Games by PlayWay are played by millions of people worldwide, often unaware that this very company is behind the latest mechanic simulator, border guard, or any other profession simulator. Today we'll delve into the unique structure of PlayWay to understand why ideas trump budgets and how the company manages dozens of studios.

Contents:

- Origins of PlayWay: From Cardboard Games to a Complex Holding

- Business Structure of PlayWay: How to Manage 60 Studios

- Key Assets of PlayWay: "Star" Studios within the Holding

- How to Develop Games That Pay Off Tens and Hundreds of Times

Origins of PlayWay: From Cardboard Games to a Complex Holding

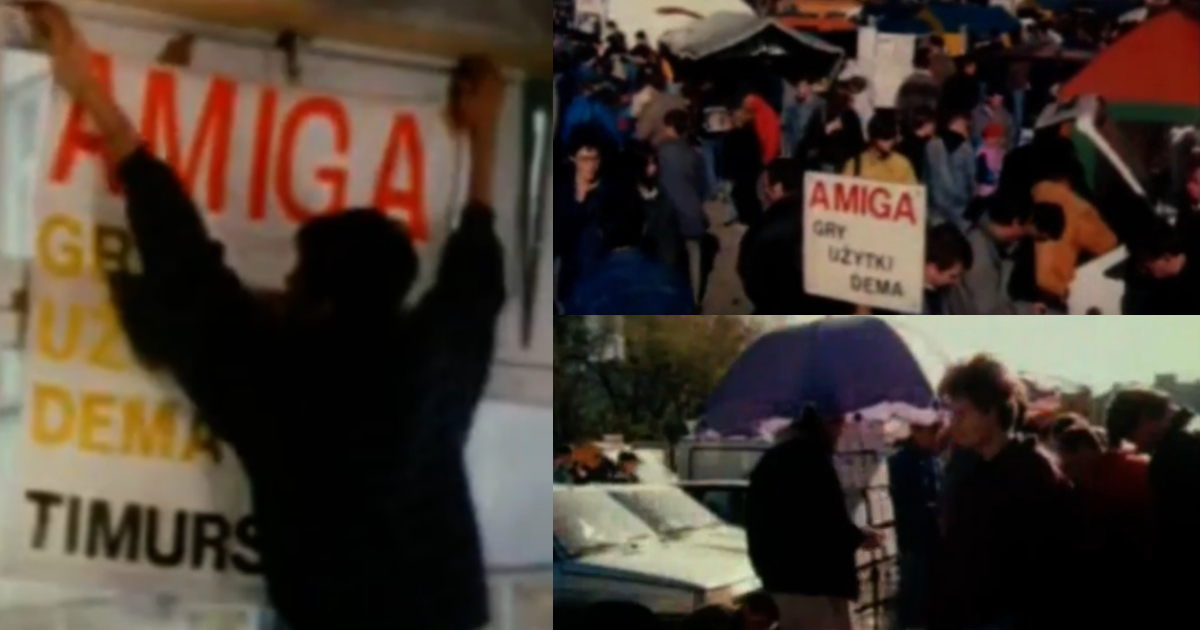

The main protagonist of this story is Polish entrepreneur Krzysztof Kostowski. In 1991, he and his older brother Jacek founded the company Play, soon opening a stall at one of Warsaw's computer markets. The brothers recorded games on floppies and CDs, selling them for a few dozen złoty per copy.

In the '90s, Grzybowska Street in Warsaw became a hub for many budding entrepreneurs who are now famous worldwide. Trading alongside Kostowski was Michał Kiciński, co-founder of CD Projekt, and Marek Tymiński, head of CI Games. Taking his first steps in the same sphere, but in Wrocław, was Techland founder Paweł Marchewka.

While companies like CD Projekt and Techland gradually shifted to creating their own large-scale projects, Kostowski took a different path.

The computer market on Grzybowska (screenshots from a Maniak Gaming video)

After Poland tightened its anti-piracy laws in 1994, Play focused on distributing trial versions of titles. Around the same time, the company discovered another successful business model — selling cheap games in newspaper kiosks on a cardboard backing. This format was called tekturki (from Polish — "cardboards").

Imagine a hypothetical "Igromania," which only retained its discs, and instead of the magazine with articles, there was vibrant A4-sized cardboard. Play recorded cheap games and programs on CDs, printed cardboard backings, and supplied them wholesale to Polish newspaper kiosks on a monthly basis.

"With large circulation, the production cost of such a 'monthly' was less than 1 złoty, while they sold for 5-10 złoty each," recalls Kostowski.

Maluch Racer 3 and other "cardboards" with games from Play (Scans: Play Publishing)

The secret to Play's success was simple: buy licenses for low-budget games and sell them with the maximum possible margin. At its peak in 2005, the company sold up to half a million such "cardboards" a month, with profits reaching 5 million złoty annually (approximately 1.5 million dollars at the time's exchange rate).

In the 2000s, Play also began actively developing its publishing division and produced a number of its own titles. Among them was the popular in Poland racing game series Maluch Racer, dedicated to the Fiat 126p (this model was locally referred to as Maluch, or "little one").

Website of Play Publishing

As the popularity of newspaper kiosks began to decline, Play's "cardboard" business gradually ceased. The Kostowski brothers decided to part ways, and in 2011, Krzysztof founded PlayWay.

He realized it was time to adapt to new market realities. The cardboards with games were replaced by digital distribution, and kiosks were replaced by Steam.

One unchanged aspect of Kostowski's business was the focus on numerous low-budget games to diversify risks. The challenge was merely to choose the right niche.

Drawing from 20 years of game sales experience, Kostowski concluded that "simulator games have always been in demand." Starting with the success of Car Mechanic Simulator 2014, various profession and activity simulators have become PlayWay's trademark.

Car Mechanic Simulator 2014 — PlayWay's first hit in the simulator genre

The second crucial feature of Kostowski's economic model was the approach to business development. Since 2011, PlayWay has invested in small teams, acting as their publisher or developing projects through internal teams or subsidiary studios.

By 2015, 44 teams all over Poland were working on its games. The number grew each year, and the company gradually evolved into a sprawling holding consisting of hundreds of developers.

In 2016, PlayWay went public on the Warsaw Stock Exchange. Today, its market capitalization stands at 1.85 billion złoty (486.9 million dollars). This surpasses the market value of notable Polish developers and publishers such as Huuuge Games (360 million dollars), Bloober Team (145 million dollars), 11 bit studios (127.6 million dollars), and CI Games (85.3 million dollars).

Among the two dozen gaming companies in the WIG Games index, PlayWay trails only behind the local giant CD Projekt (5.8 billion dollars).

Business Structure of PlayWay: How to Manage 60 Studios

PlayWay is a public company with its headquarters in Warsaw. Together with its subsidiaries, it forms the PlayWay Capital Group. According to the latest financial report, it includes 38 subsidiary studios.

To avoid confusion, a few notes are in order.

PlayWay does not own a majority stake in all of its subsidiaries. In some cases, it owns up to 100% of the capital, while elsewhere, less than half (yet still acts as a key investor). Some subsidiaries are publicly traded, but for these nearly four dozen entities, PlayWay is the parent company.

All studios adhere to unified accounting principles and may eventually be absorbed by the headquarters. However, the parent PlayWay rarely opts for direct mergers, preferring to remain a relatively small company.

For ease of evaluating the entire holding's financial situation, subsidiary studios are categorized into four groups based on their influence on PlayWay’s revenue and profit:

- Group A — companies with successful games in their portfolio, significantly impacting PlayWay's financial performance;

- Group B — they publish games but do not significantly impact the results;

- Group C — working on their first games (usually in early development stages);

- Group D — not involved in video game production (currently, no such companies are part of PlayWay).

Additionally, PlayWay Capital Group owns a stake in 25 more studios (in fact, there are 26, but one, Evor Games, is in the process of liquidation). They are referred to as "affiliate companies" — essentially, external partner companies influenced by PlayWay through direct investments.

PlayWay Studios in Poland

The holding’s share in affiliate entities ranges from 20% to 50%. Some may grow to "subsidiary" status over time, while partnerships with others might be discontinued in favor of new investments.

Thus, PlayWay controls 63 companies (as of December 31, 2024). They are all located in Poland, ranging from small startup studios to more established companies, generally comprising dozens (if not hundreds) of teams of various sizes.

The primary shareholder of PlayWay remains Kostowski, with a 40.9% stake. An equal share belongs to the Cypriot investment firm ACRX, with the remaining 18.2% of shares publicly traded.

Shareholders of PlayWay

Despite the complex structure, PlayWay itself employs relatively few people. While exact figures are unavailable, according to LinkedIn, the headquarters has only a few dozen employees. Most of them are developers.

The parent PlayWay is directly managed by three individuals: