Dapper Labs, a company known for the CryptoKitties game, is developing a new blockchain project. It’s called NBA Top Shot, its audience is approaching the one million mark and investors believe in it. In the latest funding round, Dapper Labs raised $305 million. We tell you how it happened.

NBA Top Shot is a major success of Dapper Labs, without which investments would be impossibleWhat kind of company is Dapper Labs and where did it start?

Today Dapper Labs is a studio in Vancouver with up to 250 employees.

Since its foundation in 2018, it has been focusing on the development of collectible games built on blockchain. And she is one of the few who managed to make a working and long-lived business in this niche.

Dapper Labs as a company was separated into a separate business only after the first game of its developers — CryptoKitties — became famous at the end of 2017. Before that, both the game and the team were part of the Axiom Zen incubator.

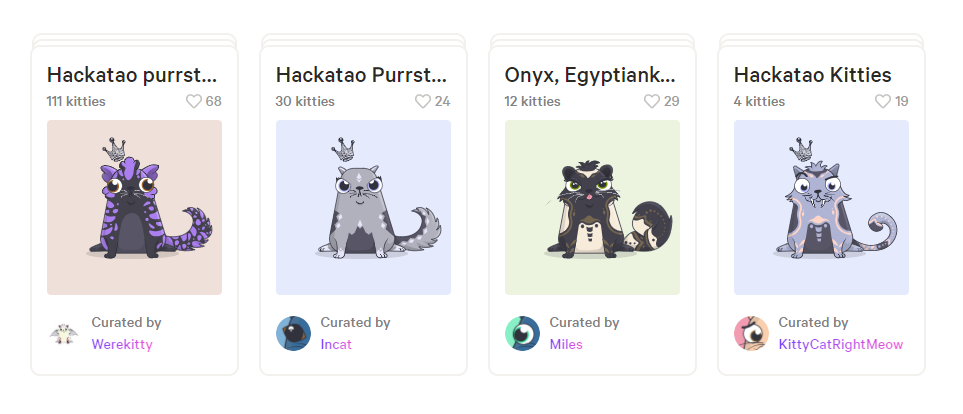

CryptoKitties

Here it is important to say a few words about CryptoKitties.

It is her success that underlies all the next achievements of the team.

CryptoKitties is, as mentioned above, a crypto game. And it is still functioning successfully. In it, the player collects and breeds seals. He can also sell them.

Every cat in the game is unique. Seals act as collectible elements, the uniqueness of which, as well as the right of ownership, is provided by blockchain technology (NFT token). Kittens are bought and sold for ether (Ethereum). The trade goes directly between the players. The developer earns a percentage from each transaction.

Crypto games existed before the “seals”, but it was CryptoKitties that became the first gaming crypto blockbuster. The audience of the game reached 1.5 million people in six months, and the size of transactions for the sale of some particularly exceptional seals amounted to $ 200 thousand at the same time. By March 2018, the cash turnover of the entire game was $40 million. Moreover, at one time a quarter of all transactions on the air accounted for this game.

In the wake of the kittens’ success, Dapper Labs managed to raise $27.9 million in two rounds. But that was just the beginning.

Problems of the Gaming Blockchain and Flow

The first blockchain games (they are also dapps, decentralized applications, that is, those in which calculations are carried out distributed outside the traditional client-service system, which is a key feature of the blockchain) almost immediately encountered significant limitations of the platforms and standards available at that time.

The main one is the problem of scaling. In dapps, all information about each transaction is stored not on one computer, but on thousands (they are nodes). This means that calculations take a long time and are expensive. Therefore, by default, such games cannot have a very large audience, as well as a low price tag for content (and without a low price tag, a low entry threshold is impossible). Because of this, the possibility of mass success of the format was questionable at one time.

That’s how Flow works somehow

Many people have taken care of solving this problem.

Including Dapper Labs, which introduced its own Flow blockchain platform in 2019. It also stores information about each transaction on thousands of devices, but not all of it, but some separate aspect of it. This made it possible to increase the throughput of the new blockchain a thousandfold and reduce the cost of operations.

Both investors and Dapper Labs partners were attracted by this approach. And the company was able to raise $11.2 million in the same year, and at the same time entered into partnerships with the NBA, Samsung, Ubisoft, Warner Music Group and other companies.

A new major success

Although Flow has become a blockchain that can be used by third-party companies, it was originally developed for internal tasks. And one of these tasks was to create your own blockchain application that will be able to gain wide popularity, go beyond the narrow cryptocurrency niche.

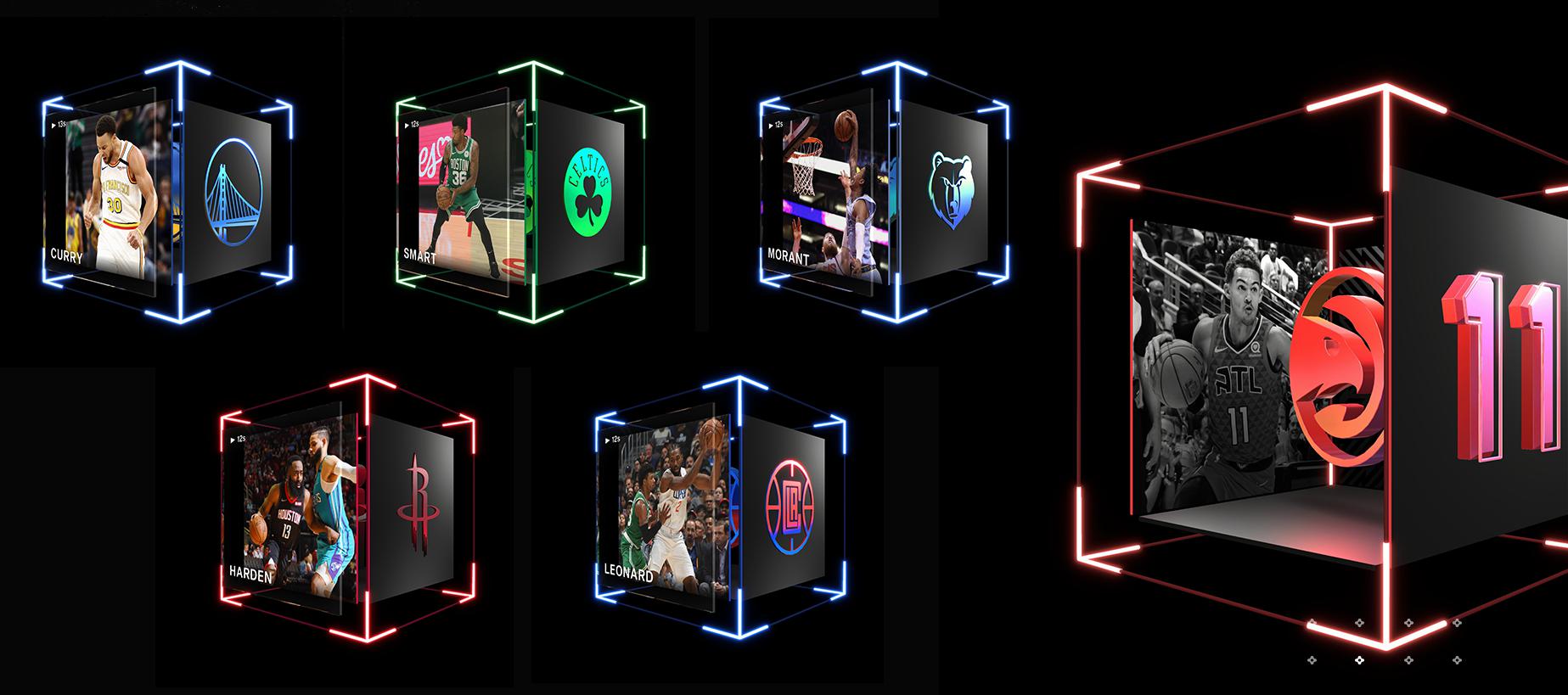

Such an application was the NBA Top Shot. However, it can also be called a game. In fact, this is an analogue of the Ultimate Team mode from EA sports simulators, but without gameplay. In the project, a player buys closed packages with collectible NFT cards with moments of basketball matches for real money.

The cost of many cards in the NBA Top Shot has already exceeded $ 200 thousand

Cards, as in traditional collectible board games, are divided by rarity.

Most of them are not unique. NFT is needed here so that the users of the application have the opportunity to trade them with each other.

The fact is that you can make various thematic collections from the cards. And if a particular card still does not fall out of the purchased packs, then you can go to the trading platform and buy it from the user who put it up for sale.

The preliminary release of the NBA Top Shot took place last October. Over the past period, the number of transactions made in the application has reached 3 million for a total amount of $ 500 million. Dapper Labs itself calls NBA Top Shot the most popular dapp in the world today.

What did it lead to?

As a result, this March, the entire Dapper Labs was valued at $2.6 billion. It is based on this amount that $305 million was invested in it the other day.

To be fair: the hype around NFT as a format that allows certifying authenticity and rights to digital and not only art also played a role (we wrote about this in detail a little earlier here).

The main investor was the hedge fund Coatue. He helped attract more than 30 NBA, NFL, MLB athletes and a number of celebrities (including Michael Jordan) to the round. The Chernin Group, Andreessen Horowitz, Venrock, USV, Version One, Sound Ventures, AG Ventures, 2 Chainz and Will Smith’s Dreamers VC are also mentioned among investors.

Dapper Labs plans to spend the funds raised on the development of the NBA Top Shot, as well as on the launch of similar applications dedicated to other sports.

In total, the company has raised $357 million in its history.