Dmitry Ilyinov, Senior Customer Relations Manager at App Annie, spoke at the WN St. Petersburg’21 conference today. He told what is happening now in the global and Russian mobile gaming markets, and also presented an updated classification of mobile games.

Dmitry Ilyinov at WN St. Petersburg’21The situation on the global market:

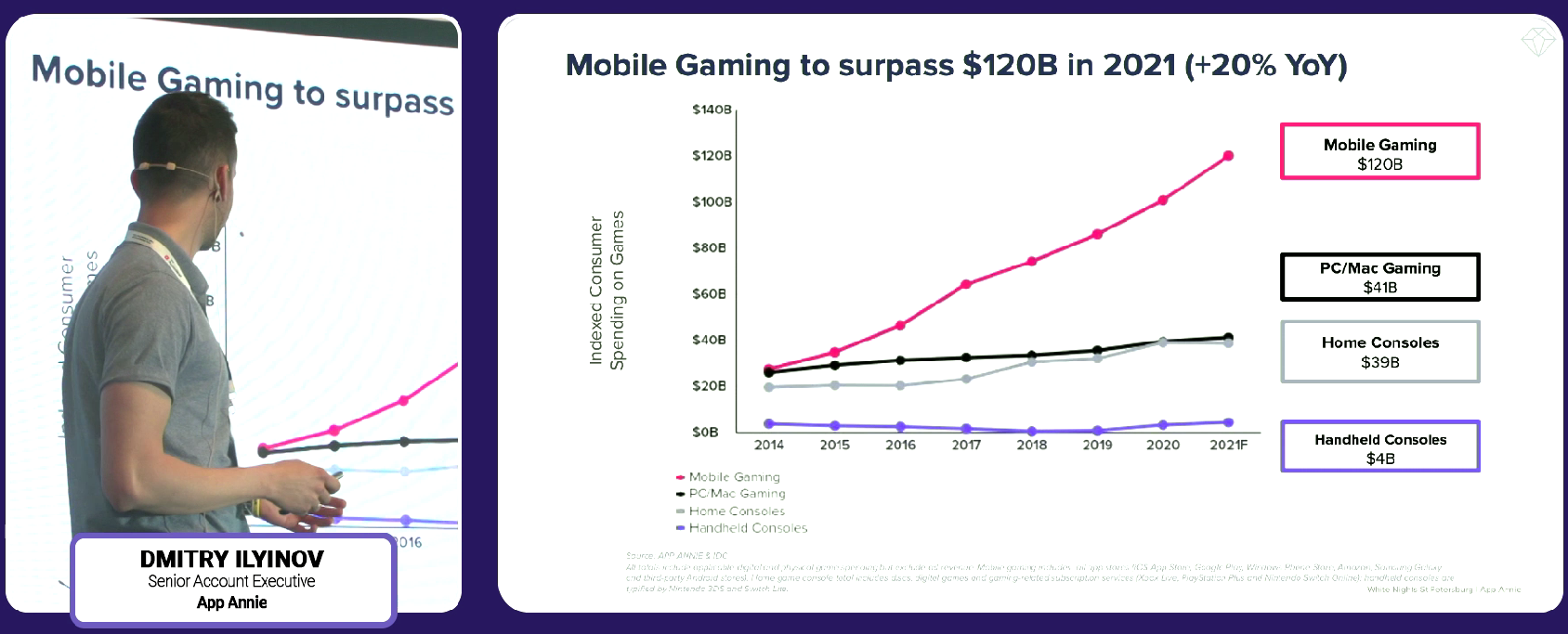

- last year, the mobile gaming market grew strongly against the background of the pandemic — its revenue exceeded $ 100 billion. According to App Annie, in 2021 he can earn even more. By the end of the year, its turnover may exceed $120 billion, which is three times more than that of the console or PC market;

- at the same time, neither consoles nor PCs show the same growth. According to the forecast, the turnover of the console market in 2021 will drop slightly in annual terms and amount to $39 billion. PC market turnover will grow to $41 billion;

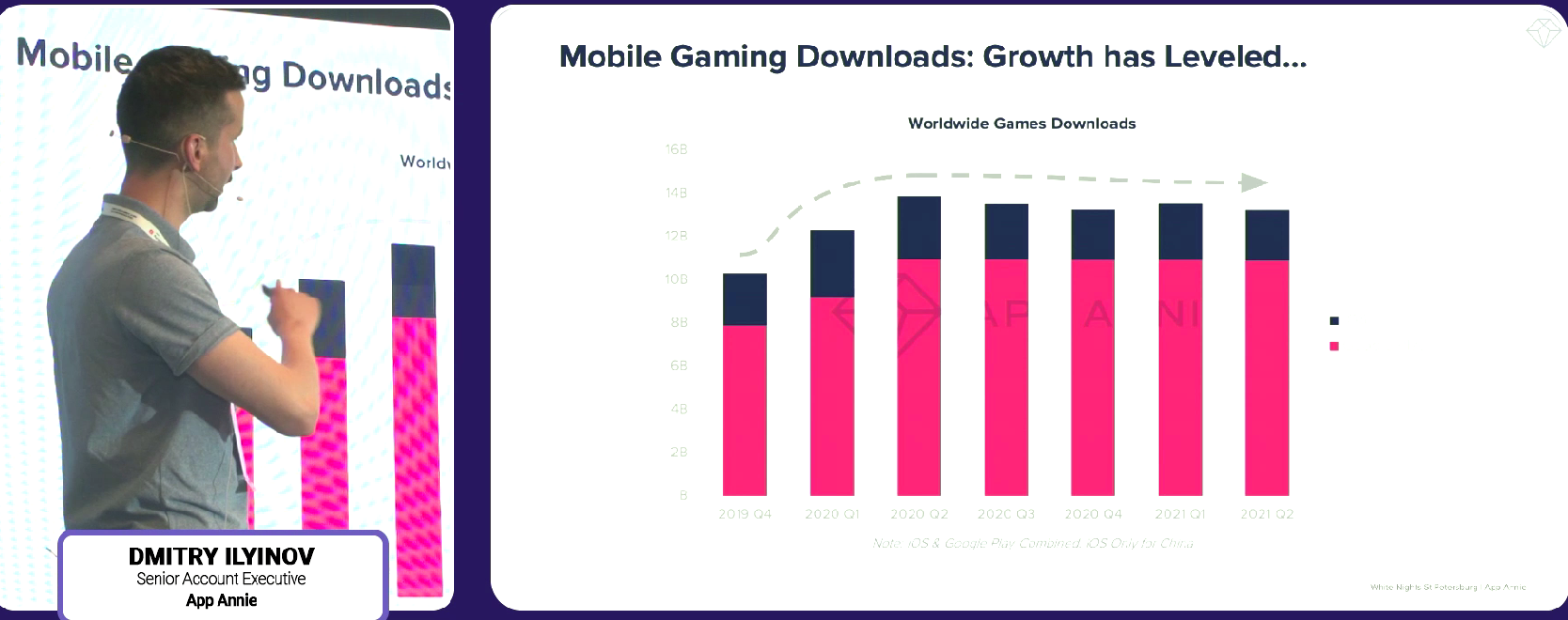

- as for mobile game downloads, according to Ilyinov, the surge began even before the pandemic — in the fourth quarter of 2019. The market reached its ceiling in terms of downloads in the second quarter of 2020, and since then it has been moving smoothly without sharp increases and falls;

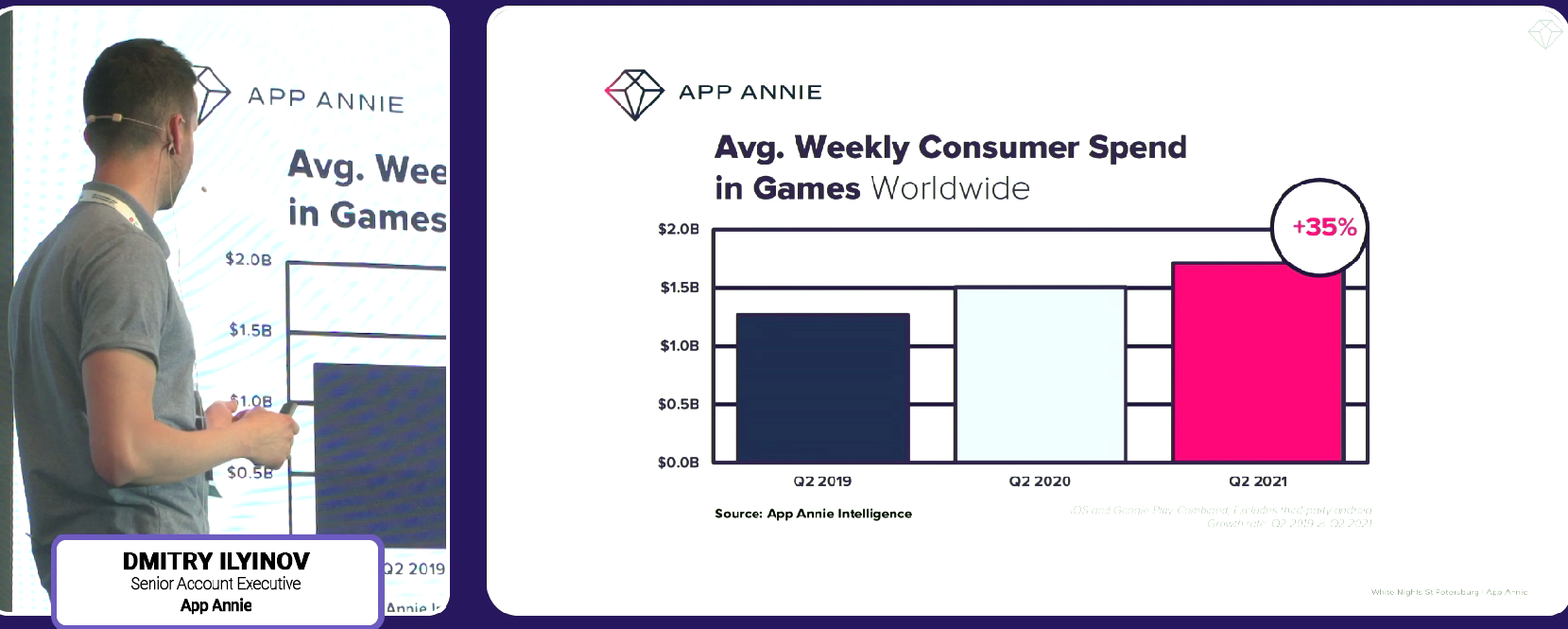

- In the second quarter of 2021, users began spending an average of $1.7 billion on mobile games per week. This is 35% more compared to the results before the pandemic in the second quarter of 2019;

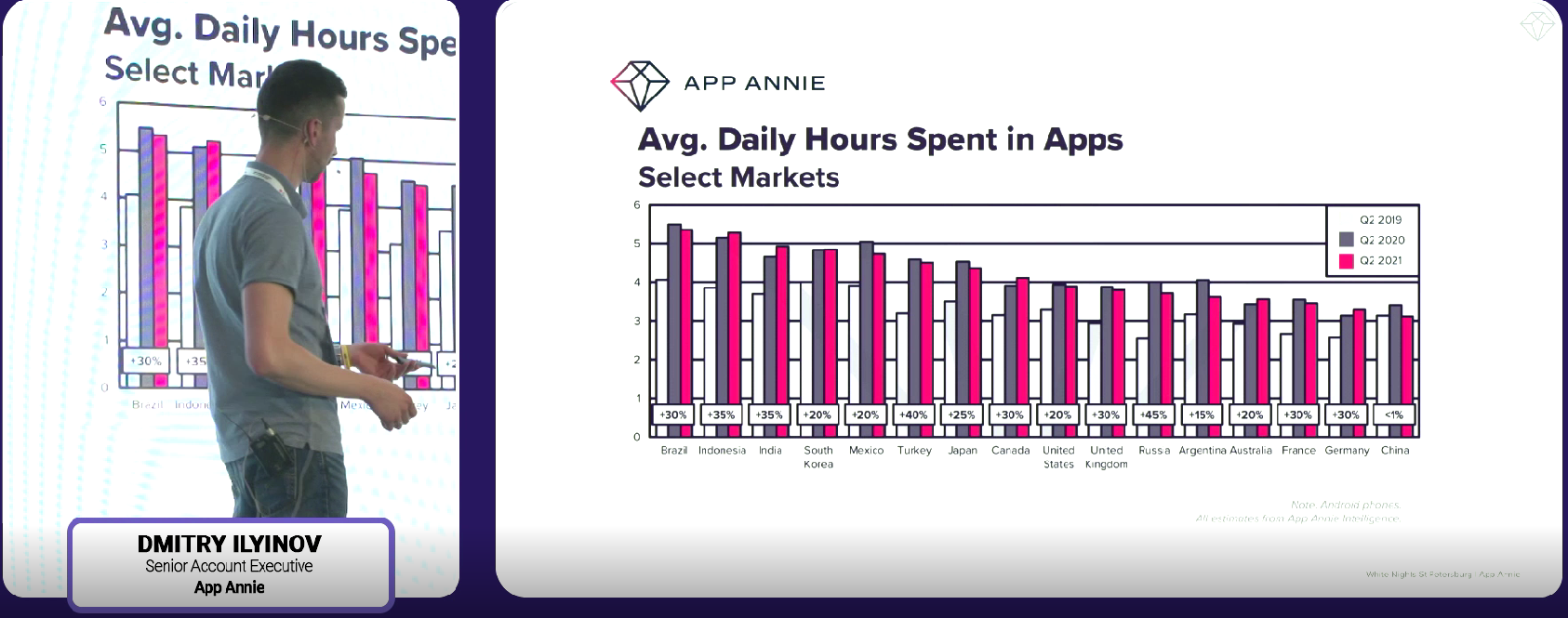

- last year and this year, users from all over the world spent significantly more time in front of the phone screen than in 2019. For example, in Russia, before the pandemic, Android smartphone owners spent an average of 2.6 hours on this, and in the second quarter of 2020 — almost 4 hours. In the second quarter of 2021, the number of hours decreased to 3.8, but this is still higher than two years ago.

Classification of mobile games:

- Ilyinov recalled that last year App Annie developed its own classification of mobile games. This year the company has finalized it;

- App Annie analyzed 28 thousand of the largest games, breaking them into categories in terms of gameplay;

- according to Ilyinov, such a taxonomy allows you to get a fairly thin slice of the market. If you look at the level of subgenres, you can see the largest representatives, the size of the audience, the number of sessions and much more;

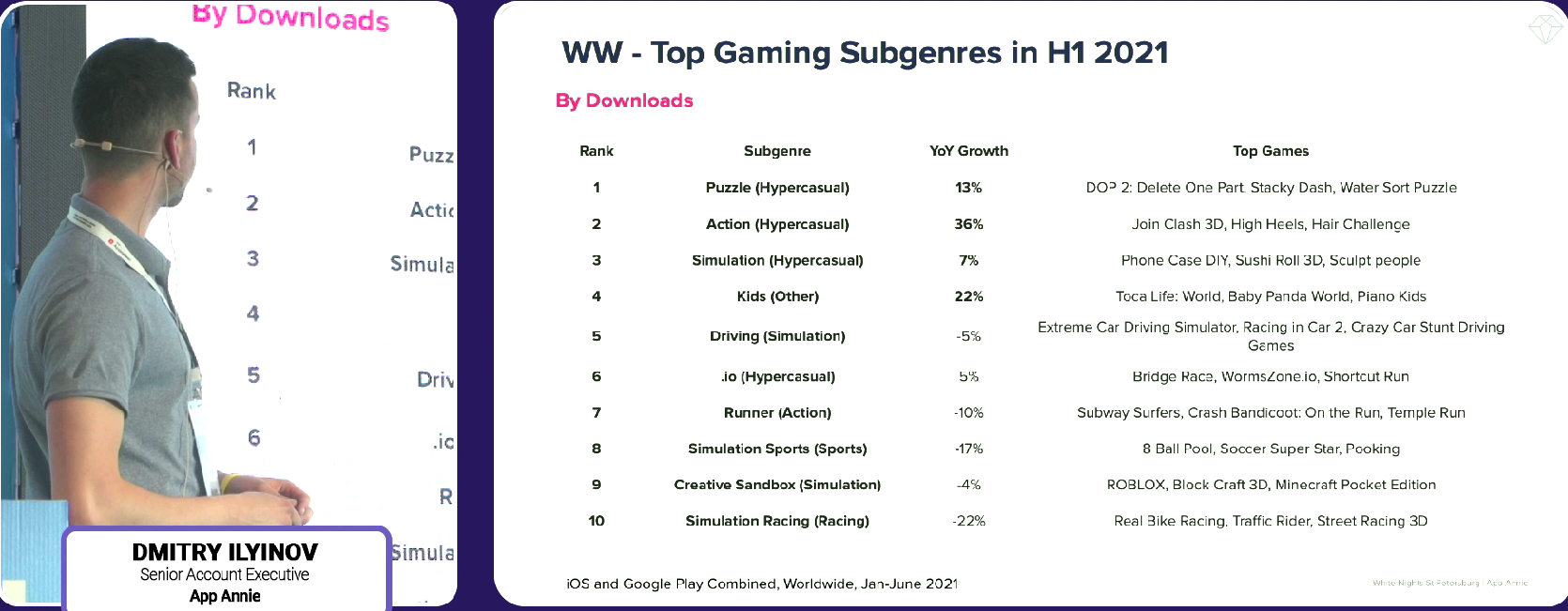

- thanks to this classification, the company learned that the most downloads in the first half of 2021 were collected by hyper-casual subgenres: puzzles, action games and simulators. Among them, the largest growth in annual terms was shown by action games – 36%;

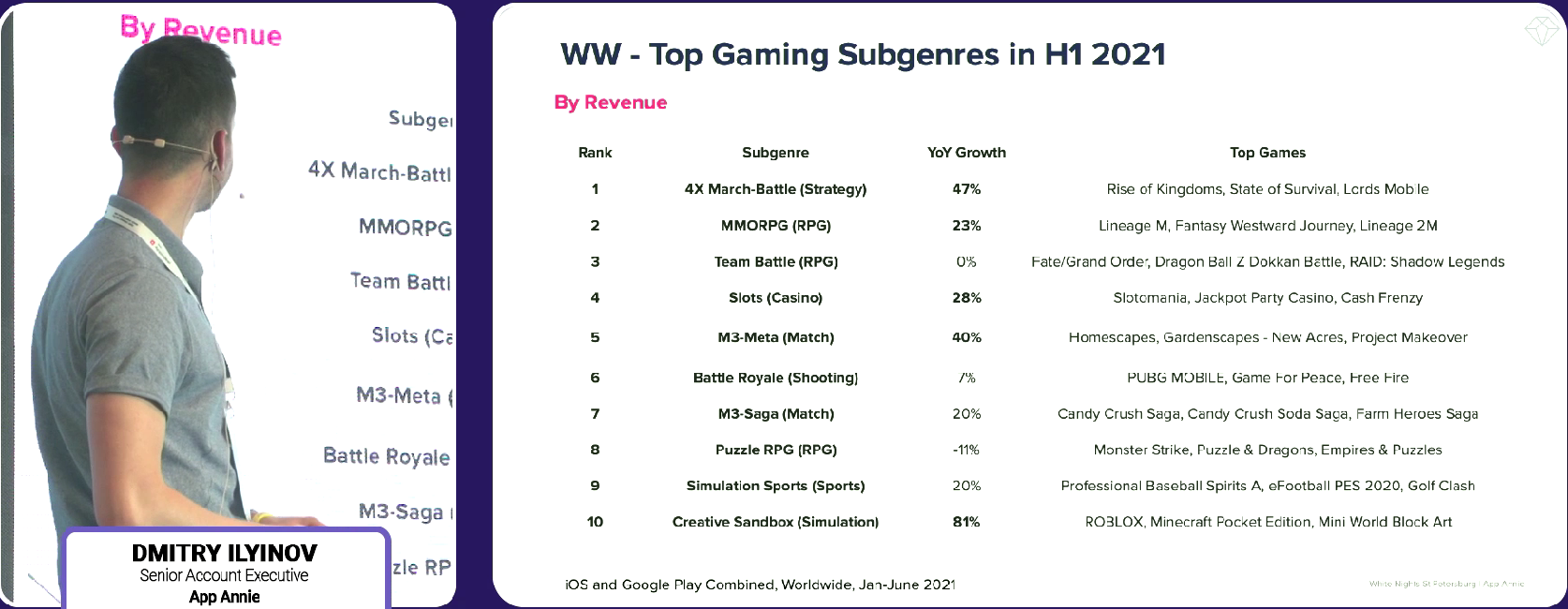

- among the highest—grossing subgenres of the first half of the year are 4X Match-Battle, MMORPG, Team Battle, slots and Match-3 Meta;

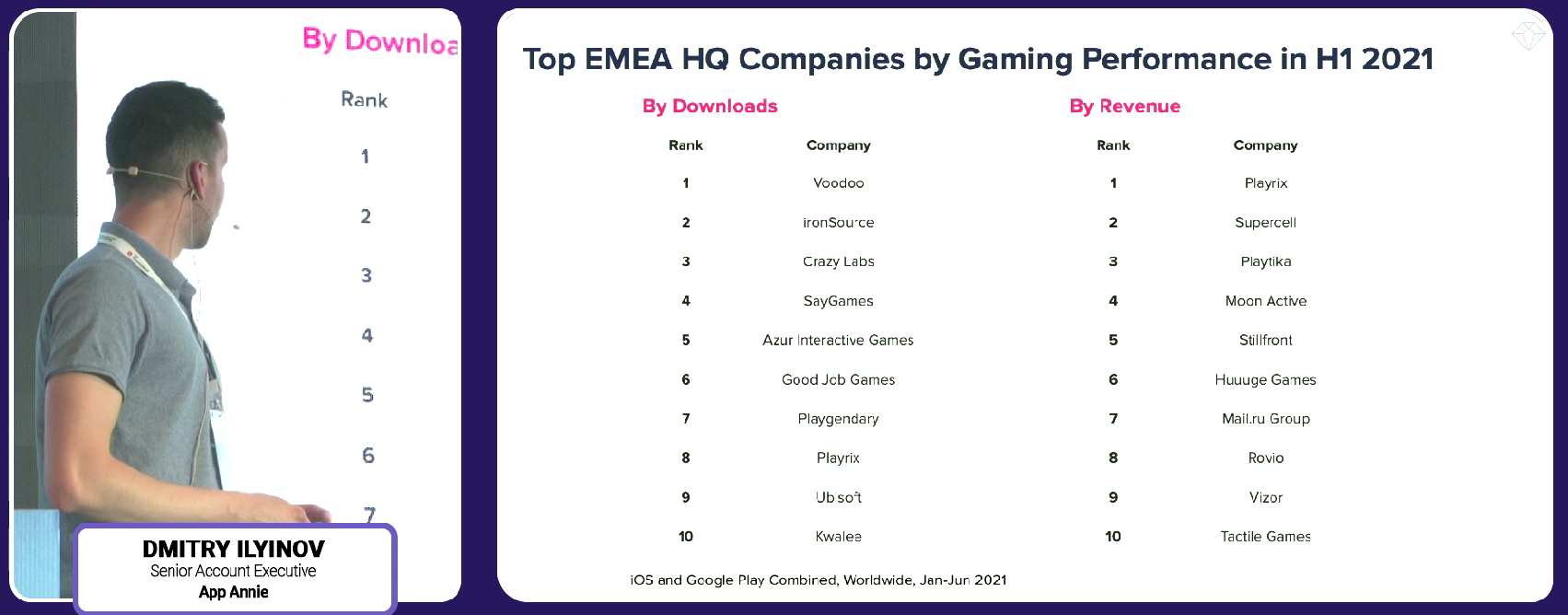

- Ilyinov also named the publishers of the most popular and most profitable mobile games of the first half of the year. The top 10 downloads were led by the French publisher VOODOO, specializing in hypercasual. And the best company at the box office was the Russian Playrix.

The situation on the Russian mobile market:

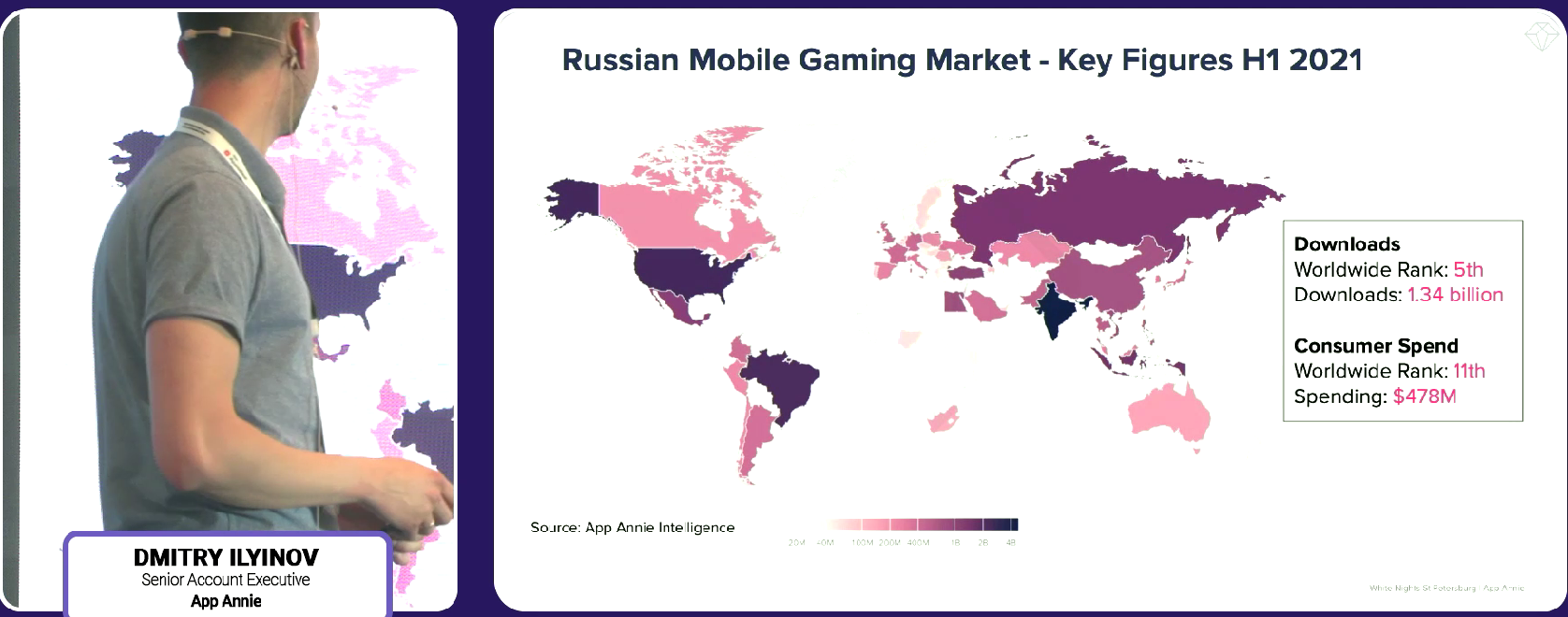

- according to the results of the first half of 2021, Russia ranked fifth in the world in terms of downloads. During this time, Russian gamers have installed mobile games 1.34 billion times;

- In the first six months of 2021, Russians spent $478 million on games. This puts Russia in 11th place in the global ranking;

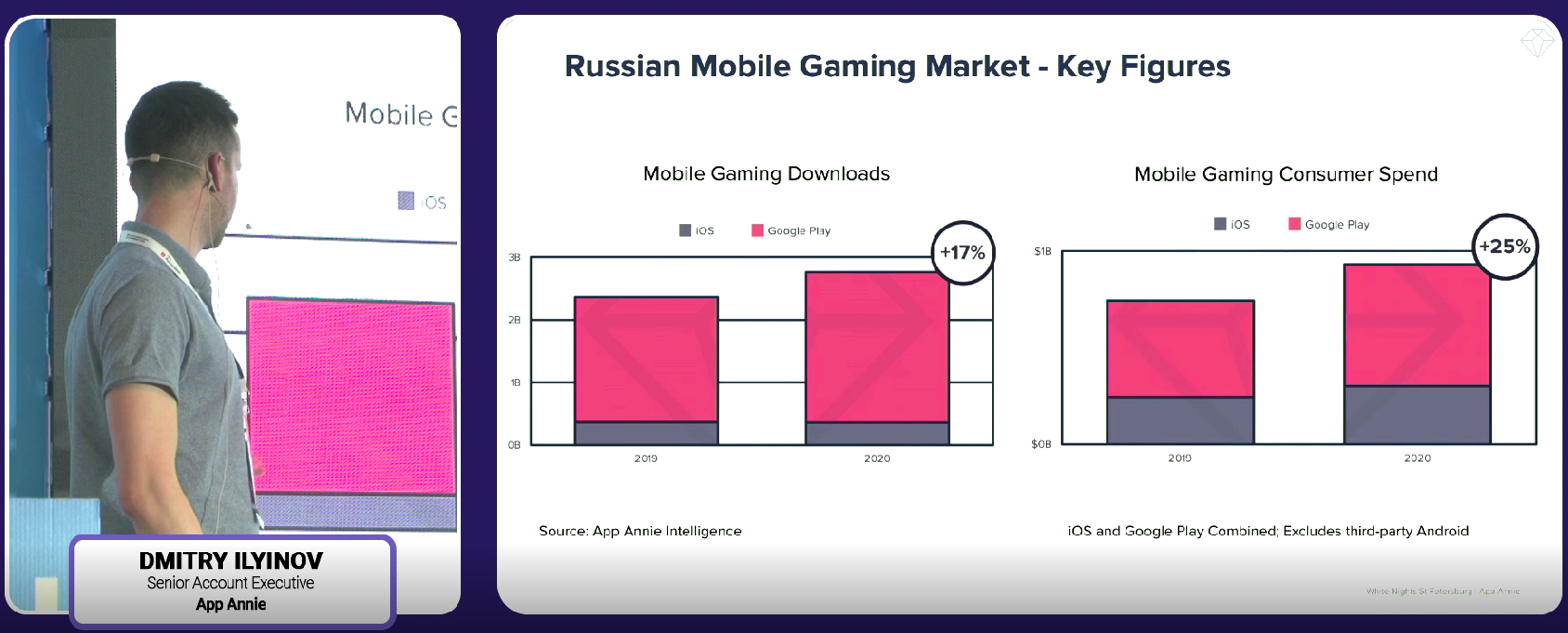

- Ilyinov compared how the Russian market behaved before the pandemic and during it. In 2020, mobile game downloads increased by 17% and revenue by 25% compared to 2019. As Ilyinov noted, the revenue growth rates in Russia are ahead of the global ones. There, the market turnover increased by only 17 over the year%;

- over the past year, the top of the most popular mobile games has changed a lot. In 2020, Russian gamers most often downloaded games such as My Talking Tom and Friends, Brawl Stars and PUBG Mobile. In the first half of 2021, DOP 2 has already become the leader in downloads in Russia: Delete One Part, Brawl Stars and Among Us;

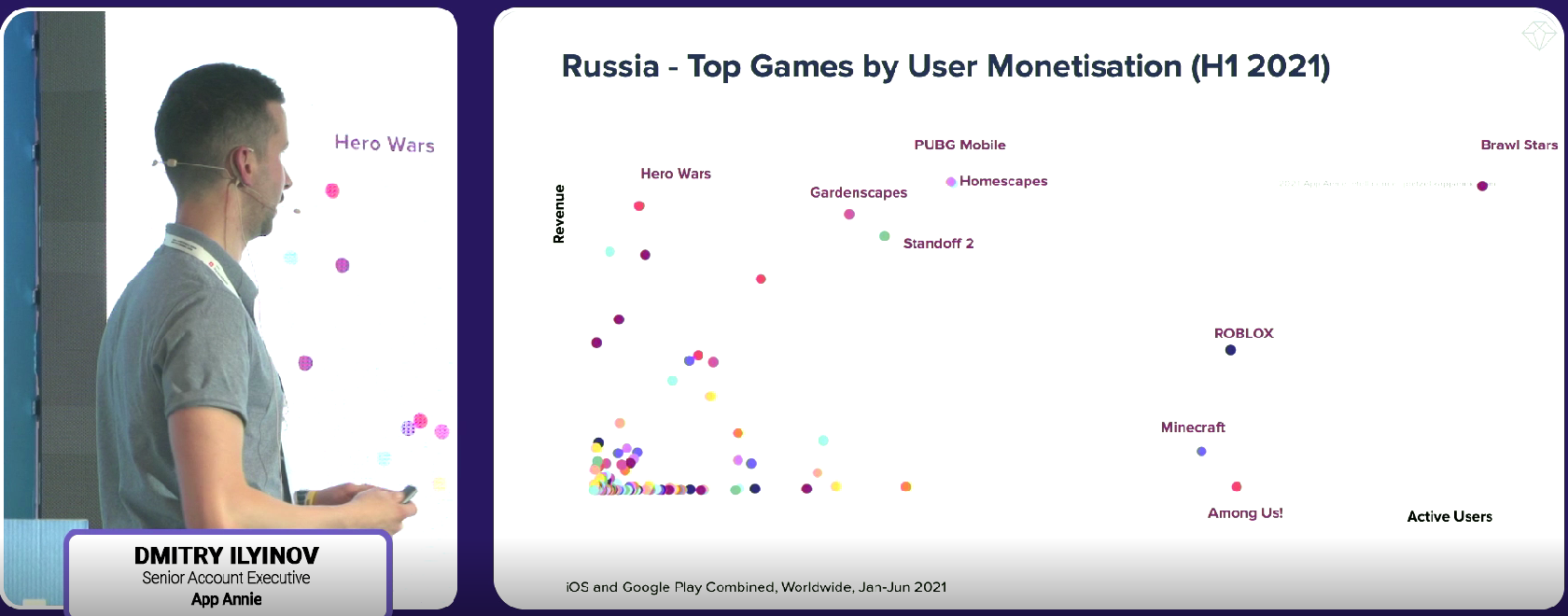

- as for the top revenue, Hero Wars, Brawl Stars and Gardenscapes collected the largest box office in 2020, and in the first half of 2021 — Brawl Stars, PUBG Mobile and Homescapes;

- Ilyinov also highlighted games that had a good box office and a large active audience in the first half of 2021. Brawl Stars again became the leaders. PUBG Mobile, Homescapes, Gardenscapes, Standoff 2 and Roblox performed well;

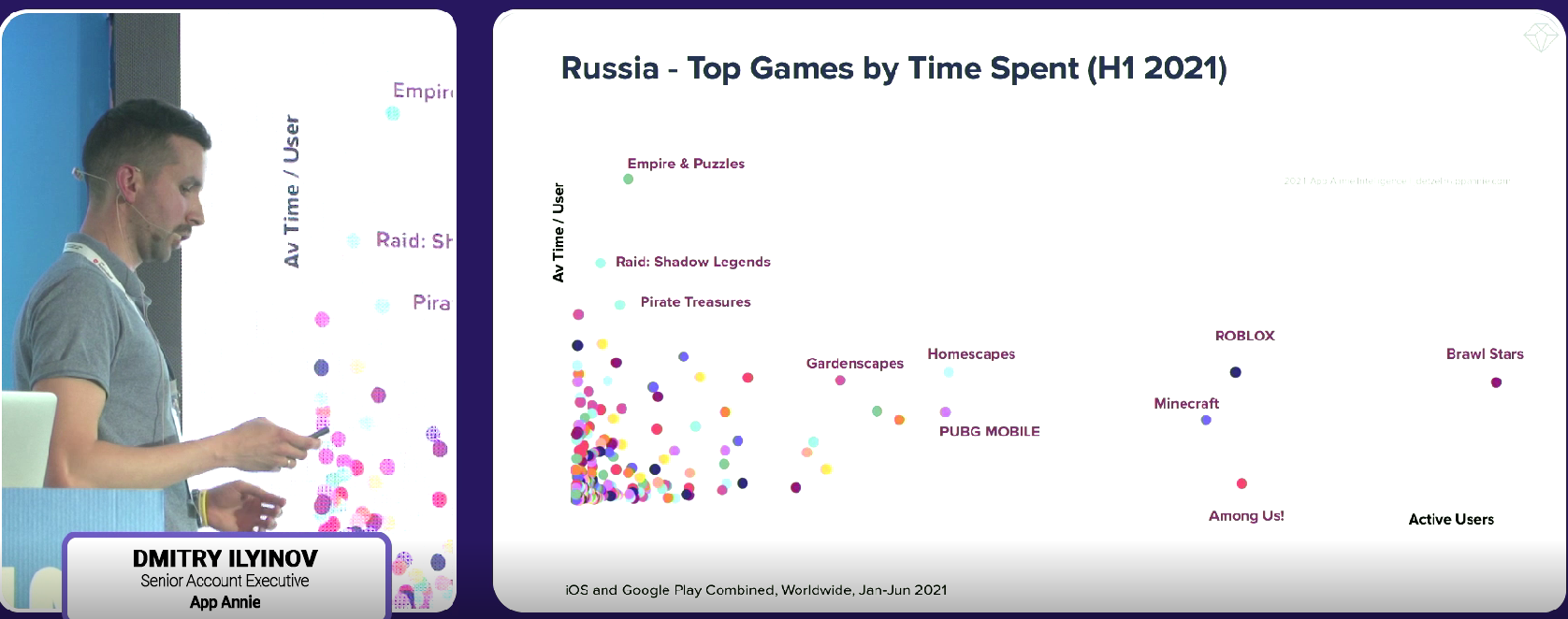

- separately, Ilyinov named titles with long gaming sessions. One of them was Empires & Puzzles. But despite the fact that Russian gamers spent a lot of time on it, its active audience was small.