Game studio NewPubCo shared with App2Top.ru a story about how the change in advertising monetization affected the long-term revenue figures of their game.

Vlad Gurgov — NewPubCo

We have chosen an advertising monetization model for our products.

And, like many others before us, we were faced with a choice at some point.

Which is better:

- strive to increase revenue per user at all costs, even at the risk of losing it?

- protect users from aggressive advertising, losing in daily revenue per user (ARPDAU), but reducing the outflow of the audience and thereby increasing LTV?

Of course, we saw the ideal scenario as finding an equilibrium point in which users bring in a fairly high income every day and at the same time do not leave. But that’s what it’s perfect for — it’s not easy to implement it.

It is also not easy to give up a high ARPDAU. There is nothing wrong with the metric itself. The problem is that its high performance is usually achieved by increasing the click rate.

This often happens rather unecologically for the player. They put a lot of advertising, make it so that the videos are difficult to close. As a result, the number of random clicks that take the user away from the application increases.

They usually don’t stop there. To increase ARPDAU, they switch to the strategy of squeezing the user at the very first stages of the game. At the same time, they are directing more and more revenue to attract new users, since it is not necessary to count on a high LTV — the level of user outflow caused by aggressive advertising is too high.

We decided to abandon this approach and check what will happen to retention if we disable one of the “aggressive” networks (that is, those that show unclosed ads). We were wondering if LTV would grow and if so, would it compensate for the losses in ARPDAU?

It was scary, because we understood that the daily income was guaranteed to fall!

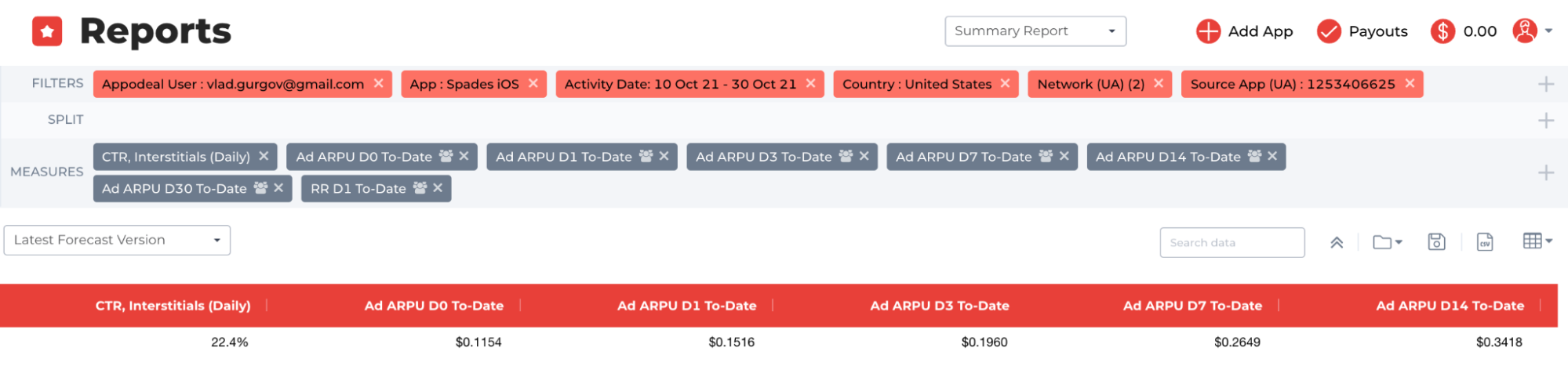

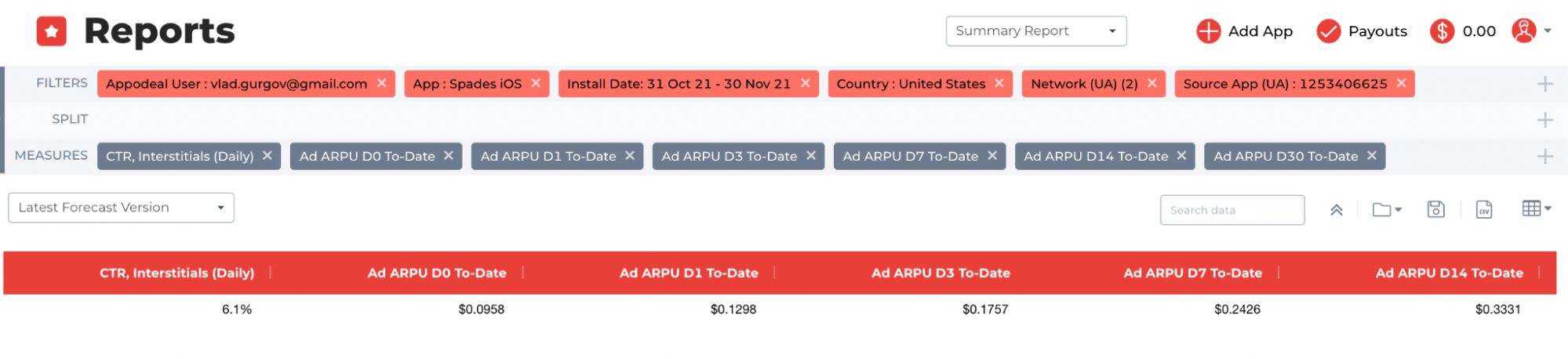

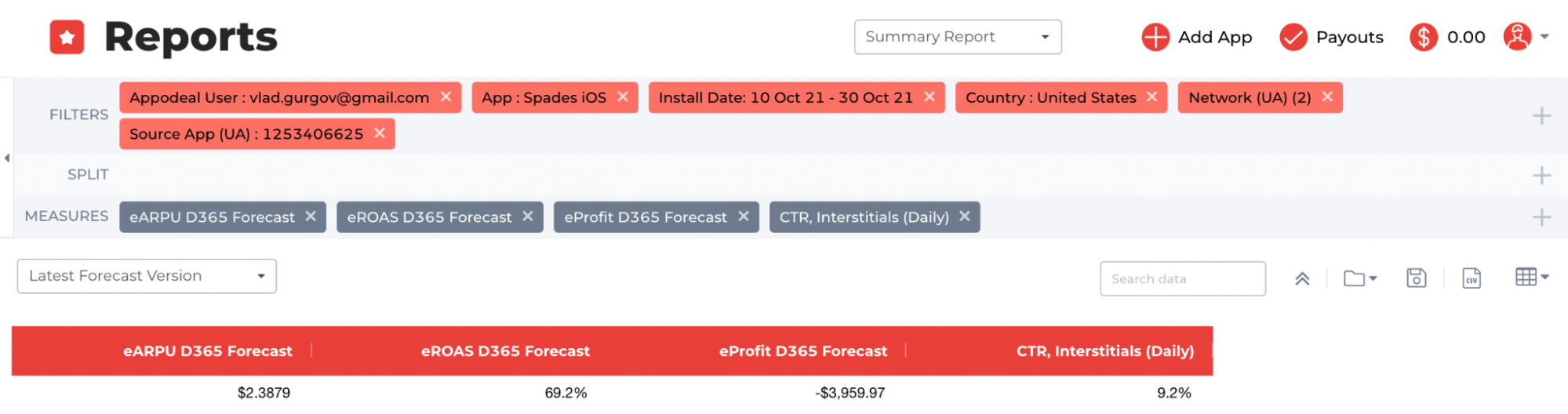

In our Spades – Classic Card Game, we disabled one of the advertising networks whose click rate exceeded 50%. As a result of this:

- CTR of fullscreen ads (the ratio of clicks to ad impressions) fell by 77%;

- cumulative APRU also decreased from 17% (APRU Day 0 to Date) to 8% (APRU Day 7 to Date).

APRU Changes

CTR before strategy change (Source: Appodeal)CTR after strategy change (Source: Appodeal)

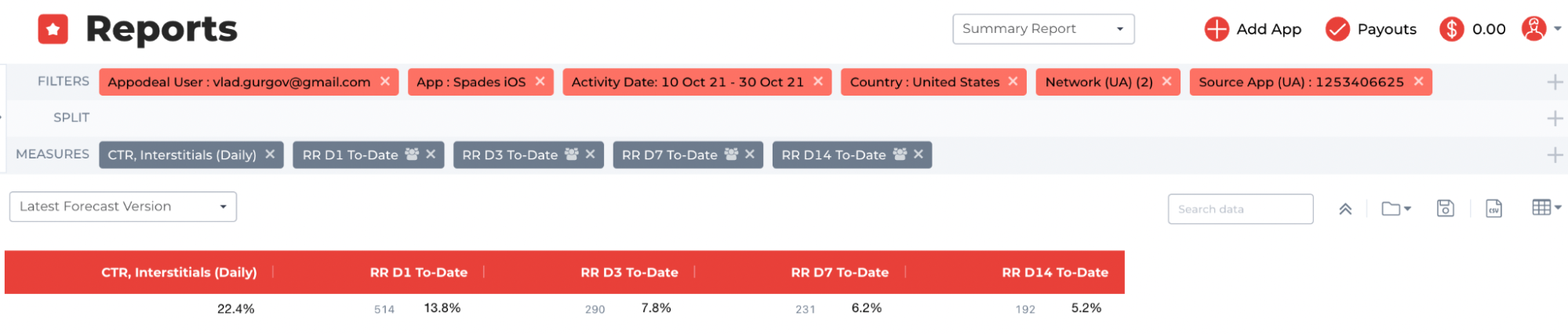

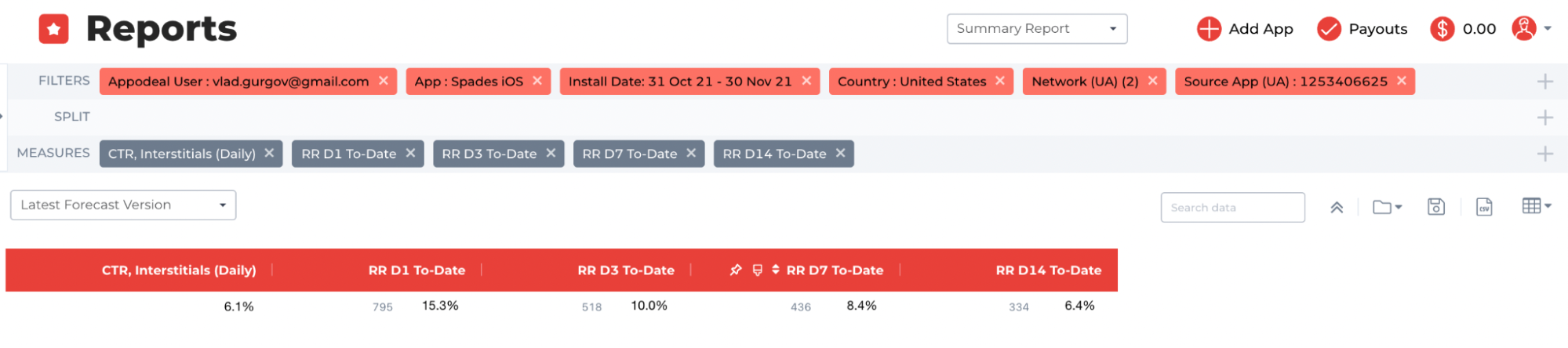

At the same time, the Retention Rate began to grow.

In dynamics, the growth ranged from 10% (RR Day 0 to Day) to 35% (RR Day 7 to Day)!

Retention Rate Changes

Retention Rate before Strategy change (Source: Appodeal)Retention Rate after Strategy Change (Source: Appodeal)

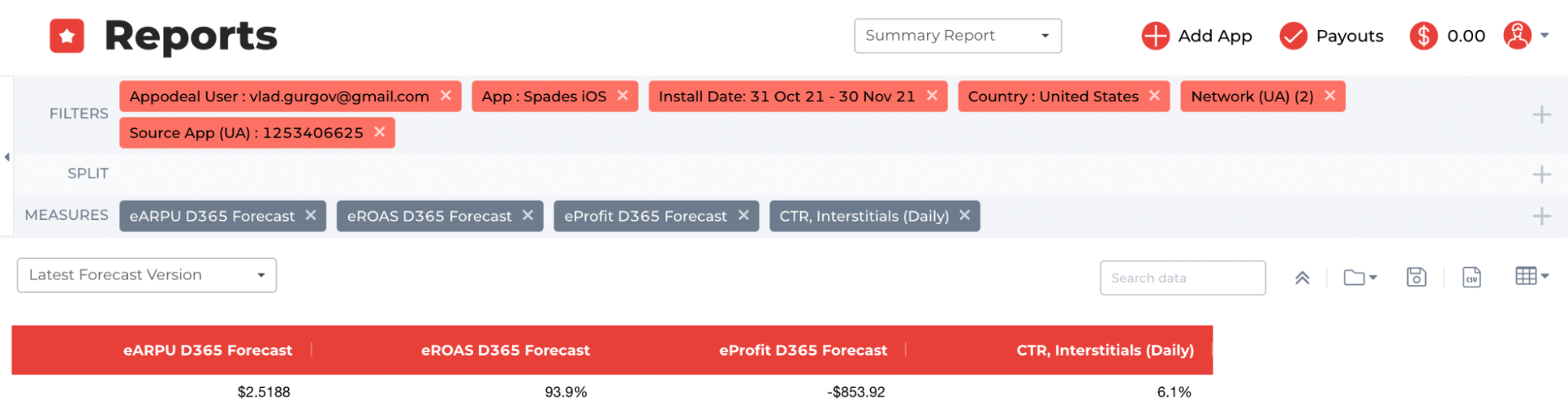

The decrease in the outflow of users led to an increase in the effectiveness of advertising costs.

The eProfit D365 Forecast indicator increased by 78%!

eProfit D365 before the strategy change (Source: Appodeal)eProfit D365 after Strategy change (Source: Appodeal)

This experiment clearly demonstrated how user care is converted into business results of applications.

Disabling aggressive networks in our case led to a decrease in revenue at the moment, but to its growth in the future due to a decrease in the outflow of users and the growth of LTV.