Eric Seufert, vice president of acquisition and user engagement at Rovio, said that CPM (Cost Per Mile / Cost Per Thousand – cost per thousand impressions) has decreased in Asia. And he shared his thoughts on what this might mean.

The original version of the material can be found on Mobile Dev Memo, a website dedicated to the mobile industry, run by Eric Seferth himself, author of the book Freemium Economics.

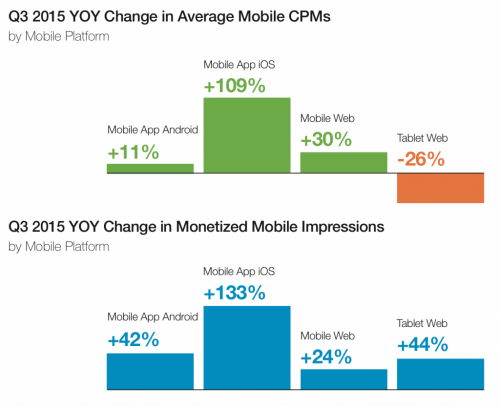

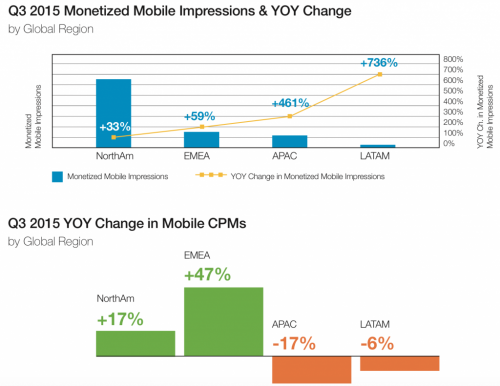

PubMatic, a developer of marketing automation software, recently published a quarterly report on mobile (Quarterly Mobile Index) for the 3rd quarter of 2015, from which two interesting conclusions about pricing in mobile marketing follow (with one caveat: the report is based on data collected using PubMatic’s own platform, and therefore does not necessarily reflect the situation affairs in the broader sector of the mobile economy).

The first conclusion is that, although the number of monetized views on mobile is increasing on both Android and iOS, the growth is much more significant on iOS, and it is accompanied by a significant increase in CPM indicators.

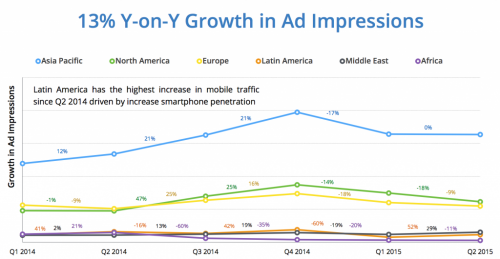

The second conclusion is that CPM indicators in two growing regions have decreased compared to the previous year, which seems natural if we take into account the rapid growth in the number of monetized views on mobile (the yellow line in the first diagram represents the growth of the indicator in annual comparison).

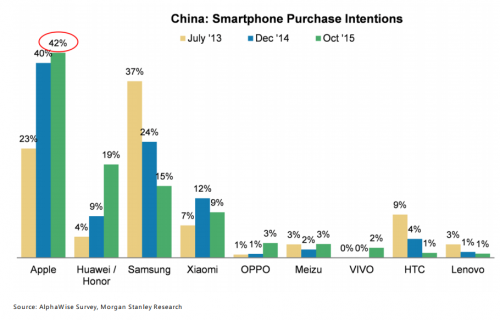

These charts display data from a variety of perspectives, and therefore it is interesting to see how they intersect – especially with regard to China. In the 1st quarter of 2015, Apple increased its sales figures by 71% year-on-year, thus taking a leading position in smartphone sales in China. The company’s revenue in the country for the second quarter of 2015 also turned out to be high, although it decreased by 21% compared to the 1st quarter. Analyst Neil Cybart from Above Avalon recently published several charts from a Morgan Stanley study on the purchasing intentions of Chinese consumers (in other words, which smartphone they are going to buy).

In China, Apple has clearly taken a confident position, and the company’s impressive sales figures in 2015 will obviously increase the number of monetized mobile views in the country (and, at the same time, reduce CPM). Since China is the largest smartphone market in the world, changes in consumer preferences have a significant impact on the metrics of the entire Asia-Pacific region.

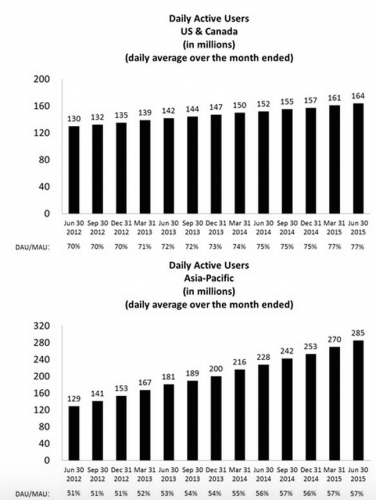

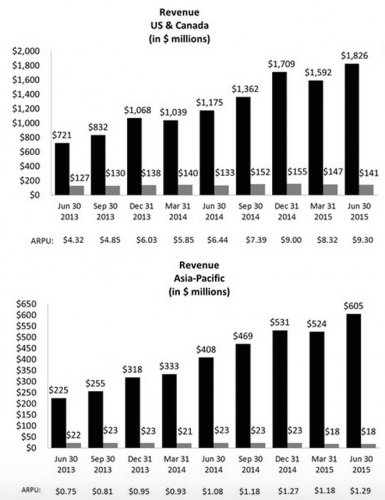

Facebook’s report for the second quarter of 2015 allows us to consider the situation in the region from a different angle. Facebook’s revenues (and ARPU) in North America are much higher than in Asia, although DAU in North America is much smaller.

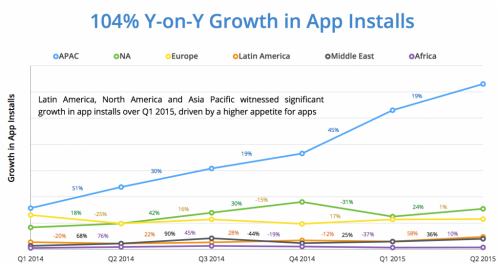

Of course, the comparison is not entirely correct, since Facebook is banned in China, whereas the PubMatic study includes data on China. However, in general, the conclusion is this: when it comes to demand-driven CPM, growing regions do not actually produce higher indicators than mature markets. Apparently, advertisers invest in mobile based on the level of monetization, and it is still low in Asia. In fact, 90% of the monetized views in the Asia-Pacific region are provided by the mobile Internet (in other words, users view ads not from applications, but simply from the Network), and therefore the growth of ad views on mobile lags behind the growth of installations (the graph is provided with the kind permission of InMobi and taken from the company about the monetization of the Asia-Pacific region for the second quarter of 2015).

Of course, “Asia” is a broad concept; it is difficult to draw conclusions when the data is not tied to a specific country. However, for advertisers, a falling CPM can be a bad omen: the spread of smartphones in the Asia-Pacific region is 40% (and will reach more than 50% by 2019), so the reduction in CPM costs caused by an increase in advertising views does not mean anything yet (and, by the way, the following graph indicates that the growth of advertising views from the 1st quarter of 2015 to the 2nd quarter of 2015 was equal to 0).

Another possible explanation for the decline in CPM is that the demand for advertising has decreased due to problems with the return on investment. If this is the case, then it may be necessary to wait for more global economic changes before developers begin to actively invest in creating a user base.