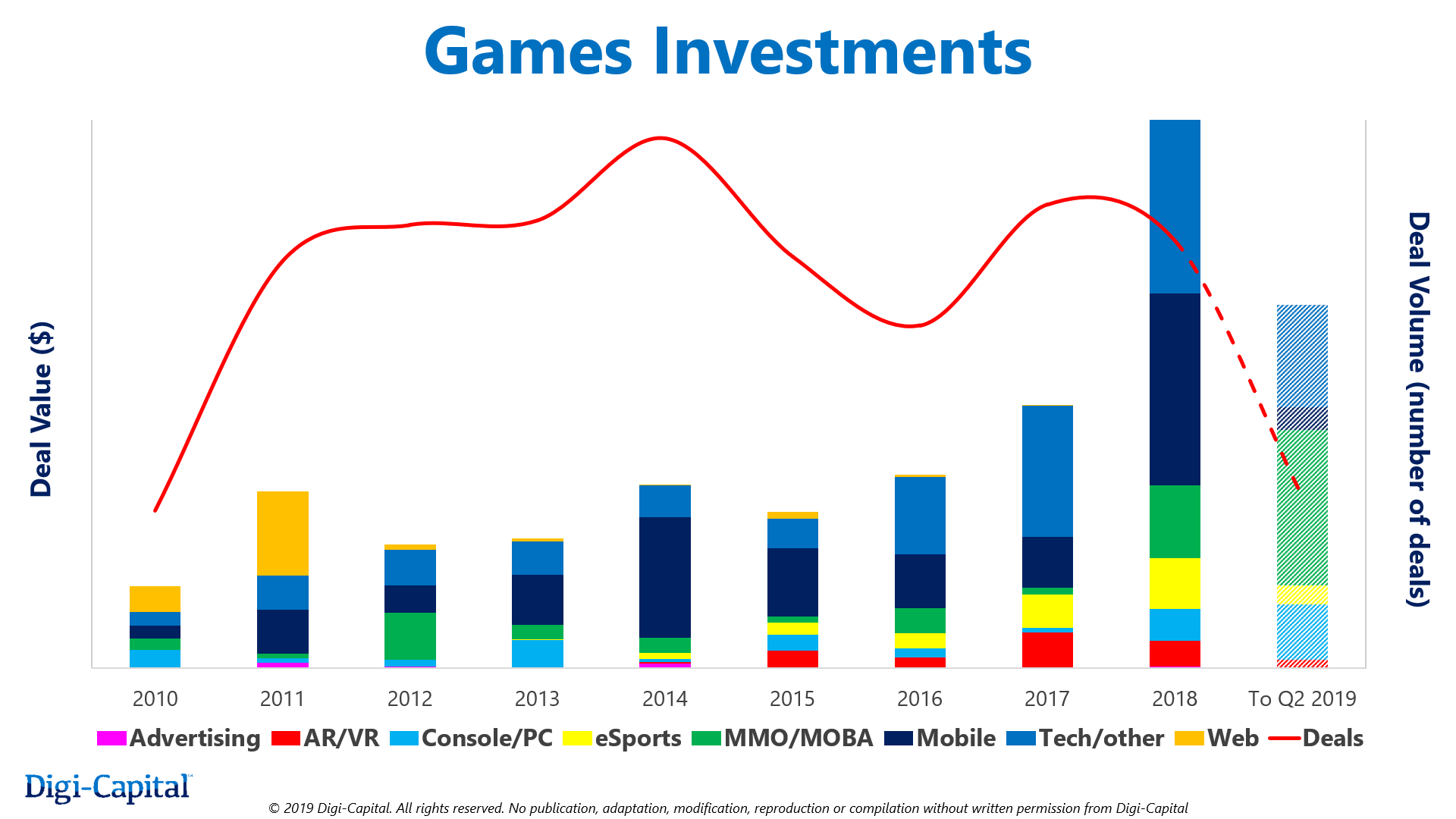

The gaming business has been experiencing an investment boom for the last year and a half. This opinion is expressed by Digi-Capital in its latest report. From January 2018 to June 2019, investors invested a record $9.6 billion in gaming companies.

At the beginning of the material — a brief squeeze, and then — details with graphics.

Squeeze

- now is a record time for the number of investments in gaming companies;

- most investments are invested in technology and MMO/MOBA projects;

- at the same time, the number of investments in esports is decreasing;

- the growth of investments is a consequence of the continued growth of the market and its nature, according to which hits “get everything” (investors see how even indie teams shoot and go to invest);

- despite record investments, there have been very few takeover/merger deals in the last six months (at the level of 2010-2011);

- there are also very few IPOs in recent times;

- both factors may be evidence that market development has slowed down and investors cannot/do not want to exit deals as quickly as a couple of years ago.

Record time

Of the amount of $9.6 billion mentioned in the introduction, $5.8 billion was invested last year, and the remaining $3.8 billion was invested in the first six months of this year.

In total, this is the same amount as was invested in the gaming business over the previous five years (from 2013 to 2017 inclusive).

If such growth rates continue until the end of the year, the total investments for 2018-2019 will be more than for the previous eight years.

The current time does not break records in terms of the number of transactions, but in terms of their volume, it is definitely approaching the threshold value.

What they invest in

Of the specified amount of $9.6 billion, the largest money was invested:

- in technology (game streaming, engines, and so on);

- MMO/MOBA projects;

- mobile games;

- PC/console games

- esports.

Important: even within a period of 18 months, the behavior of investors varies greatly. For example, in 2019, the number of tranches in mobile and esports decreased. But the interest of venture angels in MMO / MOBA and projects for PC / consoles, on the contrary, has grown.

Where does this dynamic come from

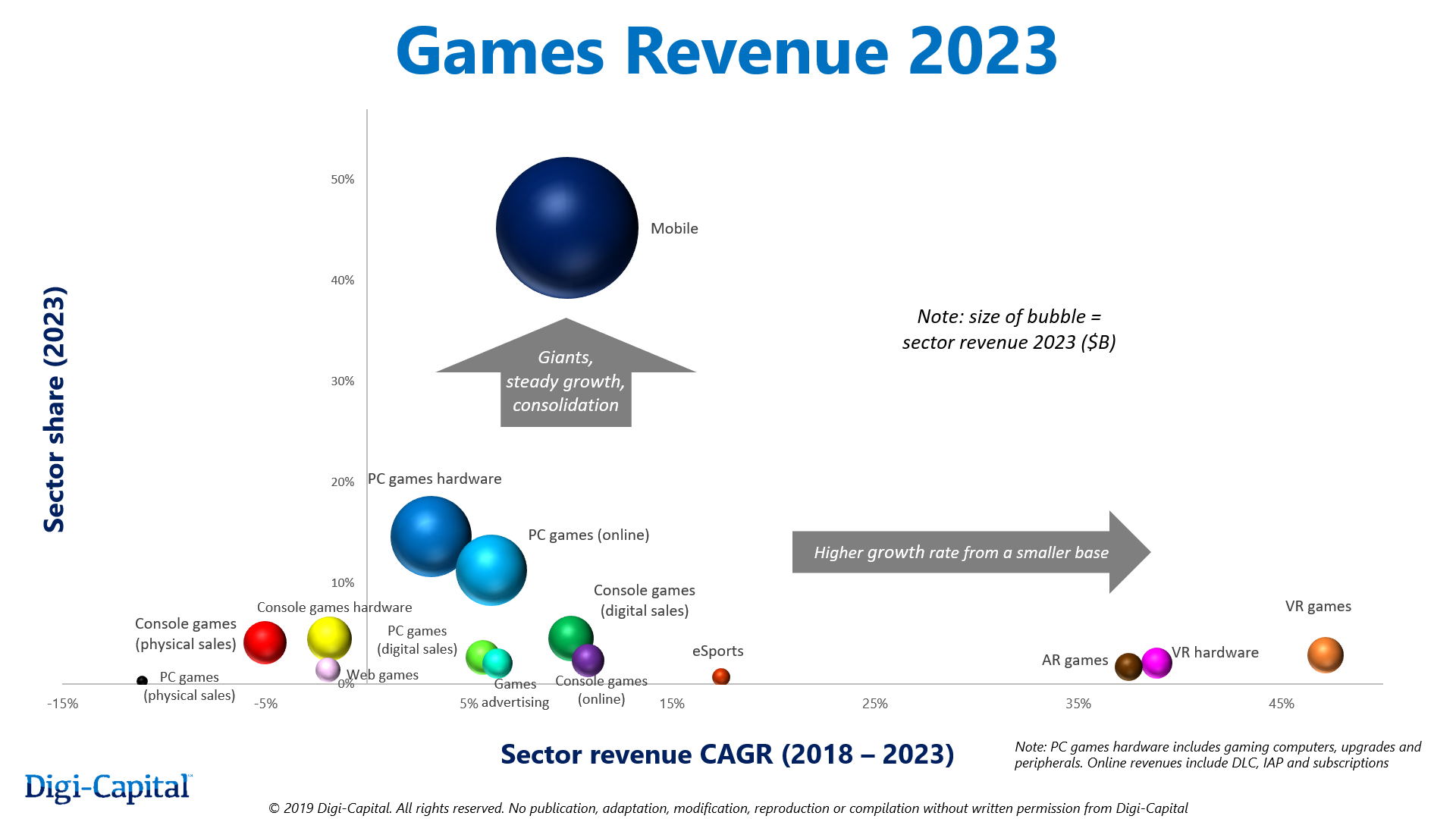

The growth of investments in Digi-Capital is explained by the continued increase in the gaming market. According to the forecast of the analytical platform, the total revenue of the gaming market (software and hardware) in 2023 will reach $ 200 billion. And investors are interested in getting a place in this market.

Despite the fact that the market is very consolidated (with 10 leading companies accounting for three-quarters of all revenue), and success on it is very difficult to predict, it remains a tasty morsel, since even independent small teams can achieve very high results on it by releasing only one or several hits.

The diagram below shows how Digi-Capital sees the distribution of gaming sales in 2023. Analysts’ faith in the VR segment is surprising. They believe that revenue from VR software in five years will be at the level of digital sales of console titles.

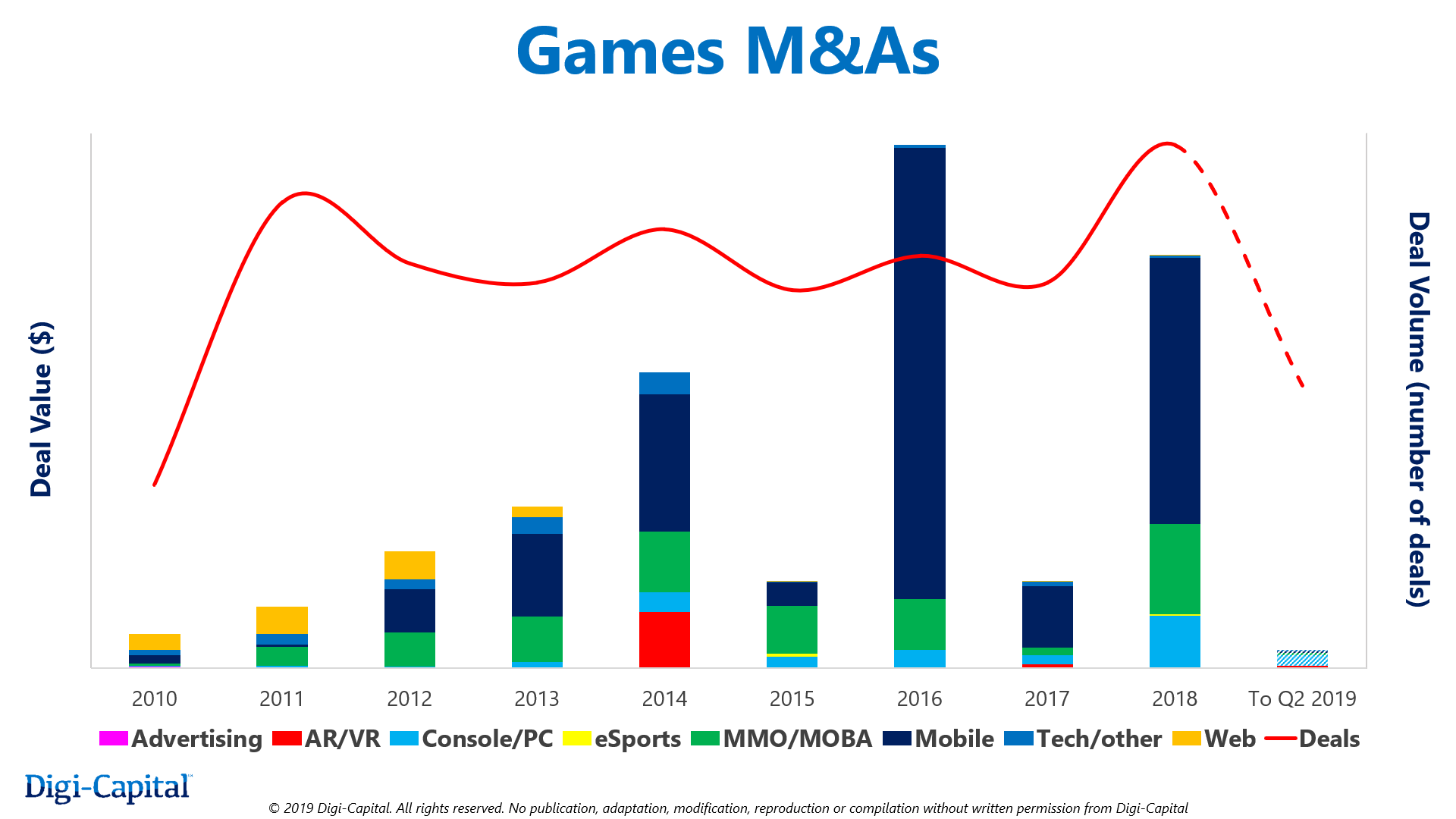

Transactions and acquisitions

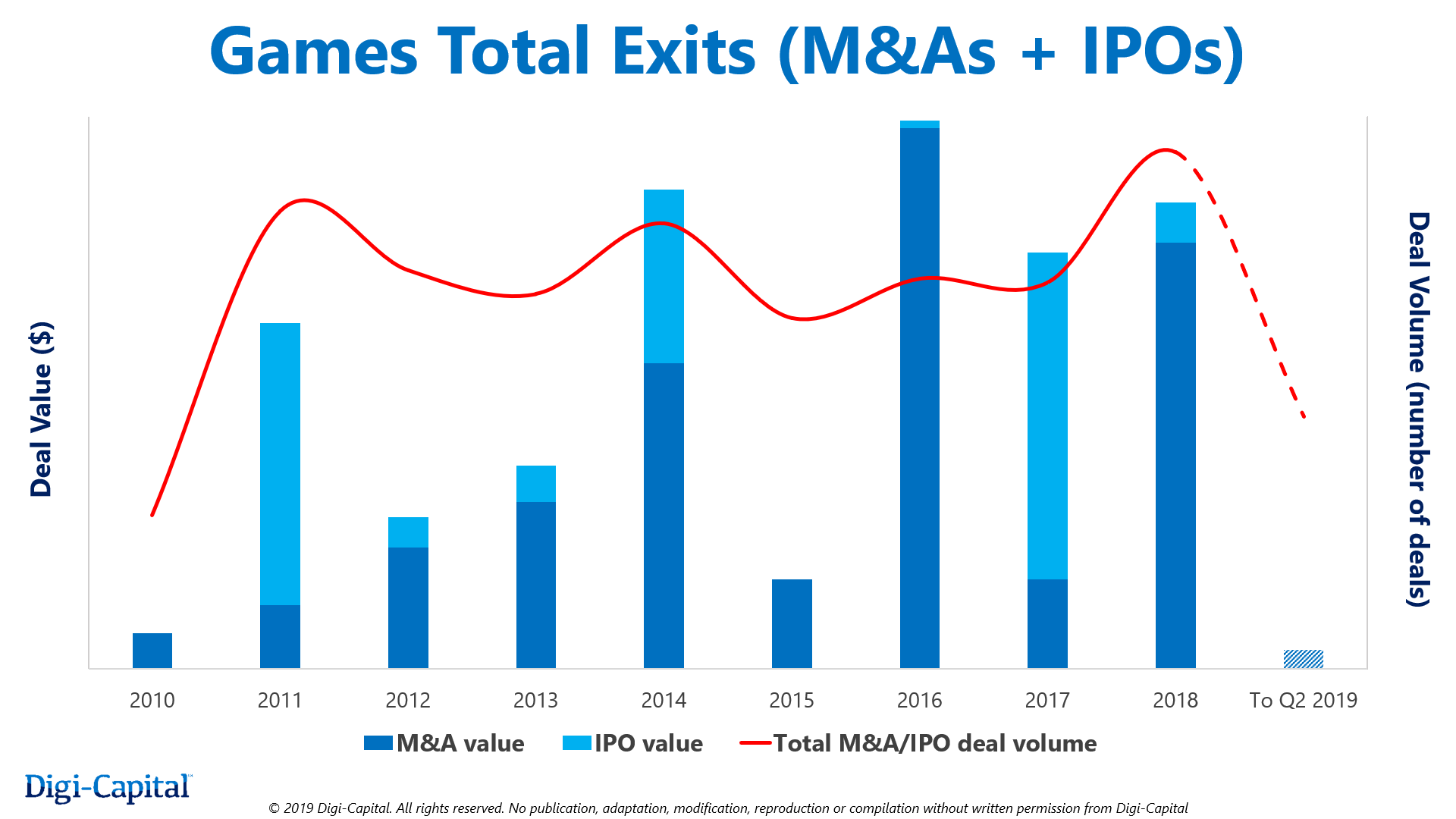

In 2018, $22.4 billion worth of deals and acquisitions were conducted on the gaming market. However, in this regard, 2019 turned out to be very weak. Analysts counted transactions of no more than $1 billion.

Over the past five years, most of the transactions have been in the mobile segment. However, this year their volume has dropped to the level of 2010-2011, when mobile was taking its first steps.

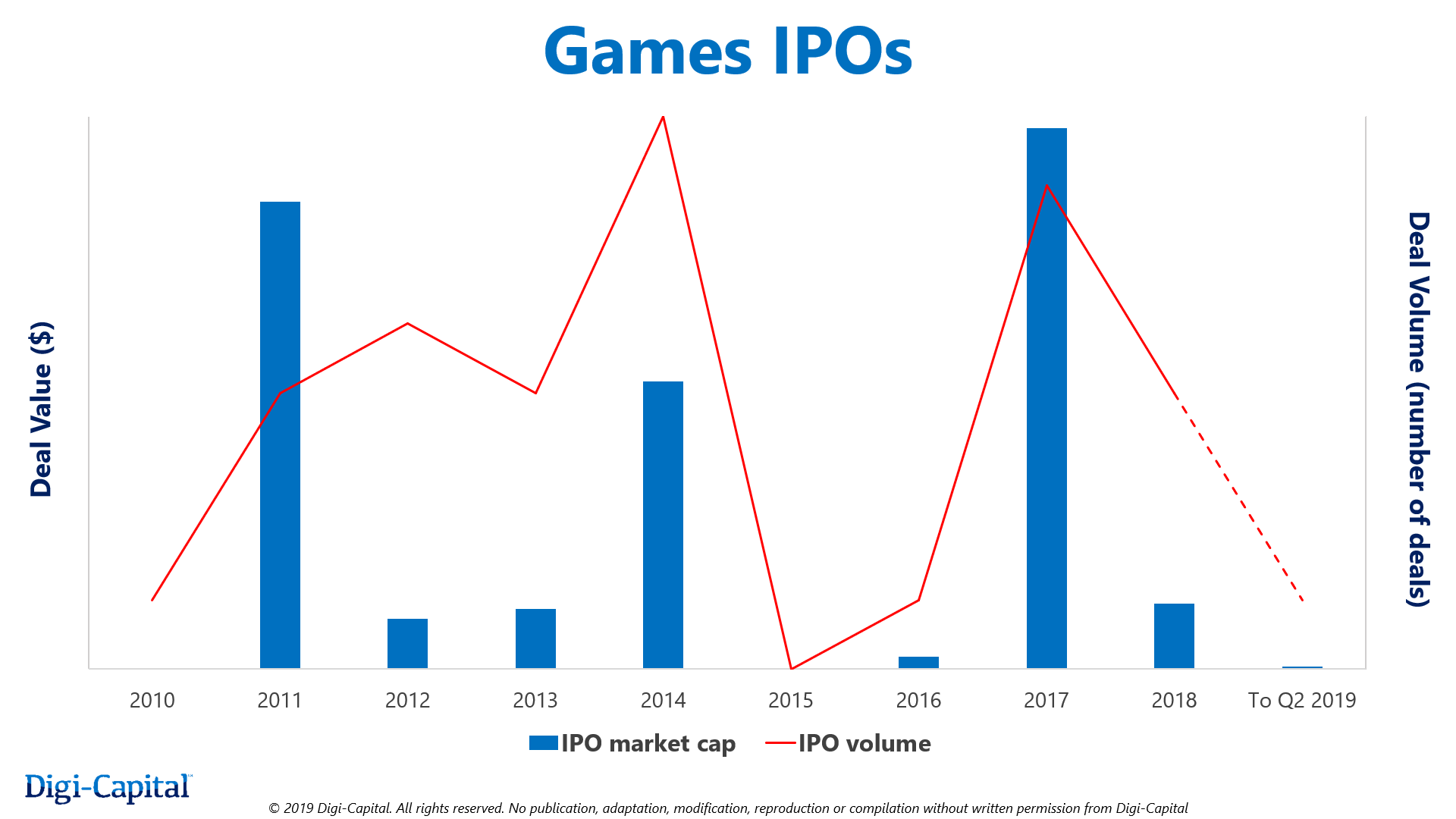

Initial placement of shares on the stock market

Gaming companies enter the stock exchange relatively rarely. Digi-Capital generally sees a stable pattern in the market. After every IPO-rich year, there are two quiet ones. So it is happening now.

After 2017, when Netmarble Games, Pearl Abyss and a whole group of Scandinavian companies, including Rovio and Remedy Entertainment, placed their shares on the stock exchange, there is a lull in the stock market.

History of unrealized capital

The last three years (2016-2018) have been record-breaking in terms of “exits” or “exits”. That is, in situations where funds are returned to investors (the latter occurs when the company is sold or when entering the stock exchange).

However, in 2019, the situation has changed dramatically. The gaming market in terms of returns has returned to the level of 2010, when there were almost none.

Because of this, the market is faced with a large amount of so-called “unrealized capital”. It’s about the difference between the current and initial value of the asset. It is unrealized exactly until the investor sells the asset, thereby fixing whether he earned or, conversely, lost on the transaction.

In other words, now, for some reason, investors do not withdraw from transactions. This formally means that they are still in the red.

The most significant difference between the potential current value and the original:

- esports assets (292 times less than was invested);

- technology (31 times less);

- mobile games (29 times less);

- MMO/MOBA (20 times less).

This does not necessarily mean actual losses. Rather, it indicates a slowdown in the growth rate of the market, and at the same time, the unwillingness of investors to exit deals as quickly as before.

Also on the topic:

- Digi-Capital: in 2018, gaming companies invested twice as much as a year earlier

- Digi-Capital: Mobile market revenues will grow to $48 billion by 2020

- AR/VR startups raised $3.6 billion in a year