted to $8.6 billion. This is 83% more than a year earlier.

- In monetary terms, 78% of transfers accounted for late-stage transactions. For comparison, early-stage financing transactions accounted for only 13% of the total amount. At the same time, in quantitative terms, there were much more of the latter (72 transactions versus 20).

- The biggest gaming investment stories: Sorare ($680 million), Discord ($500 million), Jam City ($350 million) and Dapper Labs ($250 million).

- By the way, the leader in the number of investments is Tencent. It accounted for 69 transfers out of 134 made in the first nine months of the year.

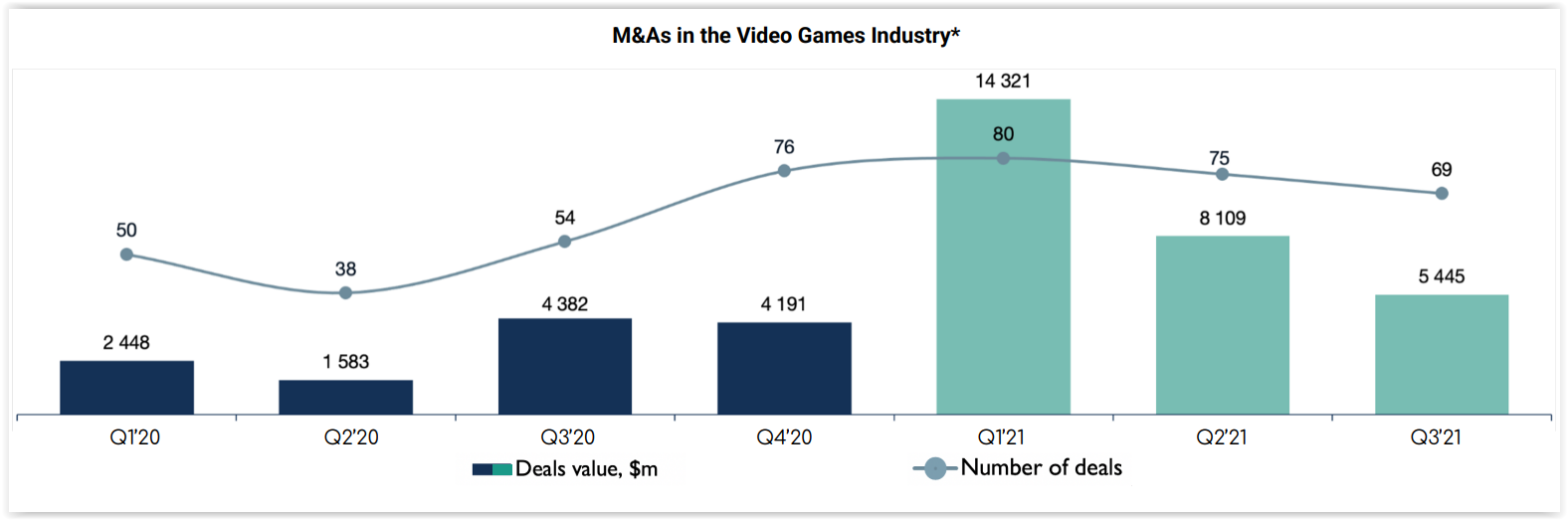

Mergers and acquisitions

- The M&A sector has also grown strongly in monetary terms. If last year for the first three months we were talking about transactions with a total valuation of $8.4 billion, then this year it was $27.9 billion.

- The main driver of growth was the mobile sector. In monetary terms, it accounted for 84% of the total accumulated amount.

- The largest mergers and acquisitions of this year at the end of September: ZeniMax ($7.5 billion), Moonton ($4 billion), SpinX ($2.19 billion), Glu Mobile ($2.1 billion), Playdemic ($1.4 billion), Gearbox ($1.3 billion) and Sumo Group ($1.27 billion).

Blockchain Gaming Stories

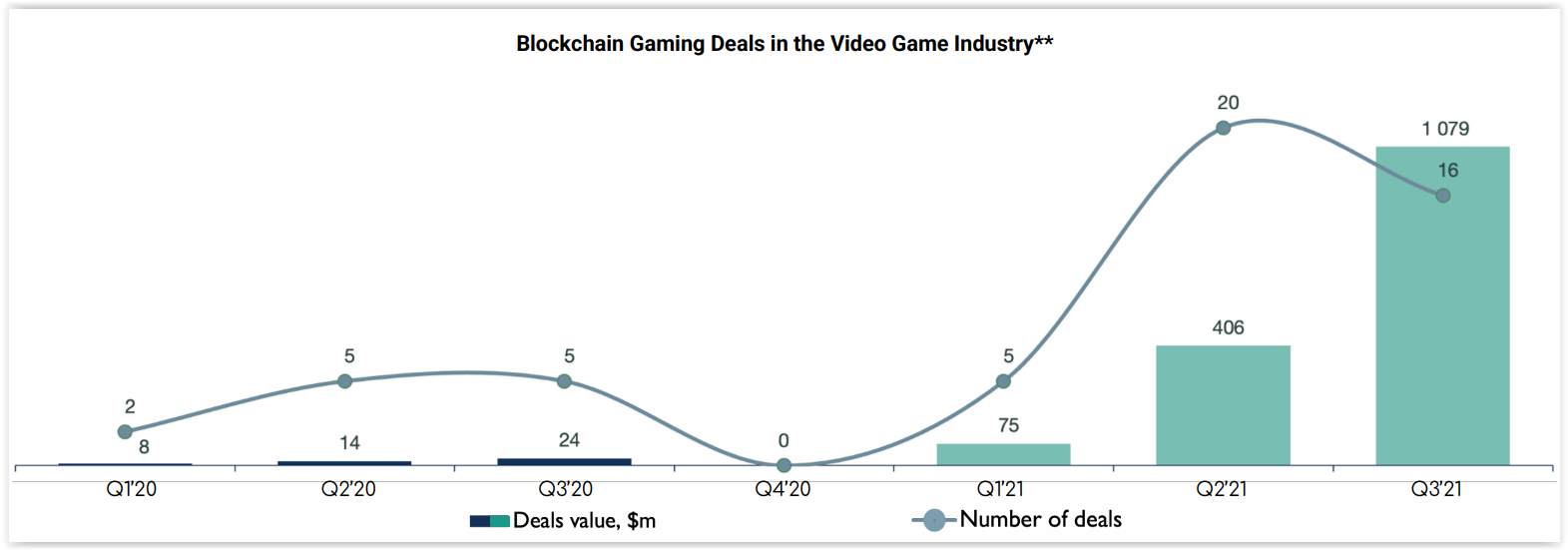

The report also focuses on transactions in the gaming blockchain market.

- The number of investments in the gaming blockchain increased 3.4 times in annual terms (41 this year versus 12 a year earlier).

- Even more impressive is the 34—fold increase in investment volume ($1.56 billion versus $46 million a year earlier).

- The largest deals on the gaming blockchain market are the Sorare Series ($680 million), Dapper Labs Series ($250 million) and Immutable Series ($60 million).