What does the mobile games market in Vietnam look like today? How promising is he? Why did Supercell remove all its games from its territory? — the answers to these and other questions are in our material.

The other day, the vice president of the Appota game publishing house Nguyen Minh Quang (Nguyen Minh Quang) posted a curious presentation. In it, in broken English, he briefly spoke about the situation with the mobile games market in Vietnam.

In part, this is a unique document in which a participant in one of the rapidly growing Asian markets talks about the not-so-simple state of affairs in the local industry.

Numbers

Of the 95 million people living in Vietnam, 60 million use the Internet. As a rule, they use smartphones for this. The estimated number of gamers in the country is around 30 million.

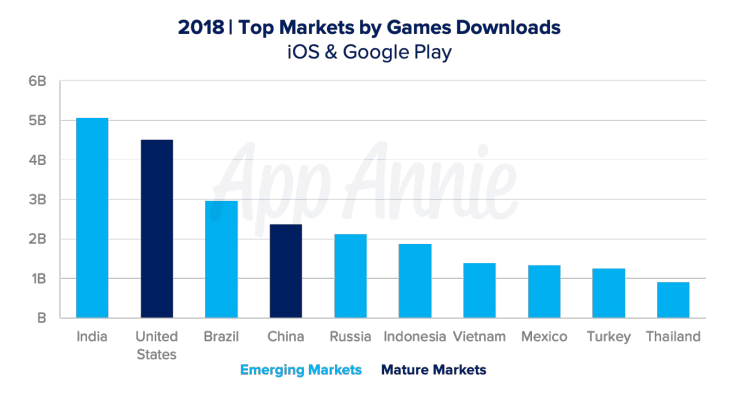

The audience is relatively small, but very active. Vietnam ranks seventh in the world in terms of game downloads. In total, Vietnamese gamers download 1.4 billion gaming applications from the App Store and Google Play every year.

Top markets by global game Downloads

This is less than the Chinese generate, who made 2.4 billion installations last year, but much more than gamers from Japan and South Korea managed to do over the same period — 0.7 and 0.6 billion, respectively.

In terms of revenue, Vietnam’s mobile games market is comparable to Russia’s 3-4 years ago. Its turnover for 2018 amounted to $365 million. At the same time, it is expected to grow by 25% by the end of this year.

Specificity

The local mobile games market is dominated by Vietnamese publishers, which can be divided into two types — funded by Tencent and the rest.

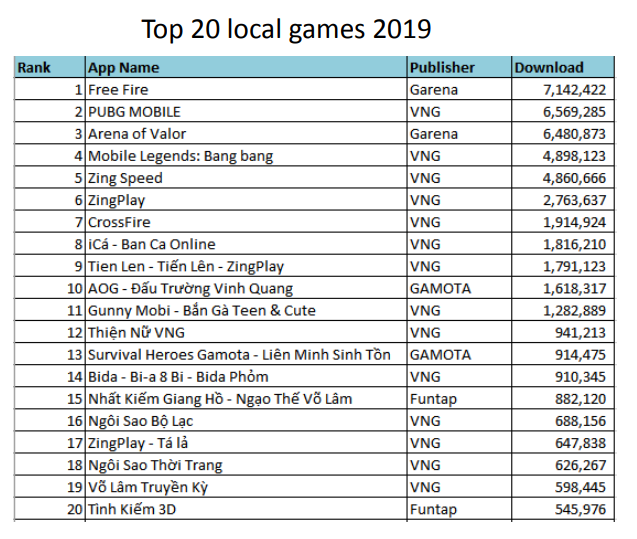

The strong positions of local players are explained simply — many world hits are published through them. For example, VNG acts as the operator of PUBG and Mobile Legends in Vietnam.

Working with local players is a necessary measure. The Vietnamese government strictly regulates the gaming market. To publish the game, you must obtain a license from the Ministry of Information and Communications.

To do this, a foreign company must find a local partner who will help in this matter and, most likely, will become a local publisher of the project. It is clear that not everyone is ready to follow this path.

There are not so many top publishers on the market

A few days ago, Supercell announced that it was removing all its projects from Vietnamese storefronts due to “problems with the local regulator.”

As can be understood from the press release of the Finnish company, it did not have a dialogue with local companies and the government.

Another factor hindering the development of the market is the ban on the use of phone cards to pay for game content. Until May last year, it was one of the main types of payment for in-game content in the country.

It worked like this: the user purchased a card for $ 1, which allowed him, for example, to send several SMS. But he activated it not as an SMS card, but as a payment in a particular gaming service.

This practice was banned by the government in 2018. The initiative has hit the mobile games market hard. Its turnover fell by 60-70%. Many projects have been closed.

At the same time, a solution was found very quickly: now all major Vietnamese publishers have their own game cards that can be bought anywhere for cash, and then activated in the game.

A couple more facts

- While there are problems with publishing games in Vietnam, everything is fine with development. Nguyen says there are thousands of teams that develop indie projects, hyper-casual games. They, as a rule, launch them immediately in the west, even bypassing their native market. The estimated annual global earnings of local teams is $200 million.

- According to their interests, the Vietnamese audience is close to the Chinese. This is noted not only by local analysts. The tops in Vietnam have about the same games as in the tops of the Middle Kingdom: PUBG Mobile, Free Fire, Arena of Valor, Cross Fire. At the same time, mobile MMORPGs earn especially well in the country.

- Various online casinos are very popular in the country. One of the largest of them — Rikvip, in which users left about $ 450 million, was liquidated by the government, and its developers were sent to court.

Also on the topic:

- Flappy Bird is the new leader of F2P applications

- The creator of Flappy Bird is thinking about returning the game